Ford: Pressure On Margins And More Debt Ahead

Summary

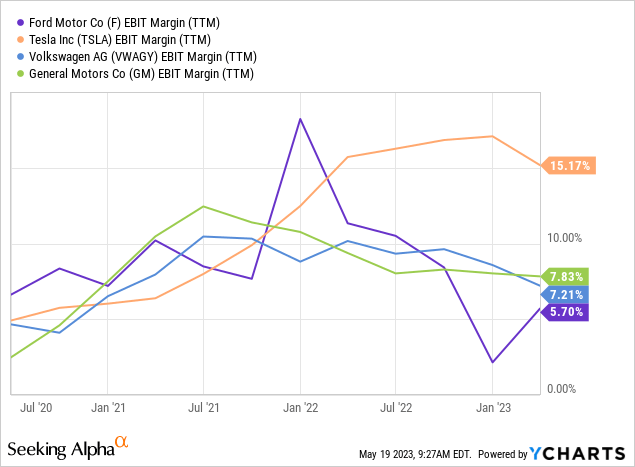

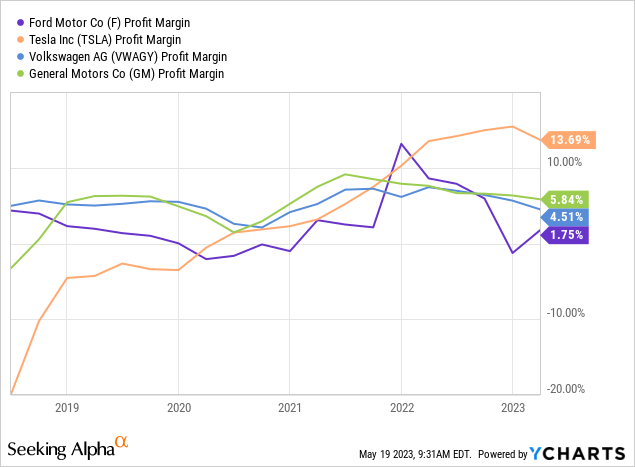

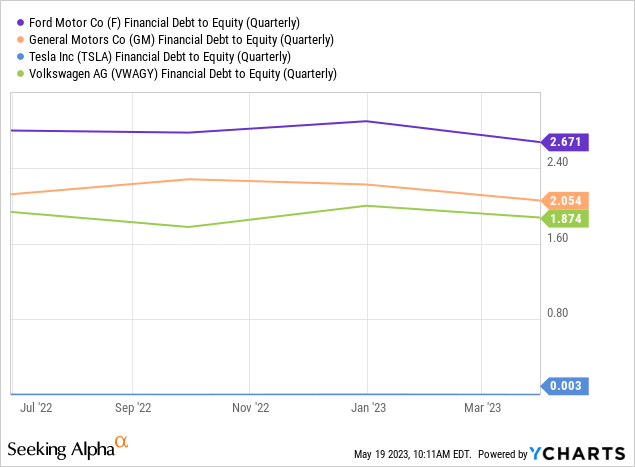

- Not only does Ford have the worst margins in the peer group, but also the highest debt.

- And this while the company wants to invest $50B in electric vehicles. This money will not be generated by free cash flow, so the debt burden will probably increase further.

- At the same time, the already poor margins will be put under even more pressure as Tesla begins to lower prices.

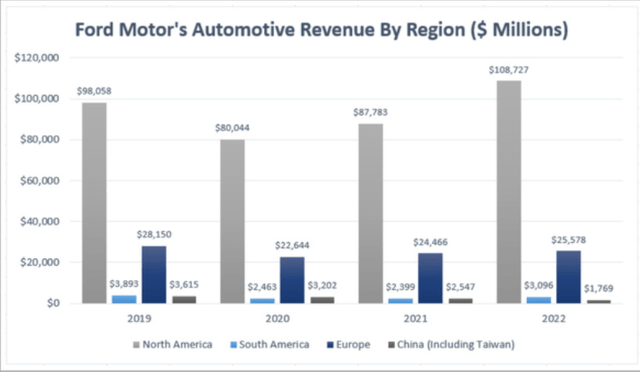

- And then there is also the competition from China. If not in America, then definitely in all other countries (and this is where 20% of Ford's revenue comes from).

kenmo/iStock Editorial via Getty Images

Investment thesis

Whether we like it or not, the future of automobiles will likely be electric. Ford (NYSE:F) is operating at a loss in this area and plans to invest $50B until 2026, while the competition is already highly profitable. Tesla's (TSLA) price cuts will put even more pressure on Ford´s already bad margins. In addition, 20% of sales come from abroad, and there will be more and more competition from Chinese manufacturers.

