IGBH Vs. IGLB: Hedging A Bond Portfolio Smooths The Ride

Summary

- The iShares Interest Rate Hedged Long-Term Corporate Bond ETF invests based on the BlackRock Interest Rate Hedged Long-Term Corporate Bond Index.

- The iShares 10+ Year Investment Grade Corporate Bond ETF invests based on the ICE BofA 10+ Year US Corporate Index.

- This article reviews both ETFs and their underlying index. In the Portfolio strategy section, I show how bonds can enhance certain features of an investor’s portfolio.

- For investors liking investment-grade corporate bonds in the unknown interest-rate environment, I give the IGBH ETF a Buy rating for its results compared to the IGLB ETF.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

DNY59

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Wouldn't bond investors like to have both higher returns and lower risk if they could find an ETF that generated both of those investment goals? So far, this seems possible when comparing these two ETFs.

- iShares Interest Rate Hedged Long-Term Corporate Bond ETF (NYSEARCA:IGBH)

- iShares 10+ Year Investment Grade Corporate Bond ETF (NYSEARCA:IGLB)

For investors liking investment-grade corporate bonds in the unknown interest-rate environment, I give the IGBH ETF a Buy rating for its results compared to the IGLB ETF.

iShares Interest Rate Hedged Long-Term Corporate Bond ETF review

Seeking Alpha describes this ETF as:

The investment seeks to track the investment results of the BlackRock Interest Rate Hedged Long-Term Corporate Bond Index designed to minimize the interest rate exposure of a portfolio composed of U.S. dollar-denominated, investment-grade corporate bonds with remaining maturities greater than ten years. IGBH started in 2015.

IGBH has just $62.2m in AUM and shows a TTM yield of 5.53% but recent payouts, even with some backtracking, point to a higher yield over the next year. Fees come to just 14bps.

Index review

BlackRock provides this background on the index used by IGBH:

Each Index in the BlackRock Rate Hedged Series of indices (“the Indices”) provides exposure to a single Fixed Income ETF, while seeking to minimize either the Interest Rate or Inflation exposure of the ETF. Each Index holds:

• An ETF position that is held with a fixed number of shares, which will adjust for any stock splits that occur.

• A series of up to 10 swaps, with terms corresponding to various KRDs points.

• A cash position intended to replicate collateral that is held for managing the day-to-day changes in swap prices.

The index construction was explained thusly: Each Index in the Series is constructed by combining its single associated ETF with 10 Interest Rate or Inflation Swaps with maturities of 1, 2, 3, 5, 7, 10, 15, 20, 25, and 30-year. The weight of each swap contract is calculated to best achieve neutral Key-Rate Durations (KRDs) of the Index at the 1, 2, 3, 5, 7, 10, 15, 20, 25, and 30-year points. The ETF for each Index will be held with a fixed number of shares (to be adjusted in the event of any stock splits), while the weights of the swaps will be rebalanced daily. The rebalance takes place at the end of each Business Day, with the new weights being effective on the following Business Day.

