U.S. Default And De-Dollarization: It's Really Not What People Think

Summary

- There's a lot fear, uncertainty, and doubt being passed around in light of the debt ceiling and de-dollarization.

- These responses are mostly unreasonable. And history shows why. Either way, the U.S. enjoys a TINA - there is no alternative - status that makes the USD's status quite resilient.

- I argue why the current narratives around dollar replacements are mostly far-fetched.

- The U.S. is facing declining credibility. Unfortunately, paying the debt is the only way out of this. TINA is helpful for now.

photoschmidt

This article’s purpose is to present a view about the current situation of the U.S. debt ceiling and the U.S. Dollar. The main point is that the mainstream narratives are overly pessimistic or ignorant. Here are a few of the myths being perpetuated in the media:

- This would be the first time the U.S. defaults – Absolutely wrong. The last U.S. default happened in 1971 when President Nixon “temporarily” suspended the convertibility of USD to gold.

- A default would have “catastrophic consequences”– Most likely wrong. U.S. financial markets presently enjoys the TINA – there is no alternative – status. The U.S. economy is well placed to be self-sufficient too.

- “BRICS Currency” or something else will replace USD – This is probably not going to happen anytime soon. It’s helpful to consider the game theory here.

- A resolution in Congress will solve the problem – Absolutely wrong. Everything besides paying off the debt decreases U.S. credibility and creates more problems later on. The U.S. economy enjoys TINA for now but this should not be taken for granted.

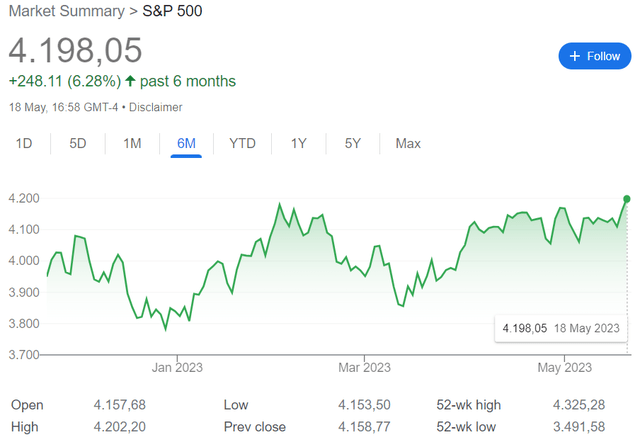

At any rate, the totality of what is going on seems mildly bullish for the S&P 500 Index (SP500) with an elevated probability of a big move either up or down. The choppy, range-bound trading action over the last month implies an indecisive market which is awaiting a clearer path forward. Let’s get into how all this debt stuff affects the U.S. equity indices.

S&P 500 6 months (Google Finance)

The First Default And Its Consequences

My favorite story about the end of the Bretton Woods currency system is Ray Dalio’s personal anecdote as a 23-year old on the floor of the New York Stock Exchange right after Nixon announced the U.S. would close the gold window. Dalio, expecting markets to crash, was instead amazed that stocks soared the next day. He states that as he learned more about macroeconomic history, including previous currency devaluations and debt restructurings, he began to understand what happened in 1971.

Closing the gold window was in fact the first time the U.S. defaulted since becoming a global power. Bretton Woods established that USD would be convertible to gold at a fixed rate while other currencies would be pegged to the dollar. Dollars were effectively debt instruments – an asset to owners but clearly a liability to the U.S. government.

In order to finance massive projects like the Korean War, Vietnam War, the Great Society, and many other things, America began printing more dollars than there were gold to back it. People realized the U.S. could not possibly pay them back in gold at the agreed upon rate, so they rushed the gold window. At this point, Nixon realized what was going on and defaulted on U.S. liabilities by closing the gold window. In the announcement, he said this:

In recent weeks, the speculators have been waging an all-out war on the American dollar. The strength of a nation's currency is based on the strength of that nation's economy--and the American economy is by far the strongest in the world.

Over half a century later, the USD’s preeminence remains relatively unchallenged – a strong testament to the truth in Nixon’s statement. The dollar continued to devalue against gold, but it also remained the primary currency used to settle international transactions because the U.S. economy is the powerhouse which cannot be ignored.

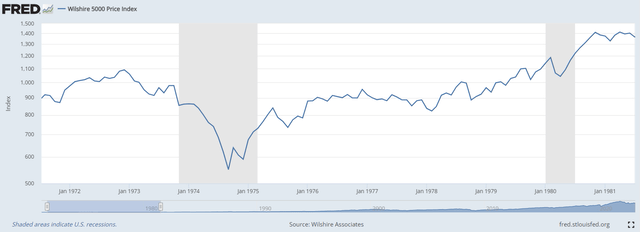

Stocks crept higher for about 15 months after the default in August 1971. The Wilshire 5000 rose about 18% (from 919 to 1090) over the next 15 months before reversing course due to other economic issues.

