Foot Locker: The Nearly 30% Decline Following Earnings Appears Overdone

Summary

- The market is punishing Foot Locker, following weak results and a cut in guidance.

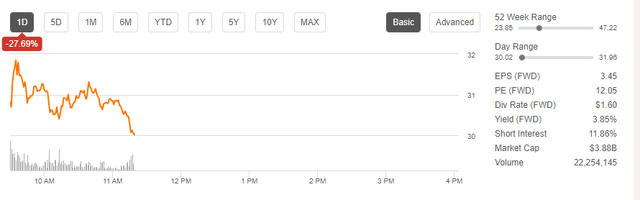

- Shares are down nearly 30% on the day and have yet to bounce higher.

- Though the results and subsequent guidance cut are disappointing, the current pullback appears overdone, especially in light of the clues provided by other retailers heading into the release.

- For investors seeking to build out long-term positioning, the steep decline provides an attractive entry point.

martinrlee

Markets are currently punishing Foot Locker (NYSE:FL) following weak quarterly results and a cut in guidance. Though not yet at new 52-week lows, shares are down nearly 30% on the day.

Seeking Alpha - Basic Trading Data Of FL

Given that NIKE (NKE) represents about two-thirds of FL's total sales, the weakness in FL also sent shares of NKE lower for the day by about 3.5%.

Results during the quarter and the subsequent revisions to forward guidance certainly weren't good, but I view the pullback as overdone. Prior to earnings, investors were updated by a plethora of retailers, including Walmart (WMT), Home Depot (HD), and Target (TGT), to name a few.

And in all updates, it was noted that consumers are pulling back from more discretionary purchases and are prioritizing value and convenience over those purchases that could simply wait, such as apparel and footwear.

And even for discretionary apparel, there's been a marked rotation into off-price retail formats. As such, expectations should have already been tempered ahead of earnings. In my view, then, the pullback presents an attractive opportunity for investors to scoop up shares at an attractively priced discount.

What Were FL's Topline Updates?

Total sales during the quarter landed at +$1.93B. This was down 11% and worse than consensus estimates of +$1.99B. The figures were just as bad in the same-store population, down 9.1%.

In addition, profits came in at just +$36M. This compares to +$133M in the same period last year. On a per share basis, this amounted to $0.38/share. Estimates, on the other hand, were for $0.78/share. Likewise, Non-GAAP earnings of $0.70/share also badly missed estimates by several cents/share.

In addition to the performance-based updates, FL also announced that Mike Baughn, formerly with Kohl's, would be their next CFO. This would push back Robert Higginbotham, their interim CFO since March, to his prior role as senior VP of investor relations.

Why Did FL Drop Nearly 30% Following Results?

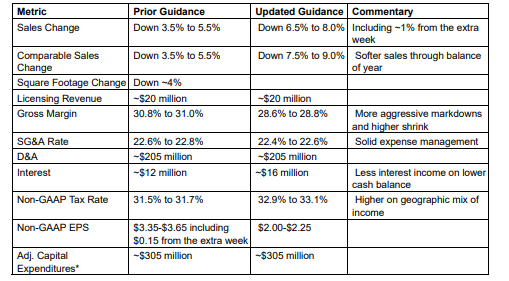

On their prior release, management had previously guided for a 5.5% decline in total sales. They now see sales down between 6.5% and 8%. The revisions were primarily due to a significant softening since the time of their last update.

In one sense, this isn't surprising, given clues provided by retailers elsewhere. WMT, for example, noted a continuing trade-down effect from higher-income households, as well as a more prioritized environment for consumables over discretionary products.

FL's reliance on premium sneakers makes them especially vulnerable. Therefore, the weakness shouldn't have been a significant surprise, given what had already been known about the broader market environment going into earnings.

But as it is, FL is already in a bit of a reset. Previously they've announced store closures, business exits, and increased spending on future growth efforts, such as technology and wages. These investments were previously expected to be accretive beginning in 2024.

The current quarter's slip could, perhaps, push that out several months or maybe even another year. Current results, for example, indicated management is planning more aggressive markdowns to right-size demand and to manage their inventory, which was up 25% YOY.

The increase in promotional activity is likely to further weigh on margins, which were already down about 400 basis points compared to last year on a combination of both increased promotions and ongoing shrinkage issues.

Given expectations of a more promotional environment and one marked with greater shrinkage, gross margins are now seen falling in the range of 28.6% to 28.8%. This would be down from a previous range of 30.8% to 31%.

Foot Locker's Press Release - Summary Of CY Guidance

Why I Think FL's Drop Was Overdone

The weaker macro environment is evidently creating headwinds for discretionary retail. There couldn't be more proof of that than in FL's earnings. But Foot Locker's reliance on premium sneakers is not a new finding for investors. Yet, the market appears to be treating it as such.

Current results could push back the company's planned reset, but I don't view their plans as completely derailed. In the near-term, increased promotional activity and ongoing issues with shrinkage will remain pain points for investors, but the long-term picture still appears bright.

In the coming years, FL's exposure to NKE is still expected to fall to around the low-60% range. And this exposure is expected to be replaced with a more diversified portfolio of brands, such as from New Balance and PUMA.

This could in turn reduce their reliance on the most premium and popular products, such as their Air Jordan sneakers. In addition, it could reduce risks pertaining to changing fashion trends.

The company also continues to maintain a healthy liquidity position, with ample cash on hand and a modest debt load, with limited financing-related risks.

Following the pullback, shares are priced at a discounted forward multiple. And current consensus price targets stand at an average of $44/share. This represents an upside potential of about 50%.

While shares could, admittedly, struggle to get there, given the sentiment, the nearly 30% pullback still appears overdone in light of the expectations that should have been set going into earnings. As such, I view current trading levels as an attractive price point for investors seeking to a build a position in a top footwear name.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.