Dover Corp.: Attractive If It Weren't For One Bad Leading Indicator

Summary

- Dover Corp. has outperformed the broader market since being rated a 'hold' in May 2022, with shares appreciating by 6.7% compared to the S&P 500's 0.7%.

- The company's financial results have been mixed but generally positive, with revenue growth driven by strong demand and the ability to overcome supply chain constraints.

- However, a decline in backlog figures indicates potential weakness in the market, suggesting caution is warranted and maintaining the 'hold' rating for now.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

July Alcantara/E+ via Getty Images

As a seasoned investor who has a solid track record, I pride myself in making some rather good calls over the years. When I look back at companies I have rated, I usually am of the opinion that the calls I made were accurate and justified. But every so often, I will look back on a company I analyzed and conclude that my assessment may have been off to some extent. One example of this can be seen by looking at Dover Corp. (NYSE:DOV), a diverse company that produces a wide array of equipment, components, software, solutions, and services, for sectors such as the vehicle aftermarket, waste handling, industrial automation, aerospace and defense, and more. A little over a year ago, in early May of 2022, I ended up rating the company a 'hold'. Since then, the firm has comfortably outperformed the broader market. Looking back, I believe that I was perhaps a bit too conservative on the enterprise. Given where shares are priced right now, it is awfully tempting to upgrade the company to a 'buy'. However, the one thing holding me back from that is the backlog data provided by management. Because of that, and only because of that, I believe that a 'hold' rating is appropriate at this time.

Mixed, but generally positive, performance

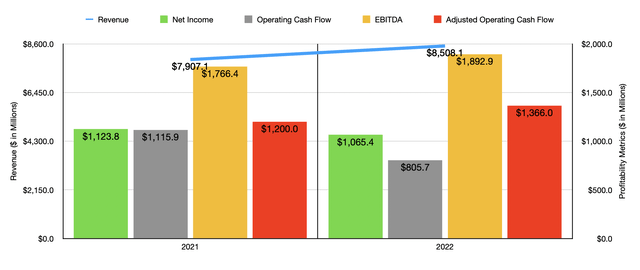

Since I last wrote about Dover in early May 2022 and rated the company a 'hold', shares of the company have generated a respectable amount of upside. Overall, shares have appreciated by 6.7% compared to the 0.7% experienced by the S&P 500. This return disparity can really be chalked up to some mixed, but generally positive, financial results reported by management. For starters, for the 2022 fiscal year, the business reported revenue of $8.51 billion. That's 7.6% above the $7.91 billion the company reported one year earlier.

This increase, according to management, was driven by an 8.8% surge in organic growth that was caused by strong demand for the company's offerings and its ability to overcome supply chain constraints in order to deliver on this demand. There were some other drivers behind the increase in sales. For instance, the Clean Energy & Fueling segment of the company was a leader in acquisition-related growth in the amount of 4.2%. Unfortunately, the company's efforts were hampered to some degree by foreign currency fluctuations that negatively impacted sales by 3.9%. Asset sales also hit the company to the tune of 1.5%. Meanwhile, price increases on its offerings helped revenue to the tune of 6.9%.

The bottom line for the company was a bit more mixed. Net income, for instance, managed to drop from $1.12 billion in 2021 to $1.07 billion last year. However, the most significant contributor on this front was a $206.3 million gain on asset sales that the company benefited from in 2021. Actual operating earnings for the company grew 7.6% year over year, matching the increase in revenue growth for the business. Other profitability metrics were also mixed. For instance, operating cash flow managed to drop from $1.12 billion to $805.7 million. But if we adjust for changes in working capital, we would have seen the metric climb from $1.20 billion to $1.37 billion. And finally, EBITDA for the enterprise grew from $1.77 billion to $1.89 billion.

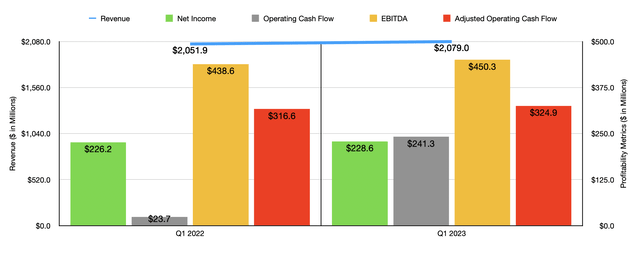

We do have some other data that is even more recent for the business. And when viewed through this lens, the picture definitely looks better. Revenue of $2.08 billion in the first quarter of the 2023 fiscal year came in 1.3% above the $2.05 billion reported one year earlier. Net income for the enterprise expanded from $226.2 million to $228.6 million. Operating cash flow surged from $23.7 million to $241.3 million. If we adjust for changes in working capital, the metric would have risen more modestly, but from a much higher base, climbing from $316.6 million to $324.9 million. And finally, EBITDA for the company grew from $438.6 million to $450.3 million.

