SHYG Vs. HYS: Own The Lower Fee ETF

Summary

- The iShares 0-5 Year High Yield Corporate Bond ETF invests based on the Markit iBoxx USD Liquid High Yield 0-5 Index.

- The PIMCO 0-5 Year High Yield Corporate Bond Index ETF invests based on the ICE BofA 0-5 Year US High Yield Constrained Index.

- This article will review both ETFs, their respective index, and then compare the ETFs based on fixed income factors, return, and risk.

- Between these two short-term HY ETFs with similar results, I give SHYG the Buy rating due to its much lower fee structure. Why pay more for the same results?

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

tumsasedgars

(This article was co-produced with Hoya Capital Real Estate)

Introduction

A logical opening question with 1-5 Year CDs yielding around 5%, why risk owning a High-Yield, or any bond ETF, when their current yields are only 70-100bps higher? These quotes taken from a recent MarketWatch article addresses that inquiry. These points seem relevant to me with both ETFs reviewed here investing in bonds that mature within five years.

- The yield curve for U.S. Treasury securities is inverted. When it is time to rollover that 12-month CD, the available interest rates might be considerably lower than the current 5%.

- Currently the high-yield market is priced around 90 cents to the dollar because [many bonds were] issued with 4% to 5% coupons over the past several years. So if you buy bonds at 90 now, you will realize a gain of 10% upon maturity.

- The default outlook for high-yield bonds may be better than it has been in other periods of economic weakness, because of regulatory changes that have shifted risk toward leveraged loans.

- Another factor that may weigh in favor of the stability of high-yield issuers is that many of the weakest companies were taken out during the earlier stages of the COVID-19 pandemic.

- Finally, some economists and bond investors are confident that if the U.S. heads into recession as a result of the Federal Reserve's cycle of tightening monetary policy to quell inflation, it will be a relatively mild one.

Source: marketwatch.com

This article will compare the following ETFs:

- iShares 0-5 Year High Yield Corporate Bond ETF (NYSEARCA:SHYG)

- PIMCO 0-5 Year High Yield Corporate Bond Index ETF (NYSEARCA:HYS)

Between these two short-term HY ETFs with similar results, I give SHYG the Buy rating due to its much lower fee structure. Why pay more for the same results.

iShares 0-5 Year High Yield Corporate Bond ETF Review

Seeking Alpha describes this ETF as:

The iShares 0-5 Year High Yield Corporate Bond ETF is managed by BlackRock Fund Advisors. It invests in the fixed income markets of the United States. The fund invests in the U.S. dollar-denominated, corporate bonds securities that are rated as below investment grade. It seeks to invest in securities with maturity of 0-5 years. The fund seeks to replicate the performance of the Markit iBoxx USD Liquid High Yield 0-5 Index. SHYG started in 2013.

Source: seekingalpha.com SHYG

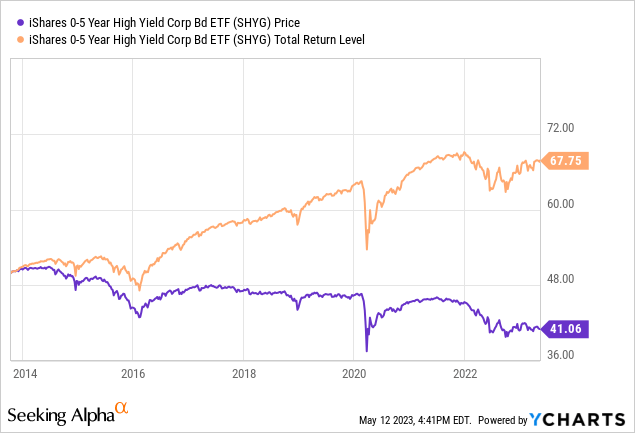

SHYG has $5.4b in AUM and has a TTM Yield of 6.11%. Fees are 30bps.

Index review

The index manager provides this description:

The Markit iBoxx USD Liquid High Yield 0-5 Index consists of liquid USD high yield bonds, which provide a balanced representation of the USD denominated short duration high yield corporate bond universe. The index is an integral part of the global Markit iBoxx index families, which provide the marketplace with accurate and objective indices by which to assess the performance of bond markets and investments. The index is market-value weighted with an issuer cap of 3%.

