DBS Group Deserves An Upgrade To Buy (Rating Upgrade)

Summary

- Net profits keep beating earlier quarters on the back of better NIM.

- We have most likely seen the top in the NIM but growth in profits may come from more business activities.

- With lower share price and an increase in dividend, the yield is now more attractive for an entry into its shares.

ClaudineVM/iStock Editorial via Getty Images DBS logo (DBS Group)

Investment Thesis

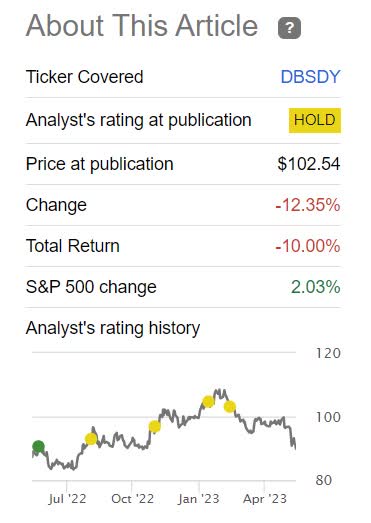

We have held a string of Hold stances on DBS Group (OTCPK:DBSDY) for some time.

The share price dropped 12% since our previous analysis of 16 February, where we looked at their 2022 Annual Results.

DBSDY is down 12% since our previous call (SA)

Is this drop in the share price enough to nibble some shares in Southeast Asia’s largest bank?

The Q1 numbers

Net profit after taxes keeps rising.

They managed to deliver SGD2.57 billion in Q1. As a comparison, this was SGD240 million higher than in Q4 of 2022 and SGD770 million higher than the net profit they delivered in Q1 of 2022.

EPS for the quarter was SGD1.00. On a TTM basis, the EPS was SGD 4.01, which gives us a very reasonable P/E of just 7.7

We often remind our readers that we want to look at a company’s ROE before we invest in them.

DBSDY’s ROE climbed to a new record high of 18.6%.

Net fee income in Q1 was SGD851 million. This should be compared up against Q1 of 2022 and not Q4 of 2022 as the first quarter of each year has much higher fee incomes. On that basis, the Q1 figure was 4% lower than the SGD891 million they made in Q1 of 2022.

Net interest income came in at SGD3.38 billion in Q1. That was actually 1% lower than what we saw on a Q-o-Q basis.

History shows that rising interest rates and inflation can be a toxic mix that often leads to some lenders defaulting on loans. It has been devastating to some banks in the past and even lead to governments bailing these banks out.

Fortunately, DBSDY is not on such shaky ground. Their Non-Performing Loans, or NPL, stood at SGD4.95 billion which is a NPL ratio of 1.1%. It actually declined in Q1 by 3% Q-o-Q with new NPL formation remaining low and more than offset by repayments and write-offs.

To determine if a bank holds enough capital to buffer against major downturns, we look at its CET-1 ratio. DBSDY has a CET-1 ratio of 14.4%

NAV per share as of the end of Q1 was SGD21.41 which is slightly higher than the SGD21.02 in Q1 of 2022. This makes the NAV just fair value as its Price/NAV is 1.44

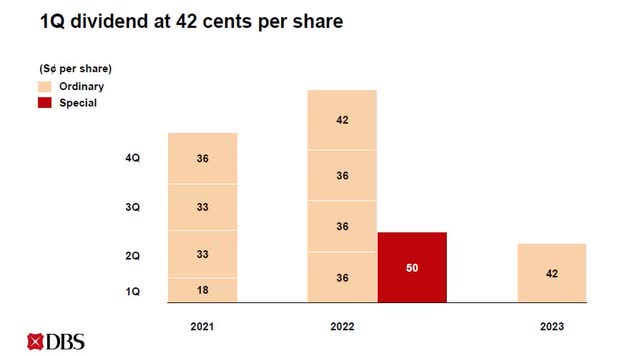

Earlier this year, when the DBS board decided on the size of the dividend for Q4 of 2022, they were comfortable not only giving shareholders a special dividend of SGD 0,50 but they also decided to increase the ordinary from SGD0.36 to SGD0.42.

This SGD0.42 was maintained for Q1 and we can assume that this will continue for the rest of this year.

DBS dividend history (DBS - CFO's Q1 of 2023 Presentation)

The forward yield is 5.45% based on a share price of SGD 30.83. The payout ratio is 42%.

That is actually quite attractive. We are of the opinion that this level of quarterly dividend is quite safe. However, it does depend on maintaining the high NIM which stood at 2.12% at the end of Q1. It is important to take into account that the NIM was much lower at 1.46% in Q1 a year ago. This 66-basis point difference resulted in an increase in NII of SGD1.42 billion over this one-year period. We will monitor NIM going forward.

Business Outlook

Money is still flowing into Singapore, especially from the region. Family offices are also sprouting up and these are just one example of the confidence many have in Singapore’s stability and business-friendly environment. DBSDY and other banks will benefit from the activities these people do.

We are also excited about the prospects of more growth in income for DBSDY from India, China, and Taiwan.

Risks and Conclusion

Banks are prone to fines from regulators.

In most countries in the world, whenever a large bank action has fallen short of their customer’s expectations, the authorities usually slap them with a fine. That is a nice way for them to make some extra money.

Not so, here in Singapore.

The Monetary Authority of Singapore imposed an additional capital requirement on DBS Bank, following the widespread unavailability of DBS Bank’s digital banking services on 29 March 2023 and the subsequent disruption to its digital banking and ATM services on 5 May 2023.

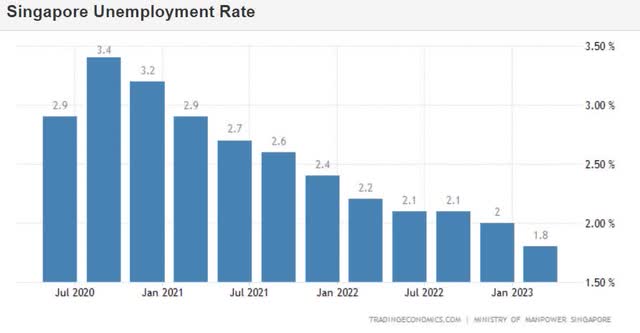

Our concern in our earlier analyses was a recession that could lead to an increase in actual unemployment in Singapore and higher foreclosures of SMEs could cause NPLs to increase.

This has not happened so far.

Unemployment in Singapore has decreased since we last reported on DBSDY.

Singapore unemployment is dropping (Trading economics and Singapore's Ministry of Manpower)

We did ask the question in our previous analyses if we would buy more of DBS Group stock at this share price level.

At that time the share price was hovering around SGD35

With a lower price at this moment and more certainty around DBSDY's future earnings, we have decided to upgrade it to a Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DBSDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Long DBS Group in Singapore.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.