ZIM Integrated: No Dividend After A Weak Q1 And Deteriorating Outlook

Summary

- ZIM Integrated Shipping Services Ltd. reported weaker-than-expected first quarter results, with both the top- and bottom line coming in well below consensus estimates.

- While management admitted to the outlook having "deteriorated somewhat" in recent months, the company reaffirmed full-year guidance.

- Adjusted for the recent year-end 2022 dividend payment, cash and cash equivalents decreased by more than $1.1 billion so far in 2023.

- With ZIM Integrated expected to take delivery of another 40 newbuilds in 2023 and 2024, net debt is expected to increase exponentially over the next few quarters as long-term lease obligations pile up on the balance sheet.

- With the weak market environment posing substantial risk to management's financial projections, I am downgrading ZIM Integrated Shipping Services Ltd. shares to "Sell."

alvarez

Note:

I have covered ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) previously, so investors should view this as an update to my earlier articles on the company.

Last year, Israel-based liner company ZIM Integrated Shipping Services Ltd., or "ZIM," attracted strong retail investor interest. This was due to its eye-catchingly high payouts and the fact that the company remains the only major U.S. exchange-listed container liner.

While ZIM barely makes the Top 10 of the world's largest liner companies, the company has pocketed its fair share of the recent container shipping bonanza.

Since listing on the Big Board in early 2021, ZIM has declared a whopping $38.45 per share in dividends.

Like all liner companies, ZIM has been enjoying record-high earnings and cash flows for most of the past two years, but with container rates now back at pre-pandemic levels and significantly increased operating expenses relative to 2019, industry earnings are likely to fall off a cliff this year.

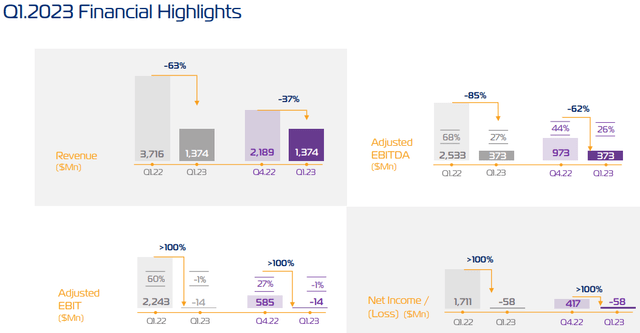

On Monday, ZIM released disappointing first quarter earnings, with volumes down meaningfully across virtually all key trade lanes and both the top and bottom lines falling well short of consensus expectations. In addition, Adjusted EBIT and Net Income turned negative in Q1:

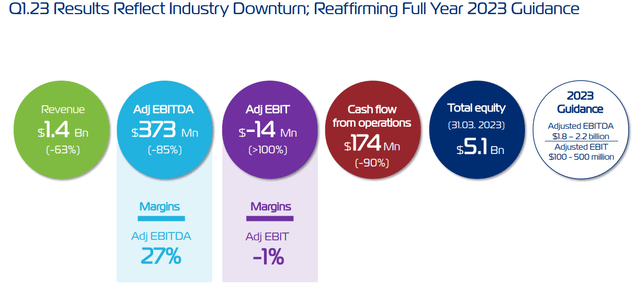

That said, the company still generated $142 million in free cash flow from operations and reaffirmed full-year guidance, with full-year Adjusted EBITDA expected to come in between $1.8 billion and $2.2 billion and Adjusted EBIT between $100 million and $500 million:

