Sector Exposures Continue To Evolve With Rating Migrations

Summary

- New fallen angels and rising stars continue to impact sector allocations in the fallen angel index. The Telecom sector’s weight decreased as a large rising star exited the index.

- After its latest interest rate increase following its early May meeting, the Fed appeared to signal that it may be considering a pause on additional interest rate hikes.

- Fallen angels yields increased by 6bps in April, while broad HY yields decreased by 8bps, which are now 36bps and 57bps tighter, respectively, than the YTD highs of mid-March.

mppriv

New fallen angels and rising stars continue to impact sector allocations in the fallen angel index. The Telecom sector's weight decreased as a large rising star exited the index.

Fallen angels underperformed broad HY by 0.45% (0.52% vs 0.97%) in April, and are now lagging by 0.48% YTD (4.24% vs 4.72%), driven by a -70.1% return on First Republic bonds which entered the index in March, and lower carry due to the higher quality tilt versus broad HY. The BB index returned 0.70% for April and 4.09% YTD, Single-B index returned 1.02% for April and 4.87% YTD and CCC & lower rate index returned 1.98% for April and 6.92% YTD.1 In terms of flows, demand of High Yield ETFs picked up, with inflows of approximately $5.4bn according to Citi, with the majority of flows in the intermediate duration bucket. All of the short end categories had outflows and long duration saw some inflows, which could indicate an interesting rotation ahead of U.S. Federal Reserve (FED) expectations for the rest of the year.

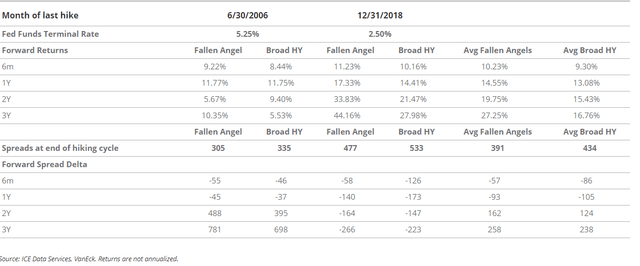

What Happens After the Fed Pause?

After its latest interest rate increase following its early May meeting, the Fed appeared to signal that it may be considering a pause on additional interest rate hikes. Since the fallen angel index inception in December 2003, there have only been two Fed pauses: June 2006 and December 2018. Historically, fallen angels and broad high yield have performed well following a Fed pause. Overall, fallen angels outperformed broad high yield over different time periods. However, these historical pauses occurred amidst very different economic and market conditions compared to each other, and compared to conditions today.

For example, although high yield credit markets provided positive returns in the year following the June 2006 pause, that preceded a massive widening of credit spreads that began about one year after the last hike, signaling the start of the Global Financial Crisis. Although long-term high yield investors would have fully recovered and achieved outperformance in fallen angels, that did not come without significant volatility, a 40% drawdown and unsurprisingly, returns that lagged U.S. Treasuries over a three-year period. Notably, the Fed paused rate hikes at a time when spreads were significantly tighter than their historical average. In contrast, the pause that occurred in 2018 was characterized by higher than average credit spreads, and began a multi-year period of outperformance of fallen angels, despite the COVID-related drawdown that occurred in 2020.

Ultimately, every cycle is different and the current environment likely differs from both historical examples. Spreads are tighter than average, but there are few signs of overexuberant lending, while the current hiking cycle was much larger than what occurred from 2016 to 2018 and the Fed's resolve to maintain high rates for longer appears strong. We do believe that these examples further support the case for fallen angels as an attractive way for investors to gain exposure to high yield, due to their higher quality and unique drivers of return that have provided outperformance through various market cycles and in changing economic environments.

Fallen Angels Overall Statistics: Fallen angels yields increased by 6bps in April, while broad HY yields decreased by 8bps, which are now 36bps and 57bps tighter, respectively, than the YTD highs of mid-March.

| Fallen Angel | Broad HY | |||||

| 12/31/2022 | 3/31/2023 | 4/30/2023 | 12/31/2022 | 3/31/2023 | 4/30/2023 | |

| Yield to Worst | 7.49 | 7.08 | 7.14 | 8.89 | 8.49 | 8.41 |

| Effective Duration | 5.45 | 5.30 | 5.27 | 4.04 | 3.83 | 3.77 |

| Full Market Value ($mn) | 112,854 | 114,776 | 110,309 | 1,199,909 | 1,234,319 | 1,234,778 |

| OAS | 337 | 325 | 332 | 481 | 458 | 453 |

| No. of Issues | 212 | 206 | 203 | 1,927 | 1,916 | 1,912 |

Source: ICE Data Services, VanEck.

