Opendoor Q1 Earnings: Solid Report, But Pesky Uncertainty Remains

Summary

- Opendoor Technologies Inc.'s business model is very seasonal. Hence, even though its prospects now look to be improving, I still remain skeptical over whether or not Opendoor has turned a corner.

- Here I explain what is Opendoor in simple terms.

- How to think about its valuation?

- This idea was discussed in more depth with members of my private investing community, Deep Value Returns. Learn More »

jittawit.21/iStock via Getty Images

Investment Thesis

Opendoor Technologies Inc. (NASDAQ:OPEN) put out a very solid Q1 report and Q2 2023 guidance. Despite this, there are still uncertainties surrounding the company's long-term viability.

Even though today the OPEN business model appears to be strengthening, I also have to take into consideration the fact that Opendoor is very seasonal. Meaning that Q1 and particularly Q2 are expected to be strong quarters for Opendoor.

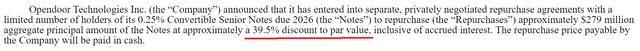

What the SEC filing above shows is that Open is aggressively repurchasing its debt, at a 40% discount to par.

There's still a lot of uncertainty, but overall the trend is improving.

Why Opendoor? Why Now?

The Opendoor Technologies Inc. business model is not like Zillow Group, Inc. (Z). Opendoor's business model is like a brokerage business for real estate. The business model is a very high-throughput business model, that strives to operate at around 4% contribution margin. That's the core of the business model.

There are other services that Opendoor provides that have higher margins. For example, the legal paperwork around buying and selling a property, and holding the escrow, are two such examples. More concretely, all the friction and services around buying and selling a property.

Although, I should note, that the vast majority of Opendoor's profit margins are tied to its core business. This is where Opendoor buys a property from sellers, holds onto the property for about 120 days while it seeks to sell its property, and ultimately profits by selling the property.

Put another way, Opendoor digitalizes that experience of selling a property and does away with the brokerage fee associated with paying a real estate agent for selling a house.

Now, to make something clear, I'm not 100% bullish on OPEN stock. I do absolutely own this stock. And have recently purchased more shares, luckily below $2. However, my overall average price is meaningfully underwater, at closer to $7.

So, I was wrong in my initial purchase price. Although I should note that since the stock fell so significantly since my original purchase, I've plenty of time to ask ''hard questions'' about my investment.

And by asking those hard questions, I've been able to a large extent to pierce through the noise and share price volatility to better understand the risks and opportunities available.

Simply put, Opendoor attempts to widen the spread between buying and selling homes when there's a lot of market uncertainty. And while I fully recognize that management was slow to adjust their real estate models as interest rates were rapidly rising, I believe that Opendoor was faced with a serious dilemma. They were forced to adapt or die.

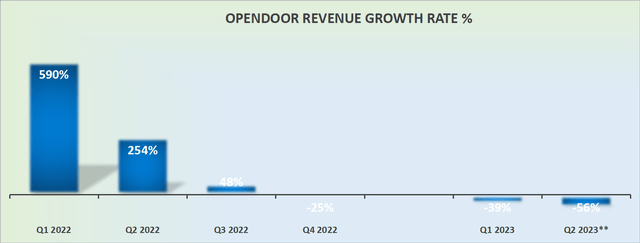

Revenue Growth Rates Fully Fizzled Out

As interest rates went up, the number of houses up for sale reduced. More technically put, the housing supply dried up, as interest rates went up.

With less volume going through the real estate market, Opendoor was forced to widen the spread between buying houses from homeowners and selling houses.

This significantly hindered their revenue growth rates.

Path to Breakeven on Free Cash Flow, Mid-2024

Opendoor has always made the case that, adjusted for substantial seasonality, on an annualized basis its margin contribution from selling homes would be around 4% to 6% on an annualized basis.

Now, Opendoor has revised this figure and believes that 5% to 7% is more appropriate starting in 2024.

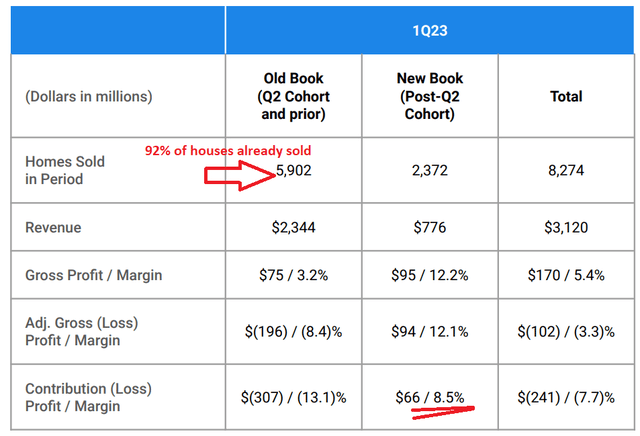

Next, Opendoor stated that it needed to rapidly shed the housing inventory it had bought last year between March and June, the ''Q2 Cohort.'' Those homes were bought at much higher prices than the comparable real estate today sells for.

Furthermore, recall that Opendoor had previously stated that they would seek to shed 85% of their ''Q2 Cohort'' by the end of Q1 2023. In fact, it turns out, Opendoor sold 92% of this old book.

Put another way, that old cohort of more expensive houses is nearly all shed, as of right now. What's left are homes that are repriced significantly lower.

Opendoor maintains, as it has done for a while, that by mid-2024, the business could be free cash flow positive. The assumption here is that Opendoor's revenues would be on a run-rate (or an annualized revenue basis) of $10 billion by mid-2024.

Given that for Q2 2023, including the strong seasonality this quarter drives, Opendoor's revenues are pointing towards $1.8 billion in revenues, Opendoor has its work cut out.

OPEN Stock Valuation

For now, Opendoor Technologies Inc. stock remains highly speculative. Even if indeed, Opendoor becomes free cash flow positive in mid-2024 on the back of $10 billion in revenues, it's still going to take a while until we see Opendoor turn profitable.

And even though I firmly believe that Opendoor has demonstrated to be very resilient particularly as many of its peers have wound up their operations, there still remain significant question marks over Opendoor's ''through-the-cycle'' enduring profitability.

Can Opendoor see around 2% net income margin, after interest payments of around $400 million per year? For this figure, I've used Opendoor's midpoint contribution margin of 6%, and subtracted interest payments of around $400 million.

This would leave Opendoor Technologies Inc. net income (before taxes, given that Opendoor is unlikely to be paying taxes for a considerable time), at around $200 million. This leaves Opendoor priced at approximately 7x next year's adjusted net income.

That being said, this is a hypothetical assumption, as we have no idea of whether in fact, Opendoor can sustainably reach around 5% contribution margins next year, as a lot depends on interest rates and the strength of the real estate market.

The Bottom Line

I understand that there are a lot of moving parts to the Opendoor Technologies Inc. business that are to a large extent outside of Opendoor's control.

While nobody doubts that Opendoor has turned a corner and is now on the front foot and rapidly improving its operations, until Opendoor reaches enough scale, the business today is far from profitable.

In summary, although I'm bullish on Opendoor Technologies Inc., I'm also cautious before I can categorically ascertain whether the worst of the property downturn is in the rearview mirror. Although, as you know, by the time I know, you'll know, and everyone else will know too. And that will be in the valuation.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.