Ashtead: Fantastic Compounder With Growth And Margins

Summary

- Ashtead Group plc is involved in the rental business of construction, industrial, and general equipment.

- Revenue has grown at a CAGR of 16% due to increased rental usage and construction projects.

- Ashtead's margins are impressive, with a NIM of 17%. The company has scope for improvement with rates beginning to rise.

- M&A should allow the business to maintain its growth trajectory, supporting any potential weakness in organic growth.

- Ashtead is trading at a discount to its historical average multiples despite the improved commercial profile.

lechatnoir

Investment thesis

Our current investment thesis is:

- Ashtead has developed market-leading expertise through strategic organic growth and M&A. The business now has >25% market share in the US and is positioned to be a lead supplier for mega / large-scale projects.

- Increased construction spending and use of rental services have allowed Ashtead to generate >10% growth in 8 of the last 10 periods (2 impacted by Covid-19).

- Interest rates remain a risk, as although they encourage rental services, they also dissuade construction projects.

- With an EBIT-M of 25%, the company's profitability profile is highly attractive.

Company description

Ashtead Group plc (OTCPK:ASHTY) is involved in the rental business of construction, industrial, and general equipment. The company operates in the United States, the United Kingdom, and Canada, providing a wide range of services including pumps, power generation, heating, cooling, scaffolding, and more.

Its products and services cater to various sectors such as facilities maintenance, municipalities, construction projects, emergency response, and entertainment events.

Share price

Ashtead's share price has performed incredibly well in the last decade, generating in excess of 500% returns. This is a reflection of the company's impressive financial performance, as well as its resilience.

Financial analysis

Ashtead financials (Tikr Terminal)

Presented above is Ashtead's financial performance across the last 10 years.

Commercials

Ashtead has grown its revenue at a CAGR of 16%, an impressive level for a relatively mature business, reflecting what has been a successful strategic execution of expansion. During this period, the company did not experience a single period of sub-10% growth, when excluding the Covid impacted years.

Despite being a British business, Ashtead generates the majority of its revenue from the US, with the country contributing 80.4% of total revenue in FY22. This is a reflection of Ashtead's strategic positioning, with Management focusing on expanding its US presence.

Revenue split (Ashtead)

Acquisitions:

One of the primary drivers of growth for the business is M&A. The Group is active in acquiring both assets and businesses across its 3 primary geographies. A Services business can grow in two ways, either by selling its current clients more work (upselling) or selling to new customers (customer acquisition). M&A is highly effective because it provides both. Ashtead can expand its geographical reach while also increasing the services it can provide. Ashtead does not want to rely on a single source, such as continued business, as construction projects are one-off in nature.

As a wider point, the equipment rental industry has witnessed a period of consolidation, with larger players acquiring regional and specialized rental companies as a means of maintaining their growth trajectory. One of the attractive qualities of a Service industry is that they are generally fragmented. Take Accounting, there are 4 "big" accounting firms yet most towns in the West will have a local firm. For this reason, we are not concerned about the long-term trajectory of this strategy. Further, acquisitions do not just bring in greater reach but also easy-to-achieve synergies. With Ashtead's infrastructure and expertise, it can immediately improve the bottom line.

Finally, there is always a degree of "valuation arbitrage" with acquiring regional / smaller players. This is because their valuations are usually lower than the larger consolidator, and so immediate value is realized when purchasing.

Moat:

Ashtead estimates that it has >25% market share, significantly up from the sub-10% it had prior to 2010. This is in part due to acquisitions but also the company's strategic decision-making. Management has focused on expanding its Specialty business lines, which are higher margin services and also display the company's expertise. This segment has increased from c.13% of business to c.30%. These services are increasingly important as technological development is embraced by the manufacturing industry.

These factors allow Ashtead to offer convenience (Able to mobilize quickly regardless of location / requirement), scale (size and breadth-of-product wise), competitive prices (Economies of scale), and expertise at a superior level to its competitors. These are Ashtead's "moat".

Infrastructure Spending:

Increasing infrastructure spending by governments across the globe is driving the demand for equipment rental services. In the US in particular, there is the "Infrastructure Investment and Jobs Act", "The Chips and Science Act", and "The Inflation Reduction Act", all of which are committing the US to significant infrastructure spending in the coming decade.

