Occidental Petroleum: Warren Buffett Buys Again, So Should You

Summary

- Warren Buffett's recent purchases of OXY prove he's a good market timer, as his buys coincided with the OXY stock reaching its supply zone.

- Despite some weaknesses during Q1, OXY demonstrated some improvements in its financial position, as far as I see it.

- OXY's superior FCF yield [TTM] could be a key factor that attracted Warren Buffett to invest in OXY, seeking a liquid company with strong management.

- Currently, OXY's stock is valued at 12 times FY2023 earnings, and the projected year-over-year EPS decline of nearly -48% seems too pessimistic to me.

- I reiterate my previous Buy rating on OXY stock and support Goldman's target of $77 per share.

- Looking for a helping hand in the market? Members of Beyond the Wall Investing get exclusive ideas and guidance to navigate any climate. Learn More »

Paul Morigi

Intro & Thesis

I've been covering the stock of Occidental Petroleum Corporation (NYSE:OXY) here on Seeking Alpha since early October 2022, and that time coincided with a fairly difficult period of falling energy commodity prices, so most major oil and gas companies experienced a rather difficult period of increased volatility.

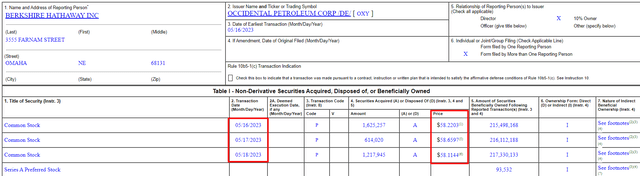

The increased volatility hasn't bypassed OXY. However, the recent turbulence in the stock's price has provided many savvy investors with an excellent opportunity to increase their allocation. Just a few hours ago, it was revealed that Warren Buffett purchased an additional $200 million [or ~ 3.46 million shares] in OXY stock from May 16-18, 2023, according to the recent SEC filing.

In total, Berkshire now owns more than 217.3 million shares of Occidental Petroleum, valued at approximately $12.7 billion. Additionally, Berkshire holds around $9.5 billion worth of Occidental preferred stock, which carries an 8% annual dividend, and has warrants to purchase $5 billion worth of Occidental common shares for $59.62 per share.

These purchases clearly show that Warren Buffett isn't only a great value investor - he's also a good market timer, as his recent purchases coincided with the OXY stock reaching its supply zone on the price chart:

TrendSpider Software, author's notes

As in my last article on OXY from March 2023, I still see quite favorable long-term prospects for the company, and the way Warren Buffett is behaving toward the stock only indirectly confirms my conclusions. In fact, there are some fundamental reasons for retail investors to follow Mr. Buffett. Let's look at them together.

What Are The Reasons To Follow Buffett's Buys?

It's been a long time since last March and the company managed to report for Q1 FY2023 [May 9, 2023] - let's first take a quick look at the operational and financial results.

OXY's first-quarter results showed adjusted EPS and cash flow from operations [CFO] of $1.09 billion and $3.15 billion, respectively. This missed the consensus forecast of $1.24 per share and $3.12 billion in CFO, according to FactSet data [proprietary source]. The underperformance was primarily attributed to the midstream business and non-cash adjustments related to taxes and other factors. Capital expenditures in the first quarter were $1.46 billion, slightly deviating from the consensus estimate of $1.49 billion. Free cash flow for the quarter was $1.7 billion. Of note, OXY repurchased $752 million of common stock and redeemed $647 million of preferred stock.

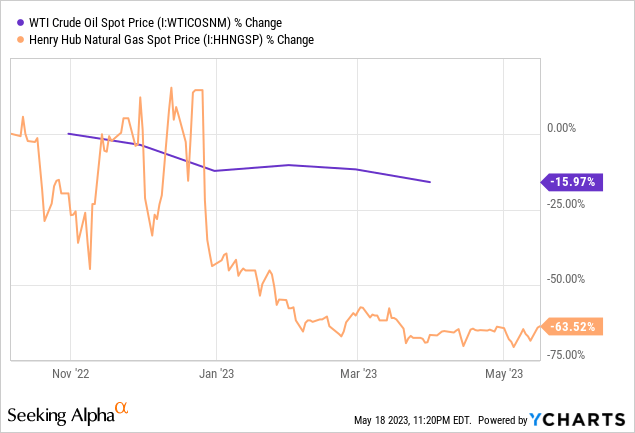

Lower earnings were primarily due to decreased prices for crude oil (-19% YoY), natural gas liquids (-38%), and natural gas (-28%). However, higher production and reduced interest expense partially offset this decline. Revenue also decreased by 14% compared to the previous year, reaching $7.225 billion, falling short of the consensus forecast of $7.617 billion.

