Walgreens Is Fundamentally Weak, While CVS Remains Strong

Summary

- In this article, I dive deep into the similarities and differences between WBA and CVS.

- While the two have overlapping and competing businesses - pharmacy & primary care - CVS is substantially more diversified in the value chain.

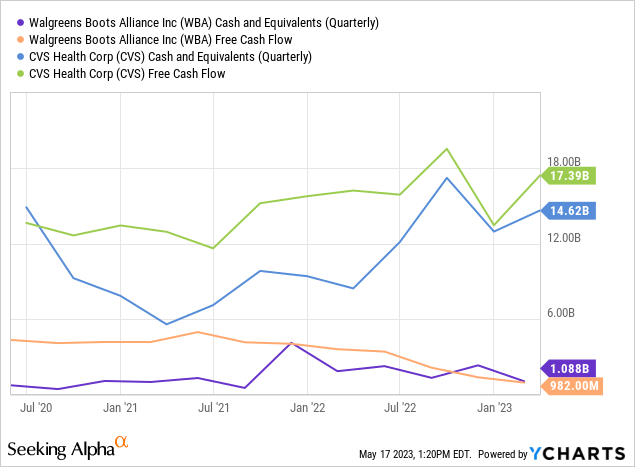

- Moreover, while CVS is bloated with cash WBA is scrambling for it.

- Both stocks have decreased 30% over the past year, but WBA is the outright sell and CVS is a hands-down buy.

J. Michael Jones

Introduction

I recently wrote an article explaining the intricacy and complexity of CVS.

CVS: A High Cash Flow Yield, But A Low Return On Capital

One point of discussion that I brought to light was the dominance of CVS and Walgreens (NASDAQ:WBA) within the U.S. pharmacy market. In the most recent quarter, CVS had pharmacy sales of $27.9 billion, while WBA had sales for the quarter of $27.6 billion. CVS measures its market share in this segment based on the number of prescriptions filled (404.8 million in the latest quarter), which the company equates to a 26.8% market share. Using this information, we can back out WBA's U.S. market share to be 19.7% given that the company filled 298 million prescriptions in the recent quarter (Walgreens Press Release).

The two companies compete fiercely in this market, but there are even more competitive environments that these two companies participate in that I did not mention in my previous article. With inspiration from, and as a complement to, a recent article Walgreens Vs. CVS: If Peter Lynch Picked Dividend Stocks I will discuss the competitive positions of Walgreen's businesses in comparison to CVS's. Envision Research discusses in their thorough article aspects such as dividend yields, share repurchases, valuation, and inventory management. I believe this article will be a good complement to the financial fundaments that they present. I'm going to further discuss the pharmacy business, the primary care business, as well as the new clinical trial business.

Similarities and Differences

To begin, I would like to highlight where these two companies overlap and where they don't. (WBA 10-K)

Similarities

- The WBA retail pharmacy is directly comparable to the CVS retail pharmacy. WBA has ~13,000 retail pharmacies spread across the U.S., Europe, and Latin America (8,886 in the U.S.), whereas CVS has ~9,000 retail pharmacies in the U.S. (its only market).

- WBA health corners are directly comparable to CVS MinuteClinics. WBA operates 117 health corners whereas CVS operates ~1,100 MinuteClinics.

- As of this year, both companies operate primary care providers. WBA operates VillageMD & Summit Health and CVS operates two new acquisitions: Oak Street Health & Signify Health.

Differences

- CVS, through its acquisition of Aetna, is a healthcare insurance provider for both commercial customers as well as for Medicare and Medicaid. WBA does not have an insurance business within the group.

- CVS is a pharmacy benefits manager (PBM), providing pharmaceutical distribution from pharma companies to pharmacies. WBA does not operate in this line of business. Though it does operate AllianceRx which provides specialty pharmacy services and mail-delivery services, similar to CVS.

- Walgreens operates a clinical trial business, which CVS just recently laid down after beginning in 2021 (Seeking Alpha News).

- WBA has a pharmaceutical wholesaling and distribution business in Germany, while CVS does not operate in this part of the supply chain.

