Walmart: A Real Safe Haven, But The Stock Is Still Too Expensive To Buy

Summary

- During challenging macroeconomic periods, Walmart is looked upon as a safe haven asset by most investors, and the latest financial numbers tell us why that's the case.

- In this note, we shall analyze Walmart's Q1 FY24 results. Furthermore, I will share my fair value and expected return estimates for Walmart.

- Due to its rich valuation, I continue to rate Walmart "Hold/Neutral" at $151.50 per share.

- I do much more than just articles at The Quantamental Investor: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

patty_c

Reviewing Walmart's Q1'FY24 Results

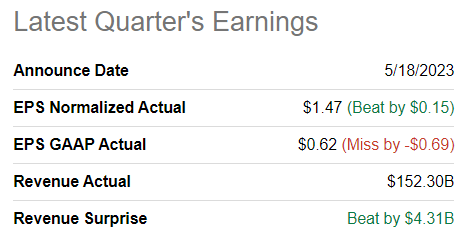

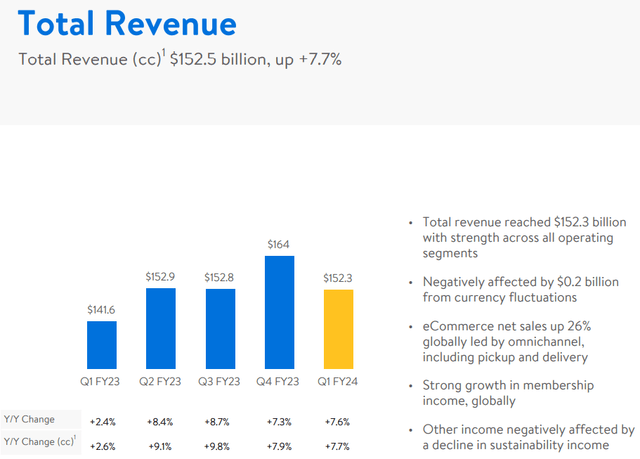

Heading into its Q1 FY2024 report, Walmart (NYSE:WMT) was projected to record sales growth of 4.5% year-over-year and an adjusted EPS growth of 1-2% y/y. However, Walmart seems to have cleared this bar with ease, with revenue coming in at $152.3B (up 7.6% y/y, beating the estimate by $4.3B), and adjusted EPS coming in at $1.47 (up 13.1% y/y, beating the estimate by 15 cents).

SeekingAlpha

Walmart Q1 FY2024 Earnings Release

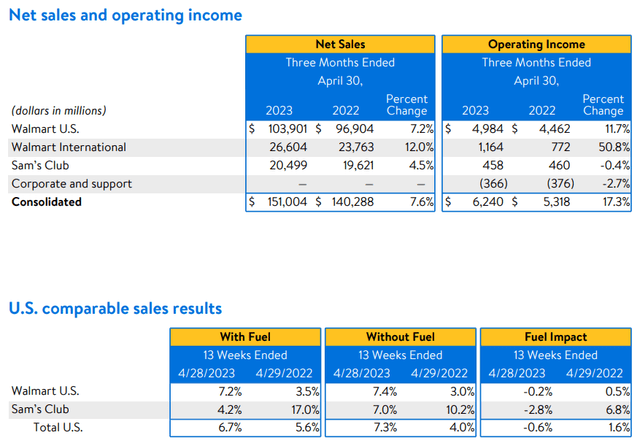

According to Walmart's management, these better-than-expected results were powered by strong comp sales across all of its business segments - Walmart US, Sam's Club, and Walmart International. Furthermore, management emphasized during the earnings call that Walmart is benefiting from a consumer trade-down in a challenging macroeconomic environment.