Source: blackrock.com Index Methodology

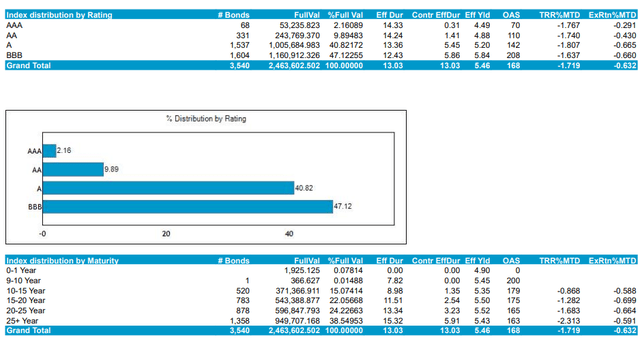

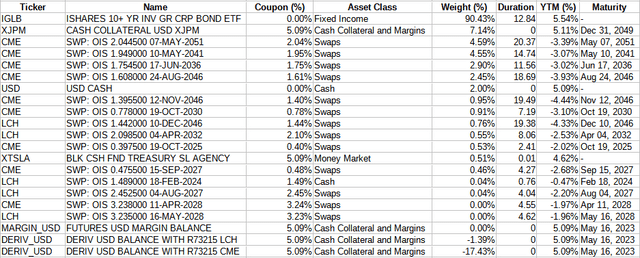

IGBH holdings review

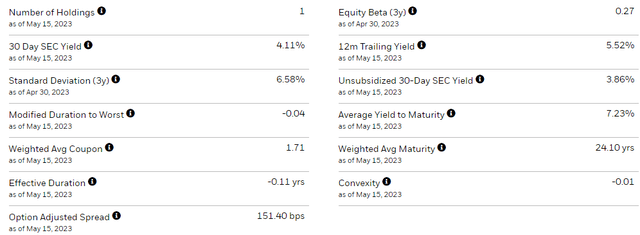

iShares provides some portfolio characteristics.

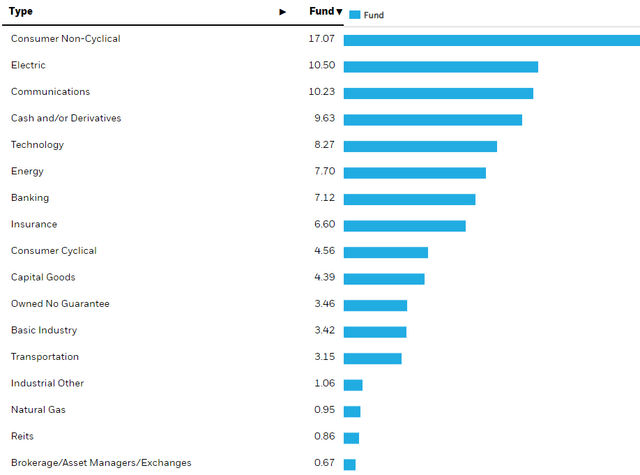

Notice that cash, used to back the swaps, is almost 10% of the portfolio.

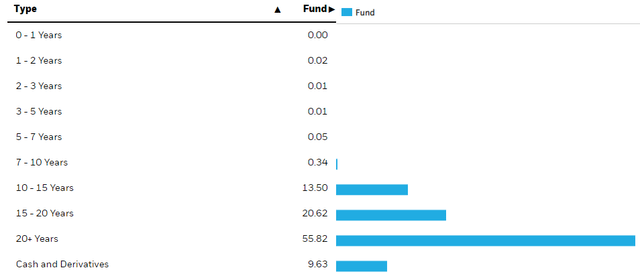

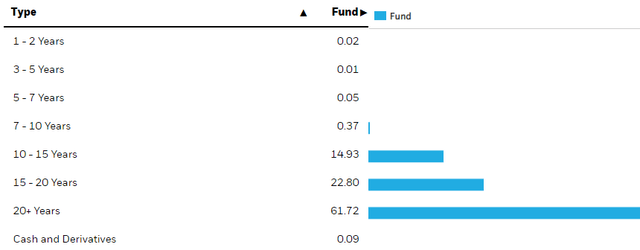

The maturity schedule shows the ETF invests at the long end of the market, as the name would indicate.

This is where the hedging strategy makes this ETF different from IGLB, as the interest-rate swaps used leaves the ETF with a negative Effective Duration of -.11 years.

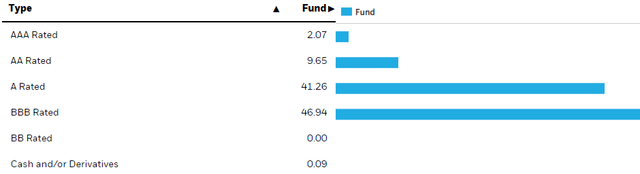

The ETF mostly hold bonds rated at the lower end of the investment-grade scale. I calculate the portfolio to have an average rating of A-.

Top holdings

ishares.com; compiled by Author

The main holding is the other ETF reviewed in this article, the IGLB ETF. The swaps mature between 2024 and 2051.

