With China set to cut down production to control rising steel inventory levels, any major increase in global prices is unlikely.

Domestic steel prices, which have been on a rally since December 2022, are set to bend under the combined weight of a slowdown in global demand, influx of cheap imports from far-eastern Asia and Russia and cooling raw material prices. Domestic hot-rolled coil (HRC) and cold-rolled coil (CRC) trade prices fell by Rs 2,000 in mid-May 2023 from the peaks of the previous month to Rs 59,000–59,500 per tonne and Rs 63,000–63,500 per tonne, respectively, in the Mumbai market. Following a flurry of cheap imports, most large steel mills corrected list prices for both HRC and CRC by Rs 2,000-2,500 per tonne in early May against April 2023 prices. Meanwhile, primary thermo-mechanically treated (TMT) trade prices saw a steeper fall of Rs 2,800 and are currently trading at Rs 57,000–57,500. End-consumer industries have switched to need-based procurement in anticipation of further price corrections.

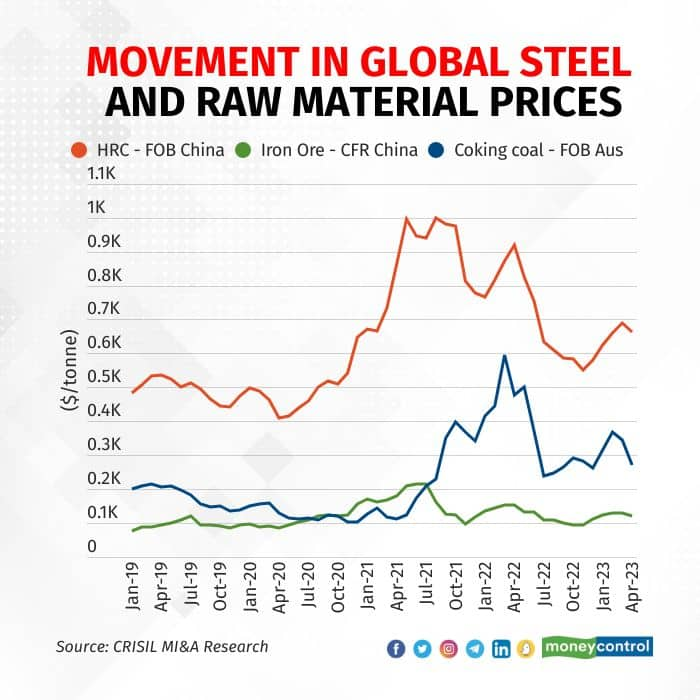

The upshot: annualised flat steel prices (HRC) will fall 2-3 percent on-year in fiscal 2024 after declining ~9 percent in the previous fiscal. Primary long steel (TMT), which is not influenced by import prices on account of its minuscule trades, will see a sharper correction in prices. Overall, long steel prices are set to decline 3-5 percent this fiscal after rising 4 percent in the previous one amid a fall in input prices and a steep correction in secondary TMT prices, in line with cooling thermal coal prices.

Input Prices To Decline

Coking coal prices fell to $240–245 per tonne in mid-May 2023 after reaching highs of $400 per tonne in mid-February 2023. The prices are expected to fall further as Australian exports pick up on account of demand cooling in India and China with the onset of monsoons. Prices will pick up only from the third quarter of fiscal 2024 when Australia’s cyclone season sets in. Annualised coking coal prices will decline 20 percent to $250-275 per tonne in fiscal 2024. However, the extent of weather disruption in Australia and China resuming Australian coking coal imports amid the lifting of the unofficial ban will remain key monitorables. The risk of disruptions related to supply-chain movements is preventing prices from reaching pre-Covid averages of $180 per tonne.

Global iron ore prices (CFR China 62 percent FE), on the other hand, dropped to below $110 per tonne after rallying in the first quarter of 2023 amid anticipated high demand from China. The fall in prices will be driven by ample raw material availability, slowing demand, and the Chinese government monitoring and controlling price fluctuations in order to prevent declines. Domestic iron ore prices (NMDC 62 percent fines) declined after rallying over 40 percent since November 2022, with NMDC correcting prices by Rs 100 to Rs 4,010 per tonne in May 2023. Prices are expected to fall further amid sluggish demand from China, a major export destination.

With China set to cut down production to control rising steel inventory levels, any major increase in global prices is unlikely. Moreover, lower supply during Australia and Brazil’s monsoon season in the second half of fiscal 2024 may lead to marginal price growth. Domestic prices, however, will end up increasing by 15-20 percent on-year on a low base due to the export ban in the previous fiscal.

Domestic Steel Mills Cautious

Indian steel mills are struggling to keep prices elevated as cheap imports, largely from east and southeast Asia and Russia, have entered the Indian market to meet the strong domestic demand despite a global slowdown. Imports surged 29 percent in fiscal 2023 to ~6 million metric tonnes, the highest since fiscal 2020. This prevented domestic prices from rising sharply despite an increase in coking coal and iron ore prices in the previous quarter. That said, though domestic prices will remain subdued over the next 3-4 months amid excess inventory built up in other countries being pushed into India, any major correction is unlikely. Moreover, domestic demand is expected to grow 6-8 percent in the ongoing fiscal following sharp growth of 11.4 percent and 13.3 percent over the last two fiscals, respectively.

Domestic demand growth continues to outshine demand from major steel-consuming economies despite moderating on the high base of fiscal 2023. Infrastructure, building, and construction, which account for 60 percent of domestic demand, are growing at a healthy pace. The growth momentum should continue, with the government looking at completing infrastructure projects ahead of the election year. Budget outlay for infrastructure factored in 17 percent growth on-year. Despite import influx driving price corrections in the first half of fiscal 2024, domestic prices will remain supported by growth in domestic demand amid anticipated production cuts in China.

Hetal Gandhi is Director - Research and Koustav Mazumdar is Associate Director - Research, CRISIL Market Intelligence and Analytics. Views are personal, and do not represent the stand of this publication.