Can Meta Platforms Stock Reach $300 In 2023?

Summary

- Meta Platforms stock has almost doubled in 2023 aided by the improving sentiment toward tech stocks, aggressive cost-cutting measures, and the company's focus on generative AI.

- According to data compiled by Seeking Alpha, 30 out of 57 analysts covering the company have a Strong Buy rating on the company today.

- Investors need to evaluate Meta's recent financial performance, earnings revision trends, and the long-term outlook to determine whether Meta stock will hit the $300 mark this year.

- I do much more than just articles at Beat Billions: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Derick Hudson

Meta Platforms, Inc. (NASDAQ:META) stock, after underperforming the market and many of its Big Tech peers for more than a year, has almost doubled this year amid the improving sentiment toward tech stocks, aggressive cost-cutting measures, and the company's focus on generative AI.

Meta's ambitious plans for building a metaverse, a virtual interactive world, added pressure to its financial performance last year. While there was initially a lot of excitement and hype around the concept of an immersive future Internet after Meta's announcement, interest quickly waned. With the rise of generative AI, Meta started shifting its focus toward this technology. The company recently introduced an ad software suite called AI Sandbox, which utilizes generative AI to assist advertisers. This move positively impacted the market sentiment toward Meta, resulting in a 2% increase in its stock price the day it was announced. Additionally, during the first quarter of 2023, the company posted better-than-expected earnings, finally sending a positive earnings signal after more than a year of grappling with metaverse-related costs.

After evaluating the recent financial performance of Meta, earnings revision trends, and the long-term outlook for the company, I believe META stock is well on its way to hitting the $300 mark later this year.

What Are Current Analyst Price Targets?

Analysts are increasingly turning optimistic about the future of Meta Platforms with the company taking a measured, cautious approach toward metaverse investments. Loop Capital analyst Rob Sanderson upgraded his rating on META from Hold to Buy on May 15 and increased his price target from $220 to $320 citing a “much brighter revenue picture”. He was particularly optimistic about the growth of Reels and the promising monetization opportunity.

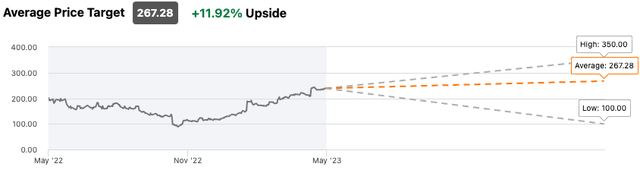

According to data compiled by Seeking Alpha, 30 out of 57 analysts covering the company have a Strong Buy rating on the company, and the average price target comes to $267.28.

Exhibit 1: Average META price target

Although I am not a fan of relying on Wall Street price targets to make investment decisions, there is no harm in monitoring Wall Street activity as analyst actions could turn out to be market-moving events.

What Is The Long-Term Outlook?

To assess the long-term outlook for Meta, investors need to evaluate the prospects for the company from a few different angles.

I continue to remain positive about the long-term outlook for Meta with the advertising market picking up and the company’s investments in generative AI expecting to drive ad growth. In the first quarter of 2023, Meta reported a surprise increase in revenue to $28.64 billion, a 3% year-over-year growth. Net income stood at $5.71 billion, a decline of 24% compared to the same period last year.

In the realm of advertising, Meta has recently introduced the AI Sandbox, a testing playground for advertisers to experiment with generative AI-powered ad tools. Generative AI is a branch of Artificial Intelligence that focuses on producing new content from existing data, such as text, images, audio, or video. Generative AI can help advertisers create more personalized, relevant, and engaging ads for their target audiences, as well as save time and resources by automating some of the creative processes. The AI Sandbox currently includes three features: Text Variation, Background Generation, and Image Outcropping. Text Variation generates multiple versions of ad copy based on a given text prompt, allowing advertisers to choose the best message for different segments of their audience. Background Generation creates background images from text prompts, enabling advertisers to test different visual elements for their ads. Image Outcropping adjusts creative assets to fit different aspect ratios across various mediums, such as stories and reels on different social platforms. Meta plans to test the AI Sandbox with a select group of advertisers before opening it up for general availability in July 2023. Meta also expects to add more features to the AI Sandbox in the future, such as video generation and audio synthesis. Meta hopes that the AI Sandbox will help advertisers build ads more efficiently and improve their campaign results.

In February, CEO Mark Zuckerberg announced that 2023 would be the company’s “year of efficiency.” To improve efficiency and streamline operations, Meta plans to implement new cost-cutting measures on top of the strategic decisions that have already been taken. These measures include possible layoffs – the company has already laid off approximately 21,000 employees since late last year. As a long-term-oriented investor, I am not a huge fan of aggressive cost-cutting measures as I fear the company might have to play catch-up in the future to attract high-quality talent. On the other hand, as a growth investor, I prefer investing in companies that continue to pursue growth opportunities even when faced with adverse economic conditions. I am, however, not suggesting that a company should not optimize its cost structure to drive earnings growth. I am keeping a close eye on Meta's cost-cutting measures to identify whether the company can improve the efficiency of its business without hindering growth. Meta's focus on efficiency represents a shift in its organizational strategy. The company, which previously followed a move fast and break things approach, acknowledges the need to adapt to a different business environment as it continues to grow and evolve.

