NCR: A New Twist To A Never-Ending Transformation

Summary

- In 2019, Blackstone exited its investment in NCR after 4 years in control, with its task of transforming NCR to an integrated software and services company presumably completed.

- Nevertheless, the new management continued on their own planned path of transformation, continuing to spend $100s of millions of dollars in the process, without discernible benefit to the bottom line.

- Even before the new transformation is completed, the company has now switched plans from integration to disintegration, with a planned spin to create two separate companies.

- Don't get me wrong, the company appears to have an excellent suite of products, software and services, ably and professionally delivered.

- My concern is the rhetoric around transformation and profit and free cash flow performance is not matched by actual results - the numbers don't add up.

krblokhin/iStock Editorial via Getty Images

NCR: Investment Thesis

Sorry to those who are enthusiastic about NCR stock as an investment choice. I have to agree the company appears to have an excellent suite of products, software and services, ably and professionally delivered. But, despite spending $100s of millions on restructuring over the last seven years to the end of 2022, management does not appear able to get the structure right to consistently generate earnings and cash flows commensurate with the promise of this otherwise fine business. Bold announcements are made for benefits to flow from costly restructuring, before another restructure is announced with no perceivable results from previous restructuring efforts. The latest change in direction is the plan to split the company into two separate companies. This follows the consideration of a whole or partial company sale of NCR, which remains an option.

Since the publication of my May 26, 2022 article, "NCR: The Numbers Don't Add Up", the share price has declined by 29.60%, compared to an increase of 2.49% in the S&P 500. Even at the current lower price, I find difficulty in finding value in the shares. I am unlikely to change this view until I see reality starting to match the rhetoric of management, as discussed in more detail below. I maintain a hold rating primarily due to the likelihood of increased interest engendered by the proposed split, and there remains a possibility of a sale of the company. Either could lift the share price above current levels.

NCR: The Rhetoric And The Reality

The Rhetoric -

1. Restructuring savings $150 million per year-

In my previous article on NCR in May 2022, I wrote,

As discussed in my Feb. 4 article, "NCR: The Blackstone Legacy And What's Ahead", Blackstone (BX) was brought in by NCR (NYSE:NCR) in December 2015 as an experienced technology investor to add value to and accelerate NCR's strategic transformation to an integrated software and services company. Blackstone exited its investment in NCR in Sep. 2019, with the transformation presumably completed. Despite this, the company management has continued on a path of transformation. GAAP to non-GAAP reconciliations reveals a total of $269 million net of tax spent on "Transformation and restructuring costs" over the 2.25 years FY-2020 through Q1-2022. These transformation and restructuring activities were supposed to achieve $150 million in savings in 2021 alone.

2. Growth in net income through acquisitions - $205 million per year

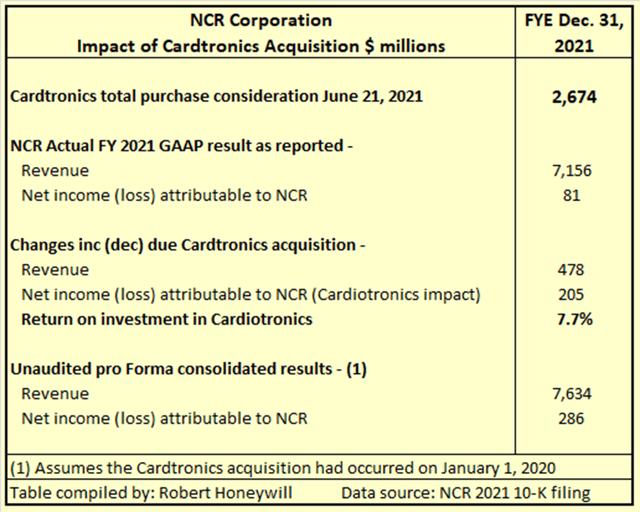

NCR acquired Cardtronics in June 2021 for $2.674 billion. A proforma calculation of net income with Cardtronics included for the full 2021 year was provided in NCR's FY 2021 10-K filing. The calculation in Table 1 below is based on actual reported FY 2021 net income for NCR and proforma results provided by NCR showing NCR FY 2021 results as if Cardtronics had been acquired on Jan. 1, 2020. The proforma results are heavily qualified by NCR and taking the actual net income figure from the proforma income figure is not strictly correct. But there is a lack of sufficient disclosure to make a more accurate calculation. Nevertheless, the imputed FY 2021 net income effect of $205 million due to Cardtronics equates to a 7.7% return on the purchase consideration of $2.674 billion. This does not appear an unreasonable objective for an acquisition.

Table 1

SEC filing

3. Cash Flow Success - $400 million in two quarters

From NCR CEO, Mike Hayford's closing remarks to the Q1-2023 NCR earnings call,

The cash flow success in the first quarter coupled with the cash flow that we drove in the fourth quarter so $400 million in two quarters against the target we had of $500 million to delever creates a lot of confidence in our team that we can get to the spin with the balance sheet at the right leverage ratio.