New Fallen Angels: Three new fallen angels were added to the Index, adding 1.33% of market value. Crane NXT (CXT) was downgraded to high yield after Crane Co. (CR) completed a spinoff. Crane Co. now comprises of Aerospace & Electronics and Process Flow Technologies; the spinoff company, Crane NXT, comprises of Payment and Merchandising Technologies. The downgrade reflects the smaller scale, less business diversification and reduced revenues post-spinoff. Rogers Communications' (RCI) subordinated debt was downgraded to BB from BBB- by Fitch and S&P and to Ba2 from Baa3 by Moody's, given the immediate increase in financial leverage following the acquisition of Shaw Communications for approximately C$25m. Western Alliance Bancorporation (WAL), a high-profile issuer following the mini banking crisis in March, was downgraded, reflecting the deteriorating operating environment and current condition for U.S. banks.

| Month-end Addition | Name | Rating | Sector | Industry | % Mkt Value | Price |

| February | Entegris Escrow Corp | BB1 | Technology & Electronics | Electronics | 1.39 | 90.92 |

| March | First Republic Bank | B3 | Banking | Banking | 0.40 | 54.63 |

| March | Nissan Motor Acceptance | BB1 | Automotive | Auto Loans | 2.57 | 87.19 |

| March | Nissan Motor | BB1 | Automotive | Automakers | 5.49 | 92.98 |

| April | Crane NXT | BB3 | Capital Goods | Diversified Capital Goods | 0.24 | 70.99 |

| April | Rogers Communications | BB2 | Telecommunications | Telecom - Wireless | 0.65 | 90.35 |

| April | Western Alliance Bancorporation | BB1 | Banking | Banking | 0.44 | 76.39 |

Source: ICE Data Services, VanEck.

Rising Stars: One new rising star, Sprint Capital Corporation, exited the index at a weight of 4.70%. Sprint entered the index in the middle of 2008 at $85, posting an approximate 35% price return over the 15-year period. Over the last 12 months, Sprint posted a negative price return of close to -3% but it outperformed the broad HY price return of -4.5% over the same period. Sprint joins Western Midstream (WES) and Kraft (KHC) as the biggest rising stars over the last 2 years.

| Month-end Exit | Name | Rating | Sector | Industry | % Mkt Value | Price |

| February | Autopistas Metropolitanas de Puerto Rico LLC | BB1 | Transportation | Transport Infrastructure/Services | 0.35 | 100.49 |

| February | Nokia Corp | BB1 | Technology & Electronics | Tech Hardware & Equipment | 0.47 | 97.5 |

| March | Western Midstream | BB1 | Energy | Gas Distribution | 5.27 | 90.44 |

| April | Sprint Capital Corp | BB1 | Telecommunications | Telecom - Wireless | 4.7 | 114.25 |

Source: ICE Data Services, VanEck.

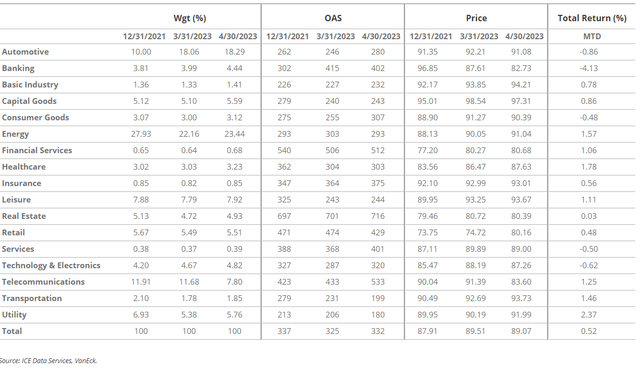

Fallen Angels Performance by Sector: Sector composition had some notable changes in April following the shakeup in March. With the exit of Sprint, the Telecom sector weight dropped from 11.68% to 7.80% and now Leisure makes up the third largest exposure with a weight of 7.92%. Energy still has the highest weighting in the index, but its weight has declined YTD, while the Automotive sector weight has increased to approximately 18%.

The Banking sector continues to have a relatively high relative exposure (3.99% on March 31) vs broad HY 0.89%, although a new issuer was added at low weight: Western Alliance Bancorporation at 0.44%. Moody's placed Western Alliance on negative watch when Silicon Valley Bank (OTC:SIVBQ) collapsed last month. First Republic Bank (OTCPK:FRCB), a fallen angel in March, dropped to close to zero following the takeover by regulators and forced sale to JPMorgan (JPM).

