Unlocking The Value Paradox: A Deep Dive Into The Discount Dilemma Of Pershing Square

Summary

- Pershing Square is presently experiencing a remarkable 37% discount, trading well below its net asset value per share.

- This gap has even widened last year despite outperforming its benchmark index the S&P for the 12th time in 18 years.

- Pershing Square is in a comparable demand cycle to industry giants like Berkshire Hathaway and Blackstone.

- The closed-end fund structure paired with significant internal ownership promotes long-term investment incentivization.

Bryan Bedder/Getty Images Entertainment

Pershing Square Holdings (OTCPK:PSHZF) has commendably eclipsed the performance of the top 100 closed-ended funds and the overall market over the previous five years. However, a conspicuous divergence remains between the growth of its stock price and the increase in its net asset value. Similar precedents in the past suggest this price gap will close in the coming years as the stock aligns with its inherent value. Alongside a steadfast approach to active asset management, this presents a compelling opportunity for investors with a long-term outlook.

Company Overview

Established on January 1, 2004, Pershing Square Holdings, Ltd. operates as an investment holding entity specializing in procuring and maintaining holdings in a select (8-12) number of publicly traded companies. The fund is set up as a closed-end fund structure; after issuing a finite number of shares via its initial public offering, the shares are publicly traded, but no additional capital is injected into the fund. The company's helm is steered by founder Bill Ackman, who retains ultimate authority over investment decisions, backed by a dedicated cohort of 8 investment professionals, a team that has seen remarkably low turnover over the past five years.

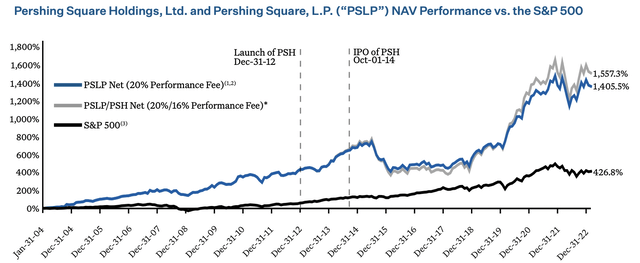

Demonstrating its financial prowess, Pershing Square Holdings has delivered a 15.2% annualized net return since its inception, significantly outpacing the S&P 500's 9.7% return over the corresponding timeframe.

Pershing Square Historic Performance (Pershing Square Annual Investor Letter)

Reasons for the disproportional NAV-discount

In his annual letter to shareholders, Bill Ackman once more drew attention to the notable disconnect between the company's stock price and net asset value (NAV). As of April 30, 2023, the NAV stood at $53.88, while the stock closed at a lower $33.80 on the same day. Consequently, the stock concluded the trading day at a hefty ~37% discount relative to its NAV. To simplify, in the event of immediate liquidation, shareholders would receive the above-cited $53.88 (excluding transaction & liquidation costs) per share, highlighting the sizeable disparity.

The underpinning factors behind this discount warrant investigation. After 2015, a period marked by Pershing Square's lagging returns against the S&P for three consecutive years, the stock began trading at a discount to its NAV. Curiously, this trend has persisted, with the stock's discount widening, despite the company's continuous outperformance of the S&P 500 since 2017. Despite Pershing Square's concerted efforts to achieve NAV parity, including top-ranking performance among the 100-largest closed-ended equity funds since 2017, new listings on the London Stock Exchange and the FTSE 100 (UKX), and a robust share repurchase program that has decreased outstanding shares by 25% since inception of the program, the discount gap has widened.

Critically, it appears unlikely that the fund's closed-ended structure is the primary driver of this discount, considering the median five-year industry discount for similar funds sits at 7.2%. Moreover, the Scottish Mortgage Investment Trust (OTCPK:STMZF), a comparable fund, trades at a mere 6% discount.

Thus, with market characteristics and share supply unlikely to account for the disproportionate discount to NAV, the demand for PSH shares plays a crucial role in this valuation disconnect. Pershing Square Holdings' choice of an offshore closed-ended fund structure — while advantageous for tax reasons with no entity-level taxation — may have inadvertently limited the company's capacity to market its fund, especially in the highly coveted US market.

Strategies to Eliminate the NAV Discount

While a quick fix for PSH's demand shortfall remains elusive, the long-term perspective presents an attractive proposition for patient investors, particularly considering the 30% discount on asset trades. The company is not oblivious to this challenge and has intensified its marketing initiatives while simultaneously diminishing supply via share repurchases. Further bolstering its appeal, insider ownership within PSH accounts for about 26% of shares, positioning the fund among the top closed-end entities in this respect. This high internal stake signifies Bill Ackman and his affiliates' vested interests, aligning their goals with the shareholders.

This scenario, wherein PSH's shares trade at a substantial discount, harks back to historical instances like Berkshire Hathaway (BRK.B). Many investment managers were initially reluctant to invest, as it effectively meant ceding investment allocation control to a third party. However, this reticence has abated over time, leading to Berkshire's inclusion in numerous prestigious funds and ETFs.

Another analogous case is Blackstone (BX), which initially found it challenging to attract investors despite expanding its assets under management, enhancing dividend payouts, and significantly boosting revenues. Ultimately, the key to winning over investors for both these firms was their consistent delivery of superior returns relative to the broader market over an extended duration, thereby validating the sustainability of their respective business models.

Similarly, Pershing Square Holdings has yielded above-market returns and stands to benefit the patient investor when the market eventually acknowledges its actual value.

Risk Factors

The aforementioned historic performance and potential future reductions of NAV discount heavily rely on two crucial elements. Firstly, it presumes that the fund's performance is to continue at this or at least at a similar rate, an assumption that may prove fragile in the present market scenario, characterized by high inflation, the Ukrainian conflict, and persistent supply chain issues. However, it's worth noting that PSH tends to thrive amid market uncertainty. This was evident in its active hedging at the onset of the 2020 pandemic, culminating in a remarkable 56.6% return against the S&P 500's 18.4%. The fund also shielded its assets against surging inflation in late 2021, with the purchase of interest rate swaps. At this point it is worth noting, that total hedges since 2020 the fund has generated more than $5.3 billion in total hedging proceeds from a cost of just $446 million, a staggering 1188% return.

The second factor significantly influencing PSH's share price rests on the company's potential to enhance fund promotion and consequently curtail the NAV discount. This gap while gradually narrowing in recent months – a positive sign, to be sure – has increased even further from my last article.

Furthermore, the fund's concentrated portfolio approach of holding only 8-12 positions can lead to more significant price swings in response to single security performance. Lastly, the fund's ability to sustain its strategy under adverse market conditions and potential key-person risk linked to its founder, Bill Ackman, are additional factors to be taken into account.

Conclusion

In conclusion, Pershing Square presents a compelling yet complex investment scenario. Its outstanding performance against the top 100 closed-end funds and the broader market in recent years starkly contrasts the noticeable divergence between its stock price and net asset value. This conundrum has provoked strategic actions from the company, ranging from stock repurchases to enhanced marketing efforts.

Drawing parallels with historical instances, like Berkshire Hathaway and Blackstone, the potential for narrowing this gap becomes more palpable over time, particularly as the company continues to deliver superior returns. However, this doesn't negate inherent risk factors like market volatility, geopolitical uncertainties, and regulatory changes.

Despite short-term challenges, the long-term outlook for Pershing Square appears promising, especially with assets trading at a 37% discount. If the company can successfully navigate the delicate balance between its intrinsic value and market price, investors will reap significant benefits akin to the experiences of other market behemoths. A cautious and measured approach is necessary in these uncertain times, calling for persistent monitoring of the market and the firm's strategies.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PSHZF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.