Snowflake: Upside Potential Does Not Outweigh Uncertainty

Summary

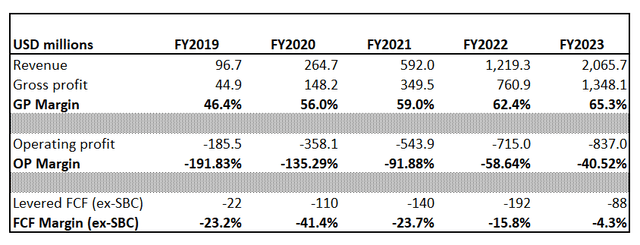

- Snowflake has delivered a staggering 85% revenue CAGR over the last five years with profitability metrics improving significantly.

- The company's revenue is expected to grow at a 28% CAGR until 2030, which I consider a very aggressive trajectory with little evidence to support this optimism.

- My valuation analysis suggests the stock is slightly undervalued, though the uncertainty over underlying assumptions is enormous.

Liudmila Chernetska/iStock via Getty Images

Investment thesis

Snowflake (NYSE:SNOW) has delivered massive revenue growth since the company went public, with margins improving rapidly. The company's balance sheet is vital as well. But I prefer not to invest at current levels since I consider consensus estimates for revenue growth as very aggressive and with little certainty. The valuation analysis with aggressive assumptions suggests there is just a 3% upside which I consider not worthy, given the level of risk and uncertainty. Moreover, my sensitivity analysis for the valuation model also suggests that SNOW stock's fair value can go substantially lower if insignificantly, less optimistic long-term revenue projections are implemented.

Company information

Snowflake is a software company that offers the "Data Cloud" network where customers can consolidate data into a single source to support a variety of ways for data usage. The platform is delivered as a service. According to Morningstar, the company has over 3,000 customers, including about 30% from the prestigious Fortune 500 list of companies.

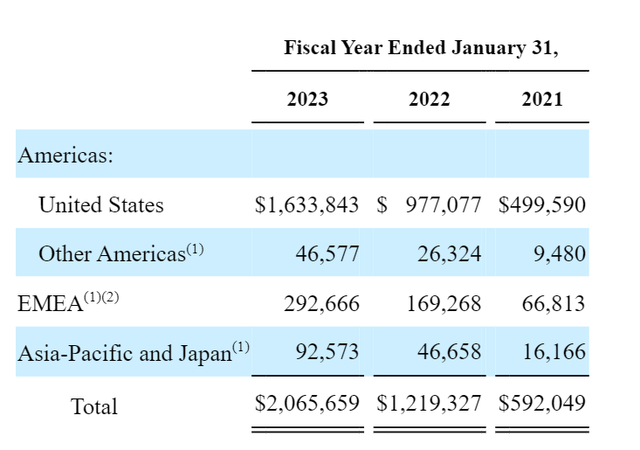

The company's fiscal year ends on January 31. SNOW comprises a single operating and reportable segment, though the company disaggregates its sales by geographic area. In FY 2023, about 80% of the company's revenues were generated in the U.S.

Snowflake's latest 10-K report

Financials

SNOW went public relatively recently, in September 2020. Thus horizon of my analysis of historical performance would be shorter than usual. The company delivered a staggering 85% revenue CAGR between FY 2019 and FY 2023, with gross and operating margins expanding significantly. The company looks far from breaking even in terms of operating profits, with a negative 40% operating margin last year.

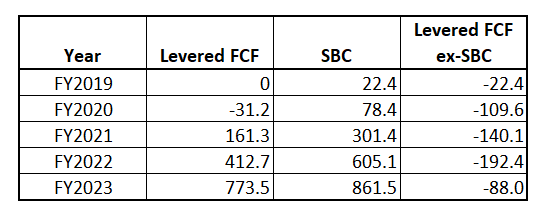

Levered free cash flow [FCF] also improved significantly. It has been positive for many quarters, but stock-based compensation [SBC] has also been significant. Below is the breakdown of levered FCF with SBC deducted to better understand the FCF-to-SBC relationship.

Author's calculations

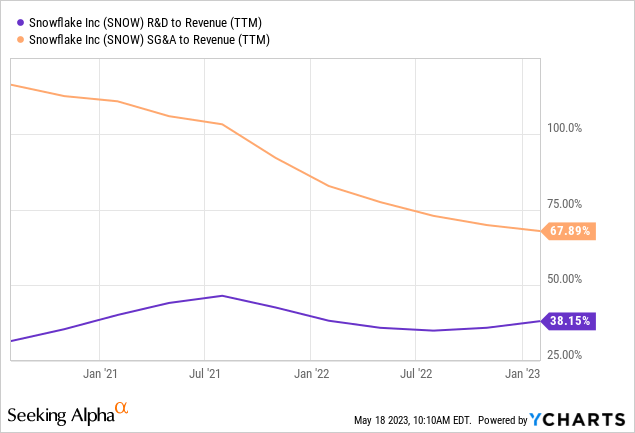

The company's balance sheet is strong, with a firm net cash position and high liquidity ratios. There is little doubt that the company has a lot of room to continue investing in R&D and marketing, which historically represented significant amounts of revenue. The good sign is that SG&A is in a downtrend as the company's revenue scales up, though I consider that spending more than two-thirds of the company's revenues is a massive proportion. I believe there should be a lot of room to optimize SG&A in the future.

