The Altria Absurdity: Dividend Yield Approaching P/E

Summary

- Market sentiment occasionally creates absurdity that offers overwhelming return odds.

- In the case of Altria, its FWD dividend yield sits at 8.30%, while its accounting P/E is projected to be only 8.1x in FY3.

- Its yield probably already exceeded its P/E now on the owner's earnings basis given its extremely light CAPEX needs.

- There are definitely challenges ahead, but I think the market fear is grossly overblown.

- Looking for a portfolio of ideas like this one? Members of Envision Early Retirement get exclusive access to our subscriber-only portfolios. Learn More »

RichVintage/E+ via Getty Images

Thesis

The market is almost efficient. And the operative word here is "almost". The truly fat pitches are always served when it is not. And lately, the development with Altria (NYSE:MO) represents as such a pitch in my view. As argued in an earlier article published in Jan 2023, I view it as an very absurd situation when its dividend yield began to approach its P/E.

Since then, it has released its Q1 earnings report ("ER") in late April. In the ER, Altria report Non-GAAP EPS better than consensus estimates ($1.18 vs. $1.17) off the back of slight revenue miss. Revenues dialed in at $4.76B and missed consensus estimates by $130M. What's really of importance to me is that the company reaffirmed its 2023 full-year guidance. The guidance affirmed diluted EPS in a range of $4.98 to $5.13, translating into a healthy annual growth rate of 3% to 6% YOY. With the projected growth and its stagnant stock prices since my last writing (its stock price dropped by about 3% since my last writing), I see the situation even more absurd and will explain next why its yield probably already exceeded its P/E on owners earnings basis.

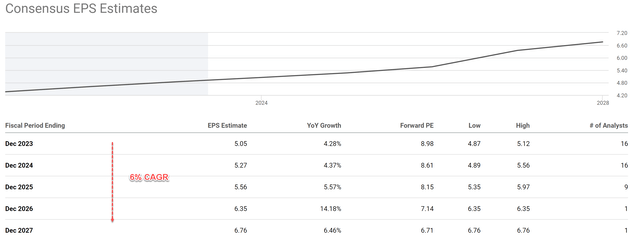

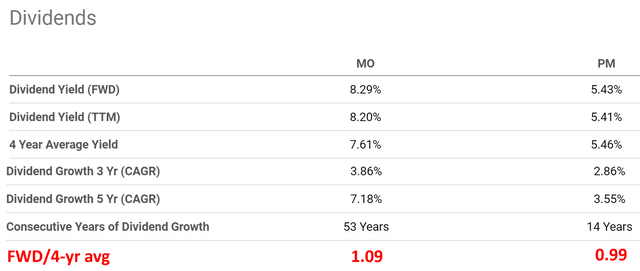

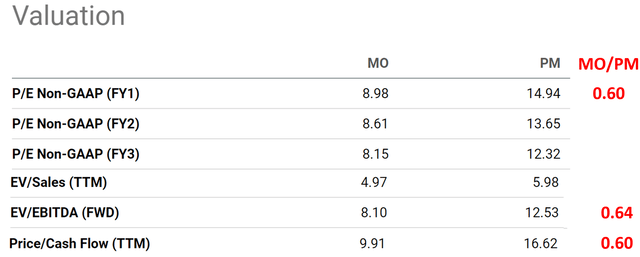

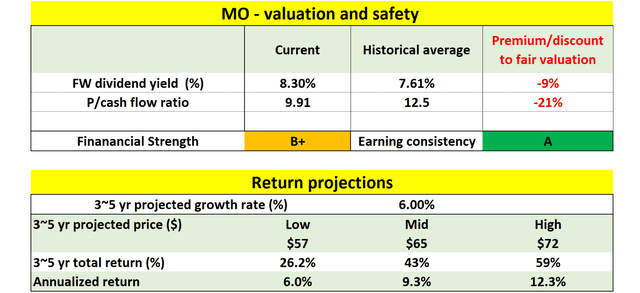

As shown in the 1st chart below, the forward dividend yield for MO currently stands at 8.30%. And as shown in the second chart below, its P/E ratio is also in a range of 8.9x to 8.1x in the next 1~3 years. I see this "yield-higher-than-P/E" situation as extremely absurd for several reasons.

