What To Expect From Qualcomm In 2023

Summary

- Qualcomm's revenue for the first three months of 2023 was $9.28 billion, down 1.9% from the previous quarter and 13.4% from the prior year.

- We initiate our coverage of Qualcomm with a "hold" rating for the next 12 months.

- At the end of the second quarter of the fiscal year 2023, Qualcomm's total debt stood at around $15.99 billion and has remained stable for over five years.

- China's slow economic recovery will continue to pressure prices and demand for Qualcomm products used in consumer and industrial electronic devices and also in various edge networking products such as wireless and mobile broadband access points.

- Despite the company's net income decline in recent quarters, Qualcomm's business diversification is beginning to bear fruit.

FilippoBacci/E+ via Getty Images

Qualcomm (NASDAQ:QCOM) is one of the leaders in the global mobile phone chipset industry. The performance and energy efficiency of Qualcomm's world-famous Snapdragon processors from generation to generation continues to grow, affecting their continued demand from mastodons such as LG, Samsung (OTCPK:SSNLF), and Xiaomi (OTCPK:XIACF) (OTCPK:XIACY). In addition, the company does not stop at the progress made but pursues an aggressive R&D policy to develop equipment for working in next-generation wireless cellular networks, recognizing the massive potential of such technologies and the growing demand for them in China and India with the recovery of business activity in these regions.

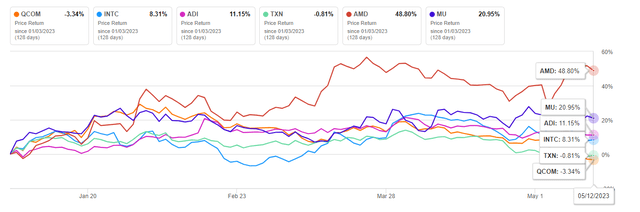

On May 3, 2023, Qualcomm published financial results for the second financial quarter, which showed decreased margins and mixed sales dynamics for the company's products. Despite the achievement of revenue and net income forecasts indicated by Qualcomm management a quarter earlier, they were slightly worse than the expectations of Wall Street analysts. Ultimately, this resulted in continued downward pressure on its share price from early 2023, in contrast to the opposite dynamics from competitors such as AMD (AMD), Micron Technology (MU), and Analog Devices (ADI).

Author's elaboration, based on Seeking Alpha

We initiate our coverage of Qualcomm with a "hold" rating for the next 12 months.

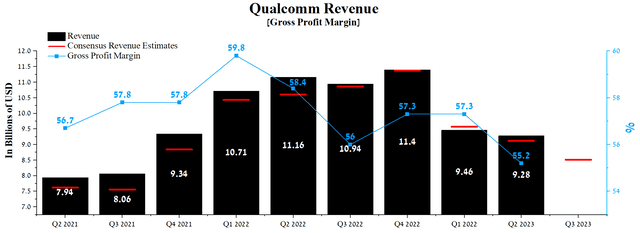

Qualcomm's Financial Position

Qualcomm's revenue for the first three months of 2023 was $9.28 billion, down 1.9% from the previous quarter and 13.4% from the prior year. But even though in most of the past quarters, the company's revenue beat analysts' consensus estimates, Qualcomm's stock continues to move in a bearish price channel. In 2023, Wall Street expects Qualcomm's revenue to be well below 2022 levels, and in the third quarter, it will be in the range of $8.45-$8.59 billion, down 7.2% from analysts' expectations for Q2 2023. Moreover, Qualcomm's management confirmed the continuation of the negative trend and weak demand for the company's products and forecasted a revenue range of $8.1-$8.9 billion for the quarter ending June 2023.

Author's elaboration, based on Seeking Alpha

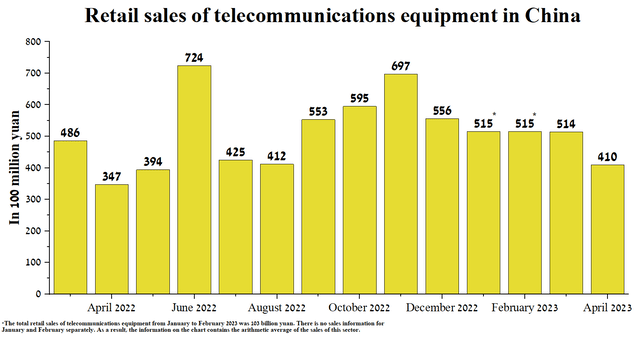

The main risk for the company's financial position is further deterioration of the situation in the smartphone market. Most of Qualcomm's QCT semiconductor business revenue comes from sales of products for use in mobile devices. However, due to weak consumer demand and a reduction in Qualcomm customers experiencing a slow decline in inventory with the company's equipment, handset revenues totaled $6.1 billion in Q2 FY 2023, down 16.9% year-over-year. Moreover, we expect the negative dynamics to continue until the end of October 2023, and only after that will the demand for electronic devices worldwide begin to recover.