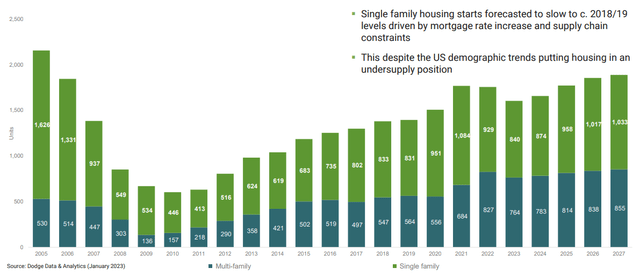

As the following charts illustrate, construction spending in the US has greatly improved in the last decade and looks to be on an upward trajectory. This should support continued organic growth.

Dodge indicators (Ashtead)

Further, rapid urbanization and population growth are fueling the need for improved infrastructure, creating long-term opportunities as demand for residential housing in key Cities is fueling home building. As a leading rental brand, Ashtead is in a position to win an outsized portion of work.

The near term could be slow, however, as current interest rates deter consumer home buying, which will impact housing starts.

We are slightly concerned about the development of commercial real estate in the coming decade. The Covid-19 pandemic has changed working trends, contributing to greater levels of working-from-home. This is already leading to reduced demand for office space, which could mean an adjustment to building plans.

Finally, despite interest rate conditions, we are seeing "mega projects" remain robust. There are currently c.300 projects with a value of over $400m in the pipeline to start late in 2022 or 2023, with an average value of $1.9bn. Ashtead is arguably one of a few leading players who have the scale and expertise to be a preferred supplier.

Economic and industry considerations:

Customers increasingly favor rental solutions over equipment ownership due to flexibility, cost-effectiveness, and reduced maintenance responsibilities. Companies are increasingly looking to trim their balance sheets, as investors seek higher returns on assets and reduced leverage. Our view is that this is a trend that will continue so long as prices remain competitive.

Economic cycles and fluctuations impact construction and industrial sectors, influencing rental demand. During a downturn, we generally see private-sector spending decline at a greater level than any public-sector increase. Although we are not in a downturn, we are certainly in a period of uncertainty and an equity bear market.

Interest rates remain the wild card. Access to financing can significantly reduce infrastructure spending as if debt markets remain difficult to access, current construction levels cannot be maintained.

Revenue

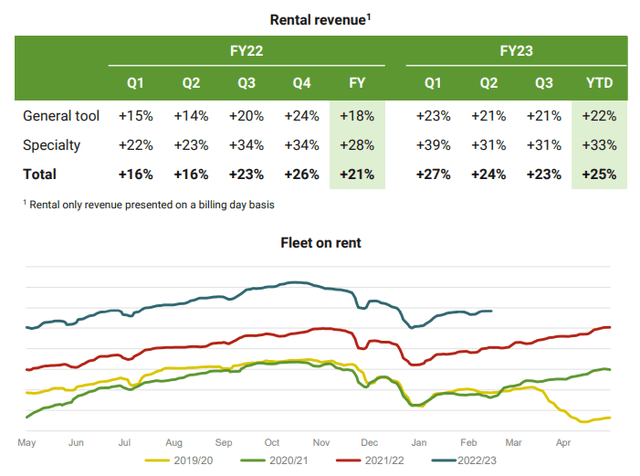

US Trading

US trading remains incredibly robust despite the current economic conditions, with YTD growth at 25%, ahead of the prior year. Management is continuing to see the market trend toward rentals, with utilization data suggesting rental rates will increase further in the coming periods.

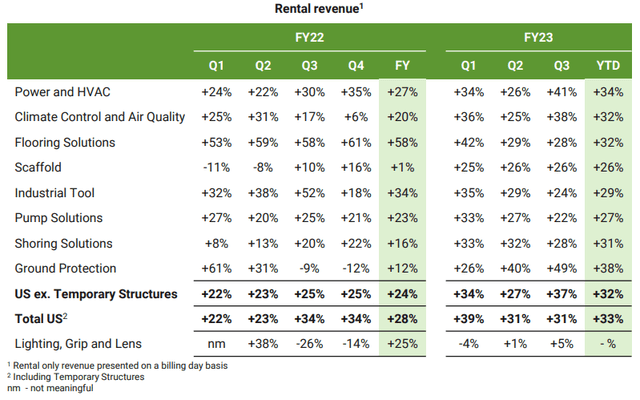

Specialty Trading

As mentioned previously, Specialty trading continues to drive outperformance. Strong growth is shared among several business lines, reducing the risk that a slowdown in any particular one will materially impact the segment.

