Alibaba's Q4: Cloud Spin-Off Incoming

Summary

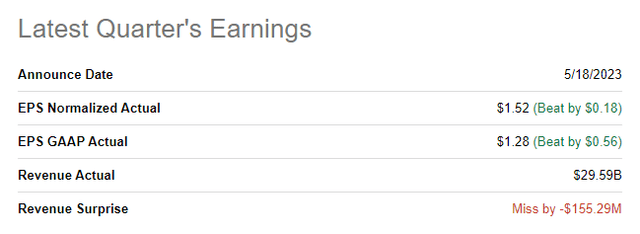

- Alibaba beat EPS estimates but missed on revenues for its fourth fiscal quarter on Thursday.

- Economic tailwinds have not been strong enough to drive a major rebound in Alibaba’s top line growth. The e-Commerce business continues to see weak growth.

- Alibaba has said it will pursue a Cloud business spin-off within the next twelve months. Investors are set to receive spin-off shares as a stock dividend.

- Alibaba's shares remain mispriced.

maybefalse/iStock Unreleased via Getty Images

Yesterday, Alibaba (NYSE:BABA) reported earnings for its fourth fiscal quarter of FY 2023 as well as for the full-year and the Chinese tech company widely beat expectations on the bottom line while missing on revenues. Before earnings, I suggested that Alibaba could be set for a sizable earnings beat due to low EPS expectations ahead of earnings. The most important take-away of Alibaba's earnings release, however, was that the e-Commerce firm is preparing to spin-off its Cloud business which would create a leading pure-play Cloud company for investors. Since shares of Alibaba continue to be mispriced, in my opinion, I believe patient investors will be rewarded handsomely in the future!

Alibaba delivered a beat on the bottom line

Alibaba's earnings sheet for FQ4'23 beat EPS estimates by a good margin. Alibaba reported adjusted earnings of $1.52 per-share which beat the consensus estimate by $0.18 per-share. Revenues, on the other hand, came in $155.3M below expectations.

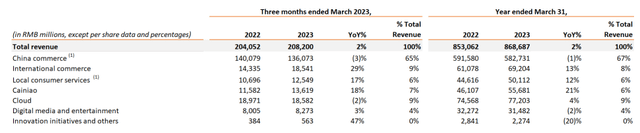

In my work on Alibaba before earnings -- Alibaba FQ4: 3 Upcoming Catalysts For A Major Rebound -- I speculated that the e-Commerce company could beat earnings expectations chiefly because of a reboot of the Chinese economy in the March quarter and related economic tailwinds due to an unleashing of pent-up demand. While Alibaba did beat earnings predictions, the e-Commerce business still disappointed with its financial performance. Alibaba's total revenues for the March quarter were 208.2B Chinese Yuan ($30.3B), showing a top line increase of only 2% year over year.

The problem was once again Alibaba's China commerce business which generated 136.1B Chinese Yuan ($19.8B) in revenues in the March quarter, showing a decline of 3% year over year. It was the fourth straight quarter showing a revenue decline for Alibaba's China e-Commerce business… which accounts for 65% of Alibaba's consolidated revenues. However, Alibaba's international e-Commerce operations delivered solid growth of 29% in FQ4'23 compared to a growth rate of 18% in the previous quarter. Local consumer services and Alibaba's logistics business, Cainiao, also saw double digit growth rates as Alibaba continues to build out its logistics network and benefited from strong order growth for Ele.me which is Alibaba's food catering platform.

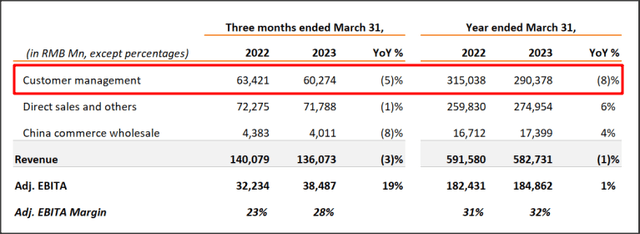

Alibaba's disappointing performance in the China commerce segment was chiefly due to revenue declines occurring in the customer management segment.

Customer management revenues chiefly relate to sales generated on Alibaba's Taobao and Tmall e-Commerce platforms and they declined 5% year over year in FQ4'23 (they declined 9% in FQ3'23 due to slowing gross merchandise value growth on those platforms and due to COVID-19 outbreaks causing dislocations in the supply chain). The weak performance in Alibaba's fourth fiscal quarter suggests demand growth is not picking up as quickly as expected after China reopened its economy in the first-quarter.

