Photronics, Inc.: Solid Company In A Growing Industry

Summary

- Photronics Inc has been able to grow revenues even if the semiconductor market is experiencing tough times right now.

- Photronics has excellent margins, but there is still room for growth and the potential to take on more market share.

- The balance sheet is sound and debt is no issue; I will rate the company a buy now as the valuation leaves little downside risk.

PonyWang

Introduction

Photronics Inc (NASDAQ:PLAB) is a manufacturer of photomasks, which are used in the production of semiconductors and flat panel displays. Their stake in the market might be small but that leaves room for growth. Photronics Inc. operates globally, with operations in the United States, Europe, and Asia. The company has established close working relationships with its clients, which primarily consist of prominent semiconductor manufacturers.

Quarterly Highlights (Earnings Report)

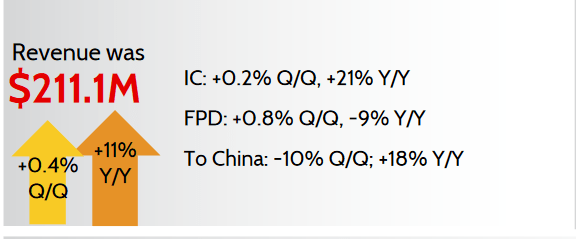

The company managed to grow revenues 11% YoY as shown in the last earnings report, which is quite impressive as many companies in the semiconductor industry have been struggling lately. PLAB has great margins and the valuation right now seems very fair to start a long-term position with. The company has a solid balance sheet with negative net debt. I think there is much more reward in getting in right now than the risk with PLAB and I think they deserve a buy rating.

Growth Opportunity

Looking at where the photomask market is heading, it seems it will experience steady growth over the next several years with a CAGR of 4.24% between 2022 and 2027. As the demand for semiconductors goes in cycles it is very likely in my opinion the same will be for photomasks. The demand for digital transformation to help automate industrial processes is another tailwind that will help push demand for photomasks as mentioned in a report by researchandmarkets.

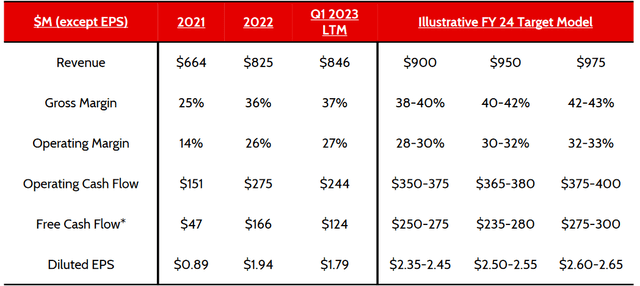

Company Goals (Investor Presentation)

PLAB has ambitious goals for 2024 where the upper end of the model would put the EPS at $2.6 - 2.65 and using the same 8x multiple the company has now would put the share price around $21, an upside of 29%. The company is small and has just barely over $1 billion in market cap so a surprise in the upcoming earnings report could be a catalyst for the share price.

The trend seems clear that demand for photomasks is growing and that PLAB will have a large market to cater to. Margins are strong but leave room for improvement. Tailwinds to look out for will be lowered interest rates which should help companies be more optimistic with spending and expansion, which makes PLAB have an easier time selling their product as companies rush to fill up inventories and satisfy demand.

The Financial State

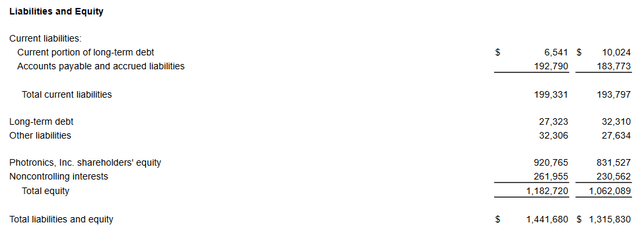

Looking at the balance sheet of PLAB I think they are in a terrific position given the small size of the market they are in and that they are still growing quite quickly. On a QoQ basis, the company has been able to grow the cash position slightly, by around $15 million, but also paid off some debt too. The long-term debt position decreased by about 15% which I think highlights the management's priority to keep a healthy financial state and make moves like this when the market is less favorable and more difficult to maneuver in.

