Cenovus Energy's Shareholder Distributions Are About To Soar

Summary

- Cenovus Energy is a Canadian oil major with efficient production, substantial oil reserves, and a focus on reducing debt.

- The company is expected to reach its net debt target by the end of this year, unlocking a wave of cash for shareholders through dividends and potential buybacks.

- CVE's strong financial position and potential for significant free cash flow make it an attractively valued investment opportunity in the energy sector.

Bet_Noire

All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

It's time to discuss a Canadian oil major I haven't discussed in the past. Calgary-based Cenovus Energy (NYSE:CVE) is one of the nation's largest integrated energy companies, producing oil and turning it into value-added products in its many refineries.

Because of its relatively low dividend yield and abysmal past performance, I didn't care for it. I mainly focused on healthier oil drillers.

However, CVE is turning its business around. The company is an efficient producer of oil, it has huge high-quality oil reserves, and it's close to changing its capital plan thanks to the high likelihood of reaching its net debt target by the end of this year.

The company is close to unleashing a wave of cash on its shareholders, which should benefit its underperforming stock price.

Now, let's dive into the details!

What's CVE?

With a market cap of $41.5 billion, Cenovus is one of North America's largest energy companies.

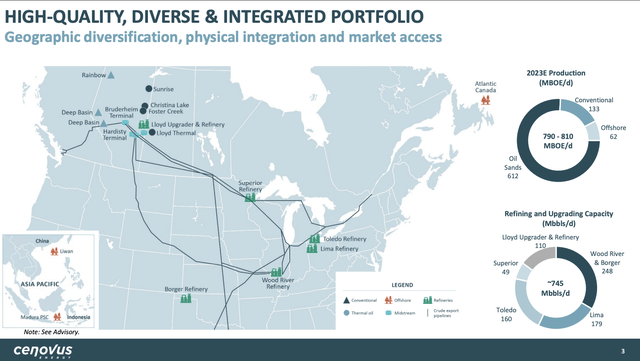

The company operates in Canada, the United States, and the Asia Pacific region. Its operations include oil sands projects in northern Alberta, thermal and conventional crude oil, and natural gas projects across Western Canada, as well as crude oil production offshore Newfoundland and Labrador.

The company is also engaged in natural gas and liquids production offshore China and Indonesia. In addition, Cenovus's downstream operations include upgrading, refining, and marketing activities in both Canada and the United States.

This year, the company estimates to produce roughly 800 thousand barrels of oil equivalent per day. Almost 80% of these volumes are expected to be extracted from Canada's oil sands.

Its total refining capacity is roughly 745 thousand barrels per day.

Furthermore, the company has more than 30 years' worth of inventory, which reduces the risks of running out of high-quality inventory, which is an issue facing the growth engine of oil supply of the past decade, as I discussed in this article (among others).

Additionally, the company is breakeven at US$45 WTI. This includes its base dividend. Its base dividend yield is currently 2.6%.

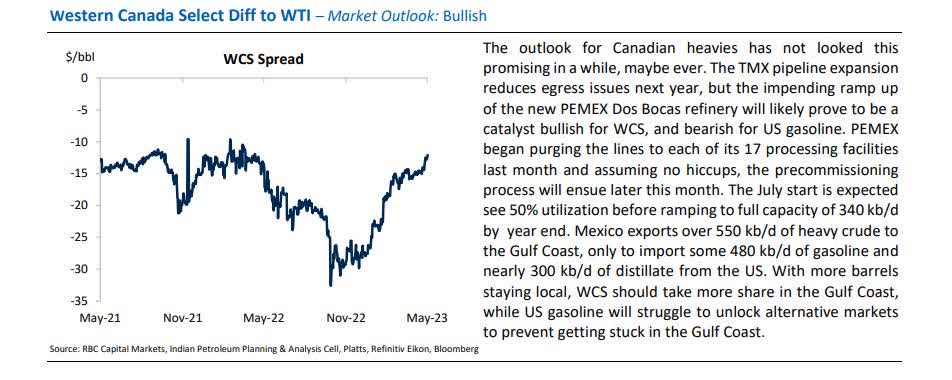

I also need to add that Canadian heavy oil is increasingly looking attractive, as explained by RBC Capital Markets. The company highlighted an improving WCS spread, which indicates better pricing for Canadian producers.

