Thungela Resources: Huge Dividends, But Wait For Coal To Bottom

Summary

- Thungela Resources is a South African coal miner.

- The company has a very good balance sheet, and the significantly lower EPS this year seems to be already priced in.

- The forward P/E ratio, according to my calculation, is only 3, and the forward dividend yield is about 20%.

- But there are problems with the railroad delivery system, and the coal price is still in decline.

- I think it is likely that the market exaggerates even further down, and you can get in even cheaper.

Orbon Alija

Investment Thesis

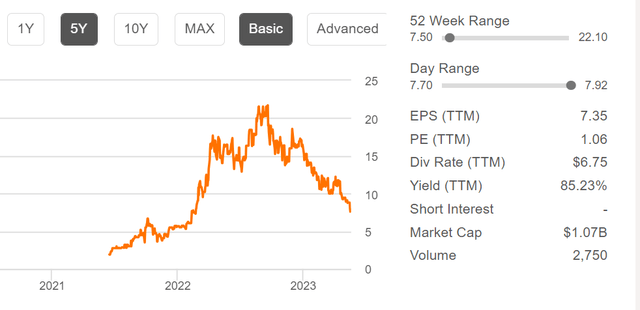

Thungela Resources Limited (OTCPK:TNGRF) is a South African coal producer that experienced a boom year in 2022 and paid huge dividends. From the peak, the share price has fallen 60% as coal prices have plummeted and delivery issues exist. However, even including 70% falling EPS in 2023, I estimate that the forward P/E is only 3, and the dividend should be around 20%. That said, earnings are heavily dependent on the price of coal. However, I think it is likely that the price will continue to fall as long as coal falls, so I am waiting for a bottom to form.

Coal Overview

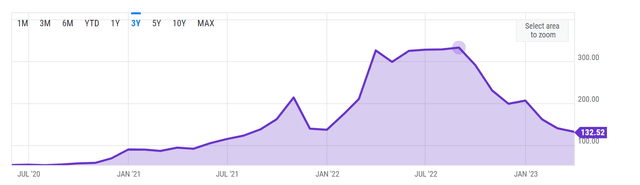

This is a chart of the South African coal export price. It has been in a downward trend since August 2022 and is currently at the level of August 2021. As we can see, the upward trend of the coal price started in the spring of 2021, well before the Ukraine war.

How the coal export price will develop will strongly influence the company's results. Price predictions are never possible, so let's look at a few general indications of the market. Fortunately, there is a very detailed and up-to-date report from IEA.org on the global coal market. I would like to summarize the main statements here.

2022 coal consumption all-time high

The report says global coal demand rose 1.2% in 2022, hitting a new all-time high. Over 70% of global coal consumption is used for power generation. The high natural gas prices have made coal a more attractive option in some regions, notably Europe. And high prices in Europe are most likely there to stay as the Nord Stream pipelines have been blown up and much more expensive LNG is bought instead, for which they also compete with the whole world.

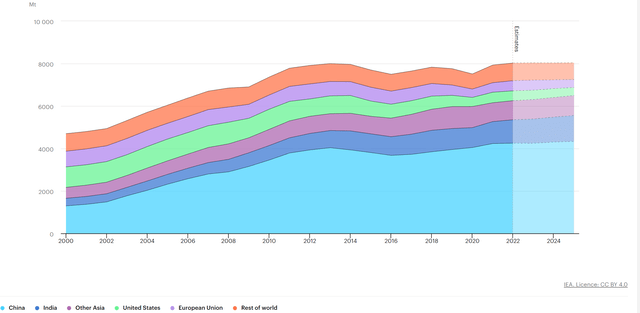

Overall, global coal demand has shifted sharply in recent decades. India alone now consumes more than the USA and Europe combined, and China accounts for by far the largest share. The forecast also assumes that India's demand will continue to rise while that of the Western countries will continue to fall. The peak in coal consumption is expected to be reached in 2022 or 2023. Of course, whether this will happen is not sure just because it is written in the report. It depends on many factors that cannot be predicted, such as the global economy, oil and gas prices, the speed of renewable energy build-up, etc.

