American Water Works: Good Upside Potential

Summary

- American Water Works is expected to benefit from investments in acquisition & capital expenditure.

- The wastewater business should provide additional upside to revenue growth.

- Considering, growth prospects along with lower than historical P/E ratio, I have a buy rating on this stock.

DKosig

Investment Thesis

American Water Works Company (NYSE:AWK) is expected to generate increased revenue and earnings per share (EPS) year-over-year in FY2023. This positive trajectory should be driven by strategic investments in acquisitions and capital expenditure (CAPEX) within its Regulated business. Moreover, the opportunity to expand the wastewater business should act as a growth catalyst for the company. Taking into account these promising growth prospects coupled with a lower-than-historical P/E ratio, I recommend a buy rating on the stock.

Growth through Acquisitions

As of March 2023, AWK had done 27 agreements to acquire businesses across 9 states including the Butler Area Sewer Authority, Waste Water System in Pennsylvania and Towamencin Township Wastewater System in Pennsylvania which should add 48,200 new customer connections in the coming years. More recently, the company announced the purchase of a Wastewater treatment plant in Granite City, Illinois, leading to $550 million of acquisitions under the agreement. While the company had signed the purchase agreement, the regulatory approvals are still pending to complete the acquisition. As a result, the company has thus far completed a mere five acquisitions across two states. AWK anticipates completing the deal of Granite City by the end of 2023 and Towamencin by mid-year 2024. These transactions are expected to boost the company's revenue stream in the upcoming years. Additionally, AWK has outlined its strategy to allocate $400 million in FY23 and $3-$4 billion over the next decade towards further acquisitions. This planned investment is projected to yield significant revenue growth for AWK in the coming future.

Benefits from General Rate Cases

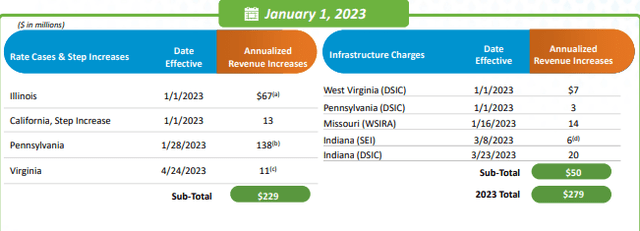

Through capital investment strategy, AWK is expected to invest $2.5 billion in FY2023 and $27-$30 billion in ten years for the CAPEX of its Regulated business. The company plans to use 68%-70% of its CAPEX in infrastructure renewal and the rest to improve water quality, resiliency etc. Such investments in infrastructure help the company to file a case to the regulatory authority for general rate increases in its services. Hence, I believe these investments should be a significant growth tailwind for the comping in the coming future. Benefiting from the investments, the company have already generated $279 million in annualized new revenue in rate cases since January 2023. This includes $229 million from general rate cases & step increases and $ 30 million from infrastructure surcharges.

AWK's general rate cases and infrastructure surcharges (Investor presentation)

The company has recently filed a general rate case in Missouri and the final decision on the matter is expected in the second quarter of FY2023 which should increase the annualized revenue by $95 million. Moreover, with a plan to invest $27-$30 billion over ten years in CAPEX, AWK should continue to benefit from general rate cases in the long term.

Opportunity in Wastewater Business

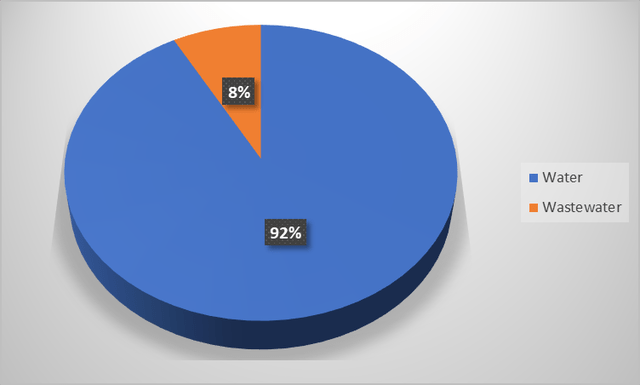

American Water Works has a customer mix that comprises 92% water and 8% wastewater, presenting a strategic opportunity for expanding its wastewater business in the coming years. In the water sector, the company boasts an extensive customer base, well-established operational infrastructure, equipment, and profound expertise. Leveraging these valuable resources, the company is poised to persistently pursue its strategy of acquiring wastewater businesses closely aligned with, or within, its existing water operations. These initiatives hold good potential to generate compelling long-term value, benefiting both the company and its shareholders.

AWK's customer mix (Company data, BI Insights )

Valuation

American Water Works is currently trading at 30.29x FY2023 consensus EPS estimate of $4.78 and 28.19x FY2024 consensus EPS estimate of $5.13 which is a discount to its 5-year average P/E ratio of 33.81x. While the P/E ratio of AWK appears to be high, I believe the companies which are engaged in the water utility business usually trade at a high P/E like Xylem (31.09x 2023 EPS consensus estimate $3.32) or Badger Meter (50.78x FY2023 consensus EPS estimate of $2.70).

Conclusion

American Water Works operates in a very stable and resilient industry, which justifies its high P/E ratio. In the fiscal year 2023, AWK is expected to achieve year-over-year revenue and earnings per share (EPS) growth. These positive outcomes are expected to result from the strategic investments made in acquisitions and the capital expenditure of its Regulated business. Additionally, the opportunity to expand its wastewater business is poised to act as a growth catalyst for AWK's overall growth. When taking into account the promising growth prospects alongside the current valuation that is lower than the historical P/E ratio, I am inclined to recommend a "buy" position on American Water Works.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.