Gold Is Becoming Attractive As The Debt Ceiling Debate Muddles Along

Summary

- Тhe immediate outcome of the US debt ceiling on the price of gold could go in either direction, but the long-term impact would not.

- It is important to look at the events through the lens of risks and uncertainties for the current monetary regime more broadly.

- Direct exposure to gold would continue to be the better alternative to fixed income when it comes to risk management of equity portfolios.

- Looking for a helping hand in the market? Members of The Roundabout Investor get exclusive ideas and guidance to navigate any climate. Learn More »

Jun/iStock via Getty Images

The case for holding gold and other precious metals as an addition to an all-equity portfolio does not rely on single political decisions, but rather on a series of events that escalate the risks for the existing monetary regime.

I have covered this topic extensively over the years, but the expected deal to raise the debt ceiling and avoid a catastrophe is an excellent example of where the current global monetary regime is headed.

The debate around the debt ceiling in the U.S. is largely seen as a non-issue, and one could often get the feeling that it has almost become an annual thing. That is why the main problem is not so much whether or not there would be a deal this time around, but rather where are we heading as the public debt continues to mount.

The main feeling that one gets from these debates about the ceiling is that we are simply kicking the can down the road. There is a sense in the air that the issue of rising debt levels at a time when fiscal spending is also set to increase would somehow sort itself out.

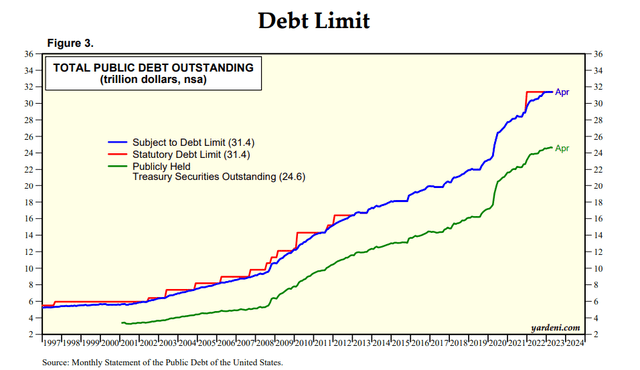

As a starting point, following the pandemic, the amount of public debt has skyrocketed and with that, the U.S. Debt to GDP ratio increased from 107% in the last quarter of 2019 to 120% as of today. More importantly, even as the economy rebounded from the brief recession in 2020, total public debt continued to increase.

Yardeni

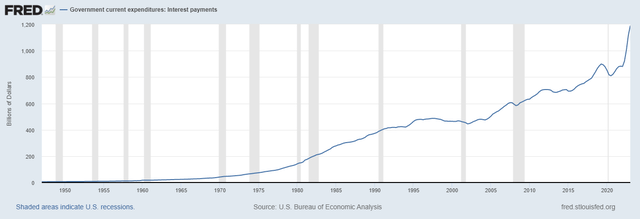

Higher inflation has eased this issue somehow by creating the necessary conditions for a financial repression, but this is hardly a silver bullet. In addition, inflationary pressures are now easing (at least in the short-term), but the annual interest payments on the large debt pile are unlikely to follow suit as interest rates are normalizing.

FRED

We should also not forget that as recession looms on the horizon and geopolitical tensions rise, fiscal spending will likely need to increase significantly in the coming years. The trend towards onshoring would require significant government help in areas, such as semiconductors, energy and other strategically important industries, not to mention the need for higher spending on defense.

Yet another problem that the famous investor Stanley Druckenmiller has been sounding the alarm about, are entitlements which are not accounted for in the debt figure we saw above. According to his latest interview, if included as a net present value, entitlements would increase the total debt figure from around $32tn to roughly $200tn.