Wilshire 5000 in the 1970s (FRED)

We don’t know if the subsequent decade of inflation was directly caused by coming off the gold standard because there is no counterfactual. But there were other factors like increased government spending and energy shortages which would certainly contribute to raising prices even if money supply remained constant. For instance, 1973 saw the beginning of an oil embargo which contributed to a stagflation environment for the next few years. In 1979, the Iranian Revolution contributed to other oil supply disruption.

The takeaway from this default is that, though it was a serious and important event, it didn’t really spook markets the way one may be inclined to think. The alarmists today seem to be making a similar and understandable mistake, not unlike Ray Dalio’s reaction 52 years ago.

What Is The Situation Today?

While there are some differences today, the things relevant to this analysis are mostly the same. The U.S. is still the world’s undisputed economic power. Moreover, the depth of the U.S. financial markets are truly an indispensable component of the global financial system. The reality is when things become unstable, people all over the world turn to the dollar and to American securities.

By securities, I certainly mean treasuries, or “U.S. government debt,” but I also mean American equities and corporate debt. A U.S. government default does not directly impact the utility which American companies, and the American economy as a whole, produces. People will still eat, take medication, drive cars, rent homes, travel, enjoy entertainment, use software, buy shoes, etc. American companies which provide these goods and services will remain valuable. The equity indices comprised of these companies will remain valuable.

There simply is no alternative that is evidently better. Warren Buffett famously said that he has never experienced a time when a long term bet against America made sense. He also stated that the stocks one should own should be companies one would be comfortable with holding even if the markets were closed for the next ten years. This last statement is even more important than the first.

If we asked informed people from anywhere in the world to pick a single country’s equity index which they would hold even if markets were closed for the next ten years, I am sure most people would name the S&P 500 Index (SP500) or Dow Jones (DJI), and that most people would expect others to name that as well. This is why there is no alternative, and this simple thought experiment drives home the point. Even if you personally would not hold the S&P 500, you probably would expect that other people would choose the S&P 500.

It’s the same exact principle with the USD. Even if the U.S. government defaults on some portions of the debt, people will simply look at what they assume is an approaching economic calamity, consider their best option, and then switch their local currency to dollars to buy U.S. securities, albeit perhaps not from the U.S. government this time.

What people are failing to understand is that the USD is not backed by nothing. Treasuries are backed by “full faith and credit,” but they are really backed by the money printer, and this is not nothing either. USD, like all currency, is backed by the cumulative economy which accepts the currency as a medium of exchange. Nothing more. Currencies do not need anything more (and they certainly do not need gold or silver). The US economy shines the brightest, so the USD will prevail as long as the U.S. economy uses USD. The money printers backing treasuries are simply tools which guarantee the creation of more USD if the U.S. government decides such a measure is necessary.

This brings us to the next point, which is the general buzz about de-dollarization, a BRICS currency, hyperbitcoinization, petroyuan, and any other expectation for a dramatic replacement of the dollar.

Why De-Dollarization Won’t Happen Anytime Soon

The simple answer is that financial markets are integral to the world economy and the U.S. has the best financial markets in the world by far. People from all over the world trade through American stocks and derivatives exchanges. Liquidity begets liquidity, and the result is a flywheel effect where all the serious financial stakeholders, no matter where they are, participate in the U.S. markets. To do so, they need USD.

Here’s an example. It is possible to use local currencies to import or export oil. But when you want to use oil futures to hedge your exposure to the price of oil, you are now in need of a financial market (in this case a derivatives market) which will likely be linked to the U.S. markets and require someone to obtain dollars. Similarly, hedging currency risk requires a liquid market of forex pairs and corresponding derivatives. Liquid markets without dollars require liquidity to be redirected from incumbent dollar-denominated markets to a less liquid, and thus less efficient, non-dollar venue. Why would a market maker do this without other incentives? This is really just a reflection of the dollar’s rock-solid network effect. USD is too entrenched into the inner workings of the global financial system to be frivolously replaced.

On top of providing a robust financial infrastructure which services the entire world, the U.S. retains a vast landmass with abundant natural resources. The two largest oceans serve as a natural protection against kinetic conflicts which could jeopardize U.S.-based physical infrastructures. America can be entirely self-sufficient as a nation if it had to be or chose to be. Trade is just more profitable due to the principle of comparative advantage, which any undergrad will learn in Introductory Economics. This strong foundation means that the American economy, the de facto backing for the USD, is not going anywhere.

