PUTW: Put/Write Strategy Underperforms In The Long Run

Summary

- PUTW ETF writes put options on the SPY ETF while investing proceeds into treasuries.

- Put/write strategies have similar payoffs as covered calls. However, in rising markets, put/write may outperform as the written puts tend to expire worthless.

- Both put/write and covered call strategies suffer from the same problem of capped upside. This will cause them to underperform over the long run.

remco86

The WisdomTree PutWrite Strategy Fund (NYSEARCA:PUTW) systematically write put options on the market while investing the proceeds into 3-month treasuries. In general, PUTW's put-write strategy is similar to covered-call strategies. In a rising market, PUTW may outperform as its written puts expire out of the money.

However, PUTW still suffers from the capped upside issue that afflicts covered call strategies. If the market rallies rapidly in a short period of time, the PUTW strategy will underperform as its upside return is only from premiums received and proceeds from treasury yields.

I am not a fan of the PUTW ETF as over the long run, the strategy's capped upside will cause it to underperform the market.

Fund Overview

The WisdomTree PutWrite Strategy Fund track the price and yield performance of the Volos US Large Cap Target 2.5% PutWrite Index ("Index"). The index basically tracks the performance of a strategy that systematically writes put options on the SPDR S&P 500 ETF Trust (SPY) with 2 different expiry dates. The short proceeds are then invested in U.S. 3-month treasury bills.

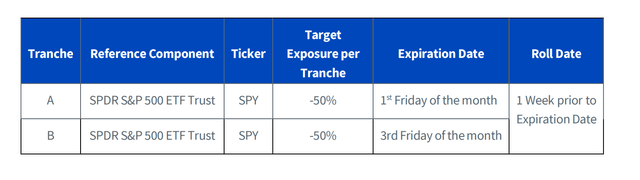

Options are written at the higher of the at-the-money ("ATM") exercise price or at a strike with premium that is closest to 2.5%. Options are written twice a month, targeting the first or third Friday of the following month, and are rolled 1 week prior to expiry (Figure 1).

Figure 1 - PUTW fund writes put options on SPY (wisdomtree.com)