RBC Capital Markets (Via Twitter @garquake)

This was confirmed by Cenovus during its 1Q23 earnings call.

[...] differentials have now really narrowed in and the spread between condensate and WCS has also narrowed. So, all of those are now moving over into tail winds. And we have seen the realizations significantly improve over the past couple of months.

CVE Is Becoming Attractive

I have become a big fan of Canadian equities. I own Canadian Pacific Kansas City (CP), and I like most of its infrastructure/energy companies. This includes Canadian Natural Resources (CNQ), which I covered in a recent article.

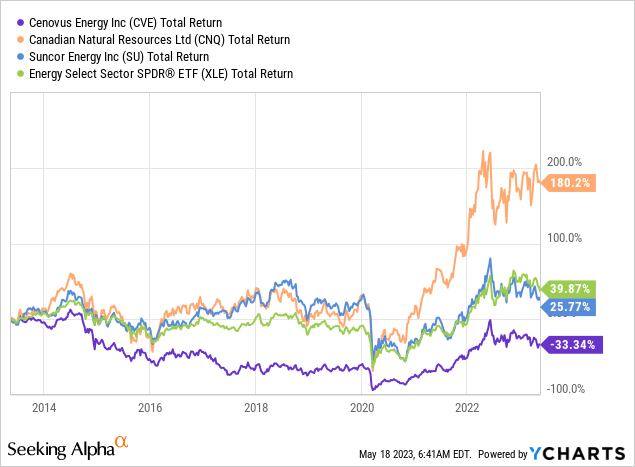

When looking at the New York listings of the three Canadian energy heavyweights with upstream operations, we see that Cenovus has been a total disappointment. Over the past ten years, shares returned negative 33%. This includes reinvested dividends. CNQ returned 180%. Suncor (SU) slightly underperformed the US-focused Energy Select Sector ETF (XLE).

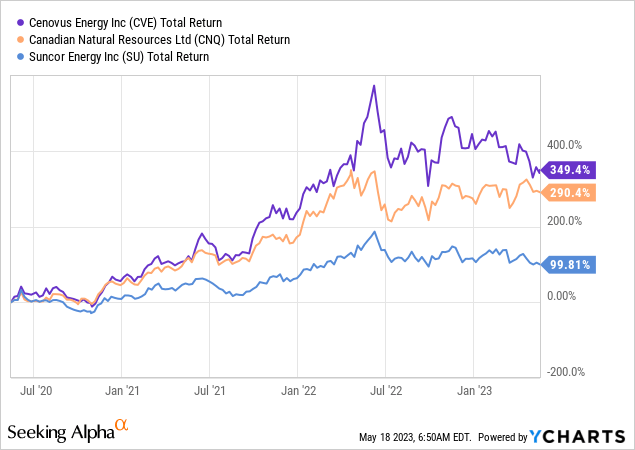

The good news is that CVE has outperformed its Canadian peers since the pandemic. Shares have returned close to 350%, which is well above CNQ's already stellar 290% return.

One key reason behind the stock's rally (besides rising oil prices) is its dedication to boosting shareholder returns.

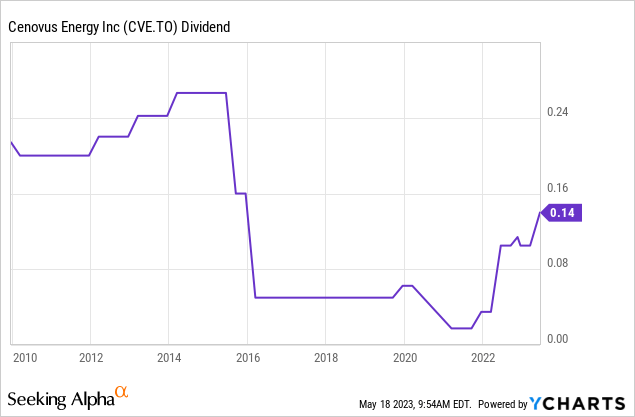

I already briefly mentioned that CVE is breakeven at US$45 WTI. This also covers its base dividend of currently 2.6%. This yield is based on its quarterly dividend of $0.14. This dividend is one of the highest it has been in many years and the result of a 33.3% hike in April.