At the same time, China's slow economic recovery will continue to pressure prices and demand for Qualcomm products used in consumer and industrial electronic devices and also in various edge networking products such as wireless and mobile broadband access points. Thus, retail sales of telecommunications equipment amounted to only 41 billion yuan in April 2023, down 20.2% from the previous month.

Author's elaboration, based on the National Bureau of Statistics of China

Since Q1 2022, Qualcomm's gross margin has been on a downward trend due to increased production costs and competition in developing regions, leading to lower prices for certain company products. We expect the pressure on margins to continue until Q4 FY 2023, and only from 2024 will it begin to recover at a high pace due to the Fed's interest rate cut and increased economic activity in Europe and China.

But even during the current difficult period for the semiconductor sector, Qualcomm's gross margin is higher than that of its main competitors, such as Intel Corporation (INTC), STMicroelectronics (STM), and Infineon Technologies (OTCQX:IFNNY), which once again shows the efficiency and flexibility of the business model built under the leadership of Cristiano Amon.

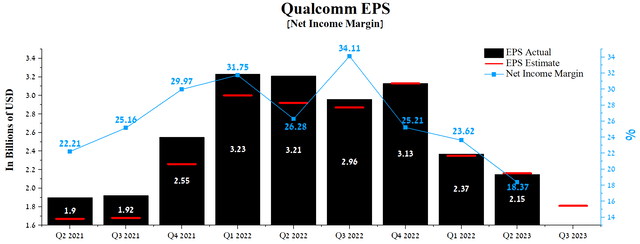

Qualcomm's Q2 FY 2023 net income margin was 18.37%, declining QoQ and YOY. The company's earnings per share for the first three months of 2023 was $2.15, down 33% from the previous year. But at the same time, in most recent quarters, Qualcomm's management continues to beat the consensus estimates of analysts, many of whom remain conservative about one of the leaders in the mobile semiconductor industry. Qualcomm's Q3 FY 2023 EPS is expected to be in the $1.79-$1.85 range, down 16.2% on average from the Q2 2023 consensus estimate. At the same time, Qualcomm's non-GAAP P/E (TTM) is 9.88x, which is 45.34% less than the average for the sector and 50.78% less than the average over the past five years, which is one of the factors of undervaluation of the company by Wall Street in the current period of geopolitical and macroeconomic instability in the world.

Author's elaboration, based on Seeking Alpha

Despite the company's net income decline in recent quarters, Qualcomm's business diversification is beginning to bear fruit. Qualcomm continues to be actively involved in the digital transformation of the automotive industry. Thus, the division's total revenue focused on developing and commercializing products for use in cars amounted to $447 million in the first three months of 2023, an increase of 20.5% compared to the previous year. At the same time, many major automakers, including BMW (OTCPK:BMWYY), Mercedes-Benz (OTCPK:MBGAF), Stellantis (STLA), and General Motors (GM), have entered into partnership agreements with Qualcomm to supply the Digital Chassis platform. But the ambitious plans to increase its share in the automotive semiconductor industry do not end there, and Qualcomm acquired Autotalks, which develops systems to improve road user safety.

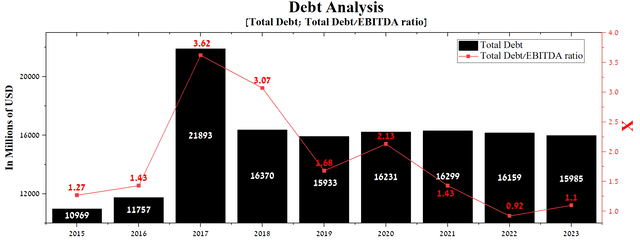

At the end of the second quarter of the fiscal year 2023, Qualcomm's total debt stood at around $15.99 billion and has remained stable for over five years. Despite the decline in EBITDA in recent quarters, the total debt/EBITDA ratio is 1.1x, which, taking into account the maturity dates and interest rates on senior notes, Qualcomm will not have significant problems with its redemption.

Author's elaboration, based on Seeking Alpha

Conclusion

After disappointing Wall Street's forecasts for revenue and net income for the third quarter of fiscal year 2023, the company's share price began a new round of decline, but Qualcomm, one of the leaders in the global mobile phone chipset industry, will not give up.

The next five months will be a period of transformation for Qualcomm's business, which is sorely needed in the current period of slow recovery in the economies of developing countries, which hurts the demand for the company's products. However, in late 2023/early 2024, we expect the Fed to cut interest rates, accelerating the global expansion of 5G coverage and the recovery of the smartphone market. Moreover, there is growing reason for cautious optimism about the company's future, thanks to increased demand for the Digital Chassis platform from leading automotive manufacturers. Under Qualcomm's share repurchase program, management remains authorized to buy back $5.9 billion in shares. Thus, Cristiano Amon has the necessary financial resources to get through the hard times in the semiconductor industry.

We initiate our coverage of Qualcomm with a "hold" rating for the next 12 months.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.