XLE: A Fund That Should Still Hold Up Well If There Is A Recession

Summary

- The oil industry is in a very strong cash position, a recession shouldn't stop upstream or downstream companies from continuing to return cash to shareholders with buybacks and dividend increases.

- There are a number of reasons to believe oil prices will stay at elevated levels even if the economy slows for multiple quarters and energy supplies remain tight.

- The 4.31% yield of this fund should be appealing to investors if this exchange-traded fund sells off anymore.

Jeremy Poland

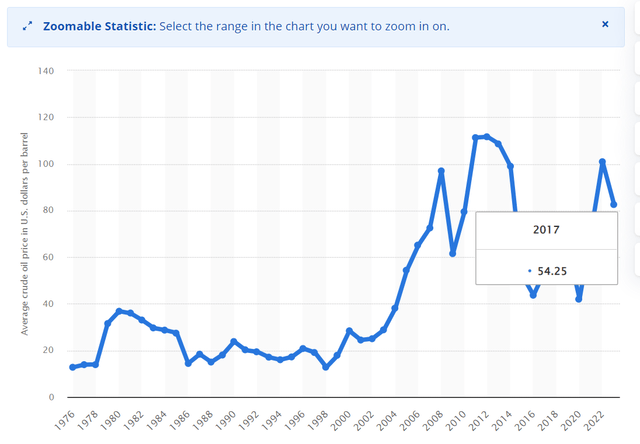

Times have changed dramatically in the last four years. Prior to Covid hitting in late 2019 interest rates were fairly low, growth rates remained high, and inflation remained under control. Energy prices also remained low for most of the four years between 2016 and 2020, with Brent Crude prices averaging just $57.75 a barrel during that timeframe. Today, inflation has consistently been at 5%, the Fed continues to raise rates, and most major commodities including oil prices remain at high levels.

One of the best-performing sectors that have consistently offered investors inflation-adjusted income and total returns since prices began to increase at historically high levels in early 2021 is the oil sector. The Energy Select Sector SPDR Fund ETF (NYSEARCA:XLE) is one of the more well-known exchange-traded funds in the energy sector.

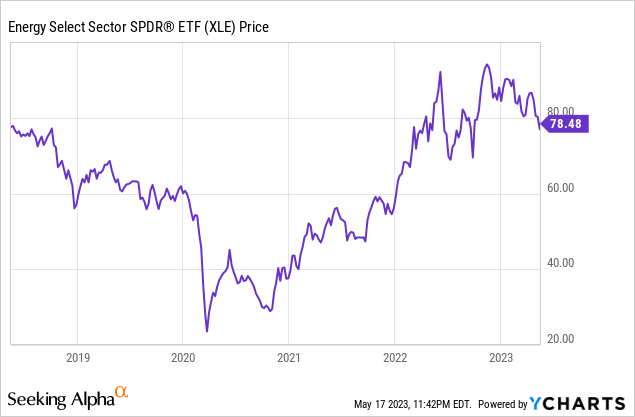

XLE has performed very well during the current inflationary period that started when prices began to rise significantly in early 2021. This fund's total returns over the last three years have been 132%, while the S&P 500's (SPY) is up 47.66% during this same time period.

Today, I rate XLE a hold. I last wrote about this fund in my article that was published in April 2022, and I rated this fund a buy. XLE is up 8.95% since that time, while the S&P 500 is only up .65% during the same period of time. I expect this fund to continue to outperform the broader indexes, but XLE's upside should also be limited since there are increasing signs that the economy will enter a recession this year.

The Energy Select Sector fund has $34.08 billion in assets under management, and this ETF is 99.6% invested in energy stocks. The fund is weighted to energy stocks in the S&P 500. This ETF has an impressively low expense ratio of just .1%, The fund's turnover rate is 13%, and the fund is in the State Street global family of advisors. This exchange-traded fund is invested in upstream and downstream operations, in integrated and independent oil producers, and in both oil and natural gas producers. The fund's 10 biggest holdings are Exxon Mobil (XOM), Chevron (CVX), EOG Resources (EOG), ConocoPhillips (COP), Schlumberger (SLB), Pioneer Natural Resources (PXD), Occidental Petroleum (OXY), Marathon Oil Corporation (MRO), Valero Energy Corporation (VLO), and Occidental Petroleum Corp. (OXY). Exxon Mobil and Chevron make up a combined amount of nearly 43% of the fund.

The oil market continues to face significant supply constraints, and demand for oil is not likely to fall significantly even if the economy enters a moderate recession. Geopolitical issues remain, with the War between Russia and Ukraine showing no signs of ending. Governments in Europe and the US also remain unwilling to aggressively support new drilling, and energy markets are still trying to make up for a period of significant underinvestment in this industry from 2016 to 2020 when prices were at lower levels. This fund is still well positioned to continue to offer solid income since the yield is 4.31% and the dividend growth of this fund continues to be impressive as well. This fund should see strong dividend growth again this year, since most leading energy producers have historically strong balance sheets.

Even though oil prices have sold off from peak levels in 2022 when crude prices spiked briefly to over $120 a barrel after Russia invaded Ukraine early last year, prices remain high today with the current price of Brent Crude Oil at $72.81. Brent Crude oil prices have remained between $70-90 a barrel for most of this year, and prices have held up well even as supply constraints have offset concerns of falling demand with increasing worries that the economy is slowing.

A Chart of oil prices. (statista.com)

Predicting the price of any commodity in the near term is nearly impossible, but there are multiple reasons to believe crude prices should remain at high levels even if the economy enters a moderate recession. Russian oil exports remain limited, and the energy industry is also still recovering from an extended period of significant underinvestment from 2016 to 2020 when prices were often at low levels. Upstream investments in the energy sector have fallen from $700 billion a year in 2014, to between $370 billion to $400 billion today. The average decline rate per year globally of oil fields is also 6%. The IAEA is forecasting global demand for oil to increase by nearly 2% this year from 2022 levels. Oil demand is supposed to continue to grow by about a half a percent a year from now until 2030. The Energy and Information Administration also recently updated the agency's forecast for crude oil prices in 2023 to $79 a barrel.

Most major energy producers also had record cash flow last year, and so XLE should continue to see impressive dividend growth moving forward. Exxon Mobil had cash flow of $62.1 billion, an increase of 64% year-over-year, and Chevron reported a record cash flow in 2022 of $49.6 billion. This fund has a history of strong dividend growth, and that fact should continue moving forward. The 5-year dividend growth of this fund is 8.09%, and the 10-year dividend growth of this fund is 9.22%.

Well obviously, even a moderate recession will likely limit the upside of XLE, this fund should still offer solid income to patient investors since the price of oil isn't likely to sell off significantly from current levels for multiple reasons. XLE has consistently offered investors inflation-adjusted income, and the dividend growth of this fund should continue to be strong moving forward since most major energy producers have very strong balance sheets. While this fund faces near-term risks, XLE should also still continue to outperform the S&P 500 and the broader indexes.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.