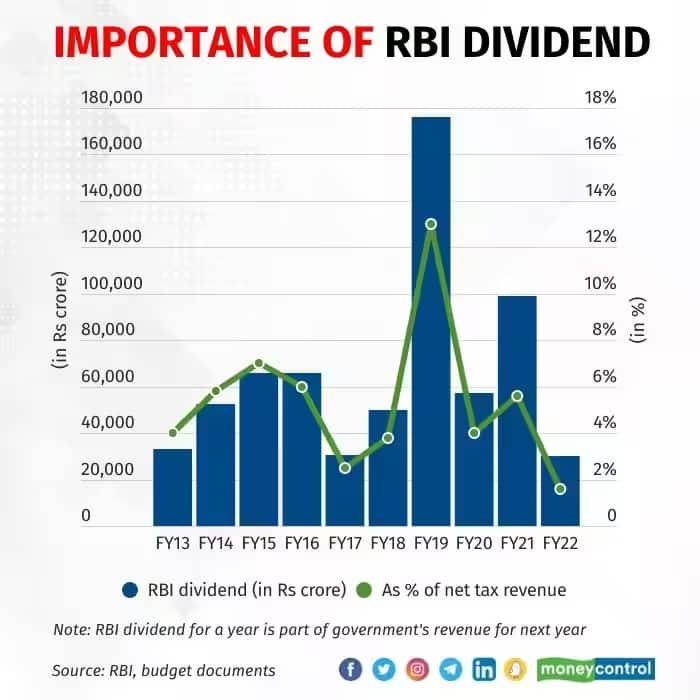

Over the years, the RBI's dividend has become a major source of revenue for the central government.

The Reserve Bank of India's (RBI) Central Board of Directors has approved the transfer of Rs 87,416 crore as surplus to the Central government for 2022-23. The board also decided to raise the Contingency Risk Buffer to 6.00 percent from 5.50 percent, the RBI said on May 19.

"The Board in its meeting reviewed the global and domestic economic situation and associated challenges including the impact of current global geopolitical developments. The Board also discussed the working of the Reserve Bank during the year April 2022–March 2023 and approved the Annual Report and accounts of the Reserve Bank for the accounting year 2022-23," the central bank said in a statement.

The dividend for 2022-23, transferred in 2023-24, is sharply higher than what the government had expected to receive. In the 2023 Budget, the government had estimated it would get Rs 48,000 crore as dividend from the central bank and state-owned lenders in 2023-24.

Moneycontrol had reported back in January that the Centre can expect a hefty dividend from the RBI this year even though 2022-23 was a bad year for the central bank's investments. With global interest rates rising sharply in 2022-23, the RBI would have faced unrealised losses on its holdings of foreign as well as rupee securities.

The price of a security – for instance, a US government bond – falls as the yield on it rises. For 2021-22, the RBI was forced to make a provision of Rs 1.15 lakh crore towards its Contingency Fund on account of the hit its investments in foreign securities took because of higher interest rates globally. This led to the central bank transferring a dividend of only Rs 30,307 crore for 2021-22 in May 2022, well below the budgeted estimate of Rs 73,948 crore.

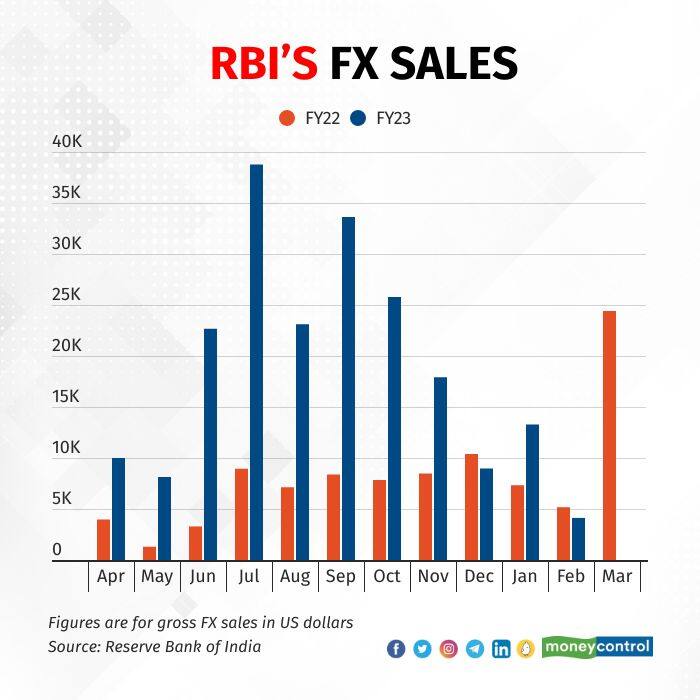

However, the RBI's dividend for 2022-23 jumped sharply likely on account of the massive foreign exchange gains it earned from its sales of foreign currency.

Over the years, the RBI's dividend has become a major source of revenue for the government, rising from Rs 33,010 crore for 2012-13 to Rs 1.76 lakh crore for 2018-19 following a change in the central bank's economic capital framework in August 2019.

The rise in the dividend followed the RBI's acceptance of the recommendations of the Bimal Jalan-led expert committee.

Foreign exchange gains

The RBI generates a profit on its foreign currency sales on account of the sale price being higher than the historical average acquisition cost. Economists peg the historical average acquisition cost of the RBI's foreign currency holdings in the range of Rs 62-65 per dollar.

Meanwhile, the rupee's median monthly exchange rate against the US dollar ranged from 76.2 to 82.7 in 2022-23. As such, every dollar sale over the year would have generated a substantial profit.

As per latest RBI data, the central bank had sold foreign currency worth $206.41 billion in the first 11 months of 2022-23.

In contrast, its sales had amounted to $96.68 billion in all of 2021-22. However, this was enough to give the RBI a foreign exchange gain of Rs 68,991 crore. Considering the RBI's gross foreign currency sales in April 2022-February 2023 were more than double the number for 2021-22, the foreign exchange gain could be close to Rs 1.5 lakh crore.

The exact details on the RBI's provisions and foreign exchange gains will be available when the central bank publishes its annual report, which could be as early as next week.