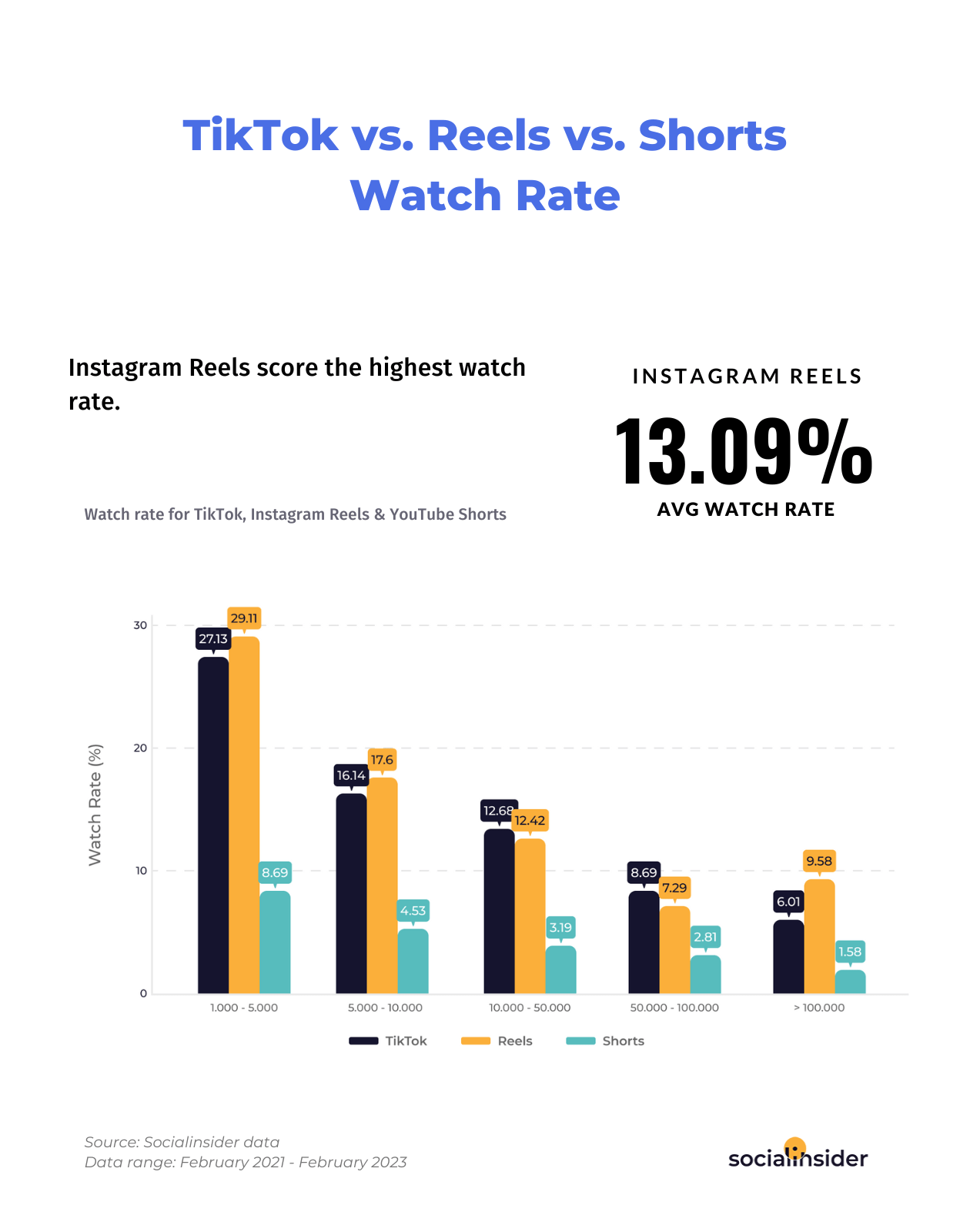

The company is also enhancing its content recommendations features using Artificial Intelligence and is trying to optimize its ad targeting algorithm to enhance user engagement. During a conference call in February, it was revealed that the monetization efficiency for Reels, Facebook's short-form video format, has doubled over the past six months. This positive trend indicates that the business is making significant progress in generating revenue from Reels. In the long run, I believe Reels will play an important role in helping Meta-owned Facebook and Instagram compete with new-age social media platforms such as TikTok. The recent success of Reels will help Meta attract and retain advertisers, but for Mr. Market to react to this positive development, I believe the company will have to attract young users again. I certainly believe this is possible with Reels gaining traction, but we need more data to ascertain Meta's ability to appeal to the younger generation.

