TJX Companies: No Slowdown Here, Reiterate Buy

Summary

- TJX has continued its strong traction and delivered a Q1 beat and raised its full-year guidance.

- While other retailers have cited pullback in discretionary purchases by consumers, TJX has continued to build momentum and attract new customers.

- We continue to believe it is perfectly positioned in the multi-year beneficiary cycle for the off-price retail.

- Reiterate it at Buy with a target price of $90 (25x PE).

Chip Somodevilla

Investment Thesis

As highlighted in my previous article, The TJX Companies, Inc. (NYSE:TJX) is well positioned in a tumultuous retail environment as consumers trade down and prefer value for money deals. Its focus on offering an assortment of attractive brand inventory packed with novel treasure hunt and pricing strategies have fared well, attracting new customers across demographics and age groups. Its focus on mid to high consumers which are slightly better placed during economic downturn has led to continued traffic growth within their stores. TJX has delivered strong set of results in Q1 where other retailers have struggled in the current environment. Reiterate Buy.

Macro Environment

Before we delve into how TJX has performed in Q1, it would be imperative to understand the circumstances in which the company has delivered such results. Walmart, Target and Home Depot and several other retailers reported weak set of results wherein their management painted a gloomy picture of the American consumer pulling back on discretionary purchases.

As it did throughout last year, pressure from inflation and rising interest rates affected the mix of retail spending in Q1 with a further softening in discretionary categories in the March and April time frame. This coincided with a deterioration in consumer confidence, reflecting recent events such as the banking crisis that emerged in March."

- Brian Cornell, Chairman and CEO, Target Corporation

We continue to see signs that customers remain choiceful, particularly in discretionary categories. In Q1, we saw nearly 360-basis-point shift in U.S. sales mix from general merchandise to grocery and health and wellness. In addition to the persistence of inflation in food and consumables, customers were also impacted by a reduction of SNAP benefits and lower tax refunds.

- John Rainey, EVP and CFO, Walmart

Management of major retailers cited events of bank failures along with reduction of SNAP benefits and lower tax refunds along with persistent inflation pulling away the American consumers from making discretionary purchases.

Earnings Beat and Raise

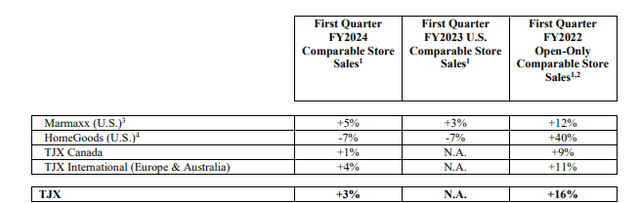

TJX reported a strong 3% comp sales growth at the upper end of the guidance primarily driven by 5% comp growth in Marmaxx. On the other hand, Homegoods (HG) partly offset the overall comp growth declining 7%, however Q1 was lapping an outsized 40% growth witnessed in Q1 2022 during the pandemic.

It has also been able to capture market share internationally by hundreds of basis points, driven by traffic as well as store closures acting as tailwinds. Growth has been driven primarily by traffic while average basket has moderated through the quarter. Stores in higher income demographic areas have been performing well through the quarter compared to lower ones and have been a driver to the comp, which resonates well with the brand's positioning catering to higher income consumers. Despite HG being negative, we are encouraged that trends improved entering into Q2 and management expects comps to improve for the remainder of the year. Segment margin for HG improved 133 bps YoY but remains 250 bps below pre-pandemic levels. We believe growing sales (with store closures among the likes of Bed Bath and Beyond acting as tailwind) and freight tailwinds would enable margin recapture over the medium term.

In the Bed Bath & Beyond situation, what's interesting is a lot of articles, many of you have probably seen them, that have come out that are referring directly to us has been in HomeGoods as being beneficiaries."

- Ernie Herrman, President and CEO, TJX Companies

Gross margins rose 100 bps due to lower freight and higher markups while SG&A remained under check helping the company smashing its EPS guidance and consensus clocking an EPS growth of 12% YoY at $0.76.

Management appeared confident and raised its full year EPS guidance by $3.49 - $3.58 from $3.39 - $3.51 earlier. 2Q sales is expected to grow 2-3%, in line with the previous year, however EPS is expected to trudge around $0.72 - $0.75, a touch below consensus primarily due to expense timing issues from Q1 to Q2 and wage hikes. Inventory declined 5% on a comparative basis and it remained upbeat about phenomenal buying opportunities for fresh product attracting Gen Z and millennial shoppers which bodes well for the future.

Risks to Rating

Risks to Rating include 1) sticky wage hikes to put dent on the operating margins 2) domestic freight rates benefit anticipated in the later half of the year could get pushed through next year 3) higher than expected shrink rate, as witnessed during Q4, would pressure margins 4) higher than expected markdowns and promotional environment from competition to drive slowing sales would impact gross margins and 5) any impact in FX movement would impact international sales.

Valuation and Final Thoughts

We continue to believe that off-price retail is in a multi-year beneficiary cycle and TJX is best placed within the segment due to its focus on higher income consumers, brand assortment and customer centric approach. Store closures within the US and internationally would continue to drive traffic and allow them to grab market share. We continue to rate it as Buy with a target price of $90 (25x PE).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.