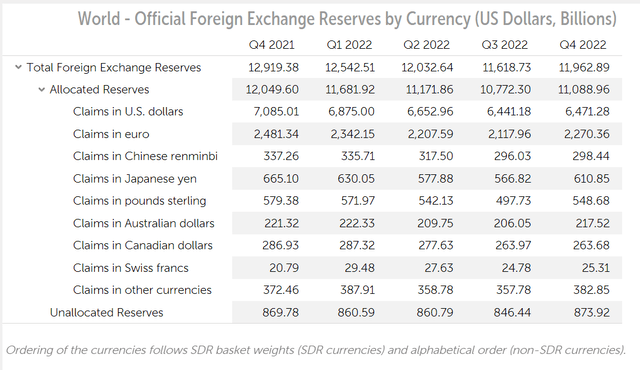

The next point is that, like the point with U.S. securities, there is no clear alternative to the USD. The best replacement candidate today would be the Euro, based on forex reserves. The next would be the Japanese Yen, followed by the British Pound. These options are all closely linked, economically and politically, with the U.S.

The actual rivals people bring up are the Chinese Yuan (or Renminbi, or RMB). The RMB poses absolutely no threat to the USD because China has capital controls, which is an immediate disqualifier for serving as a global financial infrastructure. Even if we ignored the fact that USD holdings in reserves are over 20x bigger than RMB reserves, people can’t use RMB freely. So why would they switch to that when they can use USD freely?

BRICS is probably the de-dollarization narrative that is getting the most attention nowadays. The issue with a BRICS currency is like the issue with RMB. But it is probably far worse. BRICS countries – Brazil, Russia, India, China, South Africa – are so culturally, politically, and economically different that the cooperation to even agree on a common currency would be a miracle. Then, there is the question of ongoing and continued cooperation on issues like monetary policy. Member countries must surrender some monetary sovereignty, which will expose each individual country to idiosyncratic shocks which cannot be corrected using traditional methods. The game theory here is like the prisoner’s dilemma. If the countries collectively agreed to use a common currency between them and follow through on their commitments, they might be able to unlock a high level of economic synergy that would otherwise never have occurred.

However, each individually country has an incentive to “cheat” by selectively adhering to only some of the agreed upon economic terms. For instance, if the countries agreed to phase out their respective national currencies, anyone who retains a national currency could still have some advantage offered by sovereign monetary policy. The result may well be that the shared currency does not gain much traction because everyone is cheating.

Perhaps the biggest challenge to a BRICS currency is that they would need to build the financial system infrastructure. This is not as simple as it sounds. Securities regulations are used to instill confidence in the fairness of financial markets. A bloc comprised of so many differences in politics and cultures will find a difficult time coming to consensus about such regulations.

Also, financial markets require market makers and a centralization of liquidity. Otherwise, people won’t feel comfortable transacting. In U.S.-based markets, market makers are generally specialized firms which devote significant resources to posting appropriate quotes on exchanges. Market makers tend to prefer assets which can be arbitraged so they can offload risk in creative ways while earning additional returns. This is another big issue because arbitrage requires short selling, and many of the BRICS countries have restrictions on these practices. It wouldn’t make economic sense for a market maker to provide liquidity to an isolated BRICS market.

Finally, there’s “hyperbitcoinization,” a term used among Bitcoin maximalists to describe a point where everything becomes priced in satoshis. I describe an undermentioned bullish Bitcoin thesis here, but overall, I think hyperbitcoinization cannot kick off under Bitcoin’s current financial infrastructure. It’s the same issue with the BRICS currency – the infrastructure does not exist and would be hard to build. Admittedly, I think a cryptocurrency-based infrastructure would be easier to build than a BRICS currency infrastructure, and much of DeFi is suggestively approaching some major breakthroughs in this field.

So USD Is Safe For Now, But Where Is The Limit?

No one knows where the limit is. No one, however, except the serious modern monetary theorists, believes this current charade can go on forever. U.S. supremacy is weaker than it was in 1971. We are seeing the very early stages of a multi-polar world.

Every action other than actually paying down the national debt reduces U.S. credibility. However, the raw level of credibility is not what matters in financial markets. Rather, opportunity cost and alternatives are what matters. Stocks fall when rates rise because the alternative to a riskier return just became more attractive. Lacking a better alternative, the world will continue to look to America and the USD, default or not, petrodollar or not, soft landing or not.

So the breaking point is really whenever a clear and attractive alternative emerges. But America still has a long path ahead, a lot of credibility, a very strong foundation, and plenty of time to make good decisions.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.