CrowdStrike: Conservative Guidance, 30% Growth, 30% Margins

Summary

- CrowdStrike is a leading disruptor in the cybersecurity endpoint market.

- The company has mixed high secular growth with attractive profit margins.

- Management has thoroughly disputed the notion that Microsoft is a competitive threat.

- The stock remains highly buyable for long-term growth investors.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

BlackJack3D

CrowdStrike (NASDAQ:CRWD) is a top tier operator in the cybersecurity endpoint market. While many investors might be afraid of competition from mega-cap tech titan Microsoft (MSFT), such fears may be unwarranted as CRWD appears to have a far superior product. The discrepancy is also validated by the company's ability to sustain rapid revenue growth and take market share. CRWD has already achieved 30% free cash flow margins and expects margins to expand in coming years. The sustained price weakness in the tech sector has given growth investors a protracted opportunity to acquire shares in this cybersecurity disruptor at reasonable valuations.

CRWD Stock Price

Despite remaining far below all-time highs reached in late 2021, CRWD remains well above pre-pandemic levels.

I last covered CRWD in February where I rated the stock a "strong buy" after it crumbled due to high expectations. The stock is up 20% since then but I continue to see long term upside for patient investors.

CRWD Stock Key Metrics

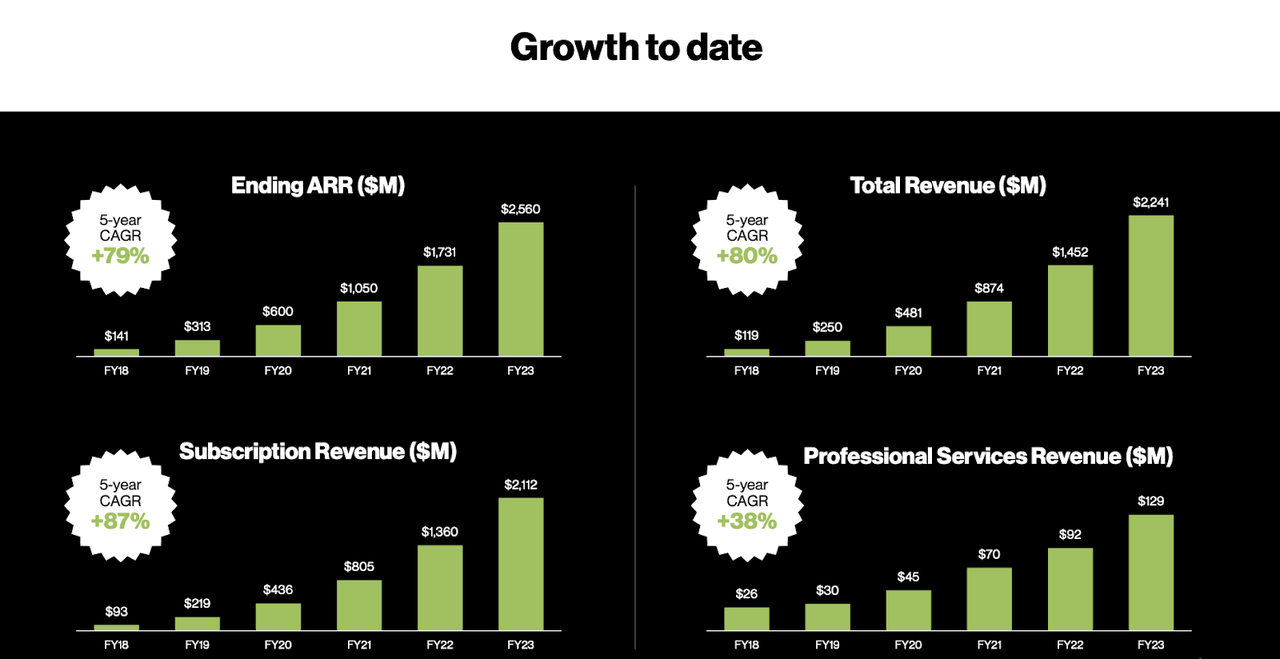

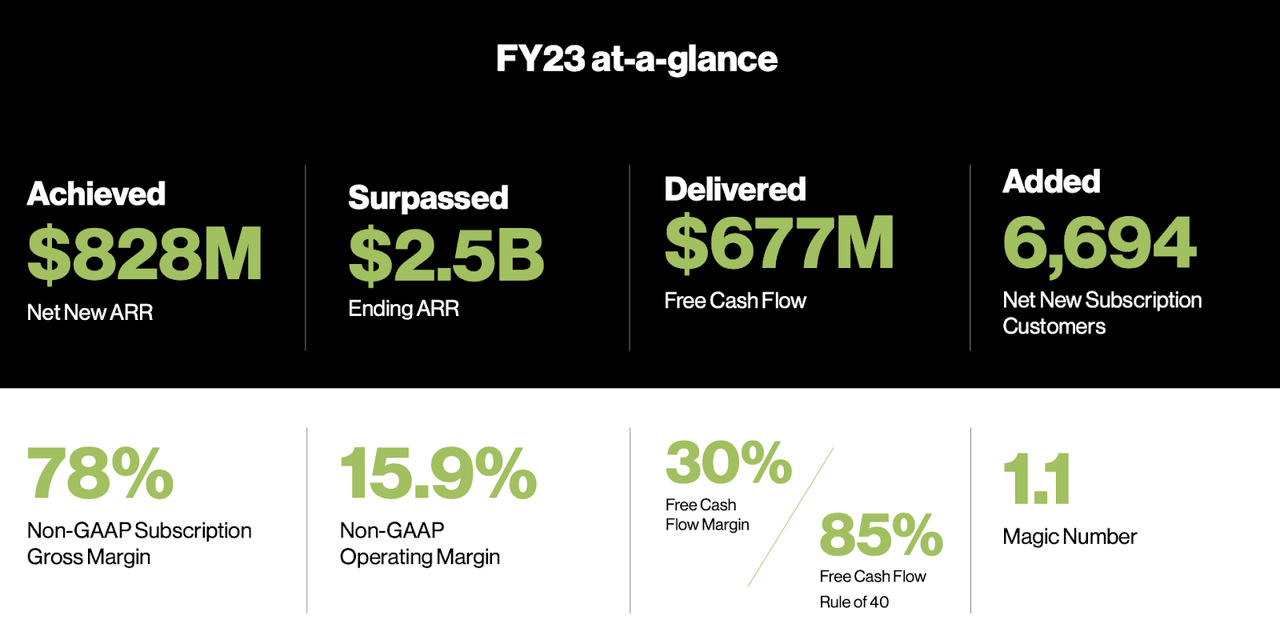

In its most recent quarter, CRWD delivered 48% YOY revenue growth, closing out a year in which the company grew revenue by 54%. It is incredible to see the lack of material deceleration in revenue growth over the past several years.

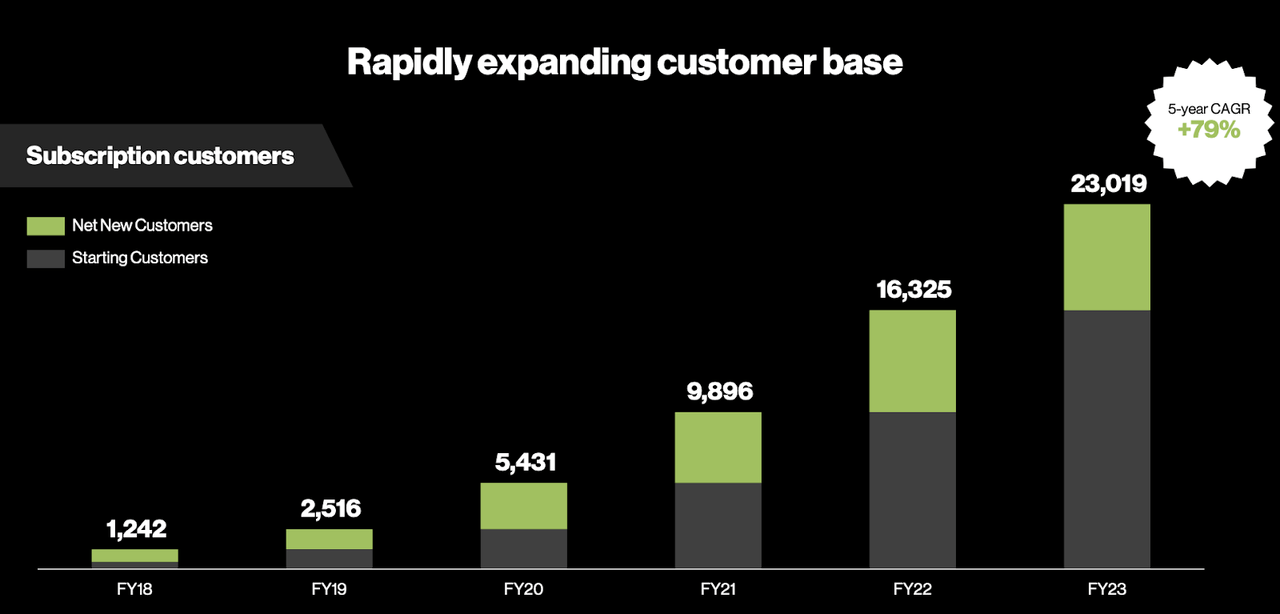

CRWD grew its customer base rapidly again this past year, which bodes well considering that the company has sustained a 120% or higher dollar based net retention rate for many quarters.