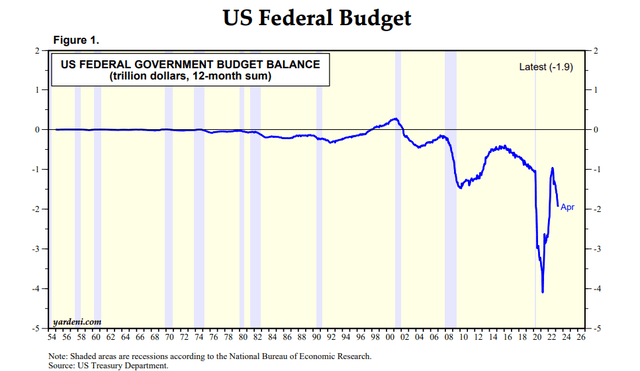

The problem with a potential recession only makes matters worse as it is very unusual for a booming economy, such as the one we had followed the pandemic, to produce a large budget deficit that we see in the right-hand side of the graph below.

Yardeni

This brings us back to the issue of the debt ceiling and the fact that what's supposed to be the positive outcome of a deal would result in public debt levels that are even harder to sustain. The newly issued debt would be largely used to cover the higher interest payments, as well as the need for increased spending in an inflationary and highly uncertain geopolitical environment.

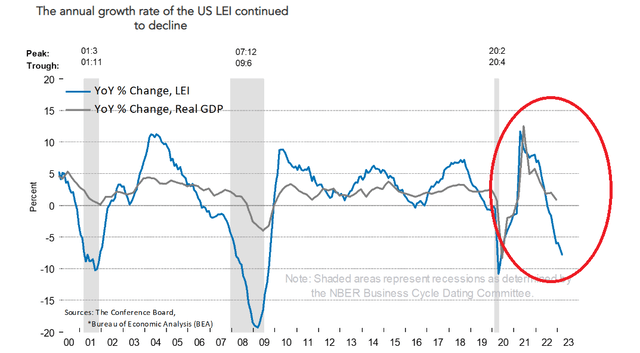

Higher fiscal spending would also be needed to support the economy, as leading indicators are quickly deteriorating.

conference-board.org

If a deal on the debt ceiling in Congress is not reached, then the unintended consequences would be significant, and we'll be entering into uncharted territory. Liquidity is likely to quickly dry-up, and the damages to the current monetary regime could be impossible to fix.

Heads I win, Tails You Lose

As we saw above, both scenarios are not ideal for the current monetary regime. Without a deal on the debt ceiling, we will be entering a period of extremely high uncertainty and evaporating liquidity.

On the other hand, a deal could give the markets a temporary relief and the unwinding of some tail risk hedges could pressure the price of precious metals. However, the pressing issues faced by the monetary system over the medium term would remain.

In a nutshell, both scenarios would be good for gold and precious metals, but with a different time frame and magnitude.

The reason for that is simple - the monetary system is due for a reset. As we muddle through all of the problems with the existing system that have been compounding for years, the case for gold gradually improves.

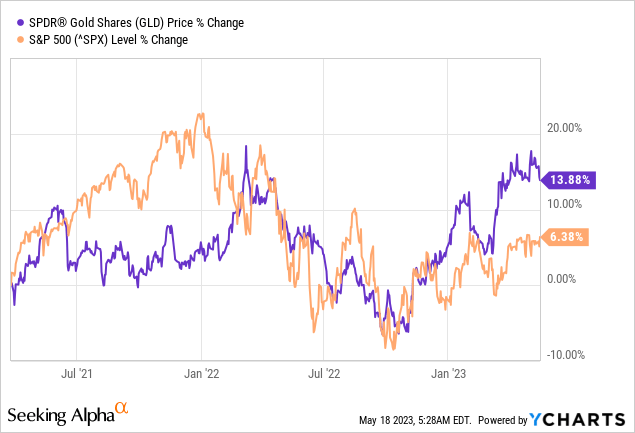

That is why, since I first laid out my thesis for the SPDR Gold Shares (NYSEARCA:GLD) two years ago, it has significantly outperformed the broader equity market and has delivered a return of ~14% at a time when the S&P 500 appreciated just over 6%.