Primary Care

WBA

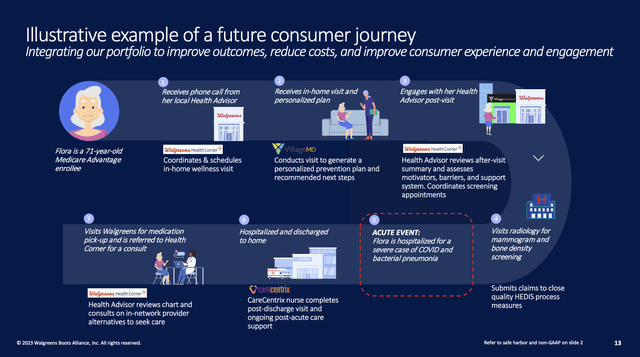

WBA's future plans are primary care focused. From the illustration below we can see that the Health Centers will be connected to VillageMDs in-home visits as well as Carecentrix. In 2021, WBA increased its stake in VillageMD from 30% to 63% for an accumulated acquisition price of $10 billion.

WBA Customer Focus (WBA J.P Morgan Healthcare Conference)

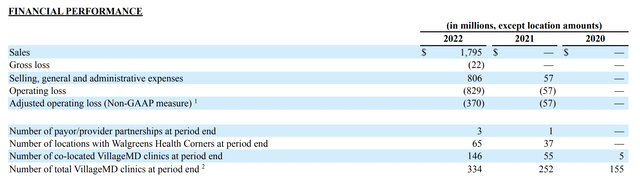

WBA has clearly been at the forefront of expanding into primary care as CVS hasn't made any primary care acquisitions until late 2022. During fiscal year 2022, 84% of WBA's "U.S. Healthcare" revenues came from VillageMD and 16% from Shields (a specialty care provider). The financial results for this segment in the prior fiscal year were as follows:

U.S. Healthcare WBA (WBA 10-K)

The adjusted operating loss is derived by adding back acquisition-related amortization costs incurred by WBA.

CVS

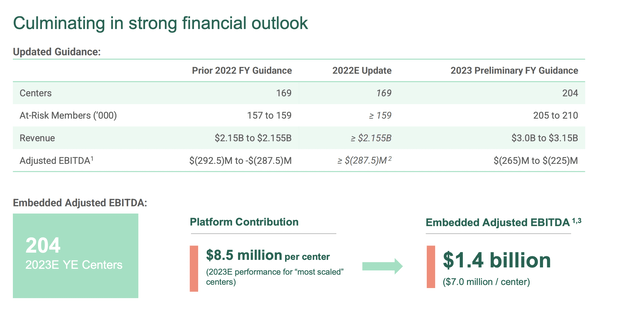

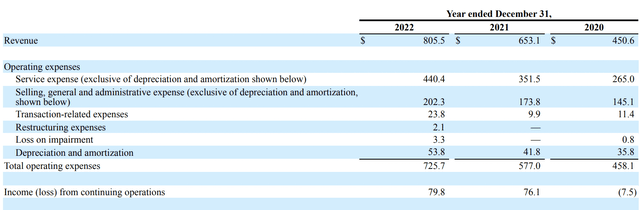

All shares of Oak Street Health were acquired by CVS for $10.6 billion at a 4,91 price-to-sales ratio. This could be considered a bargain compared to the acquisition of VillageMD which had consolidated revenues of $1,489 million in 2022 (WBA only owns a 63% stake) for a $10 billion valuation (6,67 price-to-sales ratio).

Oak Street Health (Investor Relations Oak Street)

Signify Health was purchased outright by CVS for a valuation of $8 billion, which implies a much higher price-to-sales ratio of 10x. But, as opposed to Oak Street and VillageMD, Signify is actually profitable on an operating income basis. Signify is a care provider in the home coupled with a healthcare platform that gives providers (such as Aetna) access to real-time data and assessments of a patient's health. For this reason, Signify has very low capital requirements as opposed to Oak Street and VillageMD which grow from primary care center expansion.

Signify Income Statement (Signify Health 10-K)

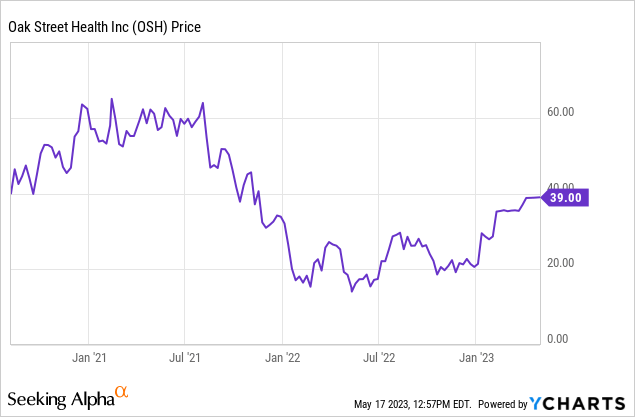

Even though WBA was quicker in acquiring primary care assets, CVS will quickly catch up with around $2.8 billion in consolidated revenue acquired. Although I can't show Signify here since the acquisition was effective long ago, we can see that it was beneficial for CVS to buy Oak Street Health during the market downturn. Signify was bought for $30/share which was below its $39 peak in the beginning of 2021. Even though I wouldn't consider these complete "bargains", the market downturn allowed CVS to purchase two seemingly high-quality businesses for a good price.