Industry challenges

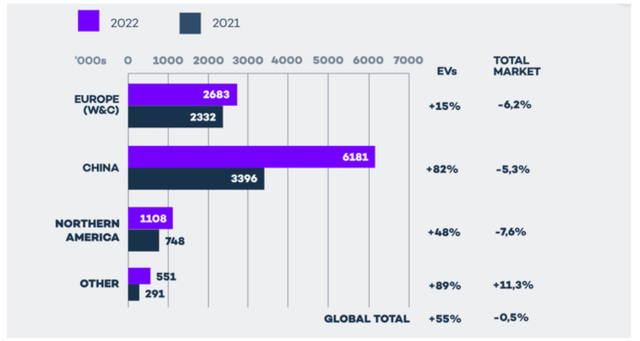

As we all know, the automotive industry is undergoing a tremendous transformation. Although there are still significantly more combustion cars sold than electric vehicles, their share is increasing rapidly. In addition, there is currently constant political pressure to persuade the population to buy electric cars by all means. This can be done, for example, through restrictions on internal combustion engines, forcing them to install more expensive filters or other technologies. At the same time, there are subsidies for electric vehicles. Nevertheless, the market share of electric cars is still tiny but is increasing rapidly and becoming more attractive due to better charging infrastructure and advances in battery technology.

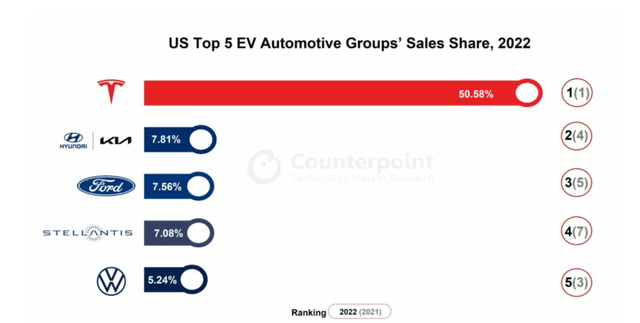

Total car sales in 2022 were about 14M. However, the share of electric vehicles in the U.S. is still less than 10%; here, Tesla has a market share of 50%.

A few days ago, I wrote a very detailed article about the changing market in China. In summary, the conclusion is that foreign car manufacturers were dominant in China in the past, but with EVs, Chinese brands are preferred. As a result, foreign car manufacturers operating in China will most likely lose significant market share in the next few years, and for many manufacturers, China is the largest market. However, Ford is an exception here and generates most of its sales (about 80%) in the United States.

Theoretically, Ford could be in a good position since import duties partly protect them from Chinese competition. But first, Ford has to invest a lot of money to build production capacities; 2 million vehicles per year until 2026 is the target, which sounds very ambitious (in 2023, production should be 600k vehicles). According to the CEO, the electric business will remain a loss-making business for at least 2023.

Ford gave a peek into the financials for its electric vehicle business, known as Model e, for the first time Thursday. The Model e segment expects to report a full-year loss of $3 billion in 2023 alone, a stark sign that the company still has a long way to go before it makes money on the cars it says will lead its future.

Source: Businessinsider

Margin pressure

So, on the one hand, combustion cars are being made less and less attractive to customers. This is a trend that will most likely continue. At the same time, the biggest competitor in EVs has already built up highly efficient production capacity and is now starting to lower prices by double-digit percentages. On the other hand, Ford is raising prices, which is a sign that they don't want to get involved in a price war.

Tesla will likely make further price reductions. They can afford it due to their excellent margins, and from what I read, they view the emerging Chinese companies (OTCPK:BYDDF, for example) as their biggest rivals in the EV space, so Tesla wants to compete with them. As a result, they may give up some revenue for a while but are likely to gain even more market share.