Walmart Q1 FY2024 Earnings Presentation

Walmart Q1 FY2024 Earnings Release

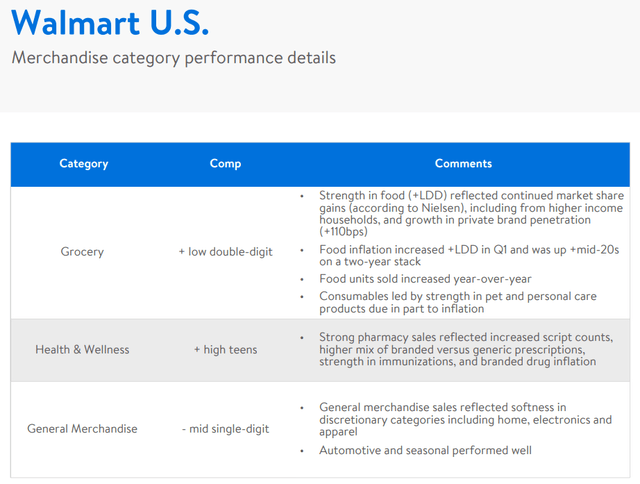

In a recession, customers tend to downgrade their spending habits, which is why Walmart is seeing an increase in market share (according to data from Nielsen). With food inflation still running at a low double-digit rate, consumers are becoming more cautious with spending. Walmart, being the top grocery chain in the United States, is reaping the benefits of this shift in consumer behavior. Walmart's emphasis on providing value on a daily basis is attracting a broader range of consumers, including higher-income households. During the Q1 earnings call, Walmart's management noted that more customers are turning to Walmart in this challenging economic climate.

Walmart Q1 FY2024 Earnings Presentation

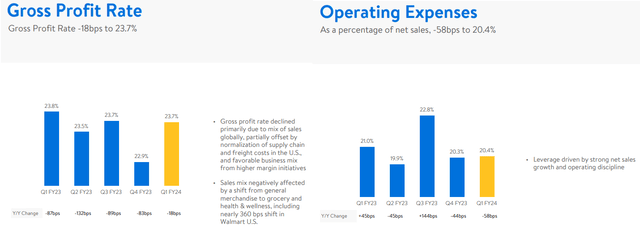

While the challenging macroeconomic environment is helping Walmart win more customers due to its value proposition, the revenue mix being tilted toward grocery (and other essentials) is creating margin pressures as consumers are spending less on (higher-margin) general merchandise (discretionary categories) like home, electronics, and apparel.

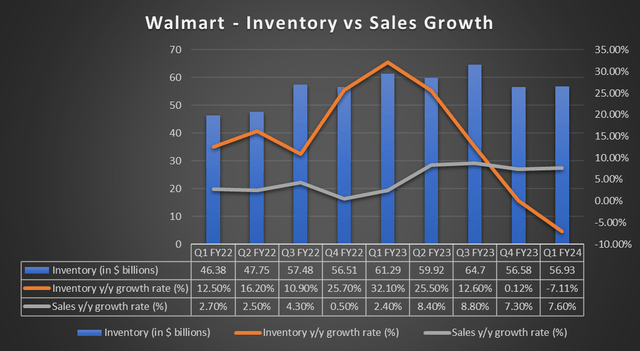

Over the last few quarters, Walmart's management has made considerable progress on right-sizing inventory. And this positive trend continued in Q1 FY2024, with inventory declining 7% y/y.

Source: Author, Walmart Investor relations

Heading into Q2 FY2024, Walmart is carrying an inventory of ~$56.93B, which is well off the record highs seen last year, but still quite high compared to two years ago. That said, the alarming trend in inventory growth has been reversed successfully, and going forward, Walmart's return on assets should improve as a result of this ongoing inventory moderation. In my view, Walmart's excess inventory issues are now firmly in the rearview mirror.

While inflation has been moderating for several months now, consumers are feeling the pinch of double-digit food inflation, and that's resulting in lower discretionary spending (hurting Walmart's margins). Now, it's still too early to declare a victory over inflation; however, the lag effect of the Fed's monetary policy actions makes me believe that inflation will collapse over the coming months. The real threat here is a recession. In my opinion, Walmart's value proposition shines during a period of an economic slump, and consumers would continue to flock to Walmart in the event of a hard landing. The long-term focused evolution to a scaled omnichannel retail company is progressing well at Walmart, as evidenced by strong growth in its e-commerce (+26% y/y) and global advertising (+30% y/y) businesses.