Further, the acquisition of Modu-Loc, Canada's leading temporary fencing provider has created a new Specialty business line with significant scope for expansion across the US.

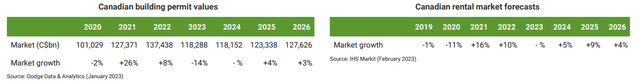

Canada

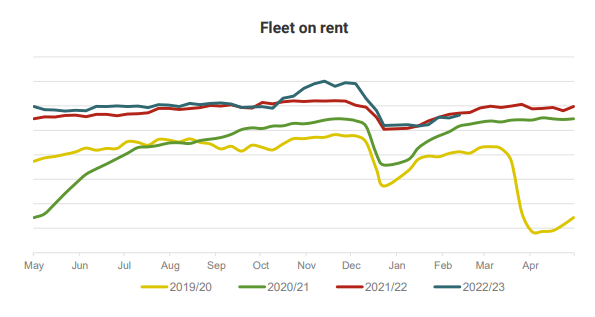

Fleet performance Canada (Ashtead)

Continued resilience is also seen in the Canadian segment.

The building and rental market in Canada is expected to remain resilient in the coming years, although with lower growth than was experienced previously.

UK Trading

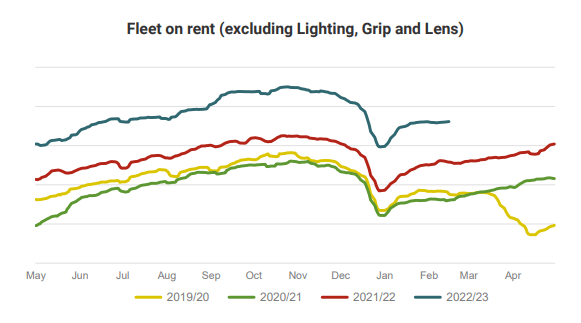

UK fleet data (Ashtead)

UK trading's performance has been resilient albeit uninspiring. The business was impacted by inflationary pressures and softer demand, although Management see improvement ahead.

Margin

Ashtead's margins are fantastic. The company has an EBIT-M of 25%, EBITDA-M of 44%, and a NIM of 17%.

Margins have improved well across the last decade (although have dipped recently), attributable to several key factors.

- Improving scale economies.

- Development of brand value and thus the ability to price aggressively.

- Greater number of larger (more lucrative) projects.

- Increased Specialty services.

- Deleveraging.

The recent dip is partially due to inflationary pressures which Ashtead has been unable to wholly pass on.

Our view is that further margin improvement is possible, reflected in the company's performance in FY19. As the cost of capital increases, we could see a greater number of businesses forced into the rental market, elevating rates.

Balance Sheet

Despite owning a substantial level of assets, the company's efficiency metrics are strong. The company has achieved a consistent ROE in excess of 20% and a ROA of >7%.

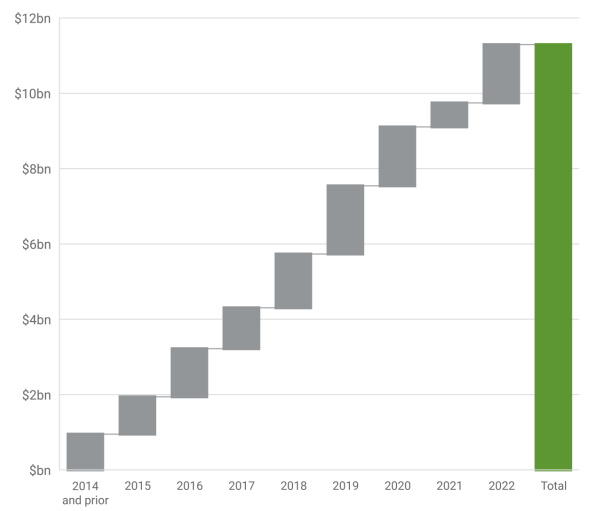

Further, Management has been smart with its fleet expansion. The company's D&A expense as a % of revenue has remained flat, reflecting fleet development in line with growth. This "smooth" fleet profile gives the business reduced volatility / lumpiness.