VillageMD and Oak Street Health offer similar services, but the integration philosophies that WBA and CVS are taking are different. WBA has 146 VillageMDs co-located whereas (although it is too early to say) CVS has communicated that Oak Street care centers will be located stand-alone. Walgreens could drive footprint synergies from the positioning they have made so far, especially considering their future customer journey mentioned above. However, CVS has disclosed in its latest earnings call that the company is evaluating options for expanding Oak Street centers more quickly than expected. While CVS has a robust cash position and robust cash flows, WBA does not. In short, WBA is taking a large risk by investing heavily in VillageMDs expansion while it continues to be unprofitable and the group continues to be cash-strapped. CVS, on the other hand, has the luxury to deploy excess cash flow as well as borrow to finance its acquisitions. Over the long run, these two primary care providers will deliver substantial cash flows while CVS's core business will continue generating a large cash position that it can use to pay down debt. To me, the winner in primary care between these two seems like a no-brainer.

Retail Pharmacy

WBA & CVS

WBA operates pharmacy chains in the U.S. as well as abroad. So, in general, one can say that while CVS has been focused on the healthcare insurance side of the industry, WBA has doubled down on pharmacies. U.S. pharmacy sales are in line with that of CVS in the latest quarter of around $27-28 billion and the WBA business had an operating margin of 3.5% (WBA Q2). The company has cited lower contribution from Covid vaccinations, as well as pressures on reimbursements as reasons for the 1.7% point drop in operating margins compared to the prior year. WBA even mentions in its 10K:

"The Company continuously faces reimbursement pressure from PBM companies, government, health maintenance organizations, managed care organizations and other commercial third-party payers. Agreements with these payers are regularly subject to expiration, termination or renegotiation. In addition, plan changes with rate adjustments often occur in January and the Company's reimbursement arrangements may provide for rate adjustments at prescribed intervals during their term. The Company experienced lower reimbursement rates in fiscal 2022 as compared to the same period in the prior year. The Company expects these pressures to continue."

CVS has also faced similar challenges in the previous quarter, resulting in a decrease in its operating margin from 6.1% to 4.1% compared to the previous year. However, the key difference between CVS and WBA is that CVS has a pharmacy benefits manager (PBM), which WBA lacks. Despite the difficulties in the retail pharmacy segment, CVS's PBM experienced impressive revenue growth of 12.6% year over year, maintaining a 3.7% operating margin from the previous year. On the other hand, WBA lacks the protection offered by a PBM and is more susceptible to the influence of larger industry players. WBA finds itself at a disadvantage, as it is last in line and receives the leftovers. This does not imply that the pharmacy business itself is poor, but rather highlights its susceptibility to significant price uncertainties.

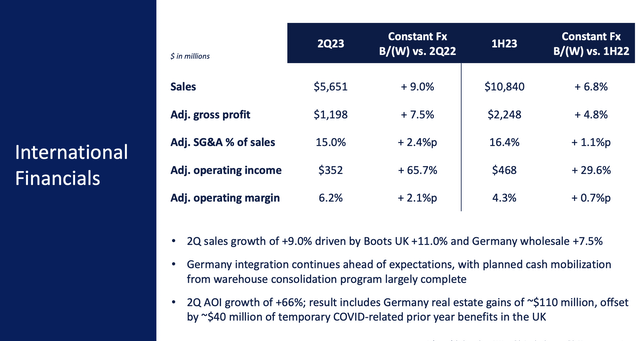

However, there is a positive aspect to WBA's operations. The company has achieved great success internationally, with the recent quarter demonstrating outstanding growth and high operating margins in its international segment. WBA has a distribution agreement with AmerisourceBergen (ABC), enabling access to generic and branded pharmaceutical products in the United States, while ABC gains access to generic pharmaceutical products through its subsidiary, Walgreens Boots Alliance Development GmbH. Additionally, WBA operates Boots UK, a pharmacy and beauty products store overseas. In this segment, retail comparable sales experienced a remarkable 16% growth, attributed to the effects of Omicron in the previous year, while pharmacy comparable sales grew by 2% year over year. Furthermore, WBA proudly announced that the Boots business has consistently gained retail market share for the eighth consecutive quarter. Overall, WBA's international business serves as a valuable asset, and the company has successfully managed its equity investment in ABC. Although WBA reduced its ownership from 25% to 17% in the past year, it received $694 million in return for the trimmed shares. (Seeking Alpha News).

