SOXX: A Tale Of 2 Cities

Summary

- The semiconductor industry has a good future ahead even with short-term headwinds.

- The market seems to think some of these companies will thrive while others will be cast aside.

- Regardless of which one win the war, this is a good ETF to hold in the long term.

sankai

The semiconductor industry is an interesting industry because on one side it's the lifeblood of all the technological developments we are witnessing but on the other side it is a highly cyclical industry. I always found it interesting because this industry includes some of the best performers as well as some of the worst performers in the stock market.

In this article I will talk about iShares Semiconductor ETF (NASDAQ:SOXX). This ETF includes 35 stocks within the semiconductor industry mostly based in the US. It also includes some big semiconductor players based outside of the US such as TSM (Taiwan Semiconductor) or ASML but they don't get a lot of weight in the index despite their size.

Typically, due to its highly cyclical nature the semiconductor industry has been seen as one of the barometers of the economy. When this industry started showing signs of weakness it typically pointed out to a weakness in the overall economy. Similarly, booming of this industry always coincided with booming of the overall economy. This is why investors typically buy semiconductor stocks at the beginning of a bull cycle and sell it when they see a recession in horizon.

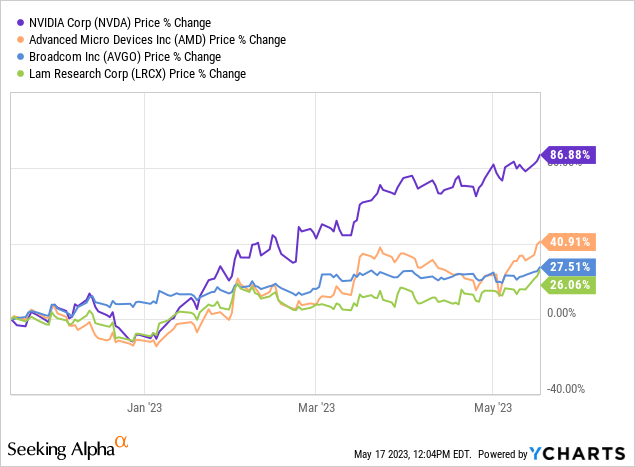

This year has been a bit different though. When we look at performance of some of the stocks in this ETF, we notice that some of them are behaving exactly like how a cyclical stock would perform at the end of a cycle while others are behaving like we are still in early stages of a bull run.

On one hand you have stocks like Intel (INTC), Qualcomm (QCOM), Texas Instruments (TXN), TSM (TSM) and Micron (MU) that are behaving like we are about to enter a recession. Even management of each of these companies called out that demand is drying up for their products. On the other hand you have stocks like Nvidia (NVDA), AMD (AMD), Broadcom (AVGO) and Lam Research (LRCX) acting like we are still in early stages of a bull cycle and rallying relentlessly.

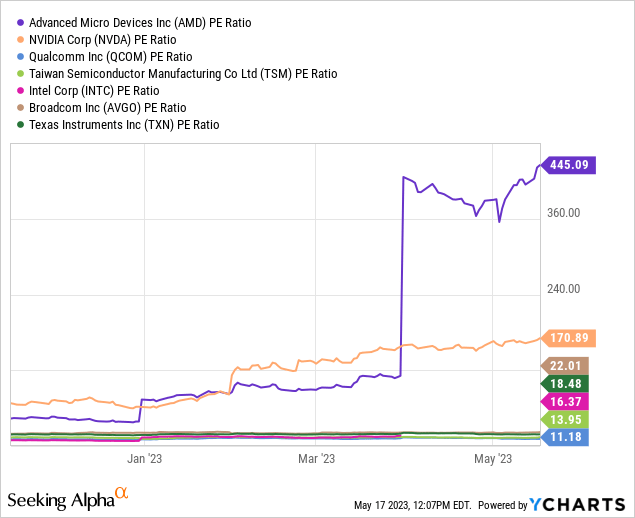

This even shows up in valuations. We have some semiconductor stocks with their P/Es in low 10s and we have others P/Es in 100s. Since those with higher P/Es recently has very strong rallies, they also happened to claim higher weighs in the index as compared to stocks that happened to have low valuations and lagged. This also drove the overall P/E value of the ETF higher. The current P/E of the ETF is 21. This ratio is either too high or too low depending on where we are in the cycle. If you believe that we are in early stages of a new bull run, the P/E of 21 is fairly low but if you believe we are on the brink of a recession this P/E might be too high since semiconductor industry's P/E values tend to drop to single digits during recessions. Regardless, the fund's P/E is still lower than Nasdaq average P/E which currently sits at 28.

In the long run semiconductor companies will continue to benefit from secular growth trends driven by data centers, AI, higher use of technology overall, rise of autonomous driving and overall rise in "smart devices" we use in our lives. This growth trend has been well in place for the last decade and could continue for the next decade or two but it doesn't change the fact that the industry is still cyclical since most demand for chips are still driven by economic cycles.

Many of the chipmakers guided for lower sales this year including those with high-flyer stocks like Nvidia and AMD but they also noted that long term trends were looking good. Some investors thought it might be a good idea to wait for a dip that might be triggered by short-term weakness but this might not come anytime soon since the market already knows to expect weakness in the short term followed by long term growth.

