Perficient: Attractive Pure Play Stock Within IT Services

Summary

- Perficient focuses primarily on consulting, application development, and systems integration services.

- The increasing cloud adoption and need for digital transformation are driving IT service spending trends towards development areas.

- My PRFT price target of $91 applies a 18x multiple to the CY25E EPS estimate of $5.09.

skynesher

Investment Thesis

Perficient, Inc. (NASDAQ:PRFT) is primarily focused on consulting and application development, and the company's growth is driven by a higher emphasis on development projects. With the increasing adoption of cloud and digital technologies, IT buyers are allocating more funds towards development areas while seeking efficiency gains in managed services. The company's ability to command higher bill rates and implement price increases indicates the value of its services. Its average onshore bill rate is approximately twice that of Indian IT services providers and closer to that of a well-established consulting firm, further emphasizing the high-end and differentiated nature of the company's services. This is largely attributed to its significant focus on development, consulting, and digital services.

Operating in an attractive area within IT Services

Perficient stands out from other IT services firms by primarily focusing on consulting, application development, and systems integration services instead of relying heavily on managed services. The company's growth is fueled by its emphasis on development projects, which aligns with the increasing adoption of cloud technology and the demand for digital transformation. As IT buyers allocate more funds to development areas while seeking efficiency gains in managed services, Perficient benefits from this trend.

Additionally, development work tends to be more engaging for employees due to its analytical nature and utilization of cutting-edge technology and tools. These areas of focus are also associated with shorter contract durations, allowing Perficient to be agile in adapting its services towards digital initiatives, which comprise 70-80% of its total revenue.

Improving financial profile

Perficient's management is actively investing in expanding its offshore and nearshore delivery centers. It is expected that there will be an organic increase of about 5 points in the low-cost delivery mix each year, potentially augmented by mergers and acquisitions to expedite the shift.

By increasing the low-cost delivery mix, Perficient aims to make its services more cost-effective for clients, allowing the company to offer a lower total cost of ownership without compromising its profit margins. I estimate that the company's revenue growth will be in the high-single digits, surpassing the industry average, and this assumption is based on Perficient's ability to shift its delivery mix towards low-cost locations. I estimate an annual potential margin expansion of approximately 50 basis points, which presents a rare opportunity for investors in a people-oriented business.

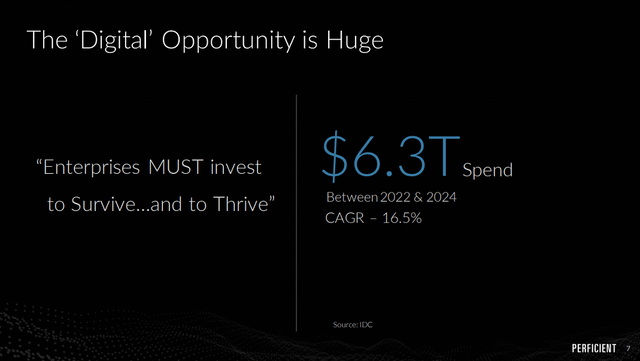

TAM & Market Growth Outlook

According to Gartner, worldwide IT spending is expected to grow by 5.5% to reach $4.6 trillion in 2023. I expect pure-play digital firms like GLOB, EPAM to grow +20%, consistent with high demand for digital transformation, while large global System Integrators should grow in the mid-to high-single-digit. Perficient has historically underperformed its peers, but increasing low-cost delivery should help improve its growth rates.

Specifically, Perficient focuses on Consulting and Application services within these services, which represent about 40% of the total IT services industry. These services are expected to grow at a premium rate over the next four years, reaching $1.3 trillion at a CAGR of 7.9%.