First, compared vertically to its own valuation historically, the current valuation is extremely compressed. As seen, MO's current forward dividend yield exceeds its own four-year average yield of 7.61% by 9% in relative terms. And bear in mind that 7.61% is a VERY generous average to start with.

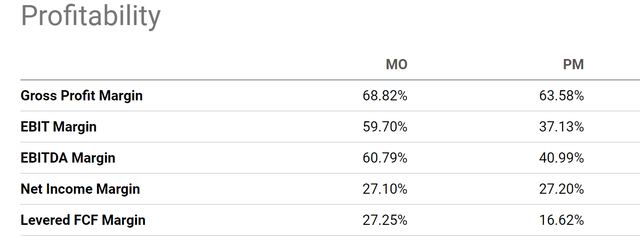

Then compared horizontally to its close peers such as Philip Morris International (PM), MO's current valuation is discounted from PM's by a large margin across all metrics as seen.

And finally, all the above discussions were made in terms of accounting P/E ratios. As detailed in my other articles, for business with extremely light CAPEX needs such as MO, their true owners' earnings ("OE") often exceeds their accounting earnings. You can get a rough idea of the discrepancy by looking at the FCF to EPS conversion ratio (see the third chart below). Its FCF-EPS conversion ratio has been consistently above 100%. The historical average is 116% and the current value is almost 140%. And also bear in mind that FCF is an underestimate of true owners' earnings. The calculation of FCF treats all the CAPEX as expenses, while only the growth portion of the CAPEX should be. Therefore, its yield probably already exceeds its current P/E based on OE.

Next, I will explain the key reason that has caused this absurdity and why I see it as a gross market overaction.

Source: author based on Seeking Alpha data. Source: author based on Seeking Alpha data. Source: author based on Seeking Alpha data.

MO's challenges and market's overaction

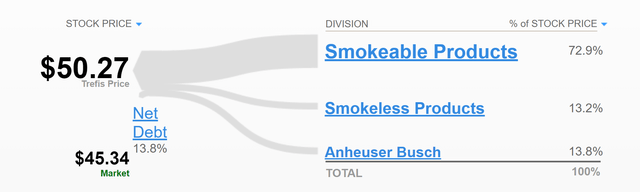

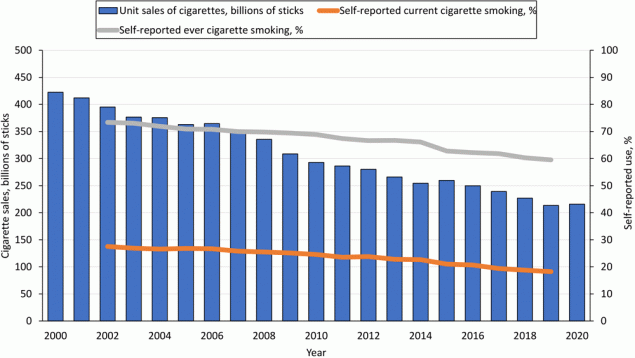

The root cause as I see is the market's fear of the secular decline of its smokable products. As seen in the first chart below, according to TREFIS data, its smokable products currently have a dominating impact on its stock prices (about 73%). And the unfortunate news is that the shipping volume in the U.S. has been in (and still is in) secular decline. The second chart below shows a 20-year study of the per capita sales of cigarettes. Note, this is not a market survey or a Tweet Pool. This is a rigorous academic study with carefully designed methods and was published by CDC.gov. And it is unequivocal that the use of smokable products is in decline.

Source: TREFIS data Source: CDC.gov data

Thus, to me, it is unequivocal that the use of smokable products is in decline and there is no need to deny or even argue about it. What I am to argue is the market overaction to it.

