Selina's Losses Are Unsustainable

Summary

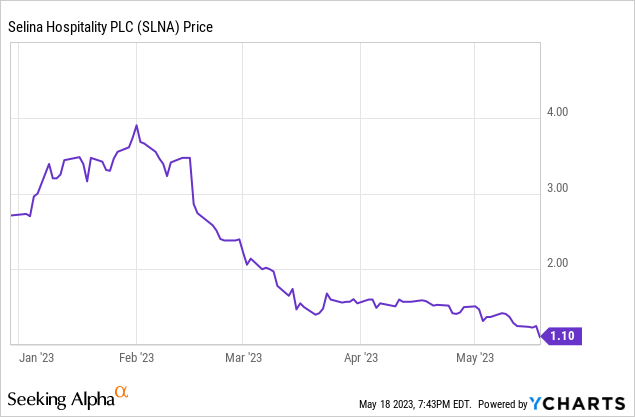

- Selina's market cap has fallen by 50% since the start of the year.

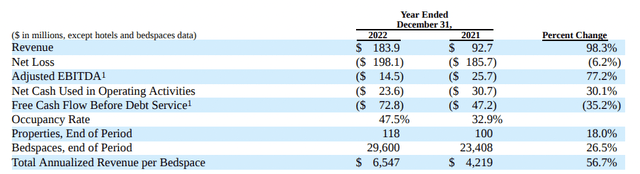

- The fledgling hospitality company grew fiscal 2022 revenue by nearly 100% over the prior year. Losses of $197 million continue to be outsized.

- Cash and equivalents at $47.7 million as of the end of the year are not sufficient to meet fiscal 2023 cash needs.

Studio Marklin/iStock via Getty Images

Selina Hospitality (NASDAQ:SLNA) is down 50% since the start of the year as its efforts to build out a hospitality network to cater to Millennial and Gen Z travelers runs into a broader risk-off environment that's been spurred by a marked increase in the cost of liquidity. The Fed funds rate has been hiked to highs not seen since 2008 and loss-making companies have become the antithesis of the current market zeitgeist. Selina recently reported earnings covering its fiscal 2022 that saw deep net losses even as revenue went through a material ramp. Last year was a watershed moment for the firm as it went public on the Nasdaq and raised millions to expand its global network of hotels.

Selina is currently swapping hands for $1.10 per share and at a $123 million market cap. This is set against fiscal 2022 revenue of $183.9 million, up 98.4% over the prior year but a miss by $57.49 million on consensus estimates. The current 0.67x price-to-sales multiple conveys both opportunities and risks. For the bears, it portends weakness from a business model that lost $197 million last year. This was 107% of 2022 revenue as whilst driven by some non-cash expenses, free cash outflow still came in at just over $72.8 million. This is not an insignificant amount, forming around 39.5% of revenue and 60% of Selina's current market cap.

Unsustainable Losses Could Derail The Nomad Story

Selina owned 118 hotels and 29,600 bed spaces as of the end of the year, it operated at a 47.5% occupancy, a material improvement from 32.9% occupancy in 2021. Total annualized revenue per available bed space stood at $6,547, up 55% over the year-ago comp. Hence, the bull story for Selina is clear. Improving unit economics as the company builds its brand and expands its network to new locations around the world.

Selina's management has stated that they want to reach profitability by the end of 2023, a hugely ambitious goal when set against current net losses. This task will especially be made more difficult by the company's long-term debt balance which stood at $137 million as of the end of the year. This drove interest payments of $17.4 million for the year, up from $6 million in 2021. However, that Selina has been able to reduce adjusted EBITDA losses by $11.2 million to $14.5 million is a vote of confidence in its ambition to reach profitability. Further gains in occupancy should help drive up revenue per available bed space as its expansion of new hotels becomes more considered against their cash needs. Indeed, the fourth quarter of 2022 saw occupancy at 49% with revenue increasing by around 24% on a same-store basis.

The Outlook For 2023

Selina is guiding for fiscal 2023 revenue growth of 30% to 40% as well as positive adjusted EBITDA and positive operating cash flow. The company's expansion strategy this year will also be done around three principles; locations that should see a faster ramp in occupancy, an expansion of existing locations with remodels and incremental leased spaces, and the negotiation of flexible lease terms with longer grace periods while shifting to variable rent for some new locations. Selina has moderated its expansion plans for the year against its current cash position. Critically, attaining positive operating cash flows has now become a visceral need with current cash and equivalents simply not providing enough of a cash runway to support a cash burn trajectory for 2023 that fully mimics the prior year.

In many ways, the current collapse is not entirely Selina's fault. The London-based company went public amidst a stock market that was already in full retreat. This capital flight away from unprofitable growth companies continues and will likely remain a dominant trend until interest rates start falling again. This comes as concerns around a recession swirl and as the post-pandemic travel boom looks to be moderating. Against these headwinds, Airbnb (ABNB) fell sharply following its fiscal 2023 first-quarter earnings.

However, the rest of 2023 from a wider macroeconomic perspective could still see sentiment improve on the back of a dovish Fed pause in the June FOMC meeting. This stands to be boosted if current concerns around a regional banking crisis, the debt ceiling impasse, and stagflation fears pass. At play here is a possible upward move of Selina's current sales multiple to a figure north of 1x. This would see a marked rate of return for current shareholders against guidance for revenue to grow by at least 30% this year. However, I'm not a fan of Selina until we see it reach profitability. The liquidity concerns are real and the company's current debt burden and rising interest expense will make it difficult to raise any more funds without having to lean on an equity raise. This is a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.