Danaos: Are Stock Buybacks Finally Coming?

Summary

- Danaos had a great Q1 and the current valuation is the cheapest in the containership lessor industry.

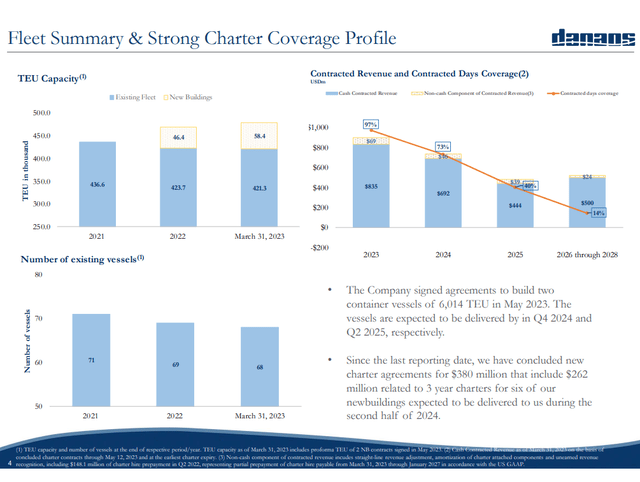

- There are big backlogs for the next two years, which will provide a shield against lower freight rates.

- Share repurchases finally seem to be on the horizon.

DINphotogallery/iStock via Getty Images

Introduction

I believe that Danaos is significantly undervalued by the market likely due to fears of a global recession. I find the risk of a significant global downturn to have little impact on Danaos (NYSE:DAC) as it has already locked in revenue for the next two years and I think the stock has already priced in a downturn with this cheap valuation. I also think that pretty soon the wait for stock buybacks will be over.

Why I Like Danaos

What I like about this business model is its predictability. Unlike the business model of a shipping company like ZIM, Danaos only leases out containerships and does so over long periods of time. This makes for contracts that are locked in for many years in advance providing predictability in revenue, and margins are very wide (50%+ net margins). This kind of business model allows for continued profitability due to a predictable top line and low expenses. Locking in contracts especially comes in handy in the current macro environment where charter rates are collapsing and a recession is likely to worsen the current situation. The other great thing I like about Danaos is that it is capital efficient; its ROA is close to 20% and its ROE is 25%. Having a high ROA and ROE means that when the expansion of the fleet is needed little capital will need to be put into CAPEX, whereas companies with a low ROA and ROE need to reinvest a lot more of their retained earnings to expand. Ultimately being efficient with capital allows for more of the cash flows to be returned to shareholders via dividends and stock buybacks. The biggest draw of all is the valuation. The containership lessor industry already trades at a low multiple, but Danaos is trading for the lowest multiple of them all. Danaos has a P/E of 2.14x and a P/B of 0.47. From the outset, it seems like a great business at a great price.

Why The Stock Has Disappointed

Based on the views of most shareholders I see both writing and commenting on Seeking Alpha it seems that the stock has disappointed despite the above positive points. The stock has traded down and then sideways over the last year.

I think it would be good to understand how we got here. In 2020 and prior Danaos had a lot of debt and simultaneously charter rates were very low, hence the company was barely scraping by with 2018 having a net loss, while in 2019 and 2020 net income was a fraction of what it was in 2021.

In 2021 due to supply-side inflationary pressures charter rates went up sharply. Danaos was able to use this opportunity to clean up its balance sheet to the point where they now have close to no net debt. Initially, this caused the stock to go up from a low of $3 to a high of $106. Then once the profitability became more normalised in 2022 the stock pulled back to $60; since then it has traded sideways.

In my opinion, there has been disappointment with the management as they seem more focused on empire-building by expanding the fleet rather than returning the giant cash pile sitting on the balance sheet to shareholders. This can be compared with other companies in this industry such as Global Ship Lease (GSL) which has been returning capital to shareholders via a larger dividend and constant stock buybacks. I suspect the lack of return of capital to shareholders is the reason why the stock has gone down and traded sideways even as earnings have been strong.