Source: cdn.ihsmarkit.com 0-5 Index

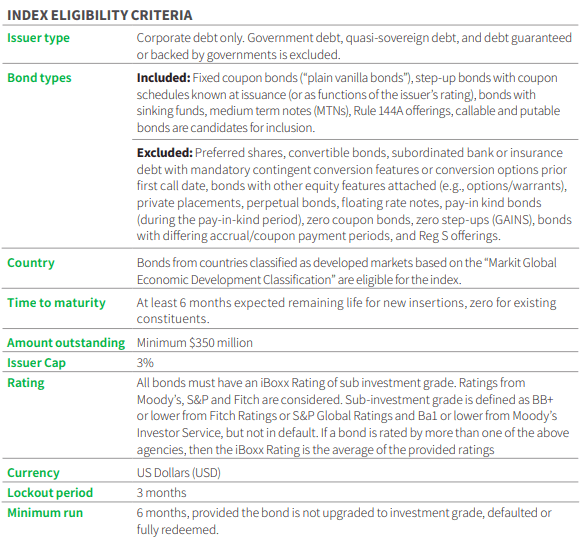

The next table provides important Index guidelines. The Index rebalances monthly.

cdn.ihsmarkit.com Index PDF

SHYG holdings review

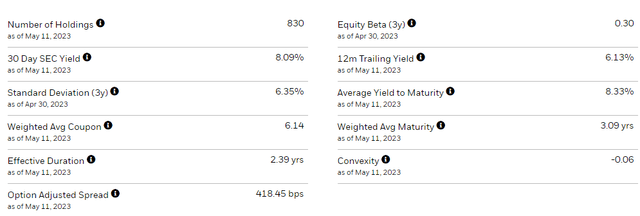

iShares provides the following portfolio characteristics.

I will compare some of these against HYS later, as I will some of the other data shown next.

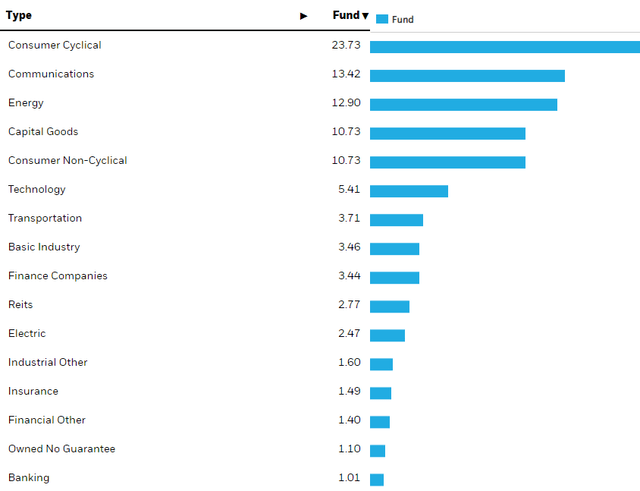

The top sector, Consumer Cyclical with almost 24% of the weight, might give investors pause if the FOMC pushes the US into a recession that becomes more than a mild one. On the plus side, Banking is the smallest sector weight with only 1% allocation.

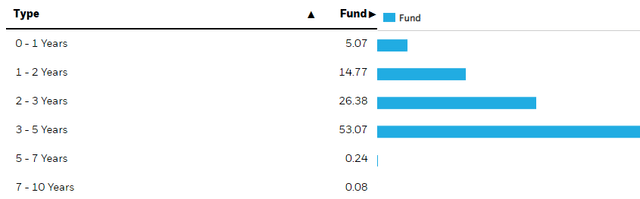

About 20% of the portfolio matures within two years which should raise the ETF's WAC, currently at 6.14%. Over half the bonds are at the tail end of the zone SHYG targets for holding. I found more details that shows 9 bonds mature in 2023 (1.47%) and 66 in 2024 (7.46%).

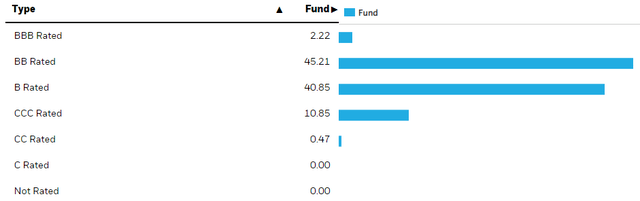

SHYG is about evenly split between the two highest rating letters below investment-grade. Details as to whether these are +/- was not provided. A concern would be the over 11% allocation to ratings of CCC or CC, where defaults rates are much higher than even those rated B.

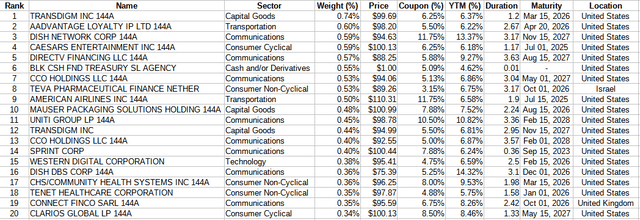

Top 20 holdings

ishares.com; compiled by Author

Out of over 800 bonds, the Top 20 account for under 10% of the portfolio. The lower half still account for a respectable 30% of the allocation by weight.