Unfortunately, the company is not a consistent dividend grower like some of its peers, which is a reason why investors dumped the stock prior to the post-pandemic surge in oil and gas prices.

Now, this is about to change.

CVE enjoys a healthy balance sheet with only $8.7 billion in long-term debt, no significant maturities until 2027, a weighted average bond maturity of 14.1 years, a 0.4x net leverage ratio, and a BBB- credit rating.

This means that the company is now increasingly focused on shareholder distributions, which include direct distributions through dividends and indirect distributions using buybacks.

The company's capital allocation priorities are very clear:

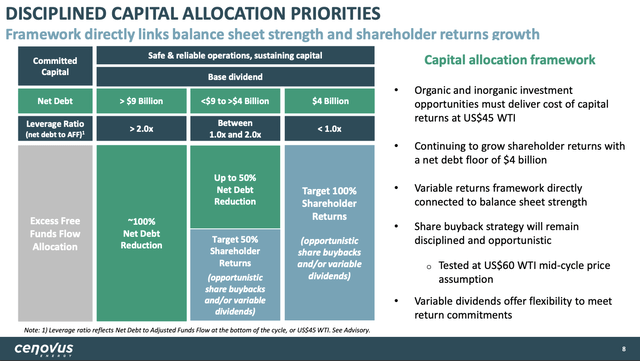

- Safe, reliable operations need sustaining capital. This one is obvious. Without secure maintenance CapEx, its business will slowly but steadily fall apart.

- Net debt reduction. The company aims to maintain a healthy balance sheet, which protects investors and related stakeholders against financial distress. This, too, is obvious.

- Shareholder distributions.

What's interesting is that CVE is in a transition. The company is now rapidly lowering debt, which allows it to accelerate shareholder distributions.

Using the overview below, we see that the company has a clear game plan that shows how much capital will be spent on debt reduction versus shareholder returns.

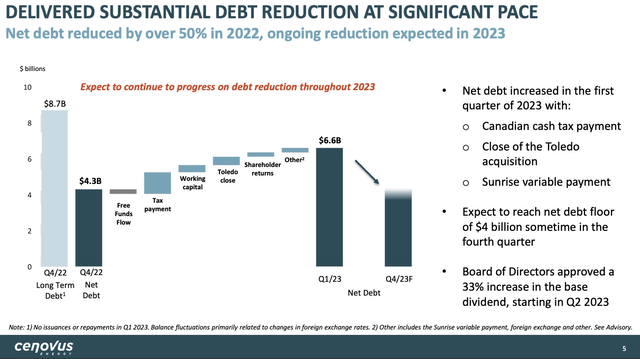

In 1Q23, the company did not buy back any shares, as it had to deal with a net debt increase of $2.3 billion to $6.6 billion.

In addition to (temporary) tax headwinds, the company acknowledged that its first quarter had been challenging and fell short of its own standards.

The ongoing costs of restarting the Toledo and Superior refineries had an impact on margins in the US Downstream segment. Additionally, non-operated refineries Wood River and Borger performed below expectations, further affecting cash flow and earnings.

Also, unplanned downtime at Wood River, related to a December incident, resulted in significant costs and obligations for finished products.

The Sunrise deal alone added $460 million to its net debt.

Having said that, the company expects a quick reduction in net debt.

Given where we are today and assuming commodity prices remain around current levels, we expect net debt to fall below the $4 billion floor in the fourth quarter.

This means that by the end of this year, the company could distribute up to 100% of its free cash flow if oil prices refrain from imploding. This is a big deal and will come with gradual yet strong growth in its base dividend and buybacks instead of special dividends.

According to the company:

[...] we do prefer share buybacks than variable dividends.

