EverCommerce Proves Resilient As It Raises Prices In 2023

Summary

- EverCommerce Inc. reported its Q1 2023 financial results on May 9, 2023.

- The firm provides vertically-integrated software to SMB businesses in various industry verticals.

- EverCommerce has proven resilient despite a slowing economy, and the stock price has risen against a higher cost of capital environment.

- Given price increases to customers and forward growth projections, my outlook for EverCommerce is a Buy at around $11.50 per share.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

AndreyPopov

A Quick Take On EverCommerce

EverCommerce Inc. (NASDAQ:EVCM) reported its Q1 2023 financial results on May 9, 2023, beating revenue but missing EPS consensus estimates.

The firm provides business management SaaS software to service-based businesses in a variety of industry verticals.

Given the firm's resilience despite a challenging macroeconomic environment and rapid cost of capital increase, my outlook for EverCommerce Inc. stock is a Buy, as the firm's price increases and new product offerings may help to offset potential headwinds, especially in the second half of 2023.

EverCommerce Overview

Denver, Colorado-based EverCommerce Inc. was founded to develop a platform providing vertically integrated software to small and mid-sized firms in the healthcare, wellness, and other home service sectors.

Management is headed by founder and CEO Eric Remer, who was previously co-founder and CEO of PaySimple, now part of EverCommerce.

The company's primary offerings include:

Marketing technology solutions

Customer engagement applications

Billing & payment solutions

Business management

The firm's primary verticals include:

Home services

Health services

Fitness & Wellness

Other

The firm pursues a "land and expand" marketing strategy for its prospective customers and places a strong emphasis on cross-selling its offerings to gain the maximum share of wallet and customer buy-in.

EverCommerce's Market & Competition

According to a 2023 market research report, the global market for SMB (small and medium-sized business) IT spending was an estimated $693 billion in 2022 and is expected to reach $988 billion by 2030.

This represents a forecast CAGR of 4.5% from 2022 to 2030.

Also, China is expected to continue as the fastest-growing region in percentage terms during the period.

Major competitive or other industry participants include:

Salesforce (CRM)

Intuit (INTU)

Block (SQ)

HubSpot (HUBS)

Manual processes

Vertically-focused competitors

EverCommerce's Recent Financial Trends

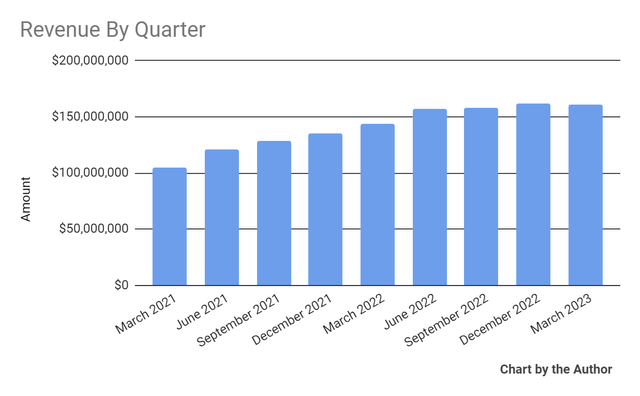

Total revenue by quarter has plateaued in recent quarters:

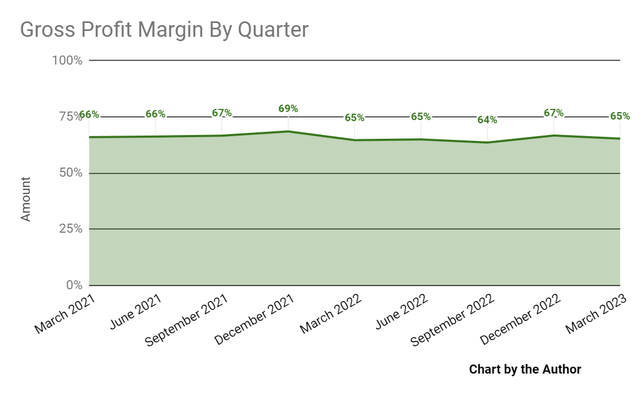

Gross profit margin by quarter has been trending slightly lower more recently:

Gross Profit Margin (Seeking Alpha)