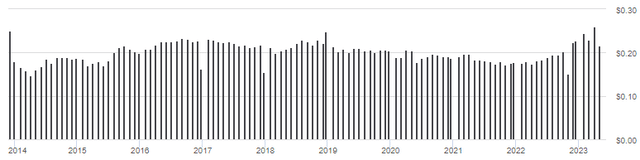

SHYG distribution review

Payouts follow the movement in interest rates, though not perfectly. Despite the FOMC pushing up short-term rates, recent distributions have started retreating, something to keep an eye on. Seeking Alpha gives SHYG a "B-" grade despite no long-term payout growth.

seekingalpha.com SHYG scorecard

PIMCO 0-5 Year High Yield Corporate Bond Index ETF Review

Seeking Alpha describes this ETF as:

The fund invests in U.S. dollar denominated below investment grade corporate bonds with remaining maturities of less than 5 years. The fund invests in securities that are rated below investment grade by Moody's, S&P and Fitch. It seeks to track the performance of the ICE BofA 0-5 Year US High Yield Constrained Index. HYS started in 2011.

Source: seekingalpha.com HYS

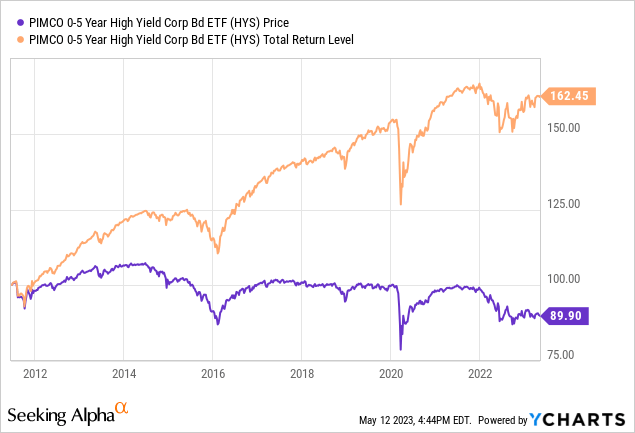

HYS has $1.1b in AUM and has a TTM Yield of 5.7%. Fees are much higher at 55bps.

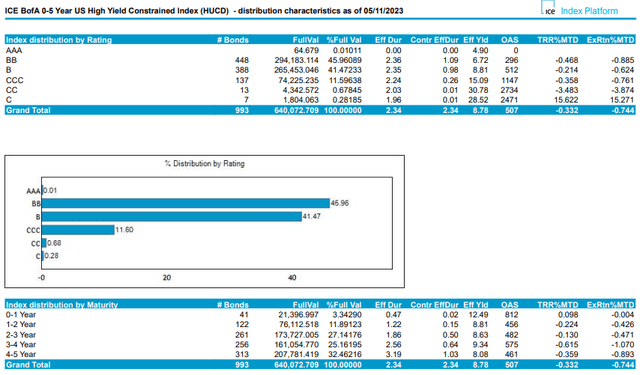

Index review

ICE describes this index as:

ICE BofA 0-5 Year US High Yield Constrained Index tracks the performance of short-term US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one month but less than five years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. In addition, qualifying securities must have risk exposure to countries that are members of the FX-G10, Western Europe or territories of the US and Western Europe.

Source: ICE.com/index

They provided these composition tables too.

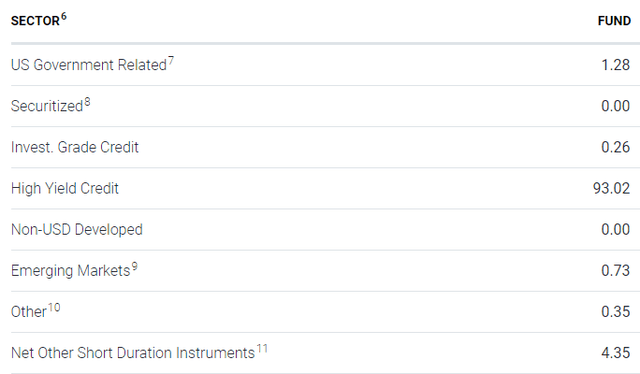

HYS holdings review

PIMCO doesn't subdivide their sectors as to provide investors with any useful data.

The maturity allocation matches up with SHYG well.

Not counting the Repo you see later, there are 13 bonds maturing in 2023 (1.5%) and 40 in 2024 (4.87%).