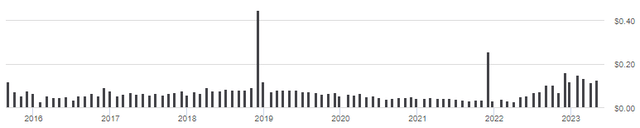

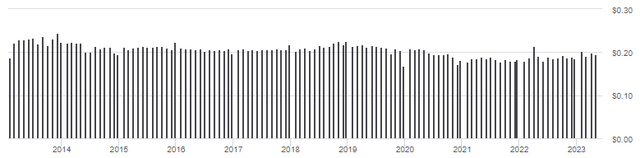

IGBH distribution review

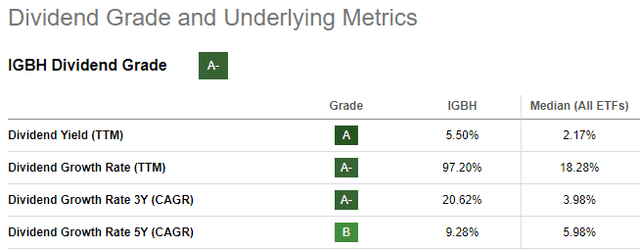

Since the FOMC starting rising interest rates, the payouts have been climbing until recently; maybe as a result of the belief that increases are close to ending. That possibility adds uncertainty to what the ongoing yield will be. Based on its history, Seeking Alpha gives IGBH a "A-" grade.

seekingalpha.com IGBH scorecard

iShares 10+ Year Investment Grade Corporate Bond ETF review

Seeking Alpha describes this ETF as:

The investment seeks to track the investment results of the ICE® BofA® 10+ Year US Corporate Index, which measures the performance of investment-grade corporate bonds of both U.S. and non-U.S. issuers that are U.S. dollar-denominated and publicly issued in the U.S. domestic market and have a remaining maturity of greater than or equal to ten years. IGLB started in 2009.

IGLB is much larger at $1.7b in AUM and provides a lower TTM Yield of 4.5%. Without the hedging costs, fees are only 4bps.

Index review

ICE provides the following description and data points for this index.

ICE BofA US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market. The ICE BofA 10+ Year US Corporate Index is a subset of ICE BofA US Corporate Index including all securities with a remaining term to final maturity greater than or equal to 10 years. Inclusion rules include the issue is at least one year remaining to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million.

Source: indices.theice.com

Key data includes the following.

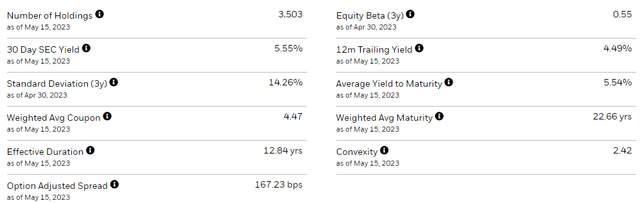

IGLB holdings review

The iShares provided facts for IGLB are as follows.

So while the maturity length is close to IGBH, the Effective Duration is not; here coming in at 12.84 years.

If adjusted down for the cash holdings differences, as expected, the sector allocations match. The same can be said for ratings and maturity allocations.

ishares.com IGLB ratings ishares.com IGLB maturities

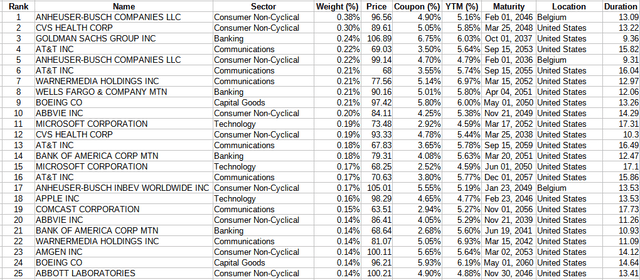

Top holdings

These are also the largest bond positions held by IGBH since its biggest holding is the IGLB ETF.

ishares.com; compiled by Author

IGLB, thus IGBH, holds over 3500 bonds. The Top 25 are just under 5% of the portfolio; the bottom 3500 are still a reasonable 25% of the weight.