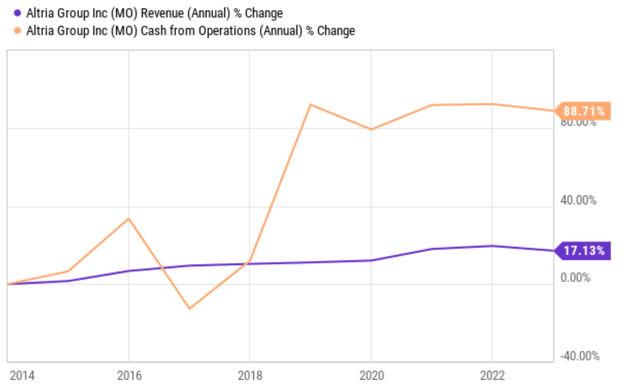

In my view, MO has been very successful in offsetting the decrease in shipment VOLUME with higher pricing and operational efficiency improvement. As a result, its total sales and profit have not only stayed stable but grown at a healthy pace over the years as seen in the next chart below. To wit despite the secular decline shown above, its total sales increased 17% over the past decade and cash flow increased 88%. Furthermore, bear in mind that the company sold its wine business in October 2021. When this divesture is accounted for, its actual growth is actually even better.

Also, note that its profitability is very competitive both in absolute terms and relative terms, as seen in the third chart. To quote a few numbers. Its gross margin of 68% rivals the best companies and exceeds PM by more than 500 basis points. And its net margin of 27% is on par with PM. Yet recall its valuation is at a sizable discount from PM both in top line and bottom-line metrics.

Dividend investors probably do not need any of this data to be convinced of its resilience. It is probably sufficient to note its long history of continuous dividend raises (53 years and accounting) at a robust pace (7.18% CAGR in the past 5 years).

Source: Seeking Alpha Source: Seeking Alpha

Asymmetric return potentials

In terms of growth and return potentials, consensus estimates indicate a quite healthy growth trajectory for the next few years, as depicted in the chart below. According to these estimates, the consensus expects its earnings per share ("EPS") to increase from $5.05 this year to $6.76 in 2025, reflecting a CAGR of 6%.

My take on the above projections is that they are a bit too conservative. As I have detailed in my previous articles, MO's return on capital employed (ROCE) has consistently averaged above 100%, rivaling Apple's ROCE. With a 100%+ ROCE, a modest 5% reinvestment rate ("RR") would fuel a 5% real growth rate (growth rate = ROCE * RR = 100% * 5%). Additionally, an argument could be made to compare MO's strong pricing power to Apple's too. Therefore, I believe it is justified to add an inflation escalator to its growth, which would push its nominal growth rates to the upper single digits - as evidenced by its annual dividend growth rate of 7.18% in the past 5 years.

However, even a 6% growth rate could generate asymmetric investment returns under MO's current conditions, as shown in the table below. My projections show a favorable return profile (again, assuming a 6% growth rate). To wit, I am projecting the total return to be in the range of 6% to more than 12% over the next 3-5 years, which translates into a total return of 26% to almost 60%. To add to the safety, a large portion (again, about 8.3%) of the return would be provided through the current dividend alone.

Source: Author Based On Seeking Alpha data

Other risks and final thoughts

To recap, the main risk facing MO is the secular decline of the demand and consumption of smokable products, which are still MO's main source of revenue. However, MO also faces a few other risks. And regulatory risk is a top one in my mind, which could impact not only its traditional products but also its new smokeless products. Potential negative impacts could include restrictions on the sale and marketing of its products, as well as increased taxes on these products. As a specific example, in June 2021, the FDA ordered JUUL to take its e-cigarettes off the market. This regulatory case has had several turns, with the ban being suspended in July 2021 and subjected to further review. In early September 2021, JUUL agreed to pay ~$440M to settle claims in 34 U.S. states and territories. The eventual outcome of this regulatory case would have a large impact on MO's role in the alternative product categories and also market sentiment.

All told, my view is that current market overaction has already priced in the worst possible scenario. Thus, I see a very asymmetrical opportunity with much more upside than downside. The picture simply does not make sense to me - high yield, healthy growth, low P/E, and superb profitability. That is why the word "absurdity" naturally came to my mind. And throughout history, I have learned that absurdity frequently presents unique opportunities.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.

This article was written by

** Disclosure** I am associated with Envision Research

I am an economist by training, with a focus on financial economics. After I completed my PhD, I have been professionally working as a quantitative modeler, with a focus on the mortgage market, commercial market, and the banking industry for more than a decade. And at the same time, I have been managing several investment accounts for my family for the past 15 years, going through two market crashes and an incredible long bull market in between.

My writing interests are mostly asset allocation and ETFs, particularly those related to the overall market, bonds, banking and financial sectors, and housing markets. I have been a long time SA reader, and am excited to become a more active participator in this wonderful community!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.