And right now at this kind of share price, we are well below our target level for share buyback and we would be alive to the opportunity that would present as long as we are at this kind of share price level.

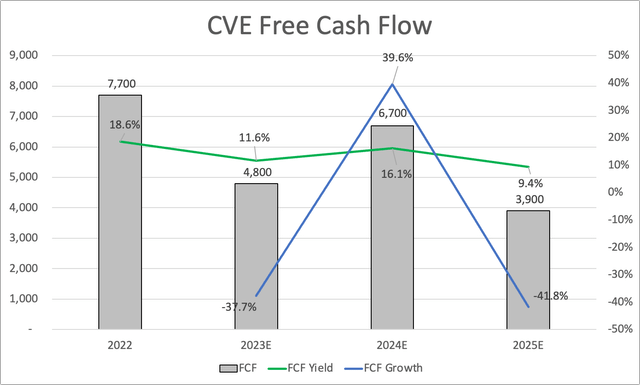

The good news continues, as the company is expected to generate a lot of free cash flow. Based on current oil prices (and normalization in the future - I disagree with that), the company is in a good spot to generate high, double-digit free cash flow yields.

This would indicate that there is a lot of room to hike the dividend and buy back shares rather aggressively.

Hence, CVE was able to outperform its peers, despite the fact that it is not yet able to keep up with peer dividends and buybacks.

These numbers also indicate that CVE is attractively valued.

Its current share price in New York is $16.20. The consensus price target is $22.60. I agree with that and believe that CVE could rise much higher on a long-term basis if my oil bull case comes to fruition. As I explain in articles like this one, I expect oil prices to trade above $100 on a prolonged basis once economic demand bottoms.

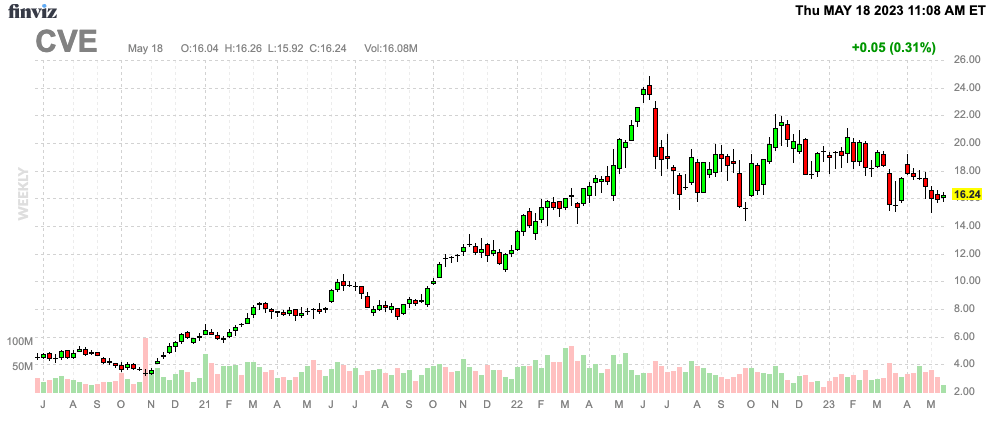

FINVIZ

Furthermore, as much as I like CVE, I still prefer CNQ, as I like its focus on special dividends. I prefer direct shareholder distributions over buybacks - at least in the energy industry.

I'm not saying this to get people to sell CVE. It's just my opinion and an explanation of why I do not own CVE shares. I also don't own CNQ shares, but I'm working on changing that.

Takeaway

Cenovus Energy, a Canadian oil major, has undergone a turnaround and is now an attractive investment. With efficient production, substantial oil reserves, and a focus on reducing debt, CVE aims to deliver value to shareholders.

It is expected to reach its net debt target by the end of this year, which will unlock a wave of cash for shareholders. This, combined with its commitment to boosting shareholder returns through dividends and potential buybacks, has contributed to its recent outperformance.

The company's strong financial position and potential for significant free cash flow make CVE attractively valued, offering a compelling opportunity for investors in the energy sector.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.