Ford's profit margins are already tighter and are mainly maintained by the sale of combustion engines, which, as I said, are becoming increasingly unattractive to customers over time. So it may well be that Ford has a few weaker years ahead.

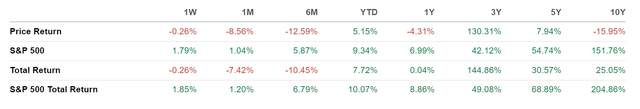

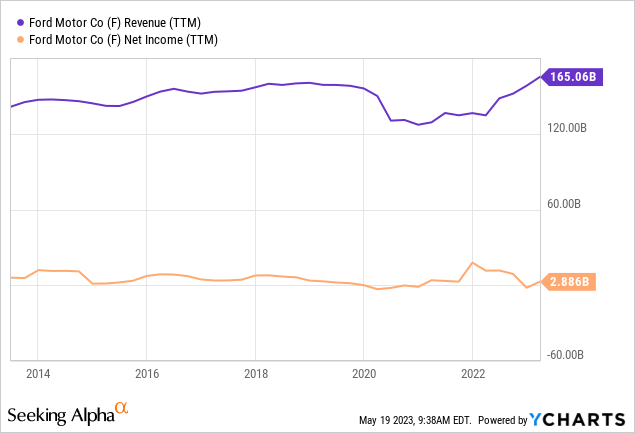

And all this while the company's sales and net income have not changed much in the last ten years anyway.

Accordingly, as a shareholder, you have only made a 25% return in the last ten years and thus massively underperformed the market.

Of course, this is the past and does not tell us much about the future. But I believe the following years will be the main challenge because so much has suddenly changed in the car market. Ford seems to be in a similar position as the major German automakers, who also did not take electric vehicles seriously for a long time and, therefore, now have to catch up.

In my previously mentioned article about the market in China, I speculated that Chinese car companies are also exporting more and more, and by doing so, are competing with Western manufacturers twice: in their home market in China and around the world. From what I have heard, the cars are of high quality, and Tesla seems to be the only manufacturer that can keep up with the prices. As I said, Ford is mainly focused on the American market, but about 20% of sales still come from abroad.

It's a political industry

As long as combustion engines are fought, and electric vehicles are promoted, customers will act accordingly. But next year is the U.S. election, and things will possibly change under a Republican president. I can imagine that in that case, the market would punish everything related to renewable energies, and Ford and Oil companies would get a boost.

But as a shareholder, it's not a pleasant situation when the company's prospects are connected to political elections. Most politicians are unpredictable, and it's not certain that a Republican president would turn things around. I'm sure some readers don't like that this article is so much about EVs, as some are already fed up with it. I can understand that and feel the same about the climate change issue. But when investing, we should leave those personal preferences or dislikes aside.

Debt & dividend

For shareholders, the current dividend yield of 5% seems very attractive. However, I am not very enthusiastic about this. Given the immense debts, upcoming investments, and competitive pressure, it seems that the company should rather invest in its future instead of spending money on shareholders at the moment. With 4B shares outstanding and an annual dividend of $0.6, the dividend costs the company $2.4B annually. The company has $50B investments ahead, and the debt is high: for every dollar of equity, the company has $2.6 in debt.

Conclusion

I have looked at share dilution, SBCs, and insider selling, but there is nothing worth mentioning. Otherwise, I believe I have already listed the risks in this article. So, to conclude, let's summarize.

Not only does Ford have the worst margins in the peer group, but also has the highest debt. And this while the company wants to invest $50B in electric vehicles. This money will not be generated by free cash flow, so the debt burden will probably increase further and, with it, the interest burden. At the same time, the already poor margins will be put under even more pressure as Tesla and other manufacturers begin to lower prices. Tesla can afford it because of no debt and excellent margins; Ford cannot. Furthermore, 20% of sales come from abroad. These will not break away overnight, but Ford has the same challenges as the German and Japanese automakers in the long term, namely very good and cheap competition from China. According to Reuters, Chinese manufacturers have a $10,000 cost advantage over foreign competitors.

Yes, it is a long-established American manufacturer, and a 5% dividend yield sounds great, but in my view, the outlook for the next few years is too uncertain. At the current valuation, it's not a candidate for a short position, but I wouldn't put my money here either.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.