TFLO: Cash Is Not Trash

Summary

- Cash has not kept pace with equities in 2023.

- The equity risk premium is very rich, the lowest is over a year.

- Cash offers investors over 5% yield to wait and see how the business cycle plays out, a substantial yield compared to average investor returns.

Rouzes

The S&P 500 has gained over 9% year to date, leaving many to ponder: why would I want to have cash?

It's a valid question. Comparatively, cash has returned 1.8% year to date, as measured by the iShares Treasury Floating Rate Bond ETF (NYSEARCA:TFLO). We prefer this fund as a cash equivalent because its portfolio of floating rate notes (FNRs) adjusts for higher interest rates weekly and experience a bond convexity of 0.0, meaning that the bond does not lose value if interest rates decline. In addition, compared to money market funds or other liquid short duration assets, FRNs have been better able to keep up with rising rates as lending institutions lag behind the Fed in adjusting the yields that they offer.

No explanation is needed, 9% is obviously better than 1.8%. But nothing in investing is guaranteed. The 9% gain is far more exposed to risk than the 1.8%. At first glance, cash may seem like trash, especially in the context of 2023 thus far. Cash is NOT trash. Cash has a deserving place in our portfolio at all times and during certain times cash deserves to be an overweight position in our portfolio.

Putting Things into Perspective

To help put things into perspective, it is important to recognize what a reasonable return is, first, and then risk-adjusted. Historically, the average portfolio has returned about 7% annually. Data from JPMorgan shows that the average active investor has only returned about 2.6% per year. The U.S. stock market has averaged about 9-10% per year. Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B), considered a gold standard for investment management, has returned 19.8% annually.

With this in mind, there is compelling evidence to suggest that investors would be better off buying index funds and doing nothing. This approach has many noble qualities. We prefer to adjust our portfolio to adapt to the business cycle by over-weighting and under-weighting asset classes.

Today, cash is yielding over 5%. In fact, TFLO is offering a yield to maturity of 5.41%. It will continue to offer that yield until the rate on the 3 month T-bill begins to decline which is not expected until the Federal Reserve begins to cut rates. The market is expecting rate cuts by November according to futures. We think this would be the earliest that the Fed may consider cutting rates which means that the yield of TFLO would remain stable for the next few months.

The yield on TFLO is expected to beat the average active investor with far less risk. It should not be expected to beat equity markets during an average year or better. Given the phase of the business cycle we are in now, we are cautious that the probability of a below average year for equities is high.

Business Cycle and Opportunity Cost

The next item to consider is equity risk premium. When "risk free" interest rates, those offered by the U.S. Treasury, move higher the risk premium for equities should shift in response. If risk premium compresses instead, this can be reason for concern. The S&P 500 is currently offering an earnings yield of 4.36%. This is a risk premium of -0.681% compared to the 1-year Treasury. Negative risk premium is not attractive. Compared to TFLO, the risk premium is -1.05%.

In October 2022, the risk premium against the 1Y was about 0.8%. At the peak in December 2021, it was about 3.75%. The expensive risk premium that equity investors are currently paying must be justified through sufficient earnings growth. We remain skeptical that earnings growth will be robust in the quarters ahead.

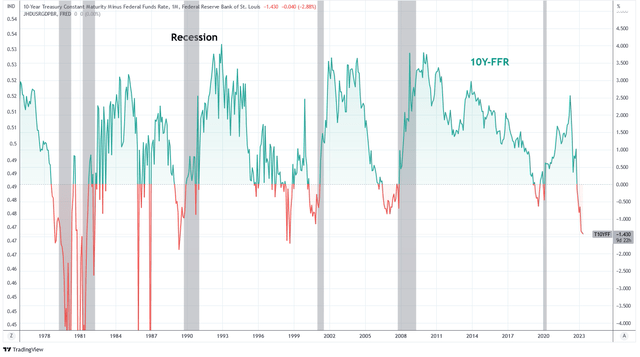

To begin, the yield curves are overwhelmingly suggesting that the economic cycle is in decline and that recession is likely. Below are two such yield curves. The first is the 10 year Treasury minus the Fed Funds rate. It is deeply negative today. Most inversions have occurred just prior to recession. Recession often begins once the yield curve flattens again, with the major exception being the 1970s.

Charts by TradingView (adapted by author)

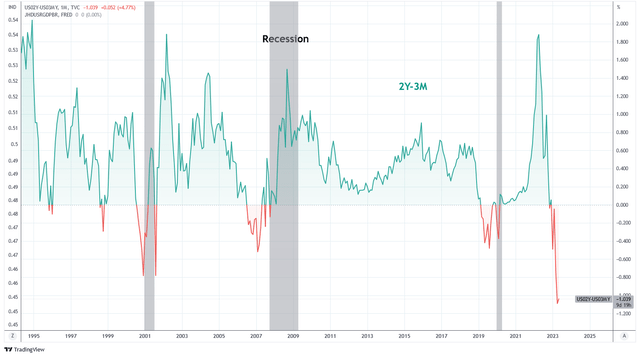

Similarly, the 2 year minus 3 month curve is very deeply negative. Inversions are often, but not always, prior to recession. Recession, though, is always after an inversion. The bond market is signaling caution to investors that growth is slowing which will translate to weaker earnings. Many pundits have proclaimed that "this time is different" and that the yield curves are sending a false signal in this circumstance. While anything is possible, we think it's more likely that the volume of money supply that was created over the last three years and distributed widely through stimulus checks, extra unemployment, PPP gifts, debt repayment moratoriums, and the wealth effect from higher real estate prices are all contributing to a massive lag in the expression of the business cycle. At least, that's our theory.

