Cboe Global Markets: Leveraging Global Growth And Access To Multi-Asset Activities

Summary

- Over the past year, Cboe has seen superior growth in both the general market and the brokerage and securities exchange industry.

- The latter highlights the 13.27% annual revenue growth to record levels of $3.96bn in addition to a 48.19% annual increase in free cash flow.

- This comes in spite of rising interest rates and bank crises, which have led to slowed growth in the financial services industry.

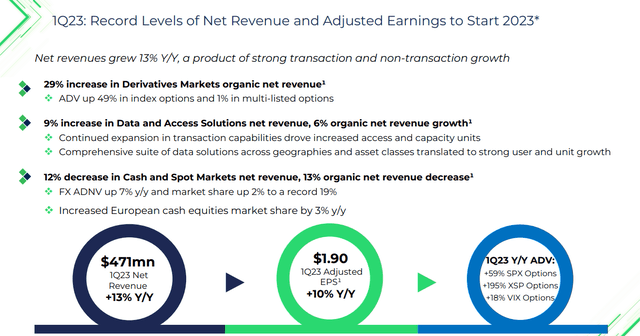

- Additionally, with a 29% increase in Derivatives Market organic net revenues and a 9% increase in data revenues, Cboe is positioned to leverage long-term growth trends.

- Combined with a general undervaluation and operational excellence, Cboe is rated a 'buy'.

TERADAT SANTIVIVUT

Cboe Global Markets (BATS:CBOE) is a US-based firm which owns and operates the Chicago Board Options Exchange and BATS Global Markets. The company handles a broad range of asset classes, from options and derivatives to equities, futures, and foreign exchange.

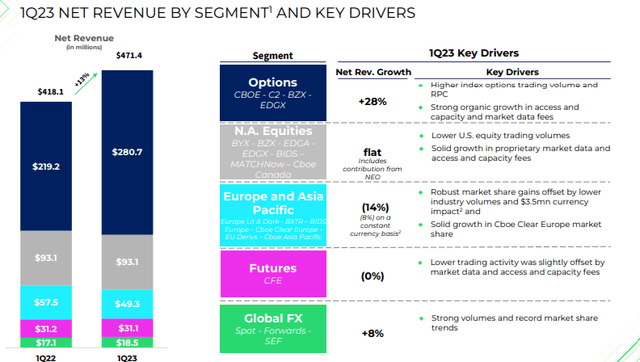

Q1 Financial Highlights (Cboe Q1'23 Presentation)

In the Q1'23 period, Cboe has generated $471mn in net revenues, enabling $1.90 in adjusted EPS, supported through an increased volume of SPX, XSP, and VIX options.

Introduction

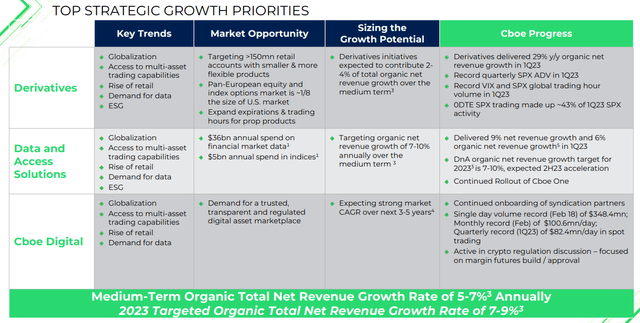

Throughout its three verticals of Derivatives, Data Access and Solutions, and Cboe Digital, the company aims for multisided growth, with globalization, access to multi-asset trading capabilities, the rise of retail investment demand, and increased demand for data driving macro growth. Moreover, the company lays out how it plans to take advantage of these trends, with defined market opportunities and growth potentials. For instance, in the Cboe Digital segment, the company aims to fulfill the demand for transparent digital asset marketplaces, an area with a strong expected CAGR over the next 3-5 years.

Cboe Q1'23 Presentation

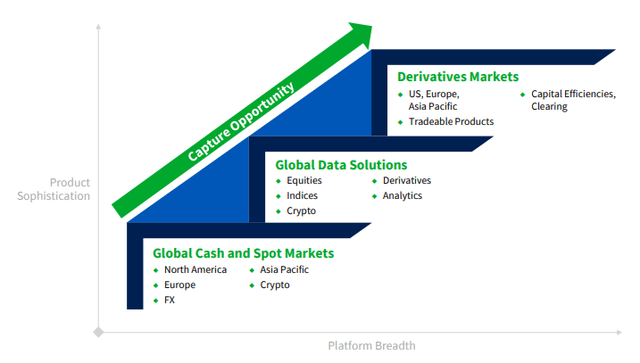

Cboe emphasizes its ability to adequately capture these opportunities, with accessibility at every level of product sophistication and platform breadth.