Writing Puts Is Similar To Covered Calls

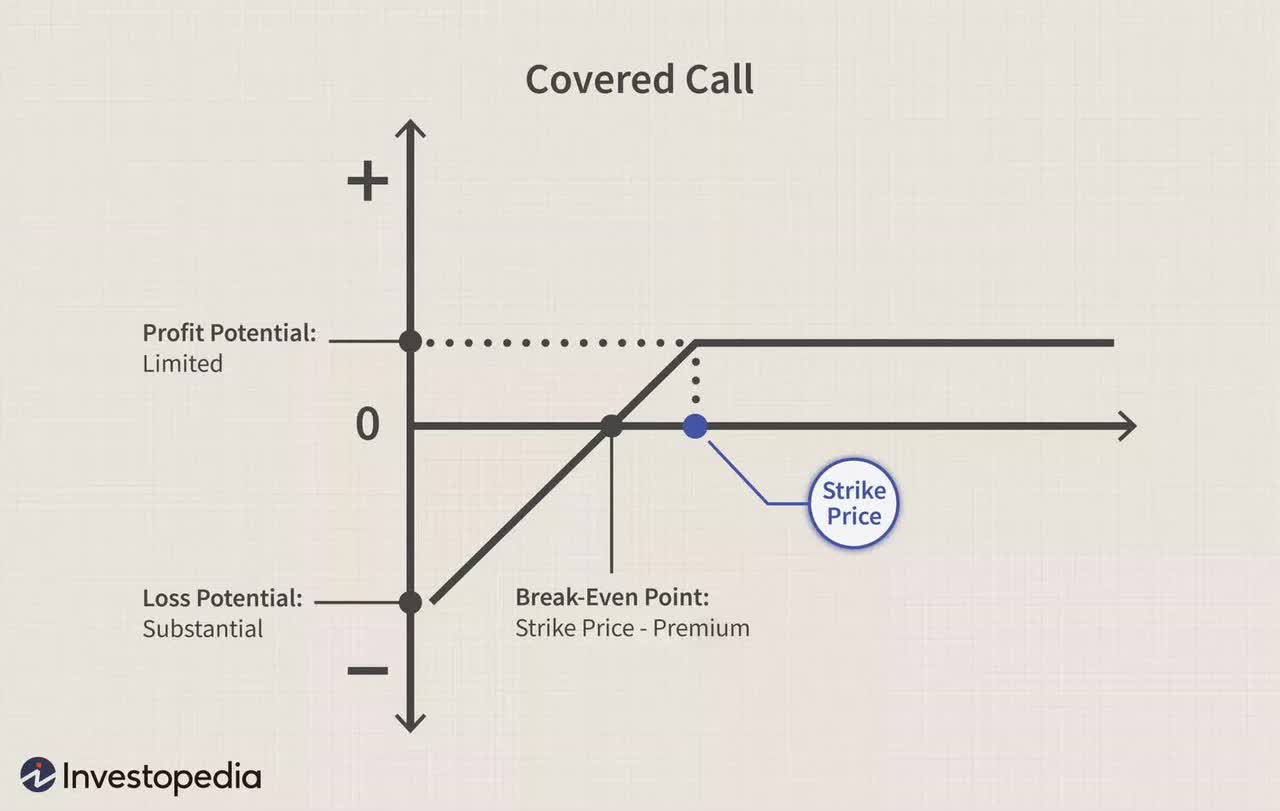

The payoff profile of writing puts (Figure 2) is similar to that of covered calls (Figure 3).

Figure 2 - Illustrative payoff profile of writing puts (investopedia) Figure 3 - Covered call payoff profile (investopedia)

In both instances, the upside of the position is capped while downside is uncapped. For put writing, the upside is the premium received plus the yield on cash. For covered calls, the upside is the premium received plus the price appreciation of the underlying security until it is called away.

Although the payoff profiles are similar, in reality, there are a number of subtle but important difference between put/write strategies vs. covered call strategies. First, investors generally want downside protection, so puts are often more expensive than calls. A strategy that systematically sells puts may be able to capture this inefficiency.

Second, in a generally rising market, a strategy that systematically writes puts may outperform a covered call strategy, as there is less chance of the put expiring in-the-money ("ITM") and requiring a cash outlay to roll.

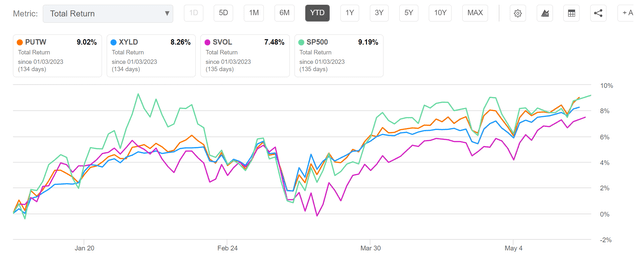

This is the reason why YTD, the PUTW ETF has outperformed in total returns against a systematical covered call writing strategy like the Global X S&P 500 Covered Call ETF (XYLD) (Figure 4). The puts written by PUTW generally expired worthless as markets have been going up.

Figure 4 - PUTW has outperformed XYLD YTD (Seeking Alpha)

Put-Write Still Misses Majority Of The Upside

However, like covered call strategies, my main criticism on the PUTW ETF is that systematically writing puts has capped upside and uncapped downside. Over the long run, this skewed returns profile will cause these strategies to underperform the market.

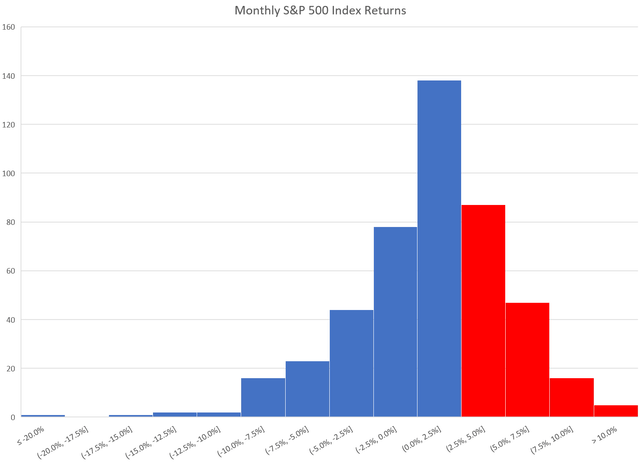

For example, PUTW will write ATM puts or puts at 2.5% premium, whichever is greater. This means that when monthly returns on the S&P 500 is greater than 2.5%, the PUTW ETF will underperform. Unfortunately, if we look at the S&P 500's historical distribution, 166 out of 460 monthly returns since 1985 have been greater than 2.5% (Figure 5). So the PUTW underperforms ~1/3% of the time when the S&P rallies more than 2.5% in a month.