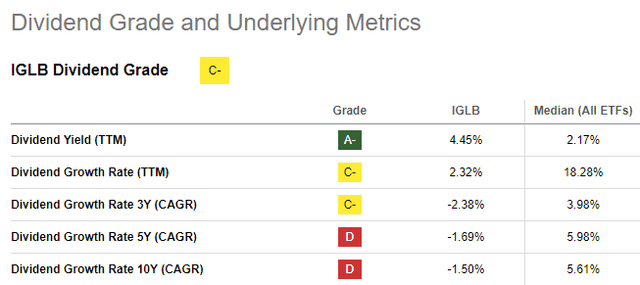

IGLB distributions review

It seems, without the hedging, IGLB's payout movement is smoother compared to IGBH's. Seeking Alpha's Quant rating gives this ETF a much lower grade: C-.

seekingalpha.com IGLB scorecard

Comparing ETFs

Comparing some data points between the two ETFs shows how holding interest-rate swaps alters some of them.

| Factor | IGBH | IGLB |

| Weight-Average-Coupon | 1.71% | 4.47% |

| Effective Duration | -.11 yrs | 12.84 yrs |

| Weighted-Average-Maturity | 24.10 yrs | 22.66 yrs |

| Yield-to-Maturity | 7.23% | 5.54% |

| Fees | 14bps | 4bps |

| SEC Yield | 4.11% | 5.55% |

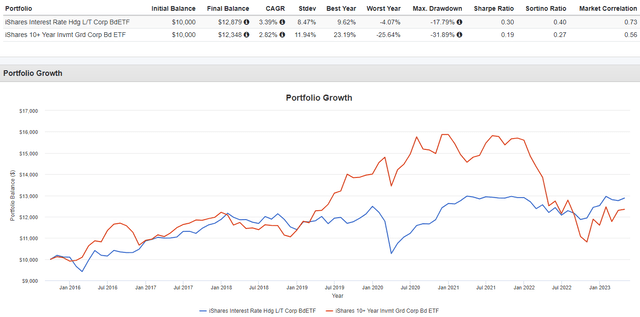

The results since 2015 when IGBH started to follow.