Cboe Q1'23 Presentation

Valuation & Financials

General Overview

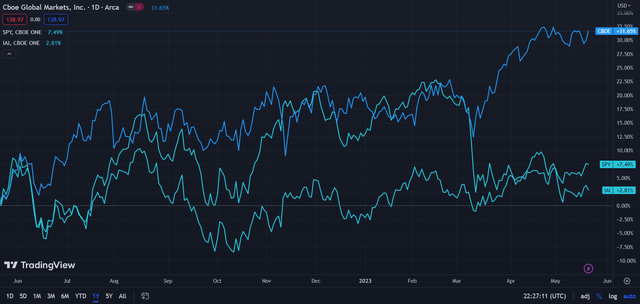

In the TTM period, CBOE stock- up 31.65%- has led both the general market, represented by the S&P 500 (SPY)- up 7.49%, and the brokerage and exchange markets index (IAI)- up 2.81%.

Cboe (Dark Blue) vs Industry and Market (TradingView)

This reflects the strength and growth of the company- especially its derivative vertical- in spite of significant macro headwinds from increased interest rates, which have had a diminishing effect on market liquidity, and recent bank crises, further reducing trust in financial services institutions.

Comparable Companies

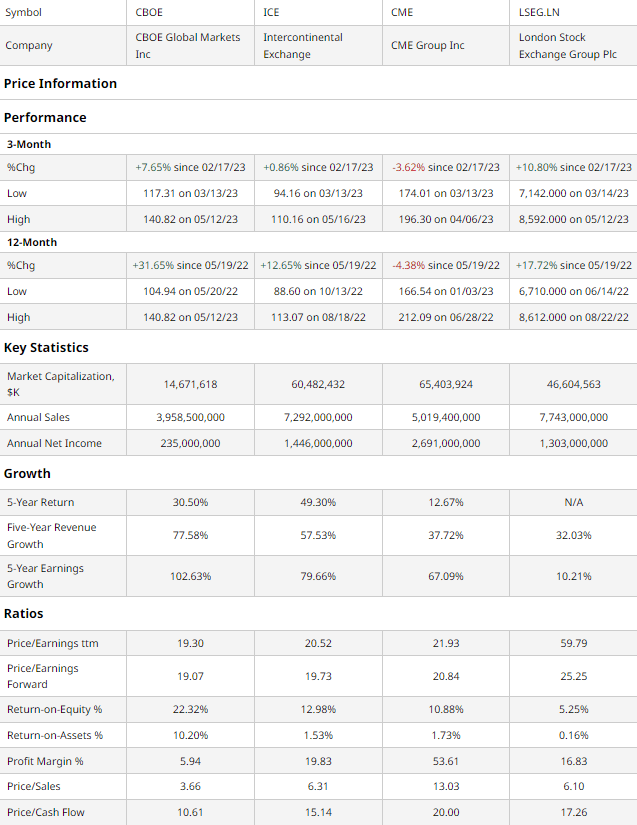

The exchange sector is a highly centralized and consolidated one, with the inherent nature and network advantage of exchanges supporting limited competition. As such, while there is little in terms of direct competition to Cboe, firms such as the NYSE owner, Intercontinental Exchange (ICE), the leading commodities exchange, the CME Group (CME), and the London Stock Exchange (OTCPK:LNSTY) can be considered key peers who should maintain similar valuations.

barchart.com

As demonstrated above, Cboe has experienced both superior quarterly and yearly price performance. Despite this, Cboe remains discounted on a multiples basis, with a respective 19.30 and 19.07 trailing and forward P/E being the lowest of the peer group, alongside to lowest P/S and P/CF ratios.

Moreover, demonstrating Cboe's ability to invest in effective growth areas is its highest ROE and ROA metrics. Such efficacious investments have additionally enabled the greatest 5-year revenue and earnings growth among major exchange firms.

Conversely, beyond just multiples, Cboe's impressive financial record is not supported by its share price action. Although the firm has seen decent 5-year growth, it trails the proportionally greater growth of the likes of the Intercontinental Exchange, for instance.

Valuation & Financials

According to my discounted cash flow analysis, at its base case, the fair value of Cboe is $152.57, with the stock currently undervalued by 10%.

My model assumes a conservative discount rate of 10%, in spite of a relatively low debt/equity and not excessive volatility (meaning equity risk premium shouldn't be too high) to account for recessionary risks and the current volatility undergirding the financials industry. Although Cboe is targeting medium-term growth at ~7%, I assume revenue growth of around 4%, further emphasizing a conservative approach and the inherent risk associated with financial uncertainty.

