Is Stagflation A Concern Investors Should Be Watching Now?

Summary

- As the Fed tightens and slows the economy, the hope is that inflation will come down too; this is the "soft landing" scenario.

- There is much concern that the Fed will overdo it, resulting in a "severe recession", but that may not be the worst scenario either.

- A 1970s stagflation repeat with high inflation/low growth is also possible, especially if the inflationary challenges prove more structural in nature.

- The energy sector can offer protection in a stagflation case while also faring reasonably well in the other possible macro scenarios.

Dzmitry Dzemidovich/iStock via Getty Images

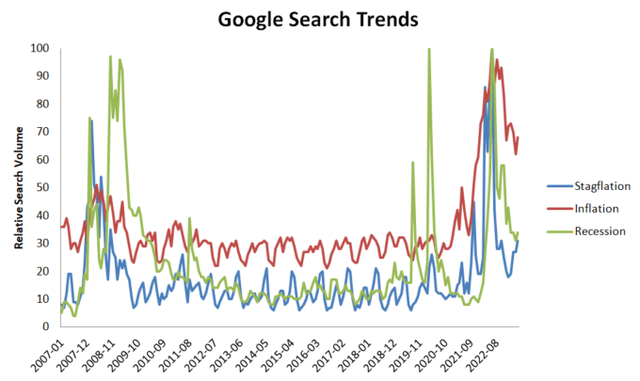

As inflation reached 40-year highs in 2021-22, another topic that made a comeback was "stagflation", the unpleasant combination of high inflation and subpar growth that defined the 1970s:

Google Trends; Author's Calculations

It looks that popular interest in stagflation, as well as in its cousins inflation and recession, has already peaked, but that hardly means the S-word is fully off the macro table.

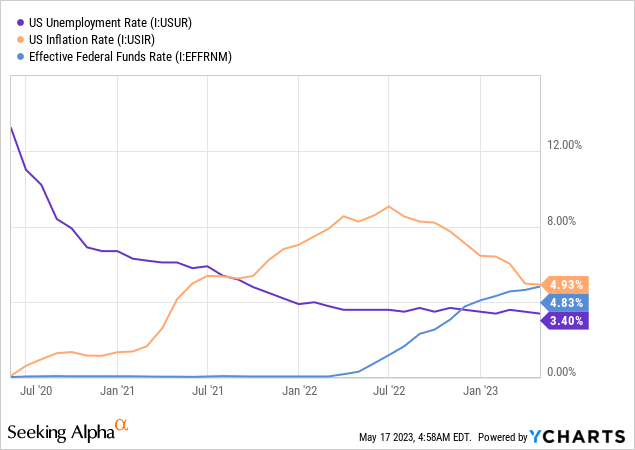

The Fed is obviously still tightening and the hope is this would slow down inflation without damaging growth too much (i.e., the "soft landing"):

The most talked about risk to the soft landing thesis is the possibility that the Fed overdoes it and pushes the economy into a more significant recession. However, while soft landing vs. recession are perhaps indeed the most likely scenarios, they aren't the only possible outcomes of the tightening cycle.

