Premier Financial: Dividend Yield Of 8.45% But There Is A Better Alternative

Summary

- The dividend yield is very high, but history shows that in times of trouble, Premier Financial has been forced to suspend it.

- There are regional banks such as Prosperity Bancshares with a lower dividend yield but more sustainable in the long run.

- The macroeconomic environment is increasingly hurting this bank's net interest margin.

Nodar Chernishev

Over the past few weeks, regional banks have come under pressure due to the various bank failures that are marking this period in history. The collapse in share prices has been inevitable, and Premier Financial (NASDAQ:PFC) is no exception. However, after a collapse of nearly 60% the dividend yield has reached 8.45%, a figure significantly higher than the industry median of 4.05%.

Is this an opportunity or a trap?

Dividend analysis

In the latest quarterly report, the dividend was increased to $0.31 per share from $0.30 per share in Q1 2022. This is a negligible increase from a numerical standpoint, but important in understanding management's desire to continue issuing an increasing dividend.

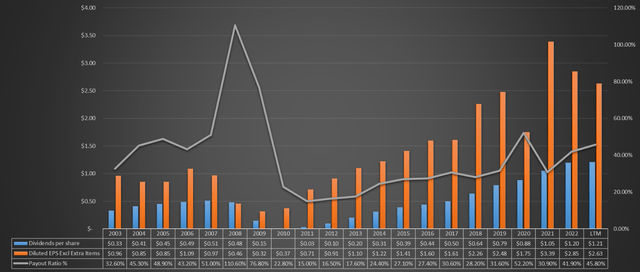

Since 2011, Premier Financial has issued an increasing dividend per share with a payout ratio always below 50% (with the exception of 2020). It is possible that this trend may continue, but the risks associated with the recent banking crisis should not be overlooked. Should the bank need liquidity for any reason, the reduction or suspension of the dividend appears to be an inevitable choice.

Going back in time, we can see how in the aftermath of the subprime mortgage crisis the dividend per share was first reduced and then suspended. EPS could no longer support the outflow of a high dividend. What's more, it took Premier Financial eight years to return to issuing a dividend per share on par with that of 2008. In short, not one of the best investments for those who were betting on the dividend at the time.

As of today, we are not yet in the midst of a major recession, but there are complications due to the sharply inverted yield curve that are already fostering the rise of some weaknesses in the balance sheet. If the situation worsens, I doubt that the dividend will still be sustainable.

Let's take a look at what these complications are.

As a first aspect, I would like to talk about what I consider the most important, which is the rising cost of deposits. As everyone knows, a bank's core business is to obtain liquidity through deposits and then invest it in financial instruments that tend to be long-term. The gain lies in the spread between the interest rate paid on the liquidity obtained through deposits and that obtained from the investment made. Well, if the cost of deposits rises more than the yield on assets, the bank's net interest margin falls. But why should this happen today? There are mainly two reasons:

- The first is that depositors may consider moving their liquidity elsewhere, since there are instruments on the money market that grant a much more attractive interest rate than a simple deposit with Premier Financial. For example, T-Bills that yield more than 5%. This is a problem for the bank, because with less liquidity coming from deposits, if needed it will have to opt for a borrowing, which is certainly much more expensive considering the current interest rates.

- The second is that when interest rates are high, both businesses and households are more reluctant to borrow because their installment would be too high.

So, on the one hand, the cost of deposits adjusts to money market rates, and on the other hand, loans originated will be issued at a higher rate but in smaller quantity because of higher credit standards. If the cost of deposits is not kept low, the net interest margin is likely to decline, and that is exactly what is happening at Premier Financial.

If, on the other hand, deposits were to fall as well as being more expensive, even worse. The bank would be forced to borrow at high rates to raise liquidity, which would make the situation even harder.

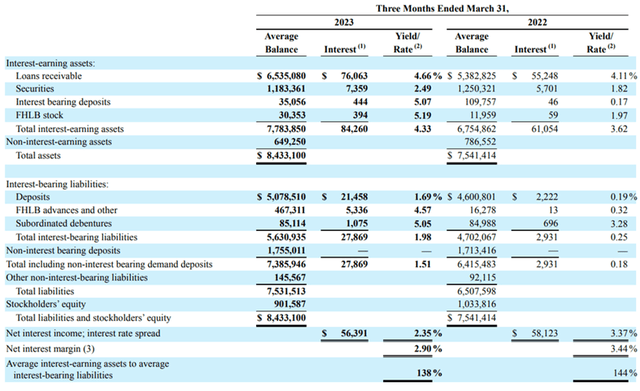

As can be seen from this table denoting the average figures, the net interest margin in Q1 2023 was 2.90%, in Q1 2022 it was 3.44%. This is a major worsening due to an excessive increase in interest expenses.

