DGRO Vs. VIG: Picking A Winner For 2023

Summary

- In my last article on DGRO, I declared this ETF as the best 2019 ETF for dividend growth investors.

- Four years later, we live in a very different world. Further, VIG, one of DGRO's main competitors, has also changed somewhat in structure.

- What does this all mean for investors in 2023? In this article, I do a deep dive into both ETFs, featuring both their similarities and differences.

- In the conclusion, I share my personal choice as winner for 2023. However, I also list the specific reasons you might make a different choice.

- I do much more than just articles at Hoya Capital Income Builder: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Daenin Arnee

(This article was co-produced with Hoya Capital Real Estate.)

Back in 2019, I declared iShares Core Dividend Growth ETF (NYSEARCA:DGRO) as "The Best 2019 ETF For Dividend Growth Investors." I started the article by paying homage both to John Bogle as well as a longtime stalwart of the Vanguard ETF family, Vanguard Dividend Appreciation ETF (NYSEARCA:VIG). At the same time, I explained why DGRO was my choice at the time.

As it happens, in the 4 years since that review was published, the results have been very close, but somewhat mixed. In short, VIG has very slightly outperformed DGRO both in terms of total return and related volatility, while DGRO has paid out between 10-20% more in dividends. The results are close enough that calling a "winner" may depend almost as much on the goals and desires of the specific investor as any other factor.

At the same time, much has changed in the world since 2019, including the COVID-19 pandemic, Russia's invasion of Ukraine, and the Fed embarking on a string of interest rate increases in the course of waging an all-out battle against inflation. In addition, there have been some changes to the ETFs themselves, most notably Apple's (AAPL) recent inclusion in VIG as a result of meeting the threshold of 10 consecutive years of dividend increases.

Given all of that, I thought it was about time to return for a second look. How do these two "heavyweights" stand up against each other in 2023?

Let's dig right in, shall we?

Comparing The Underlying Indexes

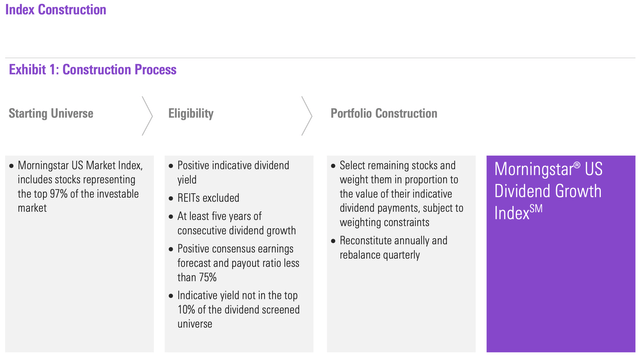

DGRO seeks to track the performance of the Morningstar US Dividend Growth Index. How, specifically, does Morningstar go about selecting stocks for inclusion in the index? It is often said, "a picture is worth 1,000 words." And, in Morningstar's promotional material, I found such a picture. Have a look.

DGRO Index Methodology Fact Sheet (Morningstar)

I'll feature just a couple of items here.

First, stocks with an indicated dividend yield in the top 10% of the universe are eliminated. There is a 'risk management' aspect to this approach because it is often the case that when a company's dividend reaches this level, it can indicate financial distress and/or a high likelihood of dividend cuts.

Second, in addition to the 5-year history of increasing dividend payments, a company must display positive consensus earnings forecasts from the analyst community, and pay out no more than 75% of its earnings in dividends. Again, that combination keeps you well up the 'quality' ladder.

Finally, all dividends must qualify for preferential tax rates, which means no REITs are included. Some like having REITs included in a dividend-focused ETF, I actually like the control of using a separate ETF for REITs if desired. For one, this allows you to determine how much exposure you wish to have to REITs, as opposed to having it predetermined for you. Secondly, since their dividends do not benefit from preferred tax rates, you want to stash REITs away in your retirement account if at all possible.

Next, let's turn to the underlying index for VIG.

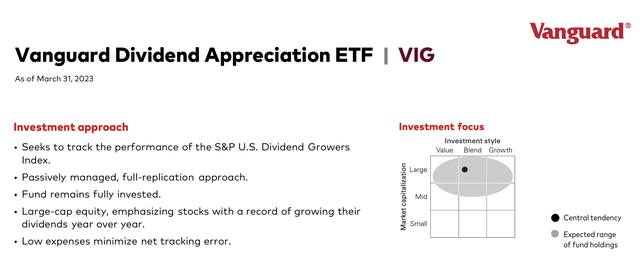

VIG seeks to track the performance of the S&P U.S. Dividend Growers Index. The below graphic from VIG's fact sheet visually depicts some of the main features of this index, with a "style box" in the upper-right-hand corner that helps you discern the investment focus.

VIG Index Methodology Graphic (Vanguard)

Digging in just a little deeper using the methodology document S&P provides for the underlying index, we find this supporting detail:

- Similar to DGRO, Real Estate Investment Trusts are ineligible.