Assets (Earnings Report) Company Liabilities (Earnings Report)

What is quite impressive is that the outstanding share count has been decreasing in the last few years. From 2018 to 2022 the shares have decreased about 21%, a sign that the company is prioritizing shareholders and using the cash flows efficiently to bring value. I don't expect this to change given the strong cash position the company has and the extremely slim chance debt would ever be an issue. In fact, I don't mind the company taking on more debt and becoming more leveraged if it means they are able to expand faster. The net debts are negative which is rare to find in this industry.

All in all the company is in a great position with the balance sheet. For upcoming reports, I will keep an eye on the cash position and whether it is increasing. In all honesty, it wouldn't be a bad thing if it's decreasing, the company can pay off their long-term debt 10 times over right now anyway.

Upcoming Report

As mentioned in the last report by the management, the margins were slightly softener than expected because of a softer market. The CEO Frank Lee had the following to say, "Profit margins were somewhat softer than the previous quarter, primarily due to less favorable mix and somewhat lower customer premiums to accelerate deliver". For the coming quarter, looking at the margins will be vital.

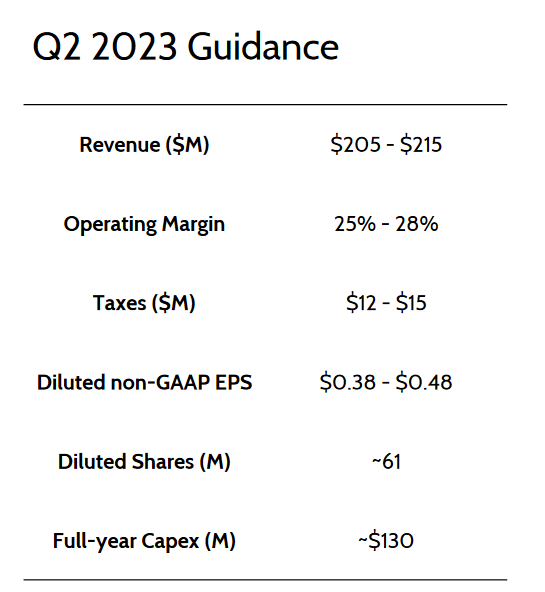

Q2 Guidance (Investor Presentation)

The company has an ambitious goal for 2024 as mentioned before, and if there continues a trend of lower margins than anticipated then I can see a good reason why the valuation of the company will be lower than the sectors. Growth is necessary to justify it and right now I think the market needs proof this is true with PLAB. The Mainstream IC part will be key to watch. The company is investing heavily here to capitalize on and capture the growth the market is seeing. It grew 31% YoY in the last report and if the trend continues this could be a catalyst to give the company a higher multiple.

Company Takeaway

Right now I think there is plenty more reward than risk investing in PLAB. The forward P/E might be increasing, but it is still sitting at just under 9x, far below the sector's 19x multiple. The company has solid fundamentals with good margins and an excellent balance sheet that lets them operate freely without the constraints of paying back large amounts of debt.

PLAB vs S&P 500 (Seeking Alpha)

The company had a massive run-up in July and August last year but has since come down a fair bit as the entire semiconductor industry seems to have experienced a slowdown and contraction in valuations. But I think the long-term opportunity remains strong with PLAB. It's a small company with a market cap of just above $1 billion, so volatility should be expected. For investors who wish to have a diversified portfolio, I think it's important to have some exposure in the semiconductor industry. It's a market that touches basically everything in our life, it's hard not to find an appliance that doesn't have a chip in it. So finding a company that seems as solid as PLAB is quite difficult. There's no lack of nonprofitable companies in the space, but PLAB sets itself apart by already now prioritizing bringing value to shareholders through buybacks. I will be rating PLAB a buy and keeping a close eye on the coming quarters to see if the 2024 goals look achievable.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.