Back in Jan. 2019, I published an article here on Seeking Alpha, "Free Cash Flows: Let's Have A Discussion Towards A Better Understanding". I published the article as a reference document, to explain why all cash flows are not the same, are not generated from just one source, and are not necessarily sustainable. Extraordinarily, some businesses can have strong free cash flows while technically insolvent and growing more insolvent by the day. Conversely, some highly profitable businesses are strongly cash-consuming. Understanding how the $400 million cash flow, and corresponding reduction in net debt, was achieved will be important in understanding the measure of its success.

The Reality -

1. Restructuring savings and growth in net income through acquisitions

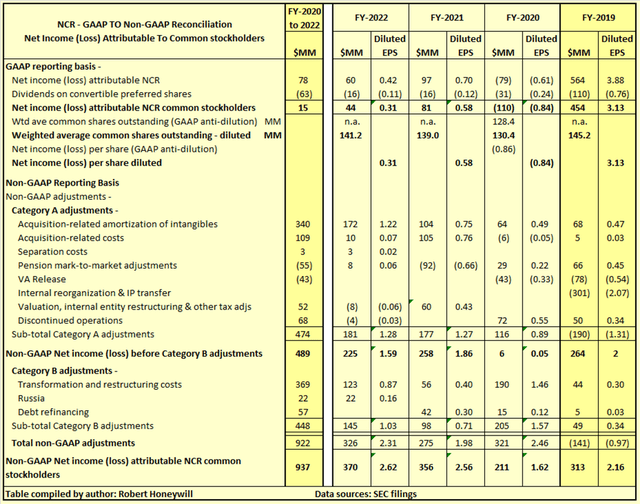

In order to see how management's efforts in growing net income since hand over from Blackstone in 2019, it is useful to use 2019 as a base year for comparison. Table 1 below shows NCR GAAP Net Income and adjusted non-GAAP results for the years 2019 to 2022 on a basis applicable to common stock shareholders.

Table 2

SEC filings

Table 2 starts with results on a GAAP basis attributable to common stock shareholders. Net income (loss) for the company is adjusted by deducting dividends on convertible preferred shares to arrive at earnings attributable to common stock shareholders. These earnings (losses) are then divided by fully diluted weighted average common shares outstanding. It will be noted in the case of GAAP losses certain share entitlements are excluded from the outstanding shares calculation to ensure the most conservative (highest) loss per share is calculated. As the non-GAAP adjustments result in the elimination of losses, the higher fully diluted share count is used throughout the reconciliation. For purposes of explanation, I have separated non-GAAP adjustments into Category A and Category B.

Category A adjustments -

The adjustments included under category A either have no real cost impact on the company's operations, or are in relation to past actions and events that have no implications for future results. So, yes, losses from discontinued operations are a cost to shareholders, but they would not be expected to be a recurring cost, and are not a cost initiated by management's current actions. Pension mark-to-market adjustments do impact shareholder funds, but these items can fluctuate either way over time and can reasonably be excluded from determination of underlying operating results. I regard acquisition-related amortization of intangibles as an arbitrary accounting-based allocation of a portion of profits, in an attempt to more correctly judge the return on capital invested in earlier periods. It does not represent a current cost to shareholders and is correctly added back for calculating economic performance.

Category B adjustments -

I am always concerned with these types of adjustments, particularly transformation and restructuring costs. These exercises are generally carried out with the promise of significant future cost savings. NCR President and CEO, Mike Hayford on the Q4 2020 earnings call,

As we discussed last quarter, we have taken actions to replace the temporary cash cost savings when the pandemic began with permanent expense savings. We entered 2021 with $150 million in cost savings that are expected to drive margin expansion.

Looking at Table 1, non-GAAP results before Category B adjustments were up by $252 million from $6 million in FY-2020 to $258 million for FY-2021. This improvement is more likely to arise from a depressed result in FY-2020 due to COVID, rather than savings due to transformation and restructuring activities. In FY-2022, the non-GAAP earnings of $225 million before Category B adjustments were below FY 2021 earnings, even with Cardtronics earnings in for a full year.

After adding back Category B adjustments to arrive at the non-GAAP earnings reported by NCR, the FY-2022 non-GAAP net income is $370 million. This is $57 million above the $313 million non-GAAP net income reported by Blackstone in FY 2019 after completing their restructuring. This $57 million increase is after spending $369 million on restructuring in the three years 2020 to 2022, and investing $2.7 billion to acquire Cardtronics to add to earnings. The $57 million is a far cry from the mooted $150 million per year in cost savings from the restructuring, and the additional $205 million in net income from the Cardtronics acquisition.