Unlike many of its tech peers, CRWD has been profitable on a non-GAAP basis, generating 15.9% non-GAAP operating margins and 30% free cash flow margins for the full year.

CRWD ended the quarter with $2.7 billion of cash versus $700 million of debt, representing a fortress balance sheet. Not only does CRWD have a top tier product offering, but it also is generating top tier financial results.

Looking ahead, management has guided for up to 39% revenue growth in the first quarter and 35% revenue growth for the full year. The non-GAAP operating margin is expected to expand to just over 17% and the non-GAAP net margin is expected to be even higher at 19% due to higher interest income. On the conference call, management called out the embedded conservatism in their guidance as they are assuming that headwinds from "budget scrutiny and elongated sales cycles" will continue this year.

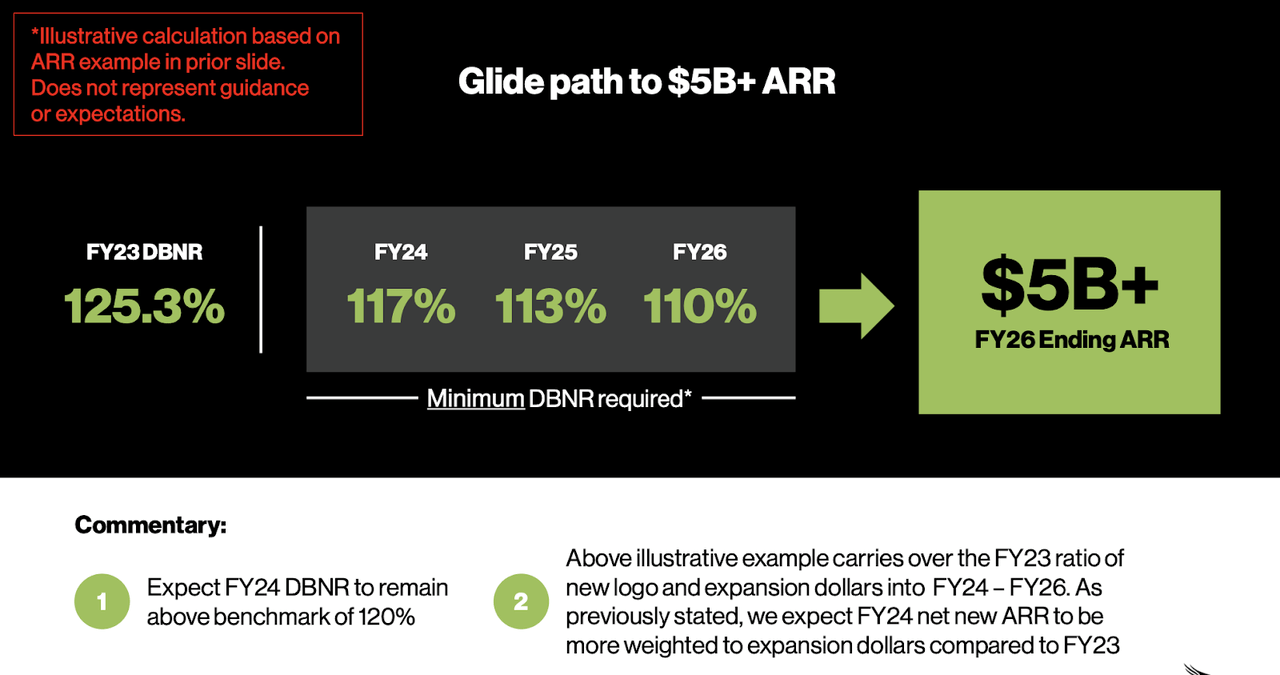

At its 2023 Investor Day, management reiterate confidence in their $5 billion ARR target for FY26, outlining the conservative underlying dollar-based net retention rates needed to achieve that goal.

