Applied Materials: Recovery In WFE Spending To Push Outperformance In 2024

Summary

- We maintain our buy rating on Applied Materials, Inc. post Q2 2023 earnings results and Q3 2023 outlook, as we expect the stock to continue outperforming in 2024.

- We expect the increased mature node demand and growth in its ICAPS business will continue to offset current demand headwinds in memory and advanced foundry/logic.

- We also believe we will see an upturn in WFE spending in 2024 due to the industry transition to advanced process nodes for both memory and advanced foundry/logic.

- Applied Materials stock is up roughly 22% since we published our buy rating back in July, outperforming the S&P 500 by 19%.

- We believe Applied Materials still provides a favorable risk-reward scenario, as we think it will again outperform in 2024.

Sundry Photography

We continue to be buy-rated on Applied Materials, Inc. (NASDAQ:AMAT) stock post the fiscal Q2 2023 earnings report and outlook for Q3 2023. We expect the company to outperform in 2024, driven by the industry transition to advanced process nodes for both memory and advanced foundry/logic and an upturn in WFE spending in 2024 and 2025.

The company beat top and bottom line estimates in fiscal Q2 2023, reporting revenue of $6.63B this quarter, up 6.1% Y/Y and down 2% sequentially, and Non-GAAP EPS of $2.00. The stock did dip slightly post-earnings due to the lower revenue growth guidance for the next quarter, at $6.15B. We still have near-term concerns about weaker demand in memory and advanced foundry/logic market in 2H23, but expect demand headwinds to be offset by increased mature node demand and growth in AMAT’s ICAPS business.

The stock is up around 22% since we published our buy rating in July last year, outperforming the S&P 500 Index (SP500) by 19%. We see further upside ahead for the stock, as AMAT is well-positioned to outperform in 2024. We recommend longer-term investors begin exploring entry points into the stock at current levels.

The following graph outlines our rating history on AMAT.

Outpacing the Market

We believe AMAT will outpace the market in 2024 and believe the demand headwinds due to reduced WFE spending in memory markets in 2H23 will be manageable and have been priced into the stock for the most part. AMAT’s a foundational player in the semi-cap space, alongside Lam Research Corporation (LRCX) and ASML Holding N.V. (ASML); hence, we expect the company to benefit from increased industry adoption of advanced process nodes for both memory and advanced foundry/logic. ASML EUV tools are leading the industry transition; we expect the industry adoption of EUV tools for advanced DRAM and higher 232 layer count NAND to impact AMAT positively.

We also believe AMAT will experience robust demand for its Gate-All-Around (GAA) transistor transition in advanced logic. GAA is the next step after the 22nm FinFET-based technology that was introduced over a decade ago. GAA reduces supply voltage level and improves performance “with a boost in drive current capability transistor variability”; this means it provides a faster time-to-yield and reduces cell area, which is important for manufacturing the 3nm and 2nm chips. We believe AMAT’s outperformance in 2024 to be primarily driven by industry demand for advanced process nodes.

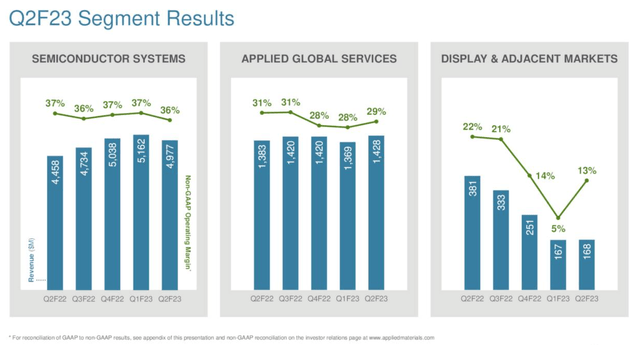

In the near term, we expect AMAT’s financial performance to remain relatively flat, consistent with management’s outlook. The company reported a 4% sequential decline and 12% Y/Y growth in its primary revenue stream, the Semi Systems Group (SSG) to $4.98B. While Applied Global Services saw slight sequential growth, growing 4% sequentially to $1.43B, and Display remained relatively flat at $168M. The following outlines the 2Q23 segment results.

AMAT 2Q23 earnings presentation

Shipments to foundry/logic markets grew sequentially this quarter, representing 84% of total SSG revenue. Memory shipments remained in the negatives, with DRAM and NAND-related shipments dropping 18% and 52% sequentially due to reduced capex spending. The memory market is going through rigorous inventory correction cycles at the moment; U.S. memory company Micron Technology, Inc. (MU) reported revenue of $3.69B in 2Q23, down roughly 52% Y/Y. We see further capex pushouts in memory and foundry/logic markets but expect growth in ICAPS (IoT, communications, automotive, power, and sensors) to help offset current demand headwinds in the memory market.

Management noted in the 2Q23 earnings call that it has revised its 2023 forecast for ICAPS business upwards due to customers’ demand for critical tech for large global inflections, including clean energy, EVs, and industrial automation, as well as regionalization of supply chains “as countries seek to build resilient local capacity.” We see an upside ahead for AMAT in 2024 and recommend investors buy the stock at current levels.

Risks Ahead

While we understand some institutional investors are concerned about the sustainability of the Chinese foundries' elevated spending, we believe the demand for mature nodes will continue through 2024 as the demand for power electronics for EVs and the related infrastructure is still in its early innings. We believe AMAT to continue to enjoy demand from Chinese foundries and expect it’ll further help offset current headwinds in memory and advanced foundry/logic markets.

Valuation

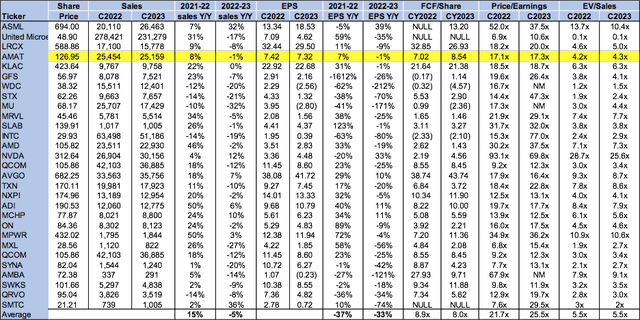

AMAT is relatively cheap, trading well below the peer group average. On a P/E basis, the stock is trading at 17.3x C2023 EPS $7.32 compared to the peer group average of 25.5x. The stock is trading at 4.3x EV/C2023 Sales versus the peer group average of 5.5x. We see favorable entry points for long-term investors into the stock at current levels as we see AMAT outperforming in 2024.

The following chart outlines AMAT’s valuation against the peer group.

Word on Wall Street

Wall Street shares our bullish sentiment on the stock. Of the 32 analysts covering the stock, 21 are buy-rated, ten are hold-rated, and the remaining are sell-rated.

The following outlines AMAT’s sell-side ratings.

TechStockPros

What to do with the stock

We expect Applied Materials, Inc. to outperform in 2024, driven by the stable demand for ICAPS business and recovery in WFE spending in 2024 and 2025 as the industry transition to advanced foundry/logic and memory chips accelerates. We see a favorable risk-reward profile for the stock into 2024. We expect longer-term investors buying Applied Materials, Inc. stock at current levels will be well rewarded in 2024, and hence recommend investors explore entry points into the stock at current levels.

Our Investing Group, Tech Contrarians, will launch on June 1st with a significant discount on the annual subscription for the life of the service. We cover everything software/hardware and semiconductors as engineers turned top analysts. Keep reading our work to see more of what's ahead.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.