Arrowhead Pharmaceuticals Remains A Buy For Pipeline Potential

Summary

- A Phase 3 study for treatment of ARO-AOPC3 for FCS has completed enrollment.

- The Phase 3 fazirsiran study started, earning a $40 million milestone.

- Cash ended Q1 at $560 million, so well positioned to get to Phase 3 results.

luismmolina

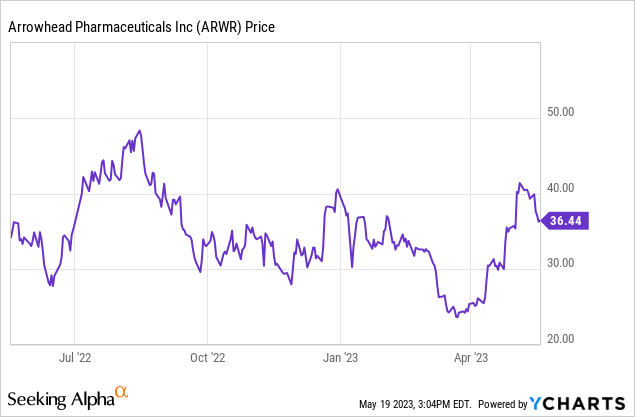

Arrowhead Pharmaceuticals (NASDAQ:ARWR) is a clinical-stage biotechnology company with a wide pipeline of potential RNAi therapies. It is getting into the home stretch now, with three Phase 3 trials in progress, plus three each of Phase 1 and Phase 2 trials, and several pre-clinical candidates. Since I last discussed Arrowhead in Accumulate Arrowhead for Its RNAi Pipeline, in January 2022, the company has made progress towards initiating or completing Phase 3 trials. Yet the stock price has fallen from about $58 per share to close to $38 today. This largely reflects the caution being exercised in the markets, in particular for development-stage pharmaceutical stocks. The 52-week share price ranges from a low of $23.09 to a high of $48.48. While there are risks involved, particularly that the late-stage trials may not produce positive data, in general, I believe the situation has improved since I last wrote about ARWR. Here, I will discuss the most advanced therapies in the pipeline. Then I will compare Arrowhead’s potential to its current market value. First, I will review the Arrowhead Q1 2023 results that were released on May 2, 2023.

Fiscal Q2 2023 Arrowhead financial results

Arrowhead Pharmaceuticals uses a fiscal calendar, so the calendar quarter Q1 2023 is its fiscal Q2 2023. In the quarter, revenue was reported as $146 million. Arrowhead has no FDA-approved products, so revenue is from up-front licensing payments and milestones achieved. GAAP net income came in at $49 million, with a resulting EPS of $0.45. Operating expenses in the quarter were $98 million. The cash and equivalents balance ended at $560 million. Because licensing and milestone revenue is irregular, it is not easy to predict how much of a cash runway that provides, but it is certainly not a short-term worry. In most recent quarters, Arrowhead has posted a loss.

ARO-APOC3

On May 16, 2023, Arrowhead announced it had completed enrollment in its ARO-APOC3 Phase 3 FCS (Familial Chylomicronemia Syndrome) trial. FCS is a lipoprotein lipase deficiency that leads to very high triglycerides in the blood. ARO-APOC3 inhibits the production of apolipoprotein C3, a regulator of triglyceride metabolism. The disease itself is rare. While I do not see potential revenues for chylomicronemia as being large, a successful Phase 3 trial followed by regulatory approval in this indication would pave the way for label expansion into the other, more lucrative APOC3 indications. ARO-APOC3 has Fast Track designation in FCS. The Phase 3 data readout is expected in Q3 2024. However, if approved for FCS it will be competing with Ionis’s (IONS) Waylivra (Volanesorsen), which was approved for FCS in the European Union in 2019, but with a different mechanism of action. Waylivra did not gain FDA approval for FCS.

Earlier, in Q3 2022, enrollment had been completed for ARO-APOC3 for severe hypertriglyceridemia. This is a very big indication. Hypertriglyceridemia in general affects about 30% of the American people, driven largely by obesity. Arrowhead estimates its label would cover about four million people in the U.S. A Phase 2 study is scheduled to read out data in 2023. That should allow a Phase 3 study to commence in 2024.

Fazirsiran

In January 2023 Phase 2 topline results for fazirsiran for the treatment of liver disease associated with alpha-1 antitrypsin deficiency were reported as positive. Partner Takeda dosed the first patient in the Phase 3 study later in Q1. The study will have up to 160 patients. Arrowhead earned a $40 million milestone payment from Takeda when the new study began. The study data point is at 196 weeks, so potential regulatory approval is years away. The first interim analysis will be at week 52.

Olpasiran

Olpasiran has been licensed to Amgen (AMGN), which is responsible for its development. Arrowhead already collected $250 million cash against the future royalty stream. In November 2022 Amgen announced that Phase 2 data showed olpasiran lowered lipoprotein(a) levels significantly. Globally, about 20% of people have elevated Lp(a) levels, which are linked to a high risk for heart disease. The Phase 3 study began enrolling in January 2023.

Future platforms: Pulmonary and Neural

I covered some of the other elements of the Arrowhead pipeline in my January 2022 article. Here I want to focus on the enormous potential of two sets of RNAi compounds, those for lung or pulmonary diseases and those for neurological diseases. Early RNAi therapies from various companies worked on the cells of the liver, so diseases related to that were targeted. Arrowhead and other companies have been working on delivering RNAi to other tissues. The payload is always an RNAi molecule that helps with the metabolic pathway that causes the disease. This molecule needs to be attached to a component that allows it to get to and enter the specific cell type of the disease. Two important organ and cell types that need addressing are neurons and lung cells. In calendar Q1 2023, Arrowhead announced interim positive Phase 1 data for ARO-RAGE showing it could address lung tissue. For the central nervous system, Arrowhead expects to submit an NDA to the FDA to begin a clinical trial of ARO-SOD1 in Q3, 2023. While there is now an approved SOD1 agent on the market, the main point here would be to prove that RNAi molecules can be delivered successfully to the CNS. See also the Arrowhead Pharmaceuticals pipeline page.

Valuation

Valuing a company that has no FDA or EMA approvals is largely a matter of opinion. At the closing price of $36.28 on May 18, 2023, Arrowhead had a market capitalization of $3.9 billion. That indicates an enormous amount of investor confidence in future profits. There is a risk of failure, but I think a degree of confidence is warranted. Several RNAi products produced by other companies like Alnylam (ALNY) are on the market and generating significant revenue. Amgen seems confident that Olpasiran will become a significant revenue generator, which would mean significant dividend revenue, as well as milestone payments, to Arrowhead. ARO-APOC3, if approved and accepted by the medical and payer community for severe hypertriglyceridemia, could propel Arrowhead into being a major, perhaps large-cap, pharmaceutical company.

Conclusion

I like the work Arrowhead has done and think it is a reasonable investment at the current price. Keep in mind the ladder of risk: failure of efficacy; unexpected safety issues (that sometimes come out in Phase 3 trials or even after FDA approval); and market acceptance, including insurers arguing over pricing or even refusing to pay. The stock price is down since I last wrote about the company, which I attribute to the general fleeing from risk in the current market. The data has been mostly good, so my judgment is that on the whole Arrowhead is currently undervalued. My strategy is to accumulate more.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARWR, AMGN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.