Additional power demand and renewables

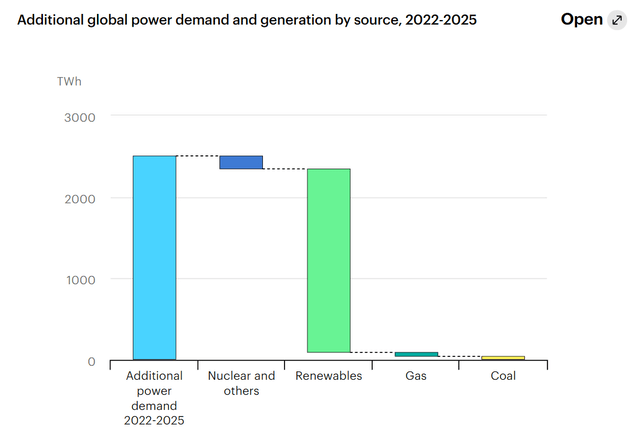

The main reason why coal demand is expected to reach its plateau is that the additional electricity demand is expected to be satisfied mainly by the expansion of renewable energies, as seen in this forecast until 2025.

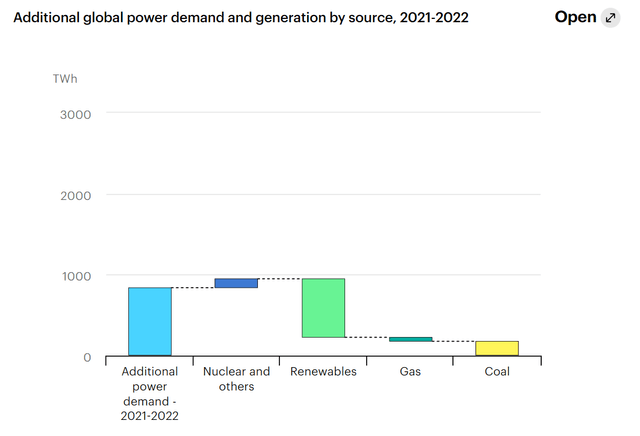

This estimate assumes that hardly any additional coal will be added to meet the additional energy demand until 2025. However, let's look at the same chart for 2021 - 2022. Again, renewables make up the largest share, but based on the chart, I estimate about 20% of the additional energy demand was met by coal. So I believe there can be doubts about the thesis that coal will contribute so little to the additional energy demand until 2025.

Overall, it is impossible to predict how the price will develop. It is too complex a system with too many factors. However, it is a fact that the world's energy demand is increasing overall, and the two main consumers are also increasing their coal consumption.

South Africa - Opportunities and Problems

According to worldstopexports.com, South Africa is the fifth-largest coal exporter, accounting for about 5% of the global volume. In addition, the largest African producer and consumer. They have benefited from the Russia sanctions as Europe needed new suppliers.

In addition, owing to the lack of rail capacity, part of the Russian coal volumes previously sent by rail to Europe or shipped from northwestern Russian ports toward Europe cannot be redirected to the east or the south. This has resulted in a decline of Russian exports and a tightening of the market. The gap left by Russian coal supplies in Europe has been largely filled by South Africa.

IEA coal 2022 report.

In addition, South Africa's coal consumption is also expected to increase.

We project South Africa's coal consumption to increase by 5.3% from 2022 to 2025 as the coal power plant fleet's performance increases.

IEA coal 2022 report.

Overall, the report predicts that global coal production will also peak in 2023 and then start to decline. Although China and India will increase their domestic production, some of the largest producers will cut back production, including the USA, Indonesia, Russia, and Europe. However, I suspect that global coal production will be closely linked to global coal demand. Where there is demand, there is supply.

Problems with delivery

There are country-specific factors that are currently hampering the delivery of coal from South Africa. So I don't want to call it a political risk, but perhaps we could say that it is an emerging market-specific risk, which probably occurs again and again in a similar form in various countries.

According to the company and the IEA coal report, there are problems with the South African railroads regarding the delivery of raw materials.

Due to weak domestic consumption and poor railway performance by operator Transnet Freight Rail. Key issues were large-scale cable theft (in total 1 500 km of cable have been stolen in the last five years), unavailability of locomotive and spare parts, vandalism and infrastructure bottlenecks. Furthermore, derailments of wagons frequently block rail lines for multiple days.

IEA coal 2022 report.

The result is that 14.5 million tons were delivered in 2021, only 13.1 million tons in 2022, and the forecast for 2023 is 10.5 to 12.5 million tons. In addition, there have been power failures and strikes at the rail operator Transnet. Chairman Sango Ntsaluba addressed these issues in detail in the annual report, pointing out that this is a national problem for the country that must be resolved as quickly as possible.