In the Oil and Gas division, the pretax net profit for Q1 2023 was $1.640 billion, down from $2.898 billion in the previous year. This decline was mainly a result of lower realized prices for commodities. Average daily production increased by nearly 13% to 1,220 thousand barrels of oil equivalent per day (mboe/d), driven by higher international production and strength in the Permian, Rocky Mountain, and Gulf of Mexico regions.

For the Chemicals division [OxyChem], pretax earnings in the first quarter dropped by 30% compared to the prior year, amounting to $472 million. This decline was attributed to lower polyvinyl prices, reduced volume in most product lines, and narrower margins due to weaker chemical pricing. On a positive note, the division benefited from lower raw material costs.

The Midstream and Marketing segment reported a pretax profit of $2 million in Q1 2023, in contrast to a pretax loss of $50 million in the same quarter of the previous year. This shift to profitability was primarily driven by the favorable timing impact of crude oil sales and improved gas margins.

Management has provided guidance numbers for the second quarter and full year 2023 production and financials - I feel it necessary to share with you not only the bare numbers but also how Goldman Sachs analysts evaluate the management's forecasts in its recently published [May 10, 2023] note on OXY's Q1 results:

| Q2 FY2023 | Full-year 2023 |

|

|

Source: Author's work, based on OXY's data and Goldman Sachs [proprietary source]

As you can see, Goldman Sachs analysts see a much bleaker future for OXY than the management articulates to the market. You'd think that the bank would be bearish. But we see an opposite picture:

GS [May 10, 2023], proprietary source![GS [May 10, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/19/49513514-1684469671357249.png)

Even with an EBITDA decline of ~30% in FY2023 [YoY], Goldman sets a 12-month price target of $77 per share, which gives OXY an upside potential of ~32.2% over the next 6 months or so as of the last close. That's a huge upside, in my opinion.

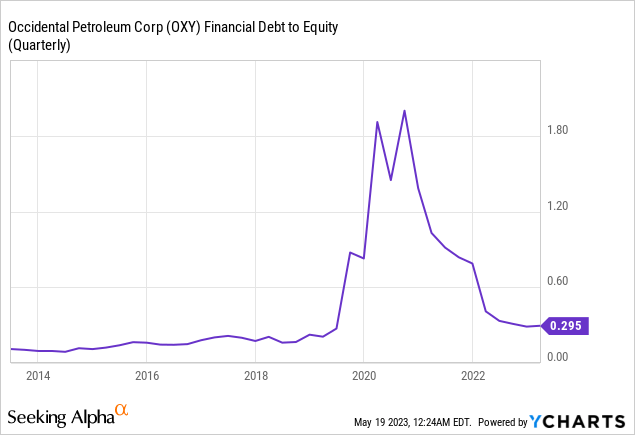

Despite some weaknesses during Q1, OXY demonstrated some improvements in its financial position, as far as I see it. Its total debt/capitalization ratio decreased from 52.2% to 41.8% compared to the previous year; the total debt decreased from $27.202 billion to $20.805 billion, primarily resulting from the Anadarko acquisition. Short-term borrowings stood at $565.0 million at the end of the quarter.

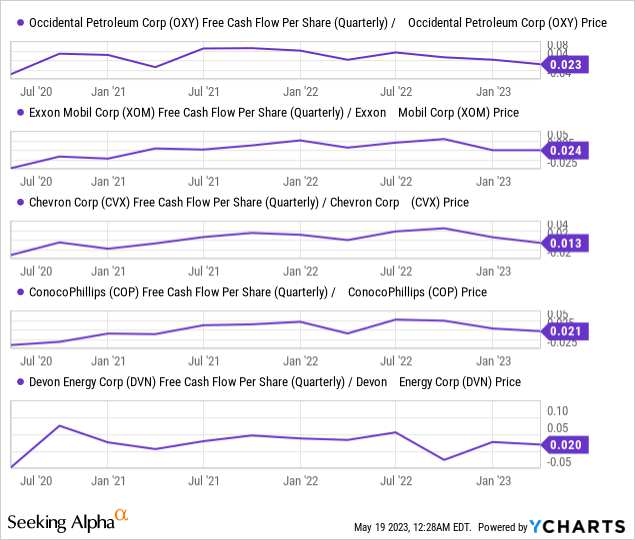

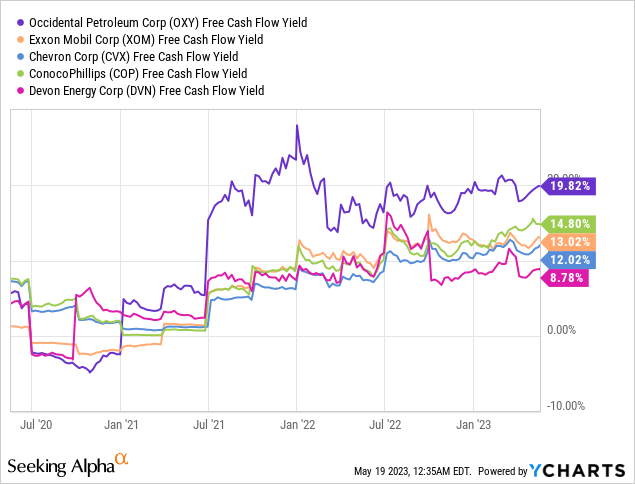

Before Q1, OXY was a confident leader in terms of FCF returns, which I mentioned in the last article. Now we see that FCF per share has dropped a bit, but still has an edge over the other peers:

At the same time, OXY still far outperforms its peers based on the TTM metric - the FCF yield displayed by YCharts. As I suggested earlier, this may have been why Warren Buffett chose OXY when he was looking for a sufficiently liquid company with high-quality management to invest his money in.