Q1 Earnings & Future Outlook

Q1 earnings were recently released. The EPS was $7.14 which is a beat by $1.24.

The big question is what the future outlook is going to look like and what the company plans on doing with its retained earnings. Now that net debt is down close to zero, it is unlikely they will continue to pay down debt. This leaves the company with two options: adding to the fleet or returning capital to shareholders.

It seems that the view of the management is that the stock price could go lower due to an economic slowdown. I suspect that as John Coustas, the President, said the following:

Well, I think we've been very clear about that, we have in place a share repurchase program, which, we are executing you know, when we believe that conditions are, right. 40% of it is already executed, almost $40 million, we have another $60 million. So, you know that part is there.

In terms of, let's say, dividends, we are maintaining, let's say, the dividend, despite, let's say, the uncertainties around in the market. And on the other hand, we are investing cautiously for the future as we've done with all our new buildings.

There are two things that stood out to me. The first is about the share repurchase program; management choosing to use only 40% of their share buyback program does make ask: why? I suspect that management thinks that we could see earnings worsen in 2024 and 2025 as rates get locked in at a lower amount than they currently are causing the stock price to go down, and along with that if we see a recession that comes with liquidity tightening and equity market downturn, it might send the stock price lower for reasons not having to do with the company itself; because of this, it seems that management wants to keep dry powder in case the stock price were to go even lower.

The second thing that stood out was John Coustas saying:

we are maintaining, let's say, the dividend, despite, let's say, the uncertainties around in the market

I find this to be a sign that management believes that economic uncertainties will put on pressure on the earnings and likely stock price.

All in all, my takeaway from the earnings call was that management seems worried about a potential downturn and is keeping dry powder to buy the stock in case that happens. I find this to be a positive as they can see potential risks and are getting in front of it. So even though the lack of stock buybacks has disappointed many, I do believe that in the future it will pay off as they might get the opportunity to buy the stock in a downturn at a lower price, and having dry powder to share repurchase at lower stock price essentially puts a floor on the stock price.

With the amount of cash on the balance sheet the company would be able to buy back 25% of outstanding stock at the current market capitalization.

Backlog

One of the things that I most like about Danaos is its multi-year backlog. Management had to say the following about it:

As of the date of this release, the contracted cash revenue backlog stood at $2.3 billion, with an average charter duration of 3.2 years, while contract coverage is at 97% for this year and 73% for next year.

This means that a majority of revenue for the rest of 2023, 2024, and even some revenue going into 2025 is locked in. If in fact, we do have a large downturn in freight rates in 2024 due to an economic slowdown Danaos's stock would likely have a knee-jerk reaction lower; in that environment share repurchase would make more sense rather than if Danaos were to increase their fleet as rates would be low at the time.

Risks

There are some risks to the long thesis that I'd like to disclose. The first risk I see is that management chooses to invest a lot of the current retained earnings in furthering the fleet; the issue with this is that the new fleet won't have any contracts or backlog on it, and with the now declining containership rates they might have a hard time leasing those containerships at a high rate. The second potential risk I see is M&A risk; with the company having so little debt and so much cash on the balance sheet I suspect many private equity funds would want to acquire a company through an LBO which would require very little equity due to the cheap valuation of this company combined with the strong balance sheet. If this company were to become a private equity target then shareholders would get bought out for current pricing and miss out on the upside. The other risk, which I believe has very little probability of playing out, but is still worth a mention is the risk of default from their backlog; for example, if one of their lessees went bankrupt it is possible that they can't then pay the lease. Again I would emphasize that this risk has little probability of playing out as even during the great financial crisis in 2008 leases were getting paid and companies like Danaos have risk management in place to make sure they are leasing to the right companies, but like all risks, it is worth a mention.

The Bottom Line

The bottom line here is simple. Danaos is fundamentally sound even if a severe recession were to hit due to locked-in revenue through backlogs; along with that, the stock is going for a dirt-cheap valuation. Most importantly, I believe that as we head into a potential recession management is keeping dry powder to buy back stock, which I have found to be one of the biggest pain points for many shareholders.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.