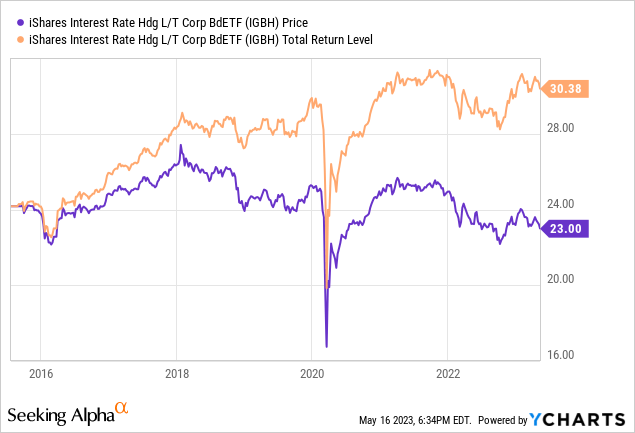

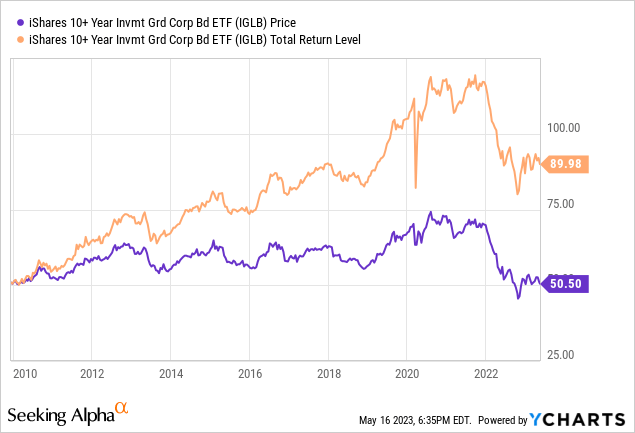

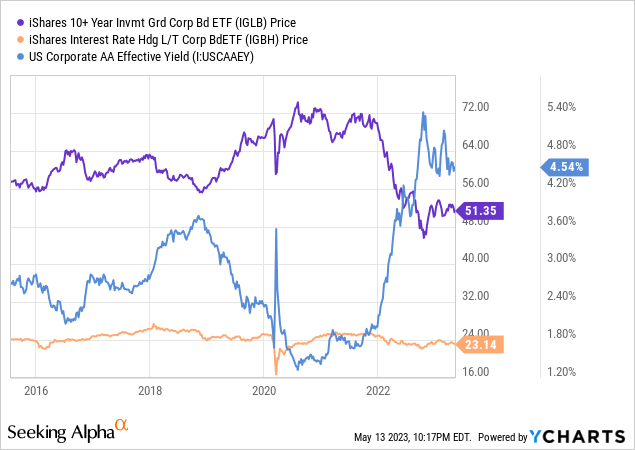

Which ETF was the better performer has changed over time, but one thing hedging achieved was a smoother performance for investors. This is clearly shown in the data investors consider: StdDev, Worst Year, and Max Drawdown.

Portfolio strategy

When deciding between ETFs where one hedges and the other does not, understanding when each is the better investment becomes an important question. I think the next chart gives investors a clue.

Hedging levels the playing field for IGBH, whereas IGLB has an inverse relationship to interest rates, as one would expect.

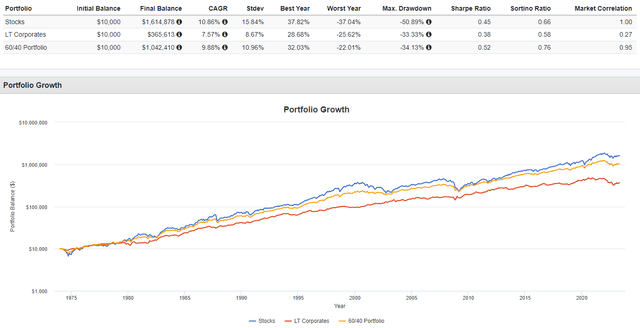

I do not think investors own bond funds to get rich, that is what equity funds are for. That doesn’t mean bond funds cannot play an important role in the construction of a portfolio with attributions superior to a 100% equity allocated portfolio, such as more income or lower risk, two things that I appreciate more now that I am retired. The next dataset shows this in action which compares stocks, LT corporates, and the standard 60/40 portfolio.

While a 100% stock portfolio was the best choice most years and over the last almost 50 years, the 60/40 allocation reduced the risk enough to make its combination of return/risk resulting in the best Sharpe and Sortino ratios. Data also shows adding bonds then added Alpha to the portfolio compared to a 100% stock portfolio.

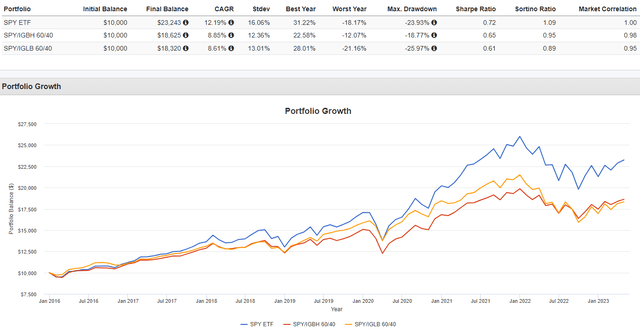

But back to 1974 is a long time so, I ran SPY against 60/40 portfolios using each of the ETFs reviewed here. Since 2015, the 100% stock portfolio was top in both return and Sharpe/Sortino ratios, even Alpha, but not StdDev.

Final thought

As a retired investor, I do not mind giving up some return for the smoother performance that having exposure to bonds via ETFs provides. The fun is determining what that allocation should be based on my age and net worth, a topic I tried to tackle some years back: Setting One's Equity Ratio Based On Age And Net Worth.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.