- Stocks must satisfy a 3-month median daily value traded threshold of US$ 1 million (US$ 500,000 for current constituents).

- Companies must have increased dividends every year for 10 consecutive years.

- The index is reconstituted annually, as of December. However, companies continue to be monitored such that, if a company that passed the dividend growth requirement as of the last business day of December, reduces, omits, or eliminates its dividend before the annual reconstitution, it is ineligible for index inclusion.

One last comment. VIG's prospectus clarifies that:

The Fund uses the replication method of indexing, meaning that the Fund generally holds the same stocks as those in its target index and in approximately the same proportions. (Italics in original text)

Some funds explicitly feature that they use the sampling method, selecting a subset of stocks from the target index that they believe, in total, fairly represent the entire index. In contrast, Vanguard specifically calls out that VIG uses a full replication strategy.

Comparing The ETFs At This Point In Time

As can quickly be seen, the basic goals, and even the indexing practices, of the two funds are very similar. Given this, I got curious to see how the respective holdings of DGRO and VIG compare as currently constituted.

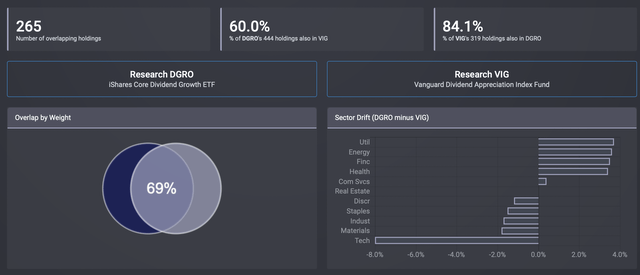

A very helpful site for taking a quick look at this is etfrc.com. The provided graphics offer a nice snapshot in one concise presentation. Let's have a look.

DGRO vs. VIG: Summary of Overlap (etfrc.com)

Quickly summarizing this, we see DGRO listed as having roughly 1/3 more holdings as compared to VIG; 444 to 319. We further see that there is substantial overlap between the funds, with some 69% of the holdings shared in common. In other words, there would not be tremendous benefit in holding both of these ETFs, you would likely obtain better diversification by pairing either of these with a more differentiated ETF.

Looking at the right panel in the above graphic, however, we start to spot a couple of key differences. Turns out, VIG is substantially overweight in Technology as compared to DGRO, with DGRO offering greater exposure to Utilities, Energy, Financials, and Health Care.

Let's dig a little deeper into how this plays out in the next graphic.

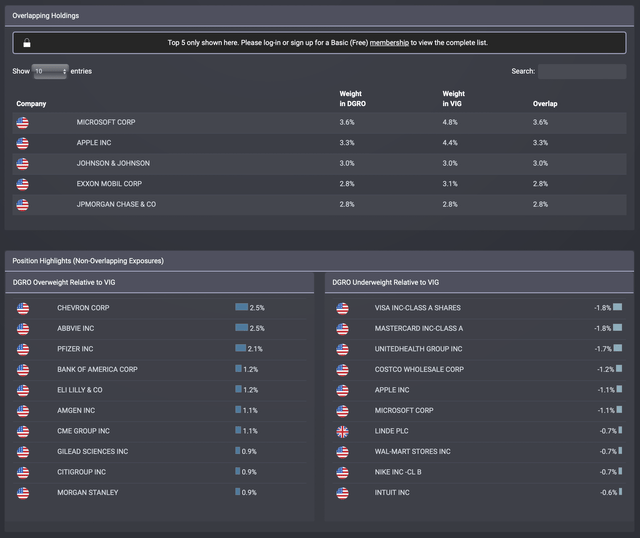

DGRO vs. VIG: Further Breakdown of Overlap (etfrc.com)

First, we see there is a fair amount of similarity in the very largest holdings. Technology bellwethers such as AAPL and Microsoft (MSFT) dominate both, but with a slightly larger weighting in VIG than DGRO due to the fact that VIG has fewer total holdings.

At the same time, in the lower-left pane, you start to see DGRO's heavier weightings in Energy, Financial, and Health Care start to play out in terms of individual stock holdings.