PRFT Digital Opportunity (Company Presentation)

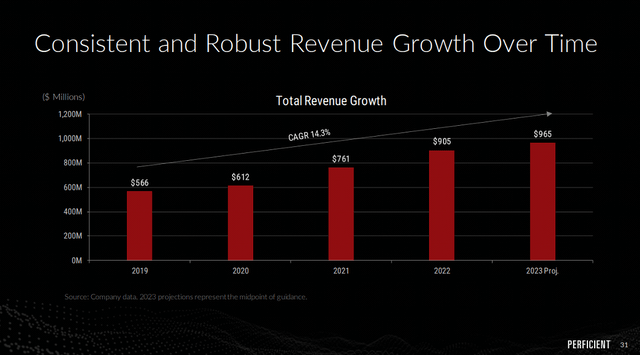

Financial Outlook: Above-Industry-Average Revenue Growth

I anticipate that Perficient will experience high-single-digit organic revenue growth in the coming years, surpassing the average rate seen in the industry. This growth will be driven by Perficient's increased emphasis on low-cost delivery and its commitment to embracing offshore resources. Meanwhile, the company's North America-based delivery is expected to grow at a relatively modest rate. I also anticipate that Perficient will benefit from ongoing bill rate increases in the United States and nearshore locations.

PRFT Topline Growth (Company Presentation)

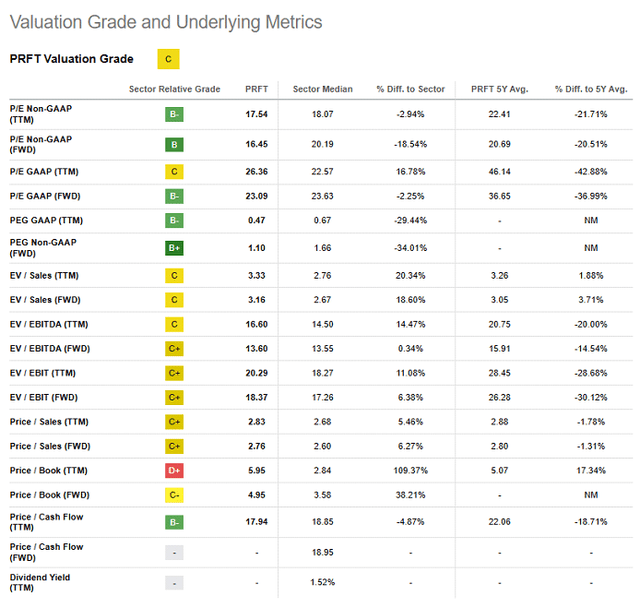

Valuation

My principal valuation metric for PRFT stock is relative P/E, which is the most commonly used metric across the industry, and most peers typically trade on respective P/E multiples. P/E multiples within the industry vary depending on the growth rates of the companies, ranging from single to low-double digits for those with stagnant or declining revenue growth, to high-teens to twenties for companies experiencing high-single-digit earnings growth, and finally to 40-60 times for companies achieving revenue growth of 20% or more. Considering Perficient's growth profile, I believe it aligns best with the second category, which is characterized by high-single-digit earnings growth.

My PRFT price target of $91 applies a 18x multiple to the CY25E EPS estimate of $5.09. PRFT is currently trading at 16x CY23E EPS, while peers are trading in the mid-to-high twenties. My PT multiple is slightly below its peers' trading range, which I believe is appropriate given the company's slightly lower growth profile.

Risks to Rating

The transition to a low-cost delivery model may introduce internal organizational challenges and potential resistance within Perficient. It also poses an increased delivery execution risk due to the distributed nature of delivery across multiple time zones. Additionally, the rapidly evolving technology landscape in Perficient's markets of operation could potentially hinder the company's ability to stay up-to-date with client demand trends and may place pressure on its capacity to attract and retain highly skilled employees.

Conclusion

Perficient specializes in IT consulting and application development services, and it is currently undergoing a necessary shift in its delivery model towards low-cost locations. I anticipate that Perficient will continue to grow at a high-single-digit revenue rate and will continue to expand its margins as it expands its footprint globally. I view the stock as a buy at current levels and have a December 2023 price target of $91 on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.