Exhibit 2: Reels have a higher watch rate than TikTok and YouTube Shorts

Social Insider

Meta's Reality Labs unit, responsible for developing virtual reality and augmented reality technologies for the metaverse, generated $339 million in sales. However, the unit also reported an operating loss of $3.99 billion, and the company guided for higher operating losses throughout the year. In the long run, I believe Meta's Reality Labs division has a lot to offer the company and its shareholders with millions of Internet users expected to embrace the metaverse. I am, therefore, more worried about Meta not following up with its original plans to focus on the metaverse and less about short-term losses in this division.

The company plans to invest in Artificial Intelligence, with generative AI being identified as a significant theme for the year. Meta aims to empower creators by introducing new products that enhance productivity and creativity. However, the company recognizes the associated costs of supporting such technology for a large user base. In the long run, AI investments will not only help Meta establish its leadership in the social media industry but will also help the company attract above-average valuation multiples in the market. The company plans to incorporate generative AI into WhatsApp and Messenger as well. The company’s previous attempts at AI-powered business messaging are not entirely forgotten. In 2015, the company launched M, a short-lived virtual assistant combining AI and human support. However, the project did not achieve the anticipated success and was discontinued in 2018. While Meta's previous forays into AI provide valuable insights for future projects, the company's current shift towards AI can be seen as a desperate attempt to find new strategies to maintain a competitive edge in the industry. Although there are distinct differences between Meta's current AI tools and its previous endeavors, the company's pursuit of AI reflects the urgent need to explore alternative avenues for growth and innovation.

According to Ari Lightman, a professor of digital media at Carnegie Mellon University's Heinz College, Meta has a history of playing catch-up with industry trends. In the past, the company acquired Instagram and WhatsApp to enter the photo-sharing and messaging spaces, respectively. Now, the company is finding a way to adapt to the latest trend of generative AI. However, Meta is up against formidable competitors who have been investing in generative AI and large language models for years. The company acknowledges this but believes its suite of products gives it a unique advantage. Meta claims to be able to offer an end-to-end approach to generative AI that few organizations can match. Nevertheless, the company's generative AI team's level of development remains unclear, as indicated by recent job postings for technical leads and product technical managers.

With limited details about Meta's generative AI product roadmap, it is reasonable to question whether Meta can truly position itself as an industry leader. Competitors like Alphabet Inc (GOOG)(GOOGL) and Microsoft Corporation (MSFT) have already made significant strides in AI, making Meta's position more challenging.

Overall, I believe Meta's advertising business will continue to thrive in the long term and I expect its social media platforms to remain industry leaders. However, I am skeptical about the company's position in the AI market although there have been promising developments in the recent past. To leverage its industry-leading position in the social media sector, I believe Meta should focus on developing immersive experiences for its users, embracing the metaverse. That, in my opinion, is an area the company can dominate as opposed to the broad AI sector which is already highly competitive. Despite some challenges, I believe Meta's strong foothold in the digital advertising industry and the expected monetization of WhatsApp will pave the way for returns on capital exceeding the cost of capital for at least another 5 years.

Positive Earnings Trends Will Launch META Stock To $300

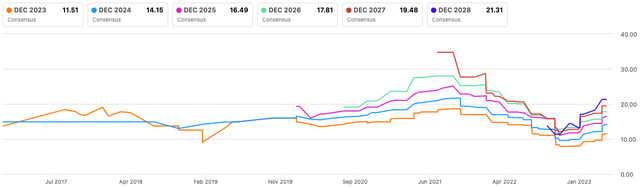

At Beat Billions, we believe stock prices can be projected by analyzing earnings revision trends and historical earnings surprises. When it comes to earnings revisions, we prefer to look at estimates at least 12 months ahead to cancel out the short-term noise. After reaching a high of $21.66 in October 2021, Fiscal 2024 EPS estimates declined to $9.57 in December 2022. Meta stock, understandably, performed poorly while earnings estimates continued to trend lower. However, since December, Fiscal 2024 EPS estimates have improved substantially from $9.57 to $14.15 with analysts beginning to boost their estimates to factor in the impact of cost-cutting measures implemented by the company. Not so surprisingly, these revisions have coincided with a stellar stock market performance.

Exhibit 3: EPS revisions

With Facebook and Instagram gaining some lost ground aided by the success of Reels at a time when ad dollars are expected to come back onto the table, I believe EPS revisions will continue to trend higher in the coming months, creating a platform for Meta stock to carry the recent momentum forward. I would not be surprised if META surges over $300 in the second half of the year if the Fed adopts a more cautious stance on rate hikes - which is a very likely scenario.

Bottom Line

Despite having to deal with several challenges including the threat of competition and poor macroeconomic conditions, Meta Platforms is well-positioned to thrive in the long term. At a forward P/E of 21, I believe the company is valued more like a mature company with steady growth ahead, and less like a company that is poised to grow in double digits annually in the foreseeable future. META stock remains attractive despite the recent run, and I will add to my long position if the market presents an opportunity to buy the stock again around the $200 level.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don't miss out on our launch discount - act now to secure your subscription and start supercharging your portfolio!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.