Mueller Water Products: A Good Long-Term Bet

Summary

- Revenue should benefit from favorable pricing and elevated backlog levels in the coming quarters.

- Margins should also improve as production at Mueller Water Products’ new brass foundry ramps up.

- I have a buy rating on MWA stock.

tfoxfoto/iStock via Getty Images

Investment Thesis

Mueller Water Products (NYSE:MWA) is expected to benefit from favorable pricing actions, an elevated backlog in hydrants and service brass products, strength in the Municipal repair and replacement end market, and increased investment from the Infrastructure Investment and Jobs Act (IIJA). These factors are projected to drive revenue growth in 2023 and beyond.

While the company’s margins have suffered in recent quarters due to high outsourcing costs associated with brass products, the situation should sequentially improve as the company is ramping up production at the new brass foundry to eliminate outsourcing costs. The company is also focused on cost reduction initiatives and operational excellence, which should contribute to margin expansion in the long run.

I believe the company can post good earnings growth over the next couple of years driven by revenue growth and margin expansion. The valuation is also reasonable, keeping in mind the company’s long-term growth prospects. Hence, I have a buy rating on the stock.

MWA’s Q2 FY 2023 Earnings

MWA recently reported mixed results in the second quarter of FY 2023. Revenue for the quarter reached $332.9 million, marking a 7.2% year-over-year increase and slightly beating the consensus estimates of $332.5 million. However, the EPS declined by 6.67% year-over-year to $0.14, and was below the consensus estimate of $0.16.

The revenue growth in the quarter was primarily driven by strong pricing momentum across most product lines, which more than offset the volume declines in the Waterflow solution segment. However, the adjusted EBITDA contracted by 190 basis points year-over-year to 14.4%, as the decline in volume in waterflow solutions segment and high outsourcing costs related to brass products outweighed the pricing benefits. This contraction in the adjusted EBITDA margin had a negative impact on the adjusted EPS for the quarter.

Revenue Analysis and Outlook

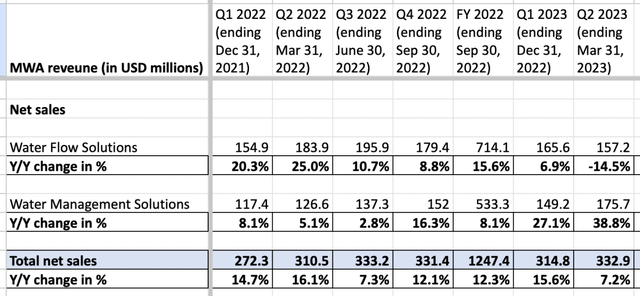

The company is benefitting from higher pricing across most product lines, which contributed to its revenue growth as it entered 2023. The Water Management Solutions segment experienced strong volume growth, particularly in hydrants and water application products, coupled with favorable pricing, leading to a remarkable 38.8% year-over-year revenue growth in the second quarter of 2023.

On the other hand, the Water Flow Solutions segment faced a decline of 14.5% year-over-year in the quarter. This was primarily due to volume declines, specifically in iron gate valves, and the negative impact of machine downtime on service brass product shipments, which outweighed the favorable pricing. However, on a consolidated basis, the company's revenue still saw a year-over-year increase of 7.2%, amounting to $332.9 million in Q2 FY2023.

MWA's Segment Sales (Company data, GS Analytics Research)

Looking ahead, management expects the higher pricing to continue contributing to top-line growth. Additionally, elevated backlogs, particularly in hydrants and service brass products, improved lead times facilitating conversion to sales, and a strong presence in the municipal repair and replacement end market are expected to help the company offset the headwinds from the inventory destocking it is seeing at some of its channel partners. MWA's channel partners are adjusting their inventory and order levels to accommodate shorter lead times and reduced demand in the residential new construction sector.