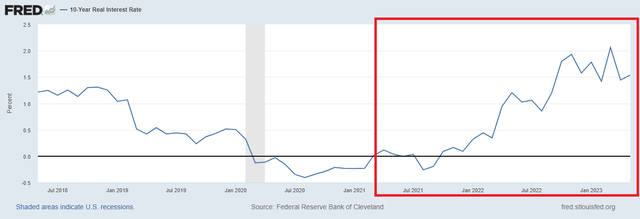

The reason why this time frame is so important is that this performance of the GLD has been at odds with the predominant narrative that rising real interest rates would cause the price of gold to plummet - yet another narrative that I have debunked previously (you can find more information on the topic here).

FRED

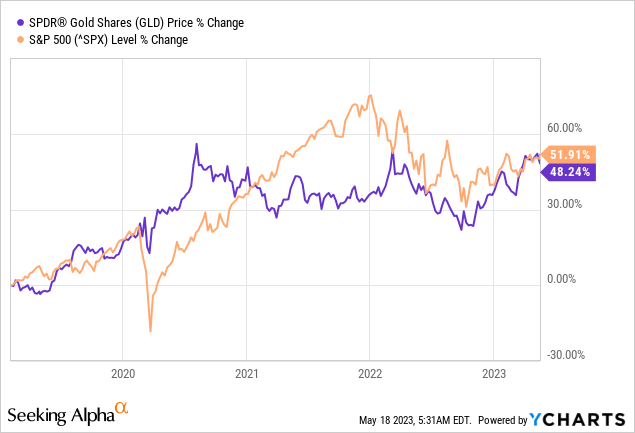

On a slightly longer time frame, in February 2019, I first laid out my broader thesis for holding gold as a complement to an equity portfolio. Since then, the GLD has performed nearly at par with the S&P 500.

The more important part, however, is that the GLD has been an excellent hedge to equities. Not only did it deliver far better returns than fixed income did, but also its correlation with the equity market has been relatively low.

Given the fact that the relationship between gold and real interest rates has broken up, I would expect ETFs with direct exposure to the precious metal to continue to be an excellent complement to equities. That is why in addition to GLD, other instruments, such as Sprott Physical Gold Trust (PHYS), should also be considered as a way to substitute fixed income in a well-diversified portfolio.

Conclusion

As the almost annual commotion around the debt ceiling unravels, the immediate impact on the price of gold could go in either direction. What matters, however, is that whatever the outcome, the price of gold would continue to benefit as the risk and uncertainty around the existing monetary system continues to accelerate. Having said that, unwinding of tail risk hedges in the event of a deal could result in a sharp drop in the price of the precious metal, but would not change the long-term thesis for holding gold.

Looking for well-positioned, high quality businesses to build a well-diversified portfolio?

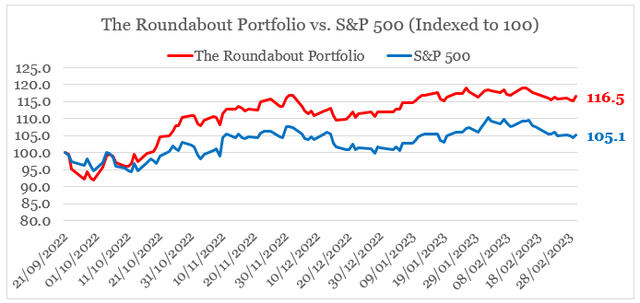

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.

This article was written by

Vladimir Dimitrov is a former strategy consultant with a professional focus on business and intangible assets valuation. His professional background lies in solving complex business problems through the lens of overall business strategy and various valuation and financial modelling techniques.

Vladimir has also been exploring the concept of value investing and in particular finding companies with sustainable competitive advantages that also trade below their intrinsic value. He supplements his bottom-up approach with a more holistic view of the markets through factor investing techniques.

Vladimir made his first investment in farmland right out of high school in 2007 and consequently started investing through mutual funds at the bottom of the market in 2009. In the years that followed he has been focused on developing his own investment philosophy and has been managing a concentrated equity portfolio since 2016. Vladimir is LSE Alumni and a CFA charterholder .

All of Vladimir's content published on Seeking Alpha is for informational purposes only and should not be construed as investment advice. Always consult a licensed investment professional before making investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PHGP.L either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.