Figure 5 - Historical S&P 500 monthly returns (Author created with data from Yahoo Finance)

On the downside, negative monthly returns are alleviated by the premiums received. However, when returns are more than negative 2.5%, the PUTW will deliver a negative month since it must close out the ITM options positions and roll to the next month. As we can see from the returns distribution, there are many months where the S&P 500's return is deeply negative.

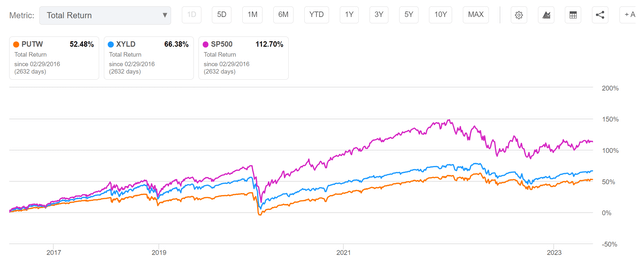

Compounded over the long run, PUTW's capped upside / uncapped downside returns distribution cause the fund to significantly underperformed the S&P 500, returning 52.5% since inception compared to 112.7% for the S&P 500 (Figure 6).

Figure 6 - PUTW underperforms the S&P 500 over the long run (Seeking Alpha)

I Prefer Short Vol To Generate Yield

In comparison to put/write or covered call strategies, I personally prefer short-vol strategies like the Simplify Volatility Premium ETF (SVOL) for generating yield. The SVOL ETF shorts modest amounts of VIX short-term futures (typically 0.2x to 0.3x of the portfolio), with a tail hedge for extreme events.

A short-vol strategy does not suffer from upside capture issues, since upside returns are uncapped when shorting VIX futures. On the other hand, short-vol strategies are susceptible to market crashes like the 2018 'Volmageddon' event, when the VIX index rose very quickly in a short period of time, wiping out investors who were short volatility via ETF products like the defunct 'XIV' ETF.

Although SVOL owns OTM calls on the VIX Index and related securities to protect against the left tail, SVOL's strategy has not been tested in any meaningful market crash, as the fund was incepted in 2021.

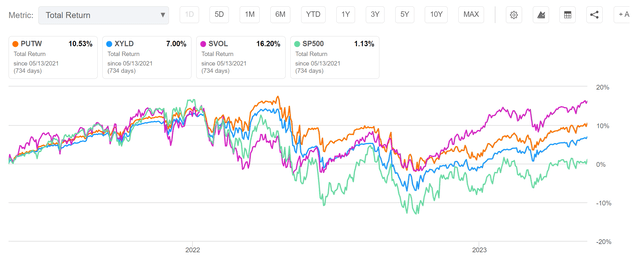

Since SVOL's inception on May 13, 2021, the SVOL ETF has delivered superior total returns compared to the PUTW ETF, the XYLD ETF, and the S&P 500 (Figure 7).

Figure 7 - Since inception, SVOL has outperformed PUTW, XYLD, and S&P 500 (Seeking Alpha)

Investors who want more details on the mechanics of the SVOL ETF should take a look at some of my prior articles.

Conclusion

The WisdomTree PutWrite Strategy Fund aims to generate superior risk-adjusted returns by systematically writing put options on the SPY ETF and investing the proceeds into 3-month treasuries. In general, PUTW's put-write strategy is similar to covered-call writing strategies like the XYLD ETF. However, in a rising market, PUTW may outperform XYLD as its written puts expire out of the money.

However, PUTW still suffers from the capped upside issue that afflicts all covered call strategies; if the market rallies rapidly in a short period of time, the PUTW strategy will underperform as its upside is only from premiums received and treasury yields.

I am not a fan of the PUTW ETF as over the long run, the strategy's capped upside and uncapped downside will cause it to underperform the market.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SVOL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.