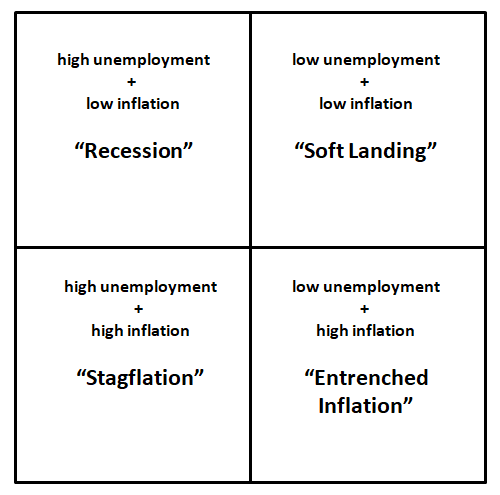

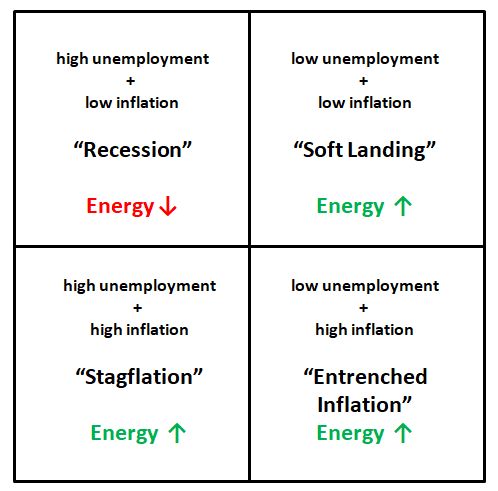

At the risk of oversimplifying, there are probably 4 possible outcomes, depending on where inflation and unemployment stand at the end of this:

Author

One should also plan for the possibility that inflation doesn't fully recede to 2%, which could imply either "stagflation" (low growth/high unemployment) or "entrenched inflation" (growth resumes but under a new inflationary regime).

What Happens During Stagflation?

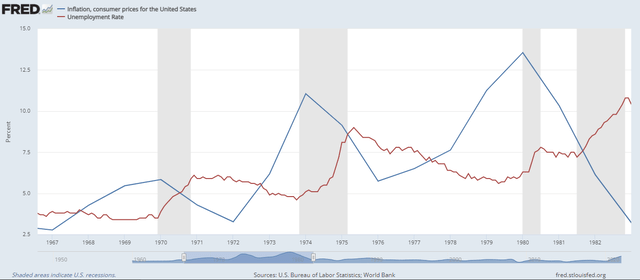

Originally coined in the U.K. in the 1960s, the "stagflation" term ended up characterizing much of the 1970s in the U.S., when subpar growth (or even contraction) coexisted with high inflation:

FRED

For example, during the 1974-75 recession, unemployment increased meaningfully, but inflation nonetheless remained elevated throughout the contraction.

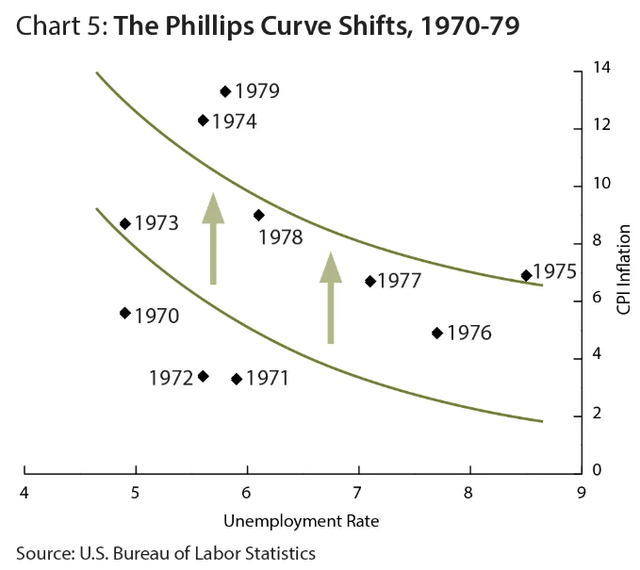

Until the 1970s, macroeconomic thought didn't assign a big probability to stagflationary conditions, as exemplified in the popular then "Philips curve":

economicshelp.org

The Phillips curve embodies the idea that there is a tradeoff between unemployment and inflation; low unemployment yields higher inflation, but, conversely, an increase in unemployment should slow down inflation. Under this framework, stagflation can be conceptualized as an upward shift in the curve that results in worse tradeoffs. So while the inverse relationship is still there, the same unemployment level corresponds now to higher inflation.