Alibaba is finally spinning off its Cloud division

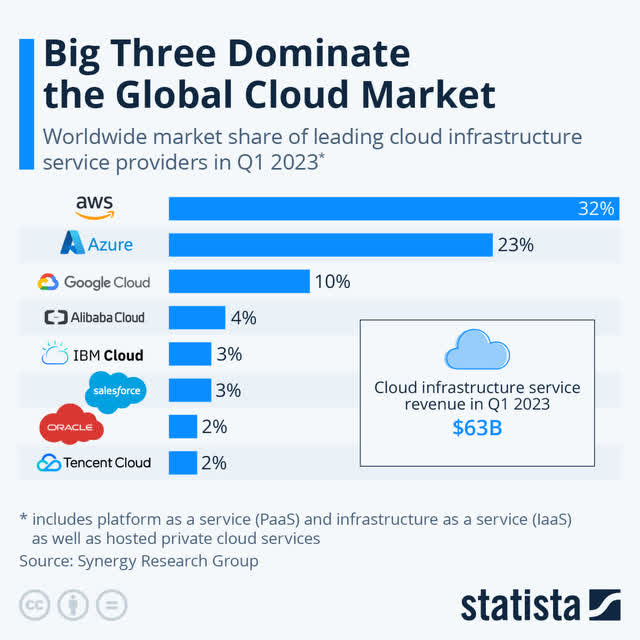

Alibaba removed considerable uncertainty and presented a timeline for its break-up plan the company announced earlier this year. Alibaba has said that it plans to spin off its Cloud business and investors can look forward to receiving shares in the business within the next 12 months. The three largest players in the Cloud infrastructure market are Amazon's (AMZN) AWS, Microsoft's (MSFT) Azure and Google (GOOGL) (GOOG) Cloud. Alibaba's Cloud business had an estimated market share of 4% in Q1'23 and is the fourth-largest Cloud service provider.

Alibaba's Cloud revenues dropped 2% in FQ4'23 to 18.6B Yuan ($2.7B) and accounted for about 9% of consolidated revenues. The drop-off in revenues, according to Alibaba, was driven by project delays related to COVID-19 outbreaks in January and I would expect Alibaba Cloud to return to positive growth in the near term. I also continue to estimate that Alibaba could achieve 90B Chinese Yuan in Cloud revenues in FY 2025 and estimate that Alibaba's Cloud business could be worth up to $60B.

Alibaba's valuation vs. other Chinese technology companies

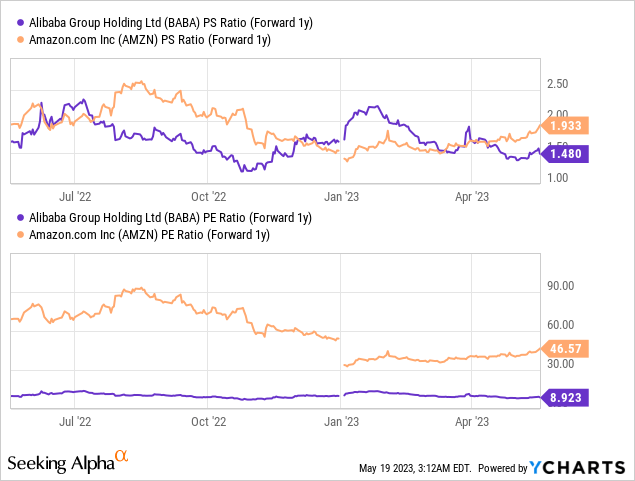

I have said for a very long time that Alibaba's shares are undervalued based off of the firm's earnings potential as well as in relation to other e-Commerce rivals, such as Amazon. However, investors had good reasons to apply valuation discounts due to Alibaba facing a brutal, year-long crackdown of China's regulators, slowing growth during the pandemic and increasing competition in the e-Commerce market. While a major revaluation has so far not occurred, I believe Alibaba's earnings potential remains grossly undervalued with a P/E ratio of 8.9X, especially when Alibaba is compared against Amazon.

While Alibaba grew only 2% in the last quarter, Amazon managed to deliver 9% revenue growth. But due to the reopening of China's economy, analysts expect a strong rebound in Alibaba's top line growth this year. Alibaba is projected to grow revenues 10% in its current fiscal year while Amazon is expected to see about 9% revenue growth.

Risks with Alibaba

Right now, I believe uncertainty about the specifics of Alibaba's business reorganization is weighing on Alibaba's shares. I believe the Cloud spin-off is a smart move for the e-Commerce company because it will establish the fourth-largest Cloud service provider (by market share) as an independent, pure-play Cloud investment opportunity for investors that could achieve a higher valuation going forward. What would change my mind about Alibaba is if the company saw a steep deceleration of its top line growth in the coming quarters, driven by the e-Commerce segment.

Final thoughts

Alibaba had a solid quarter in March although the e-Commerce company saw a 3% top line decline in its most important business segment, China commerce. However, my key argument from my previous article was correct, I believe, which was that earnings expectations heading into the earnings release were so depressed that it created a low bar for Alibaba. Additionally, Alibaba provided clarity with respect to its Cloud division spin off, which investors can expect to occur within the next 12 months. Since Alibaba's shares continue to trade at a depressed P/E ratio of 8.9X, I believe patient investors will ultimately be rewarded with their investment in Alibaba!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.