Innoviz Technologies: Accelerated Path

Summary

- Innoviz Technologies reported a mixed Q1 2023 earnings report, but the future is based on the strong order book.

- The Lidar sensor company announced another production auto deal, expected to reach production in 2024.

- Innoviz Technologies stock is cheap with a market cap of only $400 million, but shareholders face a potential dilutive equity raise in the next year.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Learn More »

Kimberly White

As 2023 heads towards the midpoint, Innoviz Technologies Ltd. (NASDAQ:INVZ) is quickly moving toward shipping Lidar sensors for production autonomous vehicles. The Lidar company even sees programs with accelerated paths to production, with timelines around 2024 and 2025 just around the corner. My investment thesis remains ultra Bullish on the stock, with a substantial order backlog set to grow over the years.

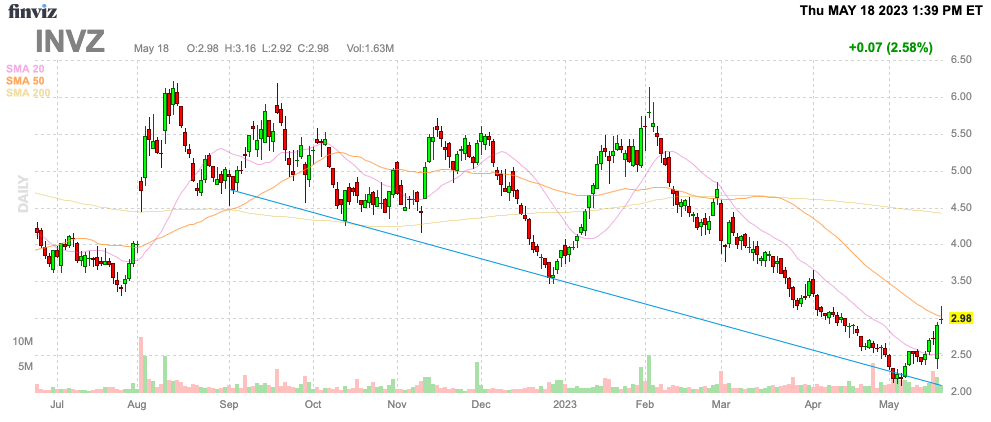

Finviz

Deal Acceleration

Innoviz already has a massive forward-looking order book, yet the company is now talking about new deals with accelerated paths. Unfortunately, though, the Lidar company didn't provide updates to previous financial targets, adding more confusion to the investment story.

The company only reported Q1'23 revenues of only $1.0 million, down 44% from last year. Innoviz even missed the analyst target for the quarter by $0.4 million.

Even though the Lidar companies went public with goals of automotive production deals not starting until 2024 or 2025, the market doesn't like the current lack of revenues. A lot of investors just can't grasp how Innoviz will go from $1 million in Q1'23 to billions in revenues in just a few years.

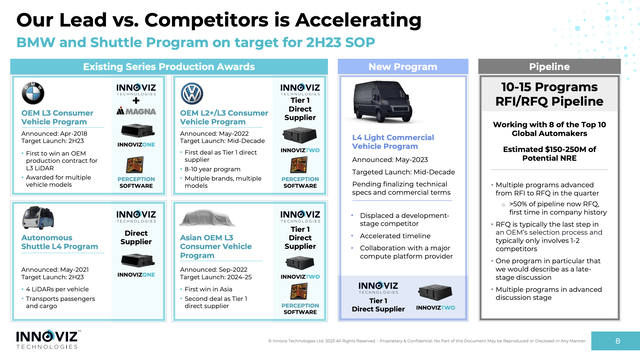

The key here is that Innoviz already has four production awards, including major deals with BMW (OTCPK:BMWYY) and Volkswagen (OTCPK:VWAGY). Along with 2 other production deals, the Lidar company announced another L4 light commercial van deal with an existing customer.

Innoviz Tech. Q1'23 presentation

The company spent the Q1 earnings release and earnings call talking extensively about the RFI/RFQ pipeline and potential NRE revenue, but the market really wanted to hear news on the forward-looking order book. Management didn't provide any details on how the new production deal stacks up, but the company confirmed on the Q1'23 earnings call that the existing large order book remains in place as follows (emphasis added):

Our goal here is to further build upon our industry leading $6.9 billion forward-looking order book, which will be updated on our fourth quarter 2023 earnings call.

Innoviz Technologies Ltd. reporting a revenue dip tends to reinforce a fear that this backlog won't turn into actual orders. In reality, the Lidar business should flip a switch in the next year, with a huge revenue ramp in the following quarters. Innoviz already has 2 production deals ramping up this year and at least one more in 2024, likely leading to substantial revenue growth.

Tesla, Inc. (TSLA) CEO Elon Musk talked to CNBC about flipping the switch on FSD (full self-driving) technology on 3 million vehicles, possibly by the end of this year. The leading executive at the most advanced EV company very much supports the revenue ramp predicted by Lidar companies.

Depressed Stock

Despite all of these positive signs surrounding Lidar production deals, Innoviz is now trading near all-time lows. The stock only has a market cap of $400 million for a company discussing nearly $7 billion in backlog already.

Innoviz only forecasts 2023 revenues of $12 to $15 million, with cash collections from customers of $20 to $30 million due to NRE bookings in the $20 to $40 million range. The market won't offer a lot of value to the NRE revenues due to the non-recurring nature to get projects going.

The company has a cash balance of $157 million. Innoviz used $27 million in operating cash flows during Q1, leaving only about 5 quarters of cash flow at this rate. The NREs from customers will help extend the cash runway.

The biggest risk to the business is definitely being forced to dilute shareholders, with the stock trading at $3. The company has the forward-looking order book to attract a capital infusion, especially at this valuation.

A crucial aspect of the business is whether Innoviz can actually hit the current consensus revenue targets of over $78 million in 2024 and $288 million in 2025. The Lidar company can greatly reduce cash burn rates when the business has positive gross profits to offset operating expenses. The market is heading towards an inflection point, and the biggest question is the amount of any future dilution.

Takeaway

The key investor takeaway is that Innoviz Technologies Ltd. stock is a huge bargain compared to the current valuation. The company likely needs to raise additional cash, with such a move a very bullish sign for the stock considering the massive deals already in place.

Investors should continue using weakness to buy a leader in the Lidar space.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INVZ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.