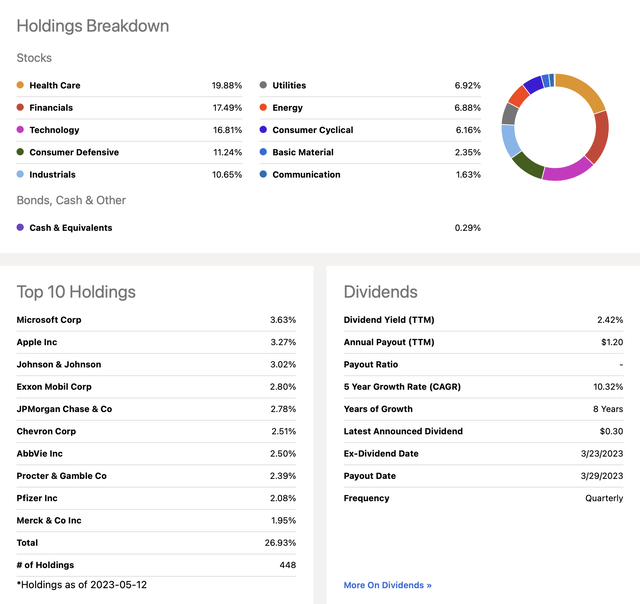

To wrap up this section, here are very helpful comparative graphics from right here on Seeking Alpha. First, for DGRO.

DGRO: Portfolio Characteristics (Seeking Alpha)

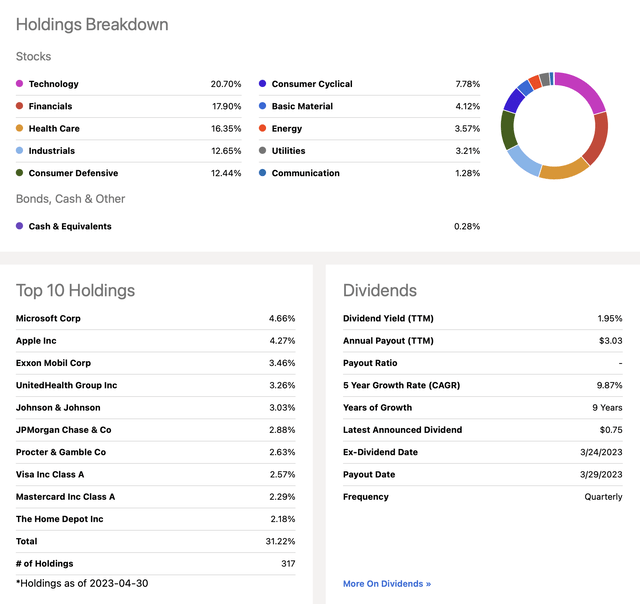

And now VIG.

VIG: Portfolio Characteristics (Seeking Alpha)

These helpful graphics confirm, and offer a little more detail around, the themes we detected from the fund overlap graphics presented earlier. Another difference I picked up on is the fact that Utilities are roughly twice as heavily weighted in DGRO as they are in VIG.

So How Should You Choose Between DGRO and VIG In 2023?

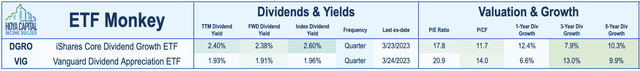

To help us make a final selection, take a look at this compact, yet comprehensive graphic, courtesy of Hoya Capital Income Builder.

DGRO vs. VIG: Selected Data Points (Hoya Capital Income Builder)

What I wish to highlight here is how 'expensive' each of the two ETFs at the present time. As can be seen in the Valuation & Growth section, VIG currently carries an overall P/E ratio of 20.9 and P/CF ratio of 14.0, as opposed to 17.8 and 11.7, respectively, for DGRO. In contrast, DGRO offers a higher dividend yield, both currently as well as prospectively over the next year.

Here's how I see it right now. In my last article for Seeking Alpha, I reviewed Vanguard Growth ETF (VUG) and offered the view that, while VUG is an excellent long-term growth ETF, investors should tread cautiously at this precise moment.

It is for this same reason that I am going to lean in favor of DGRO over VIG at the present time. In my article on VUG, I featured a brief comment from Stanley Druckenmiller as to why he went bearish in 1987, and noted several similarities to our current environment. I concluded the section with this personal observation regarding my concerns.

Anecdotally, here is just one. The New York Fed continues to report that U.S. household credit card debt continues to rise. I love Apple, and its products. In fact this article is being written on my iMac, as I review my personal portfolio on my MacBook and check Twitter on my iPad and iPhone. At the same time, I haven't in any way been moved to trade in my iPhone 13 Pro for one of the iPhone 14 variants even though, happily, household debt is not a problem for me. And yet, as I write this, AAPL stock hovers near all-time highs.

With that, let me conclude today's article this way. I leave the ultimate choice with you. While I personally lean towards DGRO right this minute, if you believe that the run in Technology stocks will continue, perhaps as a result of the growing and developing AI field, your choice might be VIG. If, on the other hand, you are concerned that a small handful of stocks is leading the market higher, and lagging overall market strength means we are overdue for a correction, I suggest that DGRO is your choice. The fact that DGRO is more diversified in other sectors such as Energy, Health Care, and Utilities, might clinch the deal for you.

I hope this comparison has proved useful to you in making your personal decision. Please, drop a note in the comments section letting me know what you think of my analysis.

ETF Monkey Teams Up With Income Builder

ETF Monkey has teamed up with Hoya Capital to offer the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DGRO, VIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.