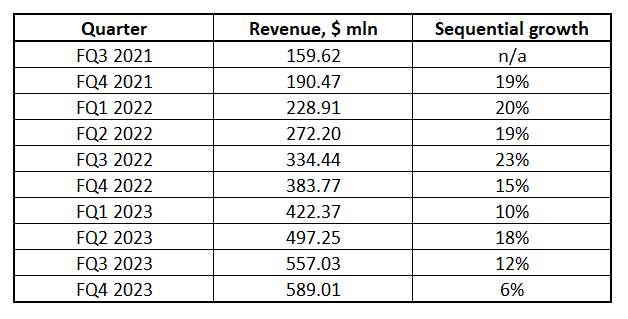

If we look at the recent quarter's earnings summary, we can see that revenue growth decelerates substantially as higher comps become more challenging to beat. The company rarely misses consensus forecasts, by the way. The table below shows that the last quarter was the first since SNOW went public when the company demonstrated sequential revenue growth of single digits. It is an apparent sign of decelerating growth pace, apart from the company's challenging macro environment.

Author's calculations

Despite decelerating revenue growth, I believe Snowflake has more than enough fuel and is well-positioned to continue demonstrating impressive revenue growth and improving margins. The question is whether the actual future growth rate would be enough to prove the current valuation. Let me now move to the Valuation section of the analysis.

Valuation

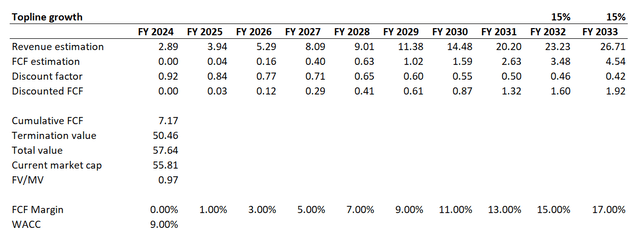

Discounted cash flow [DCF] approach is the best fit to execute valuation analysis for a growth company like SNOW. I prefer to be conservative in my valuation calculations, so I round up WACC provided by valueinvesting.io up to 9%. If we speak about future free cash flows, vast uncertainty arises. Consensus estimates project revenue to grow at a 28% CAGR up to 2030, which I consider very aggressive. Of course, some readers of this article might argue that 28% CAGR is doable given the historical revenue CAGR of 85%. But, I consider the given historical track record as short and shorter than the estimated horizon. Also, as the company's revenue scales up, comps become much higher, and it is natural that the growth rate will start to decelerate rapidly once the company gets closer to its maturity. The FCF margin also looks tricky given that historical analysis suggests the company did not deliver sustainable FCF ex-SBC, though it is close to breakeven. Therefore, I expect the FCF margin to be 1% in FY 2025 and to expand 200 basis points yearly as the company's margins expand.

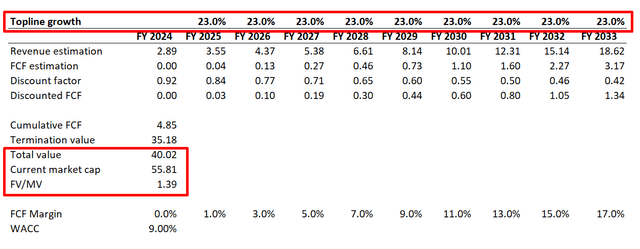

Incorporating these aggressive assumptions into the DCF model gives a fair value that is close to the current market cap, indicating tiny room for an upside at these levels. But I would like to also demonstrate what happens to fair value when we implement a less aggressive revenue growth trajectory. With topline, CAGR over the next decade decreased from 28% to 23% and other assumptions remaining unchanged, the fair value deteriorates significantly.

Under these moderated but still aggressive assumptions, the DCF suggests that the stock could be about 40% overvalued if the company fails to sustain a 28% revenue CAGR.

Based on my DCF analysis, I cannot conclude that the stock is attractively valued. Given the vast uncertainty related to underlying assumptions, I would prefer to have high-double-digits upside potential to decide to invest.

Risks to consider

The first risk is directly linked to the "Valuation" section above. The company's current substantial above $50 billion market cap is primarily based on a very aggressive revenue future growth rate. Currently, it is priced in that SNOW's revenue is expected to grow ten-fold over the next eight years, which is a very challenging task. Any doubts from the market about the company's ability to deliver such rapid growth will significantly hit the share price. The company's growth might develop exceptionally well, say at 20% CAGR over the next decade, but it still would not be enough to match the current generous valuation of the stock.

As a software company, Snowflake faces significant risks of technology obsolescence and cybersecurity threats. Any signs of falling behind competitors in technological advancement or security will severely undermine the company's brand. If customers start perceiving Snowflake's offerings as inferior to competitors, the company will start losing market share, harming SNOW's long-term growth prospects.

Last but not least, when you operate in a rapidly growing software segment, there is no guarantee that behemoths like Amazon (AMZN), Google (GOOGL), or Microsoft (MSFT) will miss the opportunity to bite this pie. I consider this risk as remote with low likelihood, but if it unfolds, adverse consequences would be massive for Snowflake.

Bottom line

Despite Snowflake managing to deliver mind-blowing revenue growth over the last five years, I believe that the current valuation is not looking attractive given the very optimistic revenue growth projection priced in. I have this stock in my portfolio as part of my tiny 'potential moonshots' allocation and at a much lower price. At current levels, I would neither invest nor sell. Thus, the stock is a hold for me.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.