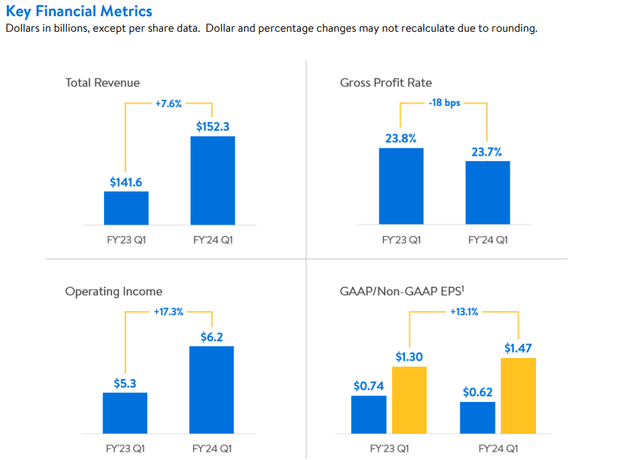

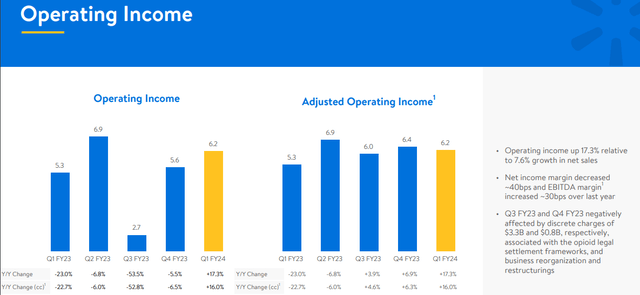

Now, let us understand Walmart's bottom-line performance. In Q1, Walmart reported a +17.3% y/y jump in operating income (outpacing net sales growth), with an 18 bps decline in gross profit margin being offset by a 58 bps decline in lower operating expenses (better operating discipline).

Walmart Q1 FY2024 Earnings Presentation

Walmart Q1 FY2024 Earnings Presentation

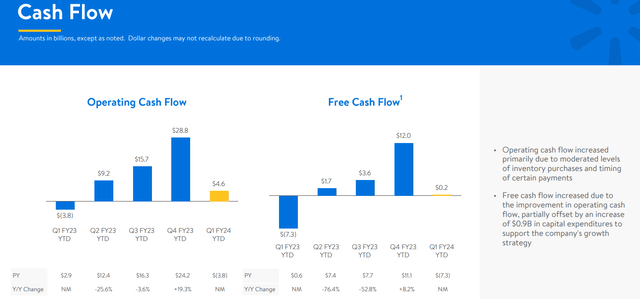

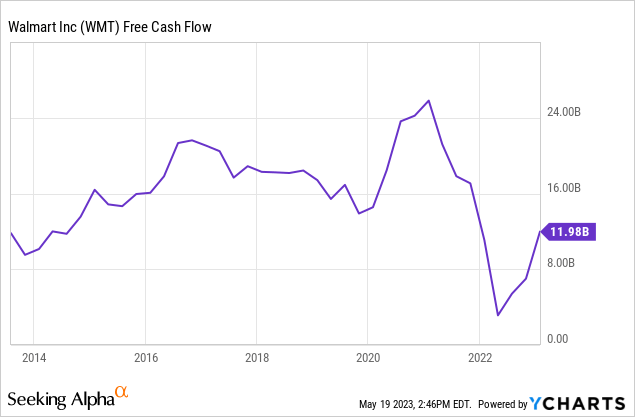

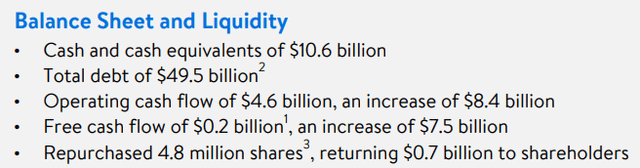

With moderation in inventory purchases, Walmart's cash flow generation has improved in recent quarters. And for Q1 FY2024, Walmart's free cash flow came in at $0.2B (up +$7.5B from Q1 FY2023).

Walmart Q1 FY2024 Earnings Presentation

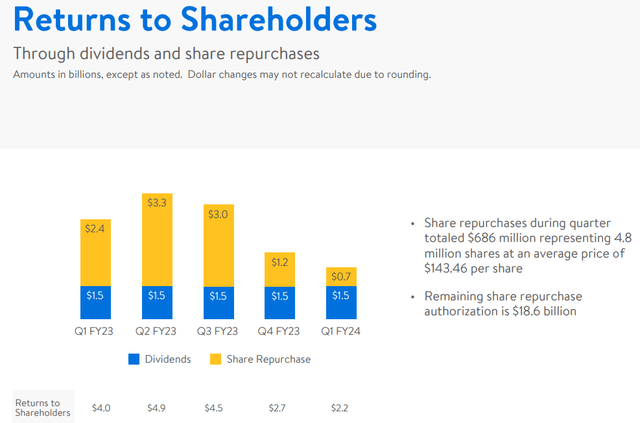

Now, Walmart's FCF generation remains well below peak levels. However, the trend is clearly positive. While Walmart's cash generation has been lumpy in recent quarters, the retail giant has maintained a shareholder-friendly capital return policy. In Q1 FY2024, Walmart returned ~$2.2B to shareholders, $1.5B via dividends, and the rest via stock buybacks.

Walmart Q1 FY2024 Earnings Presentation

As of the end of Q1, Walmart has $18.6B in remaining share repurchase authorization. However, I think further improvements in its free cash flow generation are needed for the management to be more aggressive with their stock buybacks in upcoming quarters.