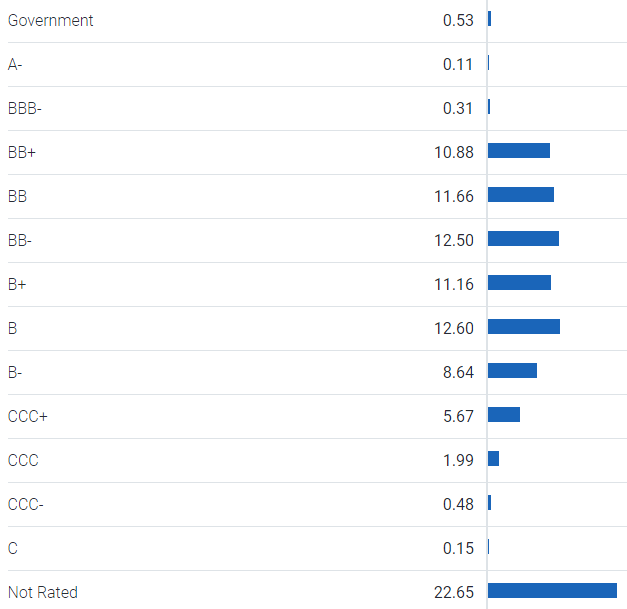

For ratings, PIMCO is more detailed than what iShares provides.

pimco.com ratings

Unlike SHYG, 22.65% of the portfolio bonds are not rated; not necessarily bad, just uninformative. HYS hold less bonds rate below the "B" classifications, assuming most of the NRs would not have gotten CCC or lower rating.

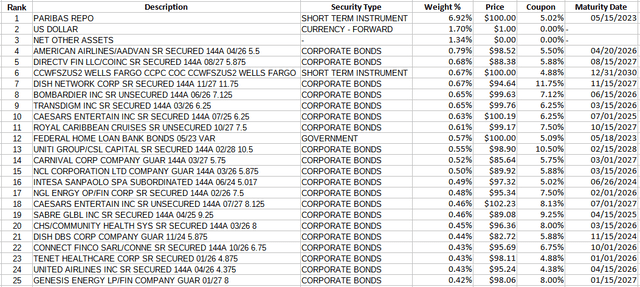

Top 25 holdings

Since the top three assets are bonds, I expanded the list to 25. Not counting the top three, the next 20 positions are 11% of the weight. The bottom half of the 677 holdings account for 18% of the portfolio, giving them less influence than the lower half of SHYG does there.

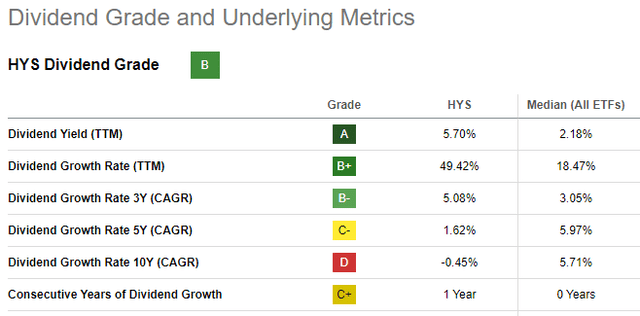

HYS distribution review

Unlike SHYS, HYS still has an upward slope in their payouts, resulting in a "B" grade from Seeking Alpha.

Seekingalpha.com HYS scorecard

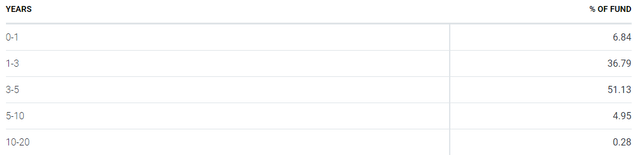

Comparing ETFs

Here is how the two ETFs compare on some common fixed income factors.

| Factor | SHYG | HYS |

| Weight Average Coupon | 6.14% | 6.24% |

| Weight Average Price | $94.21 | $93.81 |

| Yield-to-Maturity | 8.33% | 8.51% |

| Effective Duration | 2.39 yrs | 2.13 yrs |

| Effective Maturity | 3.09 yrs | 3.25 yrs |

| Portfolio rating | BB- | B+ |

| Portfolio turnover | 23% | 45% |

| Fees | 30bps | 55bps |

| AUM | $5.4b | $1.1b |

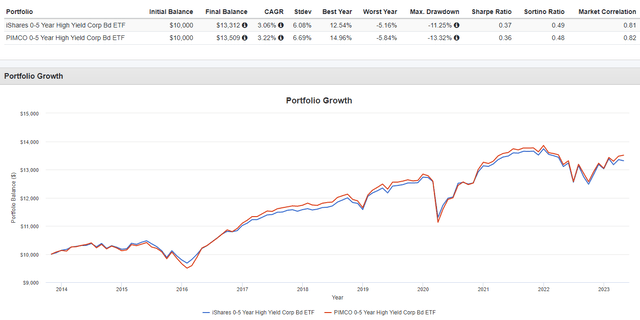

While the above is a recent snapshot of the ETFs, the next chart shows how their investors have faired since SHYG started in 2013.