2. $400 million cash flow generated over two quarters

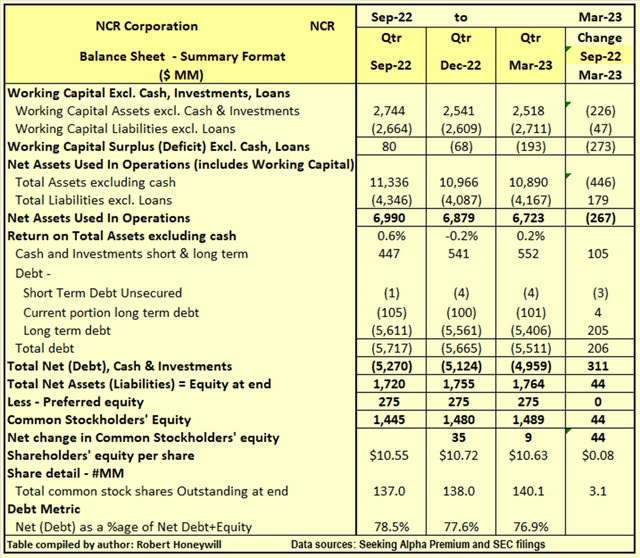

Table 3.1 below shows balance sheets for NCR for quarters ending September 2022, December 2022, and March 2023.

Table 3.1

SA Premium & SEC filings

What I am aiming for here is to test the NCR CEO's claim of success in generating $400 million in cash over the last two quarters towards getting the balance sheet at the right leverage ratio ahead of the spin. Leverage measured as Net Debt as a percentage of Net Debt + Equity has declined over the two quarters from 78.5% to 76.9%, so that is a positive. Over the two quarters, Net Debt has declined by $311 million, short of the $400 million by $89 million. Next, we can look at where the cash to reduce the net debt by $311 million came from. I can see that Net Assets Used in Operations decreased by $267 million over the two months, so, that prima facie, would free up $267 million in cash funds. I can also see that $273 million of the change in Net Assets Used in Operations came from a reduction in working capital (excluding cash and investments). On that basis, I can safely assume $267 million of the cash flow over the two months came from accelerating collection of receivables and slowing payments to creditors. The balance $44 million cash funds can be attributed to an increase in shareholders' equity, the sources for which are analysed in Table 3.2 below.

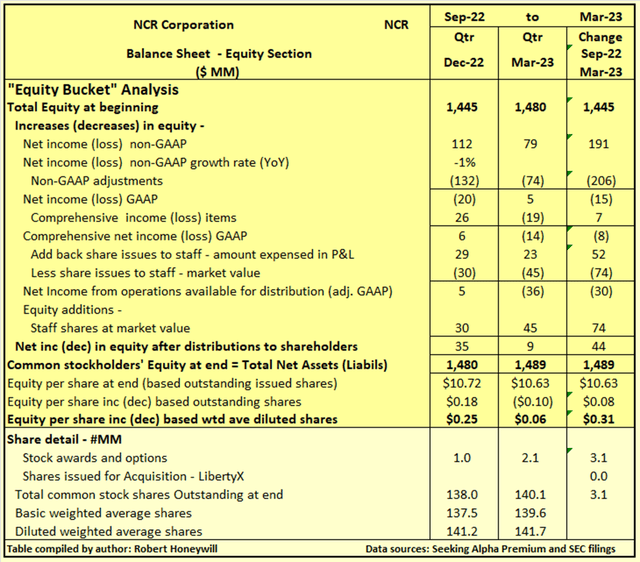

Table 3.2

SA Premium & SEC filings

Table 3.2 shows the main contributor to additional cash availability was issue of 3.1 million shares, with a market value of $74 million, as employee stock compensation, avoiding the need for cash funds for these operating expenses. This $74 million was offset in part by $30 million in loss from operations for the two quarters, leaving a net $44 million increase in equity. In summary, net debt was reduced by $311 million, not $400 million. In essence, the cash funds to pay down net debt came from actions to reduce working capital, and funds from the issue of additional shares to meet operating expenses, offset by funds required to cover operating losses.

Summary and Conclusions

Earnings growth has not matched the rhetoric around expected cost savings from restructuring, and growth in net income from acquisitions. The amount of cash flow used to reduce net debt over the two quarters was $311 million not $400 million, but still a good achievement. Disappointingly, the means of creating that cash flow was not from operating net cash flows generated in the period. Most, $267 million, of the cash flow can be attributed to collections from debtors in the period exceeding billings, and payments to creditors in the period being less than purchases in the period. Certainly, a valid means to increasing net cash inflows, but likely not repeatable very far into the future. Some will question my assertion that using share issues to pay employees is a source of increased cash flow. If companies issued shares to suppliers instead of paying cash for other operating goods and services, it would be possibly better understood and acknowledged this is a source of increased cash flows.

Some will also no doubt question my balance sheet approach to determining cash flows. I will agree the approach is more of a source and application of funds analysis, but those changes in balance sheet items are almost certainly primarily cash flows when receivables reduce, creditors increase, and net debt reduces. That cash of $311 million was used to reduce net debt should not be in question. The main reason for using a balance sheet approach is with cash flow statements, with all the detail, it is often difficult to see the woods for the trees, and even more confusing when we have both GAAP and non-GAAP free cash flow reconciliations reported by NCR and other companies.

As I stated at the beginning, I maintain a hold rating primarily due to the likelihood of increased interest engendered by the proposed split, and there remains a possibility of a sale of the company. Either could lift the share price above current levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first consulting an investment advisor and/or a tax advisor as to the suitability of such investments for their specific situation. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer, or a recommendation to buy, sell, or dispose of any investment, or to provide any investment advice or service. An opinion in this article can change at any time without notice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.