Clinical Trial Business

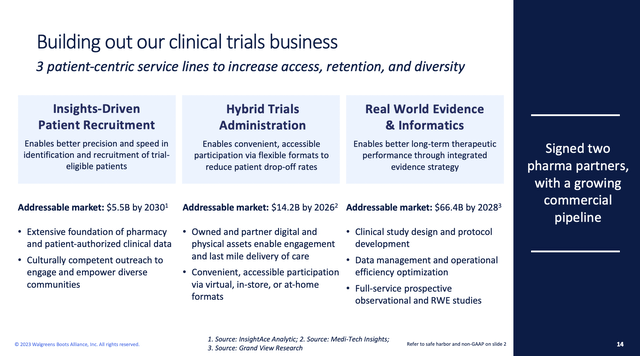

Another success story from WBA is its clinical trial business which is officially up and running. In January, the company presented that it had signed with two pharma partners to assist with clinical trials. In the wake of this comes news from CVS that it is shutting down its clinical trial business in order to focus on its core offerings. Here we see another divergence, in real-time, where the two companies choose different business strategies and markets of interest. So what does WBA see in the clinical trial business that CVS might not believe is worth it?

Clinical Trials Business (WBA Health Conference)

In short, the answer is a huge addressable market. The company believes it has a chance to capture value in a summed total addressable market of $86.1 billion through its pharmacy & patient-authorized clinical data, physical & digital primary care assets, and experience in clinical design development. This is a potential long-term growth driver for WBA and could contribute to higher profitability as one it unlocks synergies and two this business is not as capital-heavy as its other businesses. This means that WBA can continue investing in new retail pharmacies and VillageMD locations while only incurring salary and R&D costs to drive the clinical business forward. Whether this will play out well is uncertain, which means that it also poses some risks. While CVS shifts its focus to its primary care assets, WBA may experience difficulties managing many different businesses while also being low on cash. This is why I would like to raise a discussion about why WBA may have sold such a substantial share in ABC. Is it due to capital needs? If so, it is a signal that the company is weak yet aggressively investing in its various businesses.

Valuation Comparison

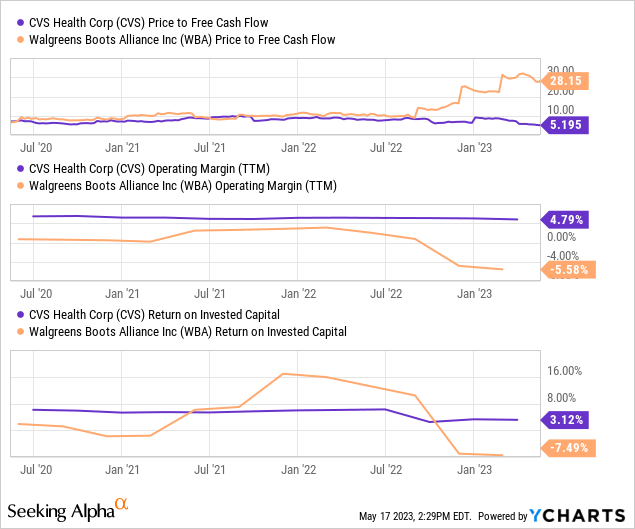

As shown through these three metrics - price to free cash flow, operating margin, and returns on invested capital - CVS is undoubtedly selling at a better valuation while the company remains fundamentally strong. WBA, on the other hand, is showing signs of weakness as its valuation is dramatically rising with the fall of operating margins and returns on invested capital. To me, this is a reflection of WBA's less-diversified group of businesses and financial inflexibility.

Key Takeaway

Based on my breakdown of WBA's businesses vs CVS's businesses, I believe that CVS is of overall higher quality. This can be seen through its higher operating margin in the U.S. pharmacy retail segment (4.1% vs. 3.5%), its better-priced & high-quality primary care businesses, as well as its robust cash flows, to continue the expansion of the emerging primary care segment. On the other hand, WBA is inflexible in deploying capital which may be the reason it sold a large stake in ABC (I am speculating and look forward to discussion regarding this point). Therefore, while WBA is seeing a weakening in its business, CVS is gaining strength through its vertically integrated group of businesses but interestingly these two companies have experienced a similar decline in their stock over the past ~30% declines over the past year. For these reasons, I believe that between the two WBA is an outright sell and CVS is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.