Lightspeed Commerce: A Slower Growth Outlook Sparks A Selloff

Summary

- Software equities have produced alpha against the S&P 500 this year.

- Lightspeed is among the biggest laggards in the industry, down about 90% from its 2021 peak.

- I have a hold rating on the company due to its shaky growth outlook and bearish chart, but some valuation metrics suggest negativity is priced in.

andresr

Software stocks have returned to relative favor in 2023 as the broad tech sector posts strong year-to-date returns. While so many pundits claim that just a handful of equities have propelled the market, some smaller issues within the tech, discretionary, and communications sectors have done well. I noticed that software stocks are among those names.

Still, Lightspeed Commerce (NYSE:LSPD) is a notable laggard. I have a hold recommendation based on negative earnings and free cash flow along with a bearish chart, but a robust growth outlook that should turn free cash flow into the black in the coming quarters.

Software Stocks Outperforming the S&P 500 YTD, Lightspeed Weak

Stockcharts.com

According to Bank of America Global Research, LSPD is a point-of-sale software company with a focus on retail, hospitality, e-commerce, and golf shops. The company monetizes through software subscriptions and payments and utilizes tiered pricing plans. Front and back-office functionality includes inventory management, advanced reporting, kitchen display, and customer-facing display.

The Montreal-based $2.0 billion market cap Application Software industry company within the Information Technology sector has negative trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

LSPD reported decent numbers in its Q4 earnings report on May 18. Operating earnings per share of $0.00 beat by $0.03 while the software firm also modestly topped analysts’ sales expectations. The reason for the sharp share price decline on Thursday was a soft Q1 guide. Lightspeed forecasts revenue of $195 million to $200 million in the current quarter, relative to the $207.4 million consensus estimate.

Maybe more troubling is that the management team withdrew its previous target of 35-40% annual organic revenue growth from subscription and transaction-based sales. Looking ahead, key risks include macroeconomic sensitivity, and heightened competition, along with any roadblocks to profitability in the coming quarters.

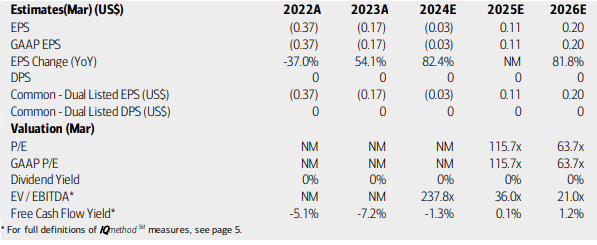

On valuation, analysts at BofA see earnings continuing to be in the red through its FY 2024 (which it is currently in). While per-share profits are seen climbing into the black in ‘25, there remains uncertainty as to how much FCF will grow in that span. What’s more, the company does not pay dividends, though that makes sense given the focus on growth. Its EV/EBITDA multiple is very high, but could come down to earth in the out years should earnings accelerate.

Lightspeed: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

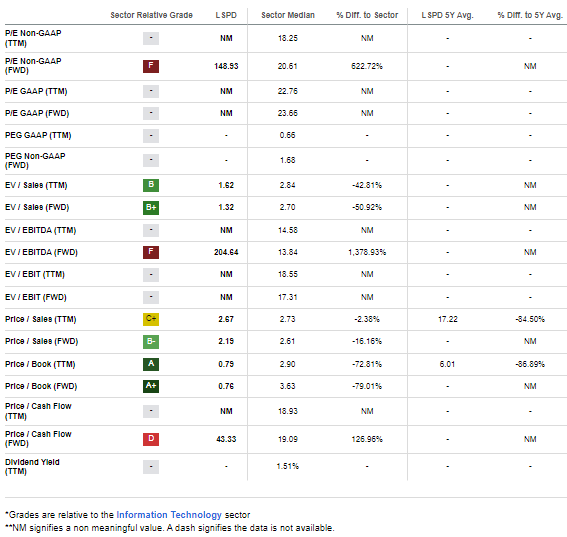

Shares trade inexpensively on an EV/sales basis and on a price-to-sales basis. This is not a sky-high valuation. I see the current 2.2 price/sales ratio as fair given the growth and risk outlook, considering that its 5-year average P/S is north of 17, and it's at a slight discount to the sector median.

LSPD Valuation Metrics Following Q4 Results

Seeking Alpha

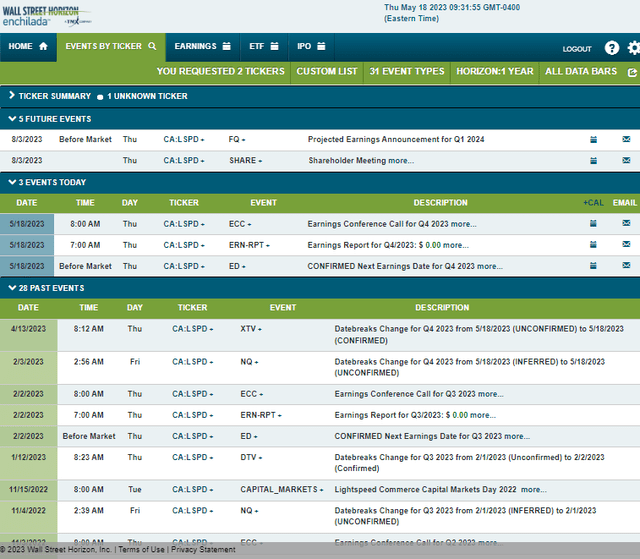

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2024 earnings date of Thursday, August 3. That will be a key date as Lightspeed’s annual shareholders’ meeting takes place on the same day.

Corporate Event Risk Calendar

Wall Street Horizon

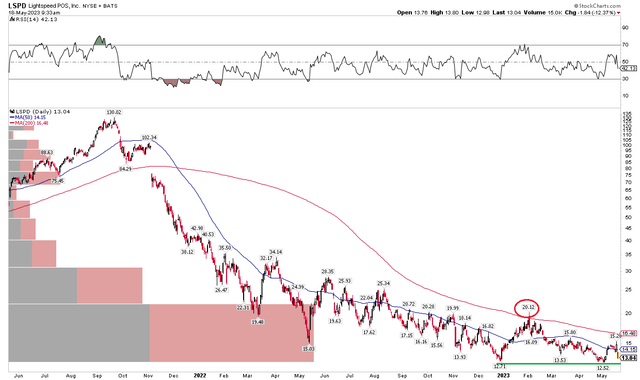

The Technical Take

LSPD’s chart is in one of the more pronounced downtrends you will come across. The stock hit a high during the speculative fervor of late 2021 at about $130. Notice in the chart below that shares plunged all the way into the low teens by the turn of this year, and LSPD is now retesting those multi-year lows after the soft earnings report. There was a volume spike last Thursday on the 13% post-earnings drop.

With a downward-sloping 200-day moving average and resistance around $20, there are few if any signs of a bullish turnaround. I would like to see LSPD rally above the 200-day to help confirm a trend reversal, but that may be far off. Perhaps buyers may step to the plate in the $12 to $13 range again, but that would be an optimistic take right now.

LSPD: Firmly Bearish Trend In Place, Monitoring $12-$13

Stockcharts.com

The Bottom Line

I am a hold on LSPD. There’s ample room for growth, but a weak earnings outlook from the management team this week and a very bearish chart are key risks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.