In terms of performance, the Banking sector continues to be the only sector posting YTD negative returns (-5.54%) after +3.99% in January, +0.33% in February, -5.56% in March and -4.13% in April. In terms of sector attribution vs broad high yield, the Energy sector contributed the most while the Banking sector was the top detractor in April.

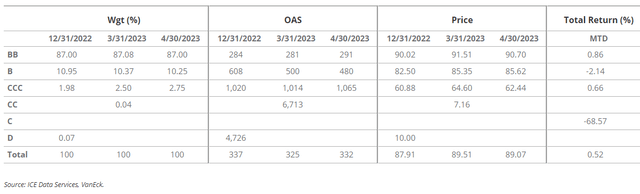

Fallen Angels Performance by Rating: Bed, Bad & Beyond (OTCPK:BBBYQ) filed for bankruptcy this past month after posting -68.57% return in April before exiting the index. It had been under stress for quite some time, so the bankruptcy was not a surprise. BBBY began running low on cash and closing stores in 2022, with spreads widening to over 1000bps during May. BBBY was about to default on its debt in February 2023 as it missed its February 1 payment, but was able to make said payment on February 28, thereby postponing its default for a few more months. The BBBY bonds entered the fallen angel index in October 2018 and had a total return of -73% while in the index. The weight in the index was minimal at the time of exit, at approximately 0.04%, due to the price decline. It is the first issuer to default since July 2021. We anticipate that default rates will pick up (from a very low level) as the impacts of Fed tightening and a slowdown in the economy materializes.

Important Definitions and Disclosures

1 BB -> ICE BofA BB US High Yield Index is a subset of ICE BofA US High Yield Index including all securities rated BB1 through BB3, inclusive; Single-B -> ICE BofA Single-B US High Yield Index is a subset of ICE BofA US High Yield Index including all securities rated B1 through B3, inclusive; CCC & lower -> ICE BofA Single-B US High Yield Index is a subset of ICE BofA US High Yield Index including all securities rated B1 through B3, inclusive.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included in this blog.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

Yield-to-Worst (YTW): This is the lowest yield that can be received on a bond that fully operates within the terms of its contract without defaulting.

Option-Adjusted Spread (OAS): The measurement of the spread of a fixed-income security and the risk-free rate which is then adjusted for an embedded option.

A fallen angel bond is a bond that was initially given an investment-grade rating but has since been reduced to junk bond status.

High yield bonds may be subject to greater risk of loss of income and principal and are likely to be more sensitive to adverse economic changes than higher rated securities.

A rising star is a high yield bond that is upgraded to investment grade.

Duration is an estimate of how much the value of a bond portfolio would be affected by a change in prevailing interest rates. The longer a portfolio's duration, the more sensitive it is to changes in interest rates.

There are inherent risks with fixed income investing. These risks may include interest rate, call, credit, market, inflation, government policy, liquidity, or junk bond. When interest rates rise, bond prices fall. This risk is heightened with investments in longer duration fixed-income securities and during periods when prevailing interest rates are low or negative.

Index returns are not Fund returns and do not reflect any management fees or brokerage expenses. Certain indices may take into account withholding taxes. Investors cannot invest directly in the Index.

ICE BofA US High Yield Index (H0A0, "Broad HY Index"), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017, is comprised of below-investment grade corporate bonds (based on an average of various rating agencies) denominated in U.S. dollars.

ICE US Fallen Angel High Yield 10% Constrained Index (H0CF, "Fallen Angels Index") is a subset of the ICE BofA US High Yield Index and includes securities that were rated investment grade at time of issuance.

Fallen Angel U.S. High Yield index data on and prior to February 28, 2020 reflects that of the ICE BofA US Fallen Angel High Yield Index (H0FA). From February 28, 2020 forward, the Fallen Angel U.S. High Yield index data reflects that of the Fund's underlying index, the ICE US Fallen Angel High Yield 10% Constrained Index (H0CF). Fallen Angel U.S. High Yield index data history which includes periods prior to February 28, 2020 links H0FA and H0CF and is not intended for third party use.

ICE Data Indices, LLC and its affiliates ("ICE Data") indices and related information, the name "ICE Data", and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

© 2023 VanEck. VanEck®, VanEck Access the opportunities®, and the stylized VanEck design® are trademarks of Van Eck Associates Corporation.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by