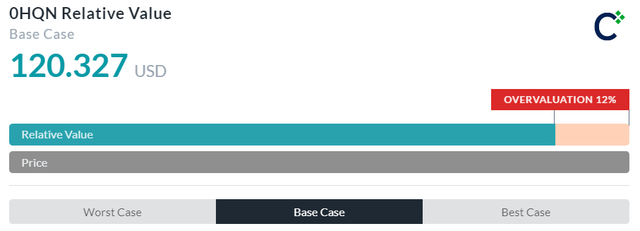

AlphaSpread

On the other hand, AlphaSpread's relative valuation tool calculates that the company is overpriced by 12%, with a fair value of $120.33. That said, I disagree with AlphaSpread's analysis, which puts a premium on EV-based valuations over other multiples and therefore skews the result.

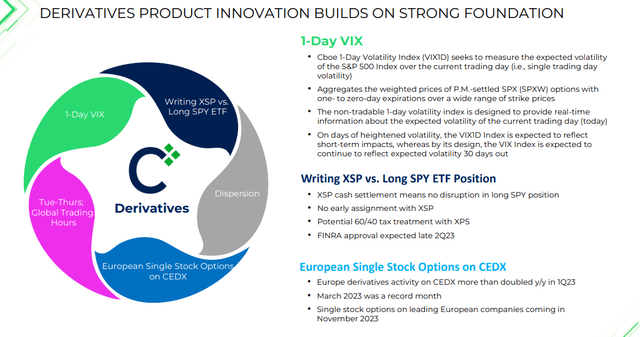

Strategic Growth Enabled by Product Innovation and Market Momentum

Throughout the unpredictability pervasive through the previous year, derivatives were key to supporting record growth, with the firm's Derivatives Market vertical seeing 29% growth in 2022, versus +9% in Data, and a real decline across all other segments. As such, supporting increased volumes in this area has been a priority; Cboe has innovated with the 1-day VIX index, XSP cash settlement, and the expansion of European single stock derivatives on CEDX. Combined with increased market access through any time proprietary product availability, for example, Cboe has supported steady scale growth.

Cboe Q1'23 Presentation

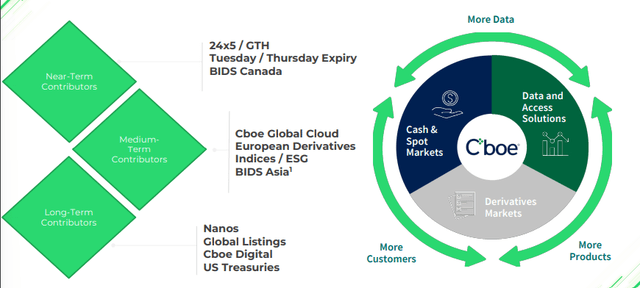

This has supported Cboe's wider, firm-wide ambition of promoting consistent growth through an integrated, virtuous cycle. Said virtuous cycle combines access expansion- exemplified by 24/5 prop availability, digital rollout, and geographic expansion to foster short, medium, and long-term contributors which will feed into one another and support sustained scale and margin expansion; for instance, as derivatives market access is expanded, greater demand for data and cash settlement will be induced, essentially locking consumers into the Cboe ecosystem.

Cboe Q1'23 Presentation

While principally underpinning organic growth efforts, this product innovation and general globalization and democratization of finance is enabling greater segmentation and geographic diversity, supporting an even more resilient organization. Although depressed liquidity levels hampered growth in the APAC region, North America, and the Futures market, the firm has seen growth in market share across these verticals, with Options and Global FX driving net revenue growth.

Cboe Q1'23 Presentation

Wall Street Consensus

Analysts generally echo my positive view on Cboe, projecting an average 1Y price increase of 5.78% to a stock price of $147.00.

TradingView

At the minimum forecasted price, however, analysts predict a price decline of -8.61% to a price of $127.00, likely a reflection of anxieties surrounding compressed market liquidity and the financial services industry at large.

Risks & Challenges

Loss of Proprietary Exclusivity

Cboe currently holds exclusive licences to list securities index options on the S&P500 Index, the Russell 2000 Index, and others in addition to other products such as Cboe's VIX methodology. Any loss of exclusivity would impact - as described by Cboe's 2022 10-K- approximately 60.7% of net transaction and clearing fees the firm has generated by proprietary futures and index options. Thus, this would have material impacts on Cboe's moat and independent operations.

Depressed Levels of Market Liquidity

In 2022, the markets which saw the least growth for Cboe were North America, Europe and APAC, and Futures, all of which are at least partially attributed to a lack or reduction of liquidity- thus trading volumes- in the aforementioned markets. Sustained reductions in liquidity may therefore inhibit Cboe's growth capabilities and ability to generate adequate cash flows.

Geographic Expansion May Harm Core Activities

The financial services industry is inherently an industry with high levels of specialized regulatory structures by country. While Cboe has thus far shown the capability to navigate these regulatory structures and grow in foreign markets, poor strategic execution may lead to reduced profitability or reductions in specialization capabilities.

Conclusion

In the short term, I expect Cboe will grow to its fair value and continue to post strong financial results.

In the long term, I project Cboe will become a pillar of global finance and trade, with an integrated and virtuous growth story.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.