Why would the curve suddenly "shift"? The answer lies usually in exogenous/structural factors. In the 1970s, some of the reasons likely included:

- The oil supply shock due to the Arab petroleum embargo, which increased costs in the entire system while lowering real output;

- The influence of trade unions, which were able to negotiate higher wages (the restrictive role of unionization is probably an instance of the more general "structural unemployment" phenomenon, when workers and skillsets aren't aligned to the sectors that need them);

- Inconsistent monetary policy can also be a contributing factor; the stop-go policies of the 1970s Fed never finished the job until Volcker came with the big axe in the early 1980s.

Some of these factors may have striking parallels to today's post-COVID world.

How Does Stagflation Differ From Inflation?

While prices increase fast under both stagflation and inflation, the former is undoubtedly worse because real output is also falling or at least stagnating. Inflation is quite annoying even when you are employed, but it could be much worse if you are also out of a job. Stagflation is also worse than a traditional recession, which would usually at least reset inflation expectations.

The worst, perhaps, is that, to the extent stagflation is driven by structural factors, monetary policy by itself can't fix it. The Fed can probably influence some choices between inflation and unemployment along the Phillips curve, but can't push the whole curve back down. Only structural reforms can accomplish that, and, right now, the environment is not conducive to anything like that. Not only do we have political gridlock, but there is also general aversion to policies that may be unpopular in the short term.

Is Stagflation Likely To Occur?

Trying to predict macro outcomes can be a bit of a fool's errand, and it's probably better to position one's portfolio in a more robust way than to rely on probabilities. My view is that we are more likely to end up in the recession/soft landing/entrenched inflation quadrants, but stagflation can't be ruled out either.

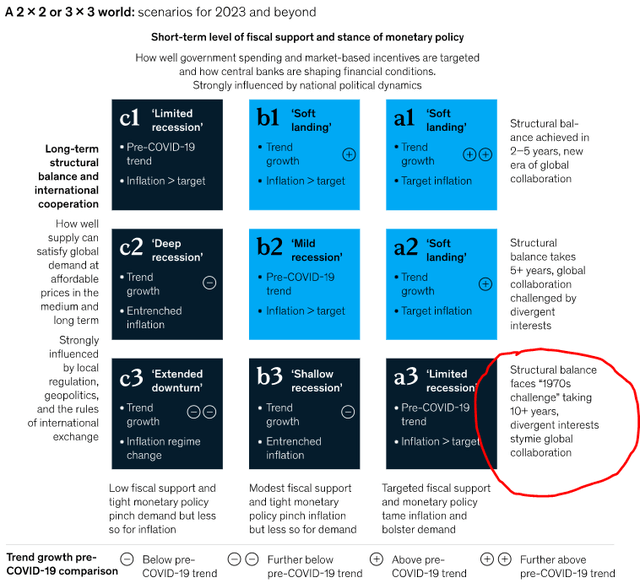

McKinsey, for example, argues that inadequate efforts from policymakers to address structural imbalances can yield outcomes that echo the 1970s:

McKinsey & Company

While, similarly to the 1970s, the world may be short on energy due to ESG restrictions and underinvestment since 2014, the McKinsey commentary also draws attention to the labor market imbalances:

[There] is evidence of a lasting job-skills mismatch in the wake of the “layoff” of 2020. Workers did not simply re-up with their same jobs when the pandemic subsided. Instead, shifts in demand across industries and geographies occurred and workers moved, lost or gained skills, or took new and different jobs. We estimate that in 2022, it took an average of 40 percent longer for an employer to fill a vacancy than it did in 2019. By November 2022, the differential recovery of employment across industries had changed the mix of jobs, as workers found employment in growing sectors. The persistence of excess vacancies demonstrates that the mismatch of skills and geographies continues.