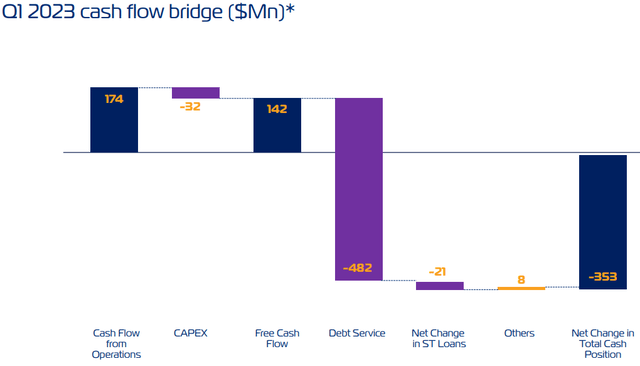

ZIM's total cash position (which includes cash and cash equivalents and investments in bank deposits and other investment instruments) decreased by $353 million from $4.60 billion at the end of 2022 to $4.25 billion as of March 31, 2023 due to almost $500 million in payments related to the company's debt obligations:

Net debt at the end of Q1 was up by a whopping $660 million to $381 million as newbuild deliveries with long-term charter commitments continue to increase the company's lease liabilities, a trend which is expected to accelerate over the coming quarters.

Please note that these numbers do not yet include $769 million in dividend payments made subsequent to quarter end.

As a result, I wouldn't be surprised to see the company's net debt obligations eclipsing $2.5 billion by the end of this year with substantial further net additions in 2024.

As the company's stated dividend policy requires positive net income, ZIM's Board of Directors has not declared a quarterly dividend.

On the conference call, management hinted to a similarly challenging Q2 and admitted to the full-year outlook having "deteriorated somewhat," but still expects profitability to come in within the ranges provided on the Q4 conference call in March.

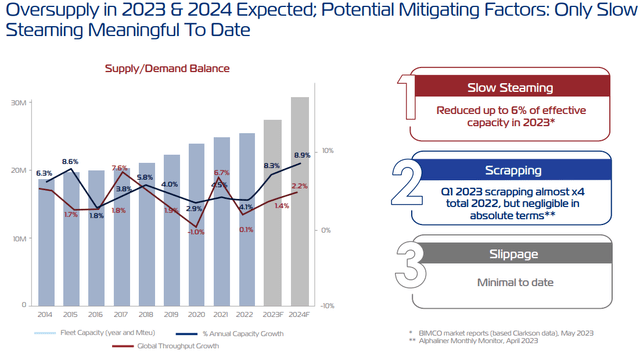

Given the sheer magnitude of newbuild vessels expected to enter the market until the end of 2024 and an apparent lack of mitigating factors, it's difficult to envision a sustained uptick in freight rates anytime soon:

Currently, the company is operating 138 containerships and 14 car carriers with an aggregate 40 newbuilds scheduled for delivery over the next six quarters. Please note that ZIM has committed to almost $500 million in down payments upon delivery of these vessels.

On the call, management expected the number of operated vessels to remain roughly the same for the time being but due to the much larger average capacity of the newbuilds expected to join the fleet until the end of next year, ZIM's aggregate capacity will increase quite meaningfully.

Management also pointed to difficulties securing long-term volume commitments as customers are looking to lock in rates at levels well below the concessions ZIM is willing to make at this point.

Bottom Line

ZIM Integrated Shipping Services Ltd. reported weaker-than-expected first quarter results, with both the top and bottom lines coming in well below consensus expectations.

While the company reaffirmed full-year expectations, on the conference call management admitted to the outlook having deteriorated in recent months.

With Q2 expected to remain challenging, investors would be well-served to prepare for another quarter without dividend payments.

As ZIM expects to take delivery of another 40 newbuild vessels over the next six quarters, related lease obligations will pile up on the company's balance sheet. Should market conditions remain weak, net debt might increase to almost $5 billion by the end of 2024.

With the market drowning in overcapacity, it's hard to see freight rates picking up substantially in the second half of the year thus putting management's outlook at risk.

While the company's total cash position adjusted for the recent year-end 2022 dividend payment calculates to slightly below $3.5 billion, investors should expect this number to come down further in coming quarters, mostly due to almost $500 million in scheduled down payments upon newbuild deliveries.

With the weak market environment posing substantial risk to management's financial projections, I am downgrading ZIM Integrated Shipping Services Ltd. shares to "Sell."

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.