OXY concentrates its development efforts on the high-yield core areas of the Permian Basin and parts of the Middle East. As I've written in previous articles, these areas are the most promising and profitable when it comes to increasing production with high-profit margins.

We also know that Occidental plans to limit its capital spending on low-carbon initiatives to $600 million this year. Hollub highlighted the current lack of external funding for additional direct air capture [DAC] plants beyond the one being built in Texas. Hollub stated that Occidental's production would recover throughout the year following maintenance-related stoppages concentrated in Q1. The company intends to continue repurchasing preferred stock but requires an oil price of $75 per barrel to do so.

And the relative stability of the oil price seems to be more obvious at the moment than it was about a month ago. One of the reasons for this was the news that the Strategic Petroleum Reserve [SPR] could be replenished as early as June, U.S. Secretary of Energy Jennifer Granholm said on May 11, 2023. Earlier the SPR repurchases were expected to begin in Q4 FY2023 after completing maintenance on storage sites in Texas and Louisiana. In the meantime, the administration has been depleting the SPR over the past six weeks, ZeroHedge reports:

ZeroHedge [May 12, 2023], a proprietary source![ZeroHedge [May 12, 2023], a proprietary source](https://static.seekingalpha.com/uploads/2023/5/19/49513514-168447265321651.png)

Even without the upcoming SPR replenishment, oil prices continue to hold above $70/b - and this is despite recession expectations [which I support] being near historic highs.

BofA [May 16, 2023], a proprietary source![BofA [May 16, 2023], a proprietary source](https://static.seekingalpha.com/uploads/2023/5/19/49513514-16844728895481048.png)

What happens if these expectations fall due to an actual recession or a soft landing? These are slightly different scenarios, but given the relative strength of the U.S. economy and the reluctance of the Saudi's to repeat the mistakes of Covid-19, I expect oil prices to recover quickly and continue to rise higher. It's not yet priced in by the positioning of the market's participants, as far as I see:

BofA [May 16, 2023], a proprietary source![BofA [May 16, 2023], a proprietary source](https://static.seekingalpha.com/uploads/2023/5/19/49513514-16844735500172153.png)

As we know, long-term investors like Buffett use temporary difficulties to outperform the market over the long term, not the short term. And the systematic underinvestment in the industry that continues to this day suggests that quality oil companies like OXY will thrive in the long run and reward their shareholders either through buybacks or dividends. The most important thing is strong FCF, and that still puts OXY in the best position among other O&G large-caps.

The Verdict

Of course, OXY's performance is heavily influenced by fluctuations in oil prices, which can result in significant volatility in stock prices, earnings, and cash flow, similar to its industry peers. This risk is unavoidable. It's also important to note that the company does not have substantial production hedges in place to mitigate this risk. Additionally, OXY investors are exposed to trends in global economic growth and interest rates, which can further impact the company's financial performance.

Another risk is the company's debt. As an Argus Research analyst wrote in his May 17, 2023 note [proprietary source], while profits at most E&P companies are benefiting from increased demand, Argus believes that low debt is prudent in a rising interest rate environment and that Occidental's current 41% leverage ratio is too high. They also believe that the liquefied natural gas and offshore assets acquired from Anadarko aren't a good strategic fit for Occidental and that it'll take more time to achieve sustainable revenue and earnings growth from these assets.

However, despite the significant risks outlined above, I believe that OXY will continue to enjoy the support of Warren Buffett's dip-buying activities going forward, as the company remains one of the best FCF generators of its size despite all the headwinds.

Currently, OXY's stock is valued at 12 times FY2023 earnings, and the projected year-over-year EPS decline of nearly -48% seems too pessimistic to me. The company will likely continue to reduce the number of shares outstanding, and thus its EPS should remain more stable than price-in if oil prices remain at current levels or even fall a bit further. I don't expect a significant drop in the oil price though - the many recession expectations failed to drop the price, and now that those expectations are falling off their peak levels [with or without an actual recession], the downward trend seems limited.

I reiterate my previous Buy rating on OXY stock and support Goldman's target of $77 per share.

Thank you for reading! Please, let me know what you think in the comment section below!

Struggle to navigate the stock market environment?

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% - hurry up!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in OXY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.