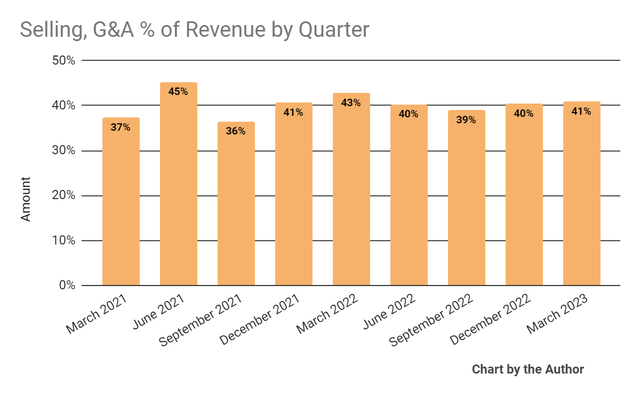

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated within a range, as shown below:

Selling, G&A % Of Revenue (Seeking Alpha)

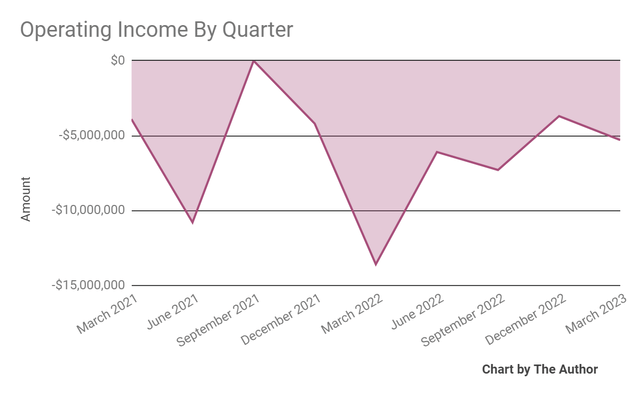

Operating income by quarter has remained negative in recent quarters:

Operating Income (Seeking Alpha)

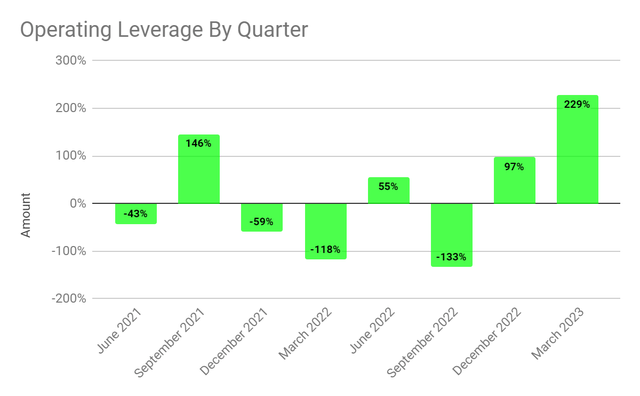

Operating leverage by quarter has improved in the two most recent quarters:

Operating Leverage (Seeking Alpha)

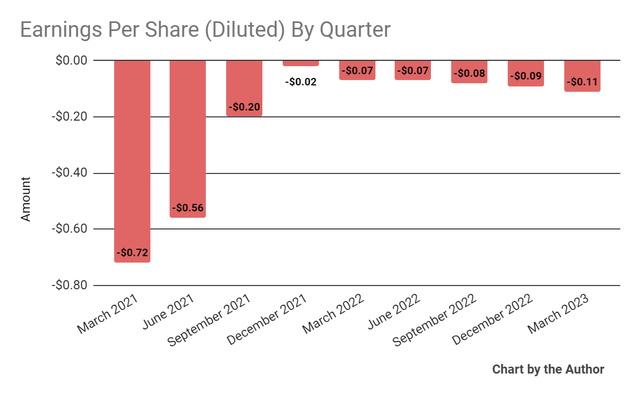

- Earnings per share (Diluted) have been trending further into negative territory:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

In the past 12 months, EverCommerce Inc.'s stock price has risen 19.81% vs. that of the iShares Expanded Tech-Software Sector ETF (IGV) rise of 14.53%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $69.8 million in cash and equivalents and $535.4 million in total debt, of which $5.5 million was categorized as the current portion due within 12 months. Management said the firm has no material loan maturities until 2028.

Over the trailing twelve months, free cash generated was $62.4 million, of which capital expenditures accounted for only $2.2 million. The company paid $28.2 million in stock-based compensation ("SBC") in the last four quarters, the highest in the past ten-quarter period.