Walmart Q1 FY2024 Earnings Presentation

At Walmart, a big chunk of capital returned to shareholders in recent quarters via dividends and share buybacks was raised in the form of new debt (leveraged re-capitalization), and as of the end of Q1, Walmart's total debt stands at $49.5B. With a cash balance of $10.6B, Walmart's net debt currently stands at ~$39B. An increasing debt load is not an immediate cause for concern here, but Walmart's balance sheet leverage has grown significantly in recent years, and unfortunately, a huge portion of these funds were used to repurchase WMT stock close to all-time highs. The negative trend in book value (shareholder equity) continued in Q1 FY2024, and if I were a Walmart shareholder, I would keep a keen eye on Walmart's debt levels and capital return program.

What's Walmart’s Outlook?

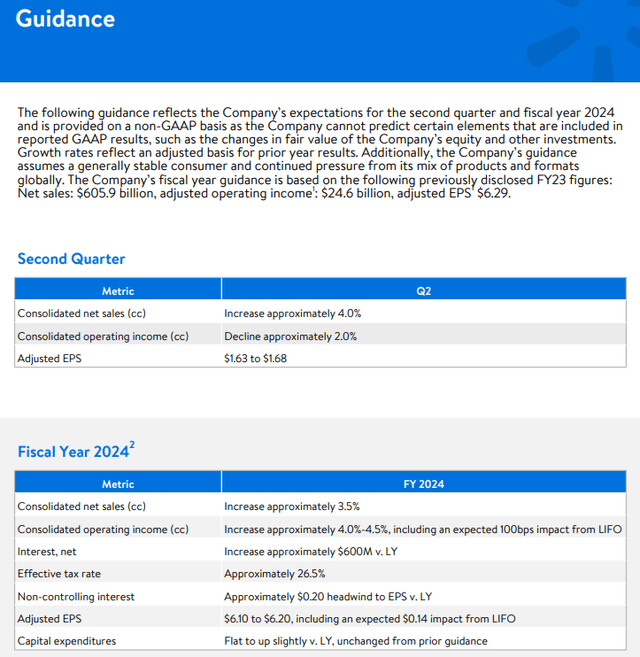

On the back of stunning Q1 results, Walmart's management raised its full-year revenue outlook for FY2024. For Q2, Walmart's management has guided for net sales growth of 4% and an operating income decline of -2% (short of consensus expectations).

Walmart Q1 FY2024 Earnings Release

With all of this information in mind, let's try to find the fair value and expected return of Walmart.

Walmart Fair Value And Expected Return

As I said in my previous note on the retail giant -

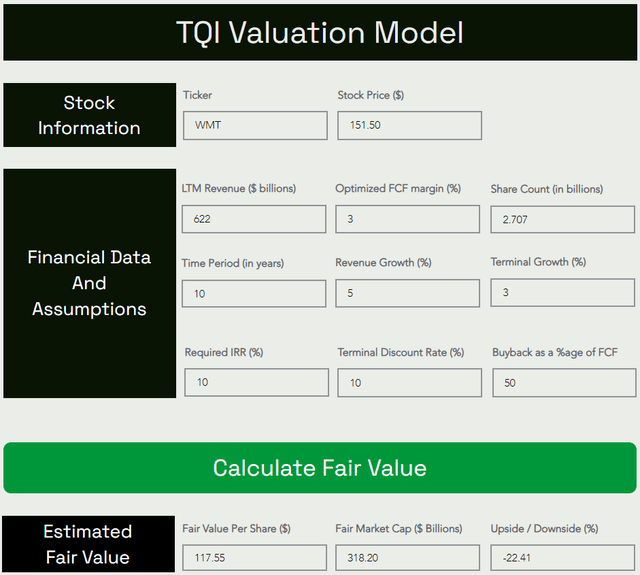

Walmart is rapidly evolving into a robust omnichannel retail outfit, and I expect to see mid-single-digit growth in its revenues from current levels throughout the next decade. While newer businesses like business advertising, e-commerce, Walmart+, and financial services will command higher margins than Walmart's core business, I'm embedding a margin of safety in my valuation by assigning an optimized FCF margin of just 3%. The remaining assumptions are fairly straightforward, but let me know if you have any questions through the comments section below.

Assuming a discount rate (required IRR) of 10%, Walmart's fair value comes out to be $117.55 per share. With the stock trading at $151.50, I think WMT is pretty overvalued at this time. The market has overcrowded the defensive stock trade amid rising fears of an impending recession, and Walmart is trading at a hefty premium, like most other high-quality defensive names.