Long-term CAGRs are very close with HYS having better results over the last three years. Risk data is very close too, including their Beta and Alpha values.

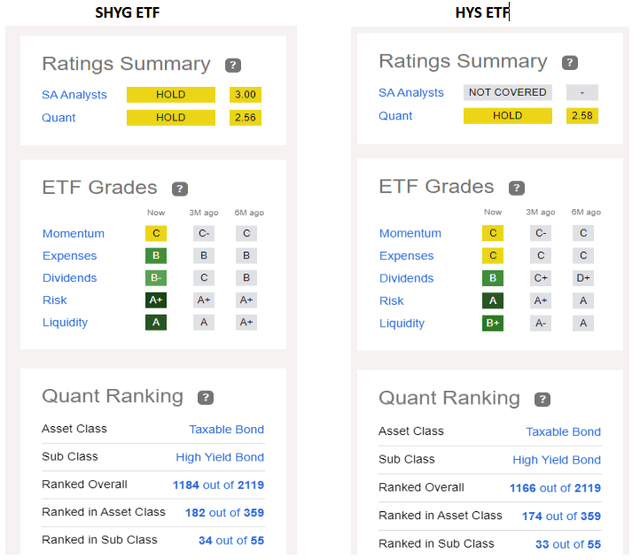

This is how Seeking Alpha rates both ETFs on various factors.

Portfolio Strategy

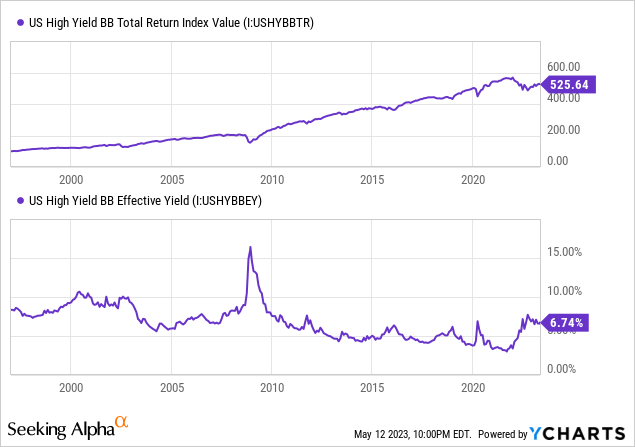

The above charts show how US HY BB-rated bonds have done since the mid-1990s: only a few times did the price erosion more than offset the yield investors received. Recent times is one of those periods. The second chart shows that BB bonds are yielding what they were when the GFC was ending. The short duration of each ETF allows them to reinvest maturing funds into higher coupon bonds, which should enhance future payouts.

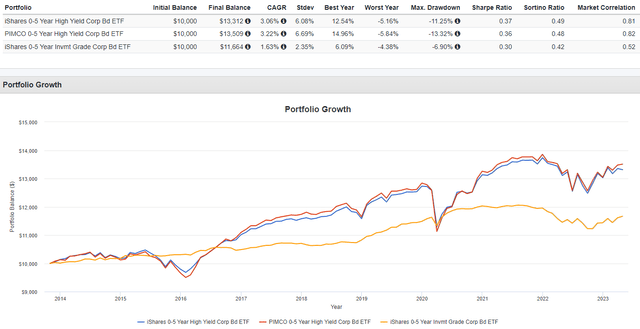

There are short-term investment-grade ETFs available too, so the next charts compares these two against one of those, the iShares 0-5 Years Investment Grade Corporate Bond ETF (SLQD).

While SLQD has a much lower StdDev, its CAGR was worse enough to result in it having poorer Sharpe and Sortino ratios.

Final Thoughts

Investing is more complicated today than when I seriously started in 1980. There were no ETFs then, now there are almost 9000 to pick from. Then high fee Mutual and Closed-End funds dominated the marketplace, most of which were broad market funds, not the narrow-focused funds investors can pick from today. The downside of that is with so many choices, it is easy to get too occupied with "beating the market" that too much money sits on the sidelines. Be careful, do your due diligence, and enjoy the ride.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.