In late 2022, Transnet and the mining industry set up collaborative structures at senior leadership levels focused on stabilising rail performance in the short term, before ramping performance back up to historical levels in the medium term. The deterioration of TFR performance to these levels seems to have been a wake-up call for government in general, and TFR in particular. There is a realisation that continuation on this trajectory could result in a national crisis in South Africa given the importance of the mining industry in providing employment, sustaining livelihoods and generating foreign currency inflows for the fiscus. We therefore call upon government to act swiftly and effectively in providing Transnet with all the support necessary for the state-owned entity's performance to start turning around and to attend to other risks such as unstable electricity supply, illegal mining and increasingly disgruntled communities frustrated by a lack of service delivery.

These problems, combined with the falling coal prices, mean that the share price is currently at the low point of its 52-week range.

2022 Results & Financials

The company had an exceptionally strong year in 2022, more than doubling its net income compared to 2021.

| 2021 | 2022 | |

| Revenue | $1.65B | $3B |

| Operating income | $548M | $1.6B |

| Net income | $403M | $1B |

| Revenue per share | $15.6 | $22.3 |

| EPS per share | $3.83 | $7.48 |

| Dividend per share | None | $5.88 |

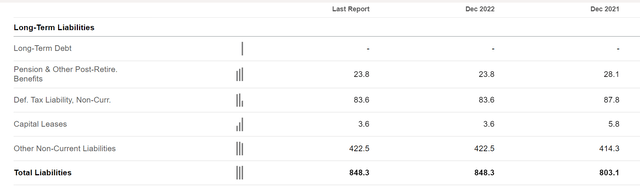

In addition, the company has about $50M more cash than liabilities. You have to be careful here: According to Seeking Alpha's main page, the company has only $9M total debt, but on the balance sheet, most of the liabilities are booked under "other non-current liabilities". All in all, a very positive balance sheet.

Valuation

As I write, the share price is $7.92. Based on 2022 results, this is a P/E ratio of about 1. The market cap is slightly over $1B, so a P/S ratio of 0.33.

Of course, the price looks so cheap because the 2022 results were that good, but will be much worse in 2023 due to the problems mentioned: coal price and delivery difficulties. Therefore, I will try to approximate the potential revenue. Although the calculation cannot be exact because the company probably does not sell at the current market price at all times, and the average coal price for 2023 must be estimated:

The coal export price chart above shows that the peak price did not hold throughout 2022, but was significantly lower at the beginning and end of the year. On average, I assume $280/t. For 2023, I assume $110/t, which is another 20% lower than the current price. So in total 60% less. In addition, exports in 2023 are about 15% lower than in 2022 due to problems in rail transport.

We can cross-check and test my calculation by taking the 13.1 Mt exports in 2022 and multiplying by my assumed $280/t = $3.6B revenue. Since the actual revenue was $3B, it at least goes in the right direction.

The median value of the production forecast is 11.5 Mt. Multiplied by $110/t = $1.265B (58% less than 2022). EPS should fall even more than 58% as margins get smaller if production costs remain unchanged. It is hard to say exactly how much this will amount to. Let's say for simplicity and to be on the safe side that the 2023 EPS and dividends will be about 70% lower than in 2022. EPS would then be $2.24, the P/E ratio just over 3, and the dividend $1.76, a yield of 22% on today's price.

Of course, the calculation has several assumptions, but I was rather conservative and calculated rather pessimistically, so the real result could be better. In the long term, the company plans to increase production again, but this seems to be only partly in its own hands. Of course, it could also happen that problems with the delivery continue for a prolonged time. This is one of the risks that makes the valuation so cheap at the moment.

Strategy to Invest & Conclusion

With the current problems in delivery that lead to lower export volumes, in conjunction with the still-falling coal prices, it seems likely that the stock could fall even lower. So I think it makes sense to wait for a bottom to form, not only in the stock but also in the coal price.

Overall, there are challenges for the company, but the chances are good that both the coal price will find its bottom and the internal South African problems will be solved; after all, raw material export is an important source of income for the country. The company has a very good balance sheet, and the significantly lower EPS this year seems to be already priced in; the forward P/E ratio, according to my calculation, is also only 3, and the dividend yield is over 20%.

Coal is still needed for a long time, and the chances are high that investors will continue to receive similar dividends for many years. Anyone who bought the share some time in 2021 has already received a yield of more than 100%. With such low valuations and thus yields, the business only has to run well for a few years, and the investor has his entire investment back.

Nevertheless, I do not want to buy yet but wait. I think it is likely that the market exaggerates even further down, and you can get in even cheaper. However, I could also understand if someone already buys a small position and possibly adds more if the stock falls further.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.