So far, things are looking pretty solid. The picture looks even better when you consider management's guidance for the 2023 fiscal year. At present, they expect revenue to grow at a rate of between 3% and 5%. This is both organic revenue and revenue that factors in foreign currency fluctuations. Earnings per share should be between $7.81 and $8.01, with adjusted earnings of between $8.85 and $9.05. At the midpoint for adjusted earnings, we would expect net income of $1.26 billion. Adjusted operating cash flow should come in at around $1.40 billion, while EBITDA should be somewhere in the range of $1.94 billion.

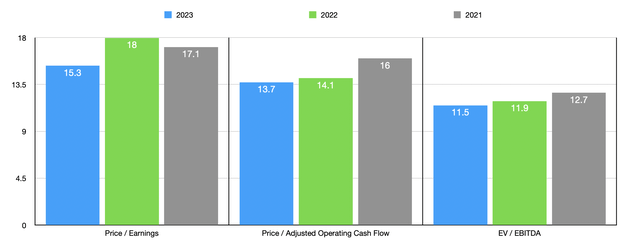

Based on these figures, I was able to easily value the company. On a forward basis, the firm is trading at a price to earnings multiple of 15.3. The price to adjusted operating cash flow multiple is about 13.7, while the EV to EBITDA multiple comes in even lower at 11.5. As you can see in the chart above, I provided not only that pricing but also pricing using data from 2021 and 2022. In the table below, meanwhile, I decided to compare the 2022 results to five similar firms. Across the board, with all three metrics, Dover ended up being the cheapest of the group.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Dover | 18.0 | 14.1 | 11.9 |

| Fortive (FTV) | 30.4 | 18.5 | 17.3 |

| Stanley Black & Decker (SWK) | 18.3 | N/A | 28.0 |

| Ingersoll Rand (IR) | 36.4 | 24.5 | 18.5 |

| Xylem (XYL) | 50.7 | 28.6 | 26.2 |

| IDEX Corporation (IEX) | 26.5 | 24.8 | 17.6 |

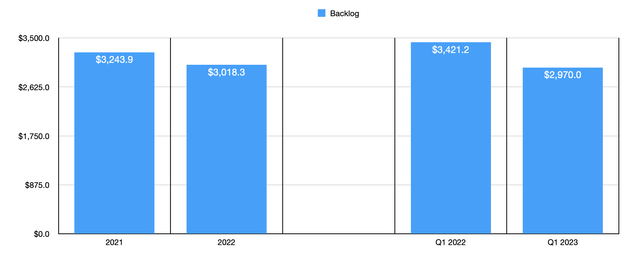

This is all great. Normally, this would be enough for me to increase my rating from a 'hold' to a 'buy'. However, in this instance, I am prevented from doing so because of the worrisome backlog figures reported by management. At the end of the 2022 fiscal year, the company reported a backlog of $3.02 billion. That's down from the $3.24 billion that the company had one year earlier. That's not a tremendous move lower. But when you look at data for the first quarter of the 2023 fiscal year compared to the same time last year, the picture does worsen. Backlog at the end of the first quarter, for instance, came in at $2.97 billion. That's down significantly from the $3.42 billion that the company had during the first quarter of 2022. A reduction in backlog indicates weakness in the market that, in turn, implies lower revenue and a reduction in margins moving forward. So while management may very well be accurate when it comes to the current fiscal year, the backlog will eventually come to bite the business. Management even acknowledged in their first quarter earnings release the backlog remains elevated compared to historical levels. So further downside from here is likely.

Takeaway

I have no doubt that, in the long run, Dover will prove to be a solid company that will do well for itself and its shareholders. In the long run, value should be generated for its investors. But this doesn't necessarily mean that the company makes sense to buy into at this moment. As things stand, shares of the company are affordable enough for a more bullish outlook. But until we see some stabilization in the backlog and the impact that its decline will have on not only revenue but also profit margins, I do believe a more cautious approach is warranted. As such, I've decided to keep it rated a 'hold' for now.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.