In particular, interest-earning assets increased yield by 71 basis points over last year, but it was not enough, as the cost of total-interest-bearing liabilities increased by 173 basis points.

Based on the Fed's forecast, rates will not decline in 2023 and it is likely that deposit beta will continue to rise, so the cost of deposits will increasingly adjust to money market rates. This of course would be a problem, as it would cause the net deposit margin to fall even further.

To overcome this dilemma, Premier Financial would have to find ways to get a higher average yield on its assets, but this would consequently increase the risk of the real estate portfolio.

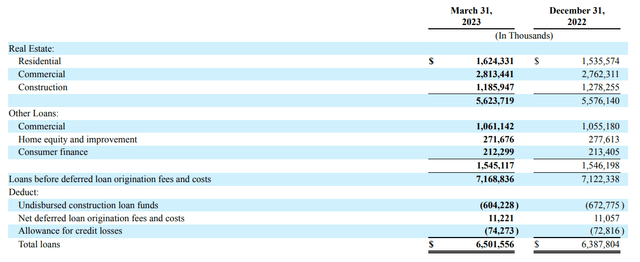

As we can see from this figure, further increasing the risk of this real estate portfolio may not be a good idea since already 39% is composed of commercial real estate. Relating the amount of CRE to CET1 gives a result of 359%, which is definitely high.

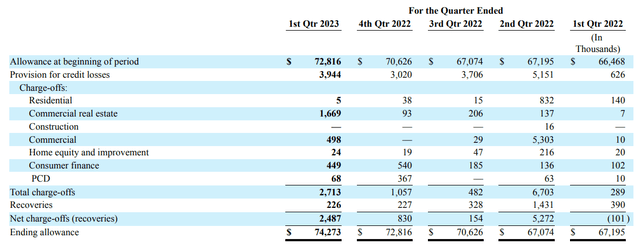

Compared to just 3 months ago, charge-offs on commercial real estate rose by $1.57 million, an increase significantly above past quarters.

Overall, Premier Financial still remains healthy in light of last quarter's results, but it is clear that gradually something is changing. Whether we are facing a crisis comparable to 2008 is unforeseeable today, but the doubts are there and we have seen before how Premier Financial performed during that period.

Since 2011, the dividend per share has always increased, but let's not forget in what macroeconomic environment the company operated during those years. Fed Funds Rate close to 0%, inflation within the 2% target, and economic growth after a period of crisis. Today everything has changed and in fact the difficulties in keeping net interest margin unchanged are obvious.

Over the past few days I have analyzed several regional banks with an equally interesting dividend, and some of them compared to Q1 2022 have even improved their net interest margin due to the almost unchanged cost of their deposits. Personally, I would focus more on these types of banks, as I believe they are the most resilient ones in case we face a new financial crisis. Let me give you an example to make you understand what I am talking about.

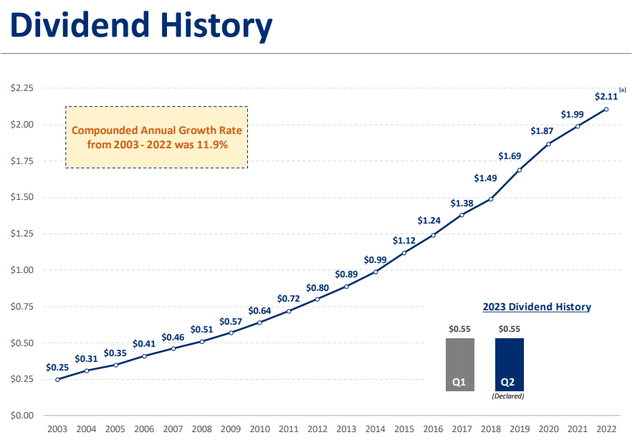

This is the dividend per share of Prosperity Bancshares (PB), a regional bank that like Premier Financial has collapsed in recent weeks (not as severely, however). In any case, unlike the latter, it has managed to increase its dividend per share every year, even during the subprime mortgage crisis. As of today, the dividend yield is 3.55%, significantly lower, but at the same time also more solid. As we saw at the beginning of the article, Premier Financial shareholders who were interested in the high dividend yield of 2008 took years before they actually received a decent dividend. I don't doubt that it may be different today than it was 15 years ago, but I don't see why to risk it; it is likely in my view that these early difficulties encountered in Q1 2023 may turn into something worse.

I personally have not invested in either of them since I prefer not to have individual exposure to any regional bank at this time, but if I had to choose on the basis of dividend there is no doubt that I would opt for Prosperity Bancshares. Much better consistency over the long run rather than short-term hopes.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.