Charts by TradingView (adapted by author)

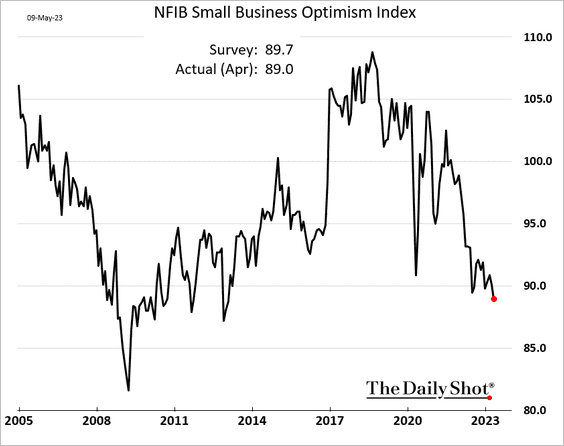

Small businesses seem to agree. The SB optimism index has fallen sharply to levels last seen during the period of recovery following the GFC in 2009-2012.

The Daily Shot (used with permission)

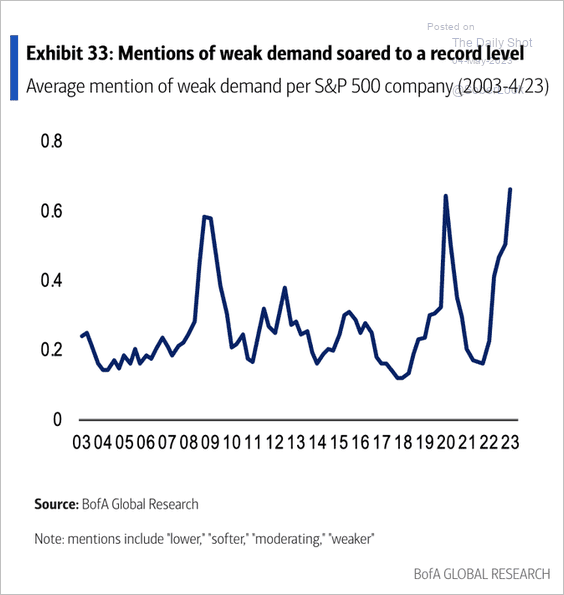

Observations of weak demand by S&P 500 companies are also at levels last witnessed during the GFC and the COVID pandemic. A recent poll by Gallup found that American's confidence in their financial situation is the worst since the GFC. Year to date, 236 U.S. corporations have filed for bankruptcy, the most since 2010. The Conference Board Leading Economic Indicators declined again in April to a level previously experienced during each of the last three recessions.

The Daily Shot (used with permission)

Many investors will justify prioritizing risk assets over cash despite these signs of business cycle decline because of inflation. The notion is that cash is trash because inflation destroys its purchasing power. First, to be clear inflation destroys the purchasing power of returns on equities, too. Therefore, the inflation by itself is not a reason to avoid cash if cash yields more than other investment classes.

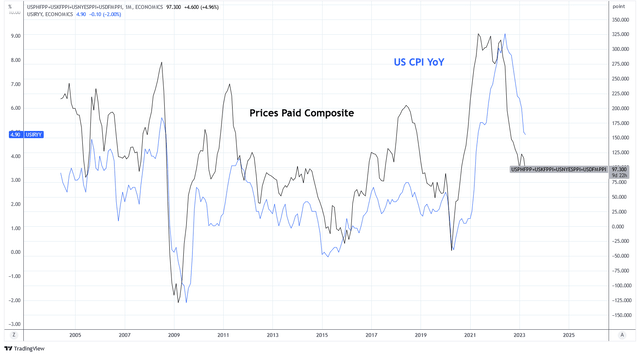

In addition, leading indicators suggest that inflation is due to decline substantially. A composite of Fed Prices Paid indexes are leading U.S. CPI lower and project a YoY CPI in the range of 3.25-3.75% by year end. The fact that this is higher than the Fed's target of 2% means that the Fed will be less likely to cut rates while their goal is underachieved.

Charts by TradingView (adapted by author)

We believe there is a significant possibility that earnings growth will disappoint as economic conditions continue to weaken. As a result, risk premium will be reconsidered. We expect that a re-rating of risk premium would reverse the year to date returns of equities. At the same time, cash will be earning 5%+. In the case of this outcome, cash will provide us with the flexibility to take advantage of the opportunity to invest in equities at lower prices.

Summary

Cash is often looked upon unfavorably, hence the metaphor "cash is trash." While cash is not expected to outperform equities in the long term, it is a necessary, useful, and sometimes critical part of our portfolio.

The iShares Treasury Floating Rate Bond ETF is a preferred cash equivalent for us. This is primarily because it offers a superior yield compared to other cash alternatives. So long as rates do not begin to decline, the yield on TFLO is expected to remain above 5%.

Macroeconomic indicators suggest that the business cycle is still in decline. This would have negative impacts on business earnings. Weak earnings is a particular problem for investors because equity risk premiums are very rich at the moment. Risk-adjusted, we find the return potential of cash to continue to be attractive and maintain an overweight allocation to cash in our portfolio.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TFLO, SP500 either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not an investment advisor, is not registered as a financial advisor, and is not suggesting any investment recommendations. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and is subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.