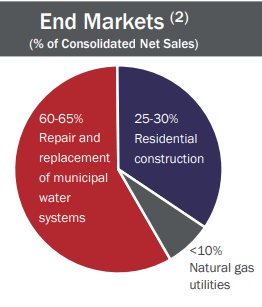

During the last quarter, total housing starts experienced an 18% year-over-year decline, primarily driven by a significant 29% drop in single-family starts. Factors such as high-interest rates and economic uncertainty have impacted the residential new construction end market. However, the municipal repair and replacement end market has demonstrated steady growth in the past quarter, with municipalities benefitting from healthy budgets, particularly in large municipalities. Considering the company's leading brands, diversified product portfolio, and strong position in the municipal market with a large installed base, I believe MWA is well-positioned to generate revenue growth in the municipal end markets. Also, the housing market headwinds are likely to reverse over the medium term as the U.S. Federal Reserve is likely to become less hawkish in the aftermath of the recent regional banking fiasco. This should also help the revenues.

MWA’s end markets (Company's Investor Presentation)

In addition, the company is poised to benefit from aging infrastructure, population shifts, and urbanization trends in the coming years, as these factors create a demand for its products and services. Furthermore, the funding provided by the Infrastructure Investment and Jobs Act (IIJA), which includes $55 billion specifically allocated for water, wastewater, and stormwater infrastructure, is expected to result in additional projects in this market in the future. This increased funding from the infrastructure bill is expected to have a positive impact on five key product categories, which collectively account for 75% of consolidated sales: Iron gate valves, Service brass, Specialty valves, Hydrants, and Repair products. Consequently, these factors are expected to further drive revenue growth for the company in the coming years.

Margin Analysis and Outlook

In the second quarter of 2023, the company's gross margin experienced a 50 basis points decline to 29.4%. This decline was primarily due to the volume deleverage in the Waterflow solutions segment, increased costs associated with outsourcing brass products used in hydrants, inflation in labor and freight expenses, as well as unfavorable manufacturing performance, which more than offset benefits from higher pricing. These factors, in conjunction with higher SG&A expenses, resulted in a 190 basis points contraction in adjusted EBITDA to 14.4% in the last quarter.

MWA's Margins (Company data, GS Analytics Research)

Looking forward, higher pricing should continue to support the company’s margin. While the company still has to outsource the production of critical brass parts due to the current production levels at the brass foundry, which is resulting in higher costs to the company, things are expected to improve with ramping up production levels at its new brass foundry in Decatur, IL. This should allow the company to close the current old foundry and eliminate the outsourcing cost related to brass parts. This, along with the focus on operational improvements, should help the company in achieving its goal of returning to pre-pandemic margin levels in 2025. So, I am optimistic about the company’s margin expansion prospects in the coming years.

Valuation and Conclusion

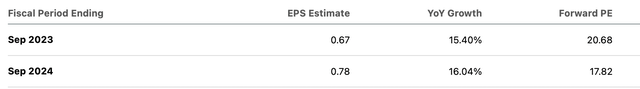

The company's stock is currently trading at a P/E of 20.68x based on FY23 consensus EPS estimates of $0.67 and 17.82x based on FY24 consensus EPS estimates of $0.78.

MWA Consensus EPS Estimates (Seeking Alpha)

The company’s EPS is expected to grow in mid-teen in the current year and the next. In the near term, the company is expected to benefit from an elevated backlog and favorable pricing, while revenue growth in the coming years is anticipated through the funding provided by IIJA. The company's long-term margin prospects appear promising due to pricing actions, cost reduction initiatives, and the ramp-up of the new brass foundry.

I believe the stock can continue posting good growth over the long term with secular drivers like aging water infrastructure in the U.S. The company’s exposure to the water end market is something that makes it very interesting. Usually, the companies levered to this end-market gets high P/E multiple. For example, Tetra Tech (TTEK) and Xylem (XYL) are trading at a current year P/E in the high 20s and low 30s, respectively, based on consensus EPS estimates. This is because water and wastewater infrastructure and conservation is a long-term theme that attracts meaningful investor attention. The company also attracted the attention of an activist investor Ancora Holdings, of late, and there is a chance of its valuation multiple re-rating if it continues to execute well. Hence, I have a buy rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Vedang S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.