XLE: Buy The Dip Amid Record 14% Free Cash Flow Yield

Summary

- Since my last article on the XLE in December 2021, we have seen a further 52% gain in the ETF, even as oil prices have remained flat.

- Oil majors have been able to generate record free cash flows despite this drop in oil prices, which put the free cash flow yield at 14%.

- While free cash flows will almost certainly fall over the coming months, they should remain elevated, and combined with strong balance sheets, this should allow for continued high dividend payments.

- The world remains as heavily dependent on crude oil as ever, with global oil demand back at pre-Covid highs despite government efforts to reduce fossil fuel consumption.

bjdlzx

I last wrote about the Energy Sector Select ETF (NYSEARCA:XLE) in December 2021, where I reiterated my long-held bullish position on the US energy sector and the XLE ETF. Since then, we have seen a further 52% total returns, despite oil prices being flat over this period. However, despite this outperformance of energy stocks relative to the price of their output, free cash flows continue to rise to new record highs. The Energy Select Index now offers a record free cash flow yield of 14%. While this yield is likely to come down as revenues fall in response to the recent oil prices weakness and rising capital expenditure, the XLE should still outperform the broader market, particularly will oil prices looking set for a near-term bounce.

The XLE ETF

The XLE tracks the performance of the Energy Sector Select Index, which tracks S&P 500 components involved in the development or production of energy products. The ETF currently yields 4.4%, which is close to the highest level we have seen outside the 2020-2022 Covid-driven oil price declines. The ETF is dominated by Exxon and Chevron, which have 23% and 20% weightings.

After outperforming oil prices and the broader market over the past 16 months, we have seen a pullback over the past month or so, and the XLE is now at a key technical crossroads, having just managed to stay above uptrend support from the July 2022 lows.

A break below $77 would be a significant bearish break, but we have seen some strength in oil prices of late which should provide support. WTI crude oil has recovered strongly off its May 4 lows, and the bearish trend appears to be rounding out.

Free Cash Flows Continue To Hit New Highs

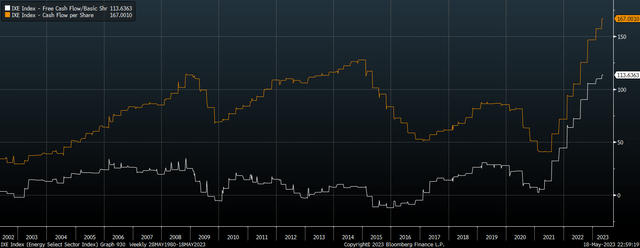

US energy majors continue to generate record-breaking amounts of operating cash flows, while relatively low capital expenditure has led to an even stronger rise in free cash flow as shown below. As a result, the Energy Select Index now offers a record free cash flow yield of 14.1%, which is also a record high 3.7x higher than that of the S&P500.

XLE Operating and Free Cash Flow (Bloomberg)

We are likely to see free cash flows fall over the coming months and quarters due to the lagged impact of lower crude oil prices and a recovery in capital expenditure. According to Bloomberg analysts, free cash flows are expected to fall by 30% over the next 12 months, driven primarily by a 14% decline in sales. This equates to a forward free cash flow yield of 9.7%, which is still extremely high relative to its own history and the broader market.

Can Capex Remain Historically Low?

This expected decline in free cash flows does not factor in any material increase in capital expenditure, which is expected to come in at around 7% of total sales, which is less than half of the figure seen at the 2015 peak. The shift in focus toward capital discipline and the rise in capital productivity suggests capex may remain low for years to come, to the benefit of shareholder returns.

Even if we do see capex levels return to their long-term averages, we should still expect to see oil majors maintain its dividends. Bloomberg analysts are expecting a 20% decline in dividends, which puts the forward dividend yield at 3.6%. However, this seems like an aggressive decline as there it would leave dividend payments at around one third of free cash flows, leading to the further accumulation of cash and short-term assets that can be used for future dividends and buybacks. The balance sheet of the Energy Select Index is far stronger than the broader market, with current assets now almost completely covering total debt, which compares to less than 80% coverage for the S&P50.

Long-Term Oil Price Outlook Remains Bright

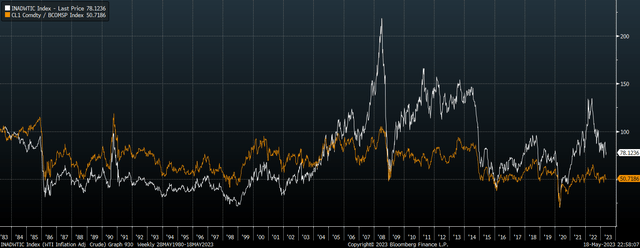

The XLE is highly likely to continue outperforming the broader market if oil prices remain at current levels, but there is a strong likelihood of oil price gains over the coming years. As the chart below shows, in inflation-adjusted terms, WTI crude oil prices are below where they were 40 years. Their decline has been even more extreme when measured relative to the broader commodity complex, with crude oil down 50% relative to the Bloomberg Commodity Index over the past 40 years.

Real WTI Price and Ratio Of WTI Over Commodity Index (Bloomberg)

As I argued in 'XLE: More Upside To Come Amid The Bright Oil Consumption Outlook', the world remains as heavily dependent on crude oil as ever, with global oil demand back at pre-Covid highs despite government efforts to reduce fossil fuel consumption. If we do see prices decline over a multi-year period it is likely to be because of productivity advances in the industry, which should benefit US oil majors and the XLE.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XLE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.