TQI Valuation Model (TQIG.org)

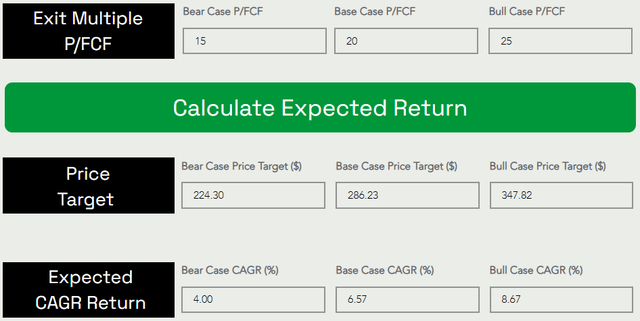

TQI Valuation Model (TQIG.org)

Over the next five years, an investor could expect to generate a CAGR return of 6.57% with Walmart's stock from current levels. If we add on the ~1.5% dividend yield, the total CAGR return rises to ~8%. Now, in my view, ~8% is an acceptable level of return for most investors looking to guard against a recession by putting capital to work in defensive stocks. Since my investment hurdle rate is 15%, I'm not a buyer in Walmart at these levels.

Concluding Thoughts

With the economy heading toward a hard landing after 15 years of easy money policy, the business cycle is turning, and a classic recession playbook would suggest owning defensive names like Walmart, as they tend to be safe haven assets during lean economic times. Unlike mega-cap tech companies, Walmart is a real safe haven during recessionary periods.

Walmart's evolution to a scaled omnichannel retail company is progressing nicely (as evidenced by the Q1 FY2024 report), and the retail behemoth is now past its excess inventory troubles of last year. Despite better-than-expected Q1 results, Walmart's management is still taking a cautious view of consumer demand for goods as the probability of a recession is rising rapidly, and food inflation is proving to be sticky. While inflation may have peaked already, bringing prices down is going to be challenging (even for Walmart). And hence, consumer discretionary spending may remain under pressure through the rest of this year. However, if we do end up in a recession in the back half of 2023, I think Walmart's value proposition will continue to shine, as customers trade down to discount retailers like Walmart in the hunt for value for money.

Walmart's Q1 results were impressive, and its business fundamentals are improving. As a result, I still regard it as one of the best defensive stocks on the market. However, this seems to be the consensus view, with Walmart trading at a premium to the S&P 500, at around 24.5x forward PE. With sales growth in the mid-single digits, it's difficult to justify a long-term investment (five-plus years) in Walmart at its current valuation. Despite a stronger-than-expected Q1 report from Walmart, the long-term risk/reward for investors remains unfavorable for investors. Therefore, I continue to rate Walmart a "Hold/Neutral" at current levels.

As an investor, I like to look at businesses (and stocks) 3-5 years out, and macro is unlikely to dominate the investment narrative five years from now as much as it is doing right now. For investors looking to defend against a potential recession in 2023/24, Walmart is a fine hideout for the next 12-18 months. However, the expected return on such an investment is mid-single digits, and personally, I would just rather buy the (risk-free) 2-yr treasury bond that's yielding around 4.25%.

Key Takeaway: I rate Walmart "Hold/Neutral" at $151.50 per share.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group - "The Quantamental Investor" - to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI's annual membership now costs only $480 (or $50 per month) for a limited period only.

JOIN THE QUANTAMENTAL INVESTOR

This article was written by

I am the Author and Chief Financial Engineer at "The Quantamental Investor" - a community pursuing bold, active investing with proactive risk management. At TQI, our mission is to help retail investors build generational wealth in equity markets. To do so, we share robust model portfolios that cater to investor needs across different stages of the investor lifecycle. All of our investment ideas are thoroughly vetted through TQI's Quantamental Analysis process, which uses a mix of fundamental, quantitative, technical, and valuation analysis. If you're interested in learning more about our marketplace service, visit: The Quantamental Investor

If you're interested in reviewing my performance, feel free to view this tracker: Performance tracker for my SA research.

To learn more about our company and services, visit: The Quantamental Investment Group LLC's website - TQIG | Home

Prior to joining The Quantamental Investment Group LLC, I served as the Head of Equity Research at LASI's SA Marketplace service - Beating The Market, for two years. In the past, I have worked as an Associate Fellow with Jacmel Growth Partners, a middle-market private equity firm in New York. My resume also includes a stint at Capgemini as a software engineer. With regards to academia, I hold a Master of Quantitative Finance degree from Rutgers Business School and a Bachelor of Technology degree in Electronics and Communication Engineering, whilst I am also pursuing the CFA certification (Level 2 candidate).

If you would like to connect with me, please feel free to send me a direct message on SA or leave a comment on one of my articles!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.