So while many analysts focus on the declining labor participation due to early retirements or COVID handouts, we may have a deeper problem in that workers aren't in the sectors that need them. For example, if the tech sector layoffs continue and ChatGPT-like technology gains traction, we may end up with an oversupply of IT workers, but that will do little to alleviate labor supply issues in, say, oil and gas field services (OIH). Then, we also have supply chain issues; these are receding now, but there is no guarantee they won't return in the same or new sectors, especially if the international geopolitical frictions continue.

As none of these structural issues can be solved by the Fed, the stagflation probability remains non-zero. Even if the Fed fails at engineering a soft landing and pushes us into an outright recession, inflation may remain elevated -- or fall and resurface quickly -- due to these structural problems.

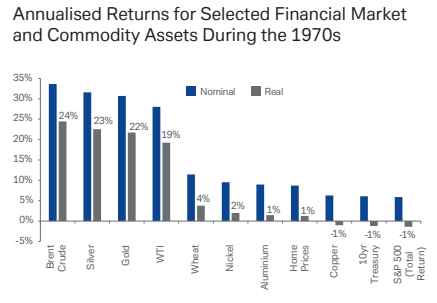

What Asset Classes Perform Well During Stagflation?

There is little doubt that in the 1970s, the place to hide was commodities, as stocks (SPY) and bonds (BND) each disappointed:

Deutsche Bank Research

Oil went up for fundamental reasons (the Arab embargo), but it also acted as an inflation hedge, similarly to gold (GLD) and silver (SLV) that also had a great decade.

While directly investing in oil futures (CL1:COM) isn't very practical for most retail investors, an allocation to energy equities can also do the job. I do believe some specific segments of the sector will perform better than others, but for a generalist investor the Energy Select Sector SPDR ETF (XLE) can be a reasonable investment vehicle. XLE tracks the energy sector of the S&P 500:

Seeking Alpha

Since XLE is market cap weighted, it is dominated by the U.S. majors Exxon Mobil (XOM) and Chevron (CVX). These companies aren't cheap, but I wouldn't consider them to be overvalued either. They may also have certain gravitational pull if institutional money realizes we are entering a stagflation/entrenched inflation scenario and increases its sector allocations.

XLE's composition is completed by a few large independents (OXY), the largest oilfield services companies (SLB), and a number of independent refiners (VLO). It is a bit of a hodge-podge because these companies play in very different parts of the value chain, but there is one important unifying theme. Namely, all XLE constituents are a claim on a scarce real asset, whether that is reserves under the ground, drilling rigs or a refinery. There is little risk of new competing capacity coming online, not just due to ESG constraints, but also because inflation makes it more expensive to build new infrastructure. Owning real assets that are supply constrained but yet provide an essential product should be a good hedge in both the high inflation/low growth and high inflation/high growth scenarios.

Bottom Line

The current macro debate seems to be primarily between the "soft landing" vs. "recession" camps. The Fed's persistence, which surprised many, has probably put the stagflation/entrenched inflation scenarios out of the spotlight, and, of these two, stagflation may be the less likely one.

However, stagflation shouldn't be completely excluded either. it is possible that the labor supply shortages aren't just due to loose monetary and fiscal policy, but also due to structural mismatches in how workers are aligned to industrial sectors. If ESG policies continue unabated and geopolitical frictions between the West and "Global South" continue, energy and commodity shortages may also become a long-term structural problem.

Going back to my simplified framework, I see energy doing well in all scenarios except a deep recession:

Author

A deep recession that reduces oil demand will pressure oil prices although I think that this effect will be short-lived, due to the fundamental issues in the sector. Nonetheless, an energy allocation could be complemented by exposure to long-term government bonds (TLT). TLT would probably do very well in a "recession" scenario and reasonably well in a soft landing, but would be a poor performer otherwise.

In conclusion, after the dismal 2022 year for the traditional 60-40 portfolio, the WSJ recently proclaimed that the "60-40 investment strategy is back" and has had a great 2023 YTD. I think it's too early to make that call; the 1970s was a marathon, not a sprint, and most investors would probably do well to maintain at least some commodity/energy exposure.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM; SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.