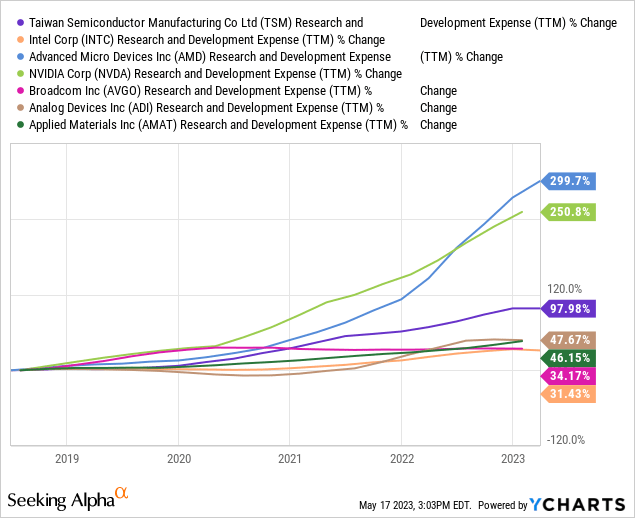

Companies like Intel and TSM have been investing very heavily to build new factories in order to support the next growth spurt of the industry which could start as soon as next year. These investments are worth tens billions and will take years to build out and if these companies didn't believe in a strong future growth they wouldn't have made those massive investments. Meanwhile fabless companies are also ramping up their R&D spend in order to prepare for the growth of the next decade. Below is a graph showing how the industry ramped up its R&D spend significantly in the last 5 years.

As you can see above, AMD and Nvidia increased their R&D spend by 250-300% in the last 5 years while other companies in the industry also raised their R&D spend by anywhere from 30% to 100%. If we saw this trend in only one or two companies we might want to believe that those couple companies are highly optimistic but when we see similar trends across the entire industry in more than 30 companies, it is safe to assume that there is significant growth ahead for the sector for the foreseeable future. After all, companies don't increase their R&D spend by anywhere from 30% to 300% in 5 years if they don't expect to see results in the long run.

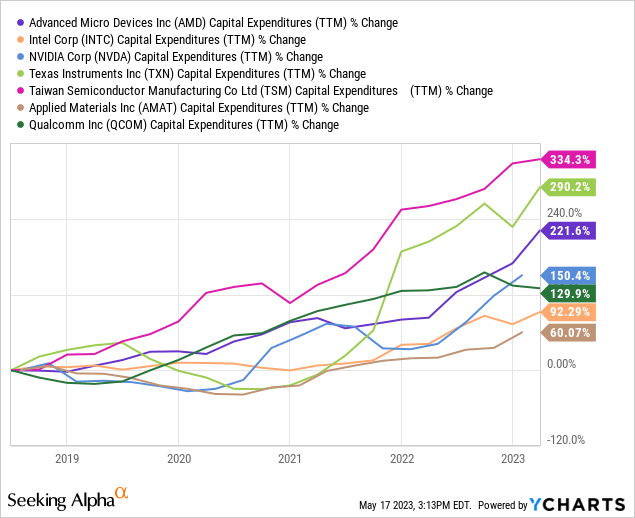

We are also seeing the same trends in capital expenditures by these companies. Many of these companies are working very hard to increase their product offerings, production capacity and expanding into new markets. That's why you are seeing their cap-ex spend up anywhere from 60% to 330% in the last 5 years. We didn't even see a slowdown in cap-ex in the last year even when interest rates were rising and capital was becoming more expensive to borrow for these companies.

On the surface the entire industry is growing but when we look under the hood we see a war going on between different companies in order to obtain a bigger piece of this seemingly ever-growing pie. On the manufacturing side we will see big battles between Intel and TSM and on the design side we will see most companies coming toe to toe in different sub-markets. Not to mention we are also seeing companies in other sectors trying to design or build their own chips lately. Two such examples are Apple and Tesla. Stock market seems to think that only some chip companies will survive the war and enjoy their bounty while others will be cast aside, evidenced with the fact that some of these stocks trade for P/Es as high as 100+ while others are given P/Es as low as 10.

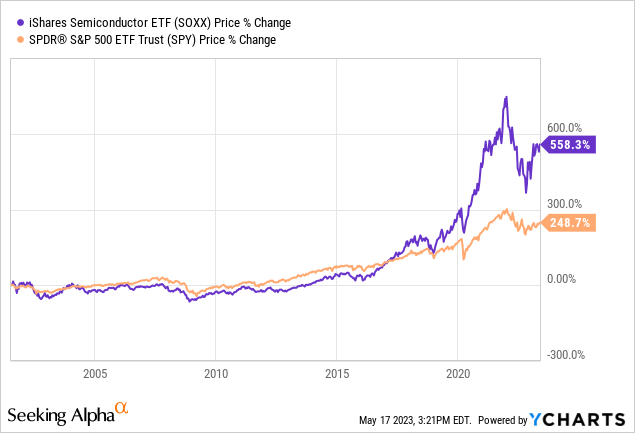

Regardless of which company you think will thrive or be cast aside, it's a good idea to be invested in the chip sector and this ETF gives you a decent exposure to it. As you can see below, the ETF has a history of beating market returns (measured by SP500) by a large margin and this could continue for a while unless something drastically changes in the way we live, work and utilize technology.

I wouldn't start a 100% position in this ETF right away though. After deciding on how much money to allocate to this fund, I would allocate about 30-40% of that amount and keep adding another 10% in every time it dips 10%. Also, this is one of those funds you want to hold in the long term so only buy it if you are prepared to hold for at least 10 years.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SOXX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.