Fleet growth profile (Ashtead)

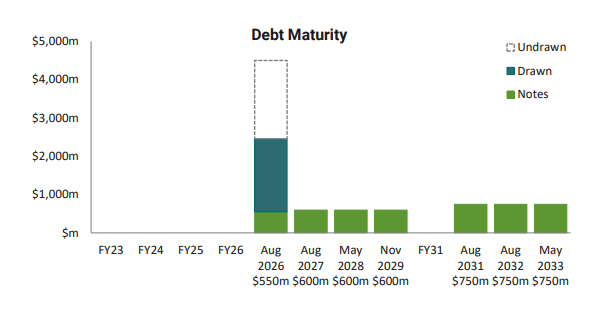

Moreover, the company is conservatively financed, with a ND/EBITDA ratio of 2.1x. This affords Ashtead the ability to conduct further M&A (and at a larger scale) should an opportunity arise, as well as expand its current fleet.

Furthermore, with its nearest maturity in 2026, the company may avoid the current interest rate environment, and refi at more attractive rates.

Debt profile (Ashtead)

With no large repayments due in the coming years, Ashtead is in a position to maintain and increase its distributions to shareholders.

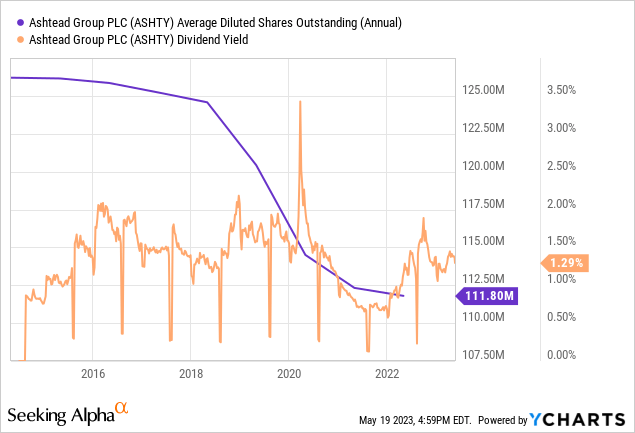

The company currently distributes through both dividends and buybacks, with both growing at a strong level.

The slight issue here is that on an absolute basis, distributions are not great. This is because the company has substantial capex commitments, reducing its FCF.

Outlook

Presented above is Wall Street's consensus view on the coming 5 years.

Ashtead is expected to grow at a CAGR of 8%, which is below what has been historically achieved but remains strong. This is likely a conservative estimate from analysts, as it is difficult to pricing in the impact of acquisitions.

Our view is that Ashtead is in a position to achieve 8-12% in the coming 5 years based on its commercial profile. The only reason we believe growth could fall below double-digits is due to the risk of a construction slowdown.

Presented below is Management's forecast fleet expansion. The majority of this is rightfully in the US, with a 54-67% increase by 2024.

Valuation

Valuation (Tikr Terminal)

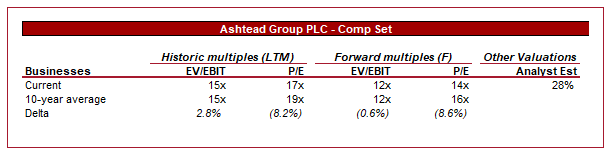

Ashtead is currently trading 12.4x NTM EBIT and 14.4x NTM earnings.

Based on its historical trading range, Ashtead is at a slight discount. Our view is that the key bullish arguments for a premium valuation to average are:

- Improvement in the company's moat. With a large market share, Ashtead's average rental value should be higher.

- Increased scale should allow for more M&A to supplement organic growth.

- Long-term infrastructure spending should support continued growth.

- Solid Management team who has sustainably grown the business.

- Increasing use of rental services rather than ownership.

- Deleveraged.

The bear argument (/key risks) as to why a discount is justified are:

- Potential for a construction bear market if heightened interest rates contribute to a material slowdown in new builds.

- Cash flow generation remains mediocre.

- The business has shown itself to be susceptible to inflationary pressures.

Overall, we believe there to be a sufficient argument to suggest the company should trade at a premium to its average multiple.

Final thoughts

Ashtead is a high-quality business. Management has expanded its geographical and services reach extensively in the last decade, allowing the business to develop a rare offering in a fragmented market. This moat is not patent protected or irreplicable but has created a large barrier around the company's competitive position.

From a commercial perspective, we believe construction will remain robust over the next decade, with near-term risks (such as higher interest rates) somewhat offset by increased spending due to legislation.

Ashtead's financials are equally impressive, with sticky margins and high growth. We believe the company can continue on its current trajectory.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.