Valuation And Other Metrics For EverCommerce

Below is a table of relevant capitalization and valuation figures for the company:

Measure (TTM) | Amount |

Enterprise Value/Sales | 4.2 |

Enterprise Value/EBITDA | 32.7 |

Price/Sales | 3.4 |

Revenue Growth Rate | 20.7% |

Net Income Margin | -10.5% |

EBITDA % | 12.7% |

Market Capitalization | $2,200,000,000 |

Enterprise Value | $2,660,000,000 |

Operating Cash Flow | $64,650,000 |

Earnings Per Share (Fully Diluted) | -$0.35 |

(Source - Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

EVCM's most recent Rule of 40 calculation was 33.5% as of Q1 2023's results, so the firm has performed moderately in this regard, per the table below:

Rule of 40 Performance | Calculation |

Recent Rev. Growth % | 20.7% |

EBITDA % | 12.7% |

Total | 33.5% |

(Source - Seeking Alpha)

Commentary On EverCommerce

In its last earnings call (source - Seeking Alpha), covering Q1 2023's results, management highlighted its pursuit of balanced growth as it focuses on its embedded payments system which grew its revenue by 37% year-over-year.

The number of customers using the firm's services increased 22% year-over-year, and 10% of its customers use more than one of its services.

EverCommerce Inc. management expects that growth and strong margins will be driven by "price increases and new product introductions" in 2023.

The company's net revenue retention rate was stable at 100%, indicating moderate product/market fit and sales & marketing efficiency.

Total revenue for Q1 2023 rose 12.2% year-over-year and gross profit margin increased 0.7 percentage points.

Selling, G&A expenses as a percentage of revenue fell 1.9 percentage points year-over-year while operating losses improved year-over-year.

Earnings per share worsened sequentially and year-over-year.

Full-year 2023 revenue is expected to be $690 million, or 11.2% year-over-year growth.

Adjusted EBITDA is expected to be $140 million, a rise from previous guidance. Adjusted EBITDA typically excludes stock-based compensation expenses.

EverCommerce Inc.'s financial position is relatively strong, with ample liquidity, reasonable long-term debt, and solid free cash flow generation.

Regarding valuation, the market is valuing EVCM at an EV/Sales multiple of around 4.2x.

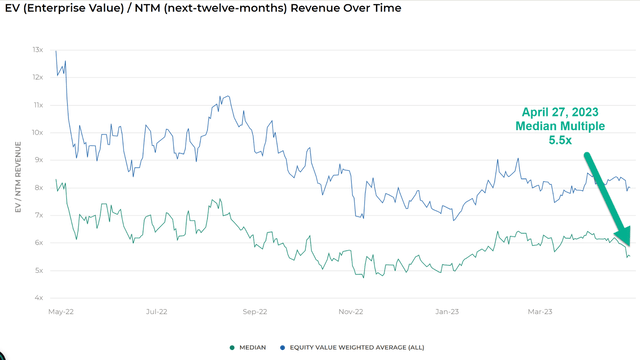

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 5.5x on April 27, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, EVCM is currently valued by the market at a discount to the broader Meritech Capital SaaS Index, at least as of April 27, 2023.

The primary risk to the company's outlook is a macroeconomic slowdown that appears to be already underway, tightening credit conditions which may affect customer spending plans, and lengthening sales cycles which may reduce its forward revenue growth trajectory.

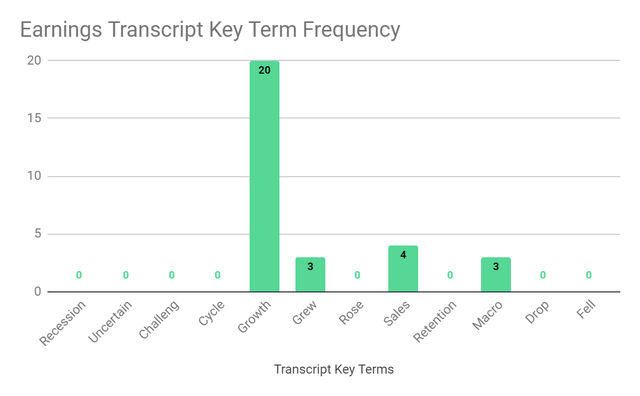

From management's most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Term Frequency (Seeking Alpha)

I'm most interested in the frequency of potentially negative terms, so "Macro" appeared three times.

The "Macro" term was mentioned in the call in the context of questions about the impact of the potentially slowing macroeconomic environment on the firm's operations.

In the past twelve months, the firm's EV/Sales valuation multiple has dropped by only 9%, a notable achievement during a period of sharply rising cost of capital, as the chart from Seeking Alpha shows below:

EV/Sales Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include a material improvement in macroeconomic conditions or dropping cost of capital assumptions, leading to improved valuation multiples for the stock.

Given EverCommerce Inc.'s resilience despite a challenging macroeconomic environment and rapid cost of capital increase, my outlook for the stock is a Buy, as the firm's price increases and new product offerings may help to offset potential headwinds, especially in the second half of 2023.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.