Capri Holdings: Making Headway Towards Future Set Targets

Summary

- Capri Holdings is a luxury fashion company comprising three brands; Versace, Jimmy Choo, and Michael Kors.

- CPRI capitalizes on the strength of its brands to drive its performance and achieve its set targets.

- The Asian market provides a significant growth opportunity for the company.

- It reported attractive and growing profit margins as well as a high return on equity.

bravo1954/E+ via Getty Images

Investment Thesis

Capri Holdings Limited (NYSE:CPRI), formerly known as Michael Kors, is a global luxury fashion company that designs, markets, distributes, and retails branded apparel, footwear, and accessories for both men and women. It functions through three segments; Versace, Michael Kors, and Jimmy Choo.

CPRI's share price has decreased about 10.29% over the past year, but it has remained successful. The company is capitalizing on its brands' strong points to achieve its set targets. It has made good progress towards achieving them, especially in increasing their global retail footprint. In addition, the Asian luxury goods market is rapidly growing and provides a good growth opportunity factoring in its low penetration in the region.

The company has recorded attractive profit margins and a high return on its shareholders' equity, thus creating value for its investors. On the other hand, it has a high debt level that raises concern, and investors should move cautiously. Despite this, I remain bullish on the stock as the company shows great potential in its growth and performance.

Capitalizing on its Strong Brands

Capri Holdings comprises three strong and iconic brands: Versace, Michael Kors, and Jimmy Choo. The brands are backed by a strong and experienced management team with an average of 24 years and 12 years in the retail industry and Capri's brands, respectively. The three brands provide fashion luxury offerings to their customers and are well known for their top-tier design and innovativeness.

CPRI acquired Jimmy Choo and Versace back in 2017 and 2018. Utilizing its expertise in footwear and accessories, the company boosts the Versace segment by increasing its presence globally and developing its e-commerce business. For Jimmy Choo, Capri capitalizes on the brand's expertise in footwear to expand its market share and establish a 50% revenue target from its accessory products. Michael Kors is the company's foundation brand and focuses its expertise on design, style and innovation and offers a wide range of luxury fashion products.

The luxury group aims to grow Jimmy Choo's revenue business to $1billion, Versace's to $2billion, and Michael Kors' to $5billion over time. It has also been increasing Versace's and Jimmy Choo's global retail footprint to attain its 300 retail stores target for each brand. With Michael Kors' premiumization, the company has aimed to create a shortage of the brand's products by reducing supply and wholesale outlets from 4038 in 2015 to 2742 by the end of 2022. Further, since the luxury group initiated its price ramp-up in 2019, prices have surged by about 25% on average. The company believes that the strategy is suitable to elevate the brand and its products.

How is the Progress?

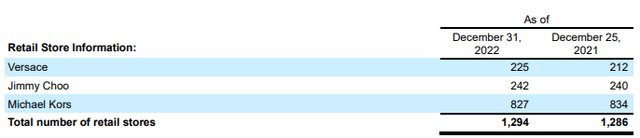

CPRI is making headway towards its target, especially on its retail store expansions. According to the MRQ, the company had 225 Versace and 242 Jimmy Choo retail stores, an increase from 212 and 240, respectively.

Capri Holdings Q3 fiscal 2023 report

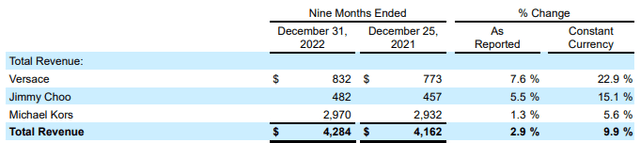

For the nine months that ended December 31, 2022, CPRI reported the following revenues for Versace, Jimmy Choo, and Michael Kors; $832million, $482million, and $2.97billion, respectively.

Capri Holdings Q3 fiscal 2023 report

The above table shows an increase in revenue from the same period in the prior year. Capri recorded a 7.6%, 5.5%, and 1.3% increase and 22.9%, 15.1% and 5.6% increase in constant currency for Versace, Jimmy Choo, and Michael Kors, respectively. Although the company has more ground to cover, especially in its revenues, it has made decent progress in attaining its target and believes in its ability to achieve it.

Geographical Growth Potential

The global luxury goods market is currently valued at $354.8billon, with a CAGR of 3.38% through 2028. Luxury fashion is the largest segment in this market, valued at $111.5billion and a CAGR of 3.39% through 2028.

China is a fast-growing market expected to dominate the luxury goods market in 2025. China and Japan account for most of Asia's luxury goods market value. Japanese consumers spend more on luxury goods, and China has a higher number of consumers. This Asian market offers a significant growth opportunity for Capri as it expands its global footprint. It has a relatively low market presence in this region which accounts for 16.4% of the company's total revenue.

CPRI has set its eyes on the Asian market to increase its market share and aims to open more stores in this region, especially the Michael Kors brand. Considering the relaxation of the Covid 19 restrictions, the Asian luxury goods market is set to thrive. The Asian market appears promising for the luxury's group growth and could aid in attaining its targets.

Margins and ROE

Capri had a gross profit margin [TTM] of 65.74%, outpacing the sector's average of 35.16%. This is the same case for its net income margin, which was 12.7% and higher than last year's margin of 10.7%. It also outperformed the sector's median by 8.3%.

The company also recorded a reasonably high return on equity at 29.3%, higher than its peers' 10.7%. The luxury group has seen year-over-year growth of 34.35%, beating its peers by 48.7%. This shows how well the company manages its equity and creates value for its investors. Going forward, the company's ROE is expected to grow 30.16%, which I think is sustainable.

What About its Financial Health?

CPRI's balance sheet has total liabilities amounting to $5.3billion, including those due in a year and beyond. Cash available is at $281million, and receivables amounting to $384million, resulting in liabilities of $4.67b more than the cash balance and receivables combined. Compared to its market cap of $4.92billion, this is a cause of concern, as it can lead to a significant dilution of its shareholders in the company trying to secure liquid money to meet its financial obligations.

The company's total debt of $3.34b is 67% of its market cap. A total equity of $2.2 billion brings its debt-to-equity ratio to 150%, which is quite high. This is an indication that the balance sheet is highly leveraged. The CFO and EBIT are important to consider to assess its ability to finance its debt. Capri's CFO is 40% of its debt, signaling the debt is well covered. Moreover, interest expenses tied to the debt amount to $13million and EBIT to $907million. This results in an interest coverage ratio of 69.7x; its earnings cover the interest expenses by about 69.7x.

Although the company's debt and interests are well catered for, its total liabilities are rather staggering; therefore, investors should move cautiously.

Conclusion

CPRI, a luxury fashion company, consists of three strong luxury houses: Versace, Jimmy Choo, and Michael Kors, and capitalizes on each brand's expertise to drive its performance. The company set targets for its future performance and has made decent progress, especially in increasing its global retail footprint. The fast-growing Asian market provides a significant growth opportunity as the company vastly uncovers it. Capri has reported attractive profit margins and a significantly high return on its equity. It is also highly leveraged, and investors should closely watch the company's debt moving forward. Despite this, I believe the company is a good investment and recommend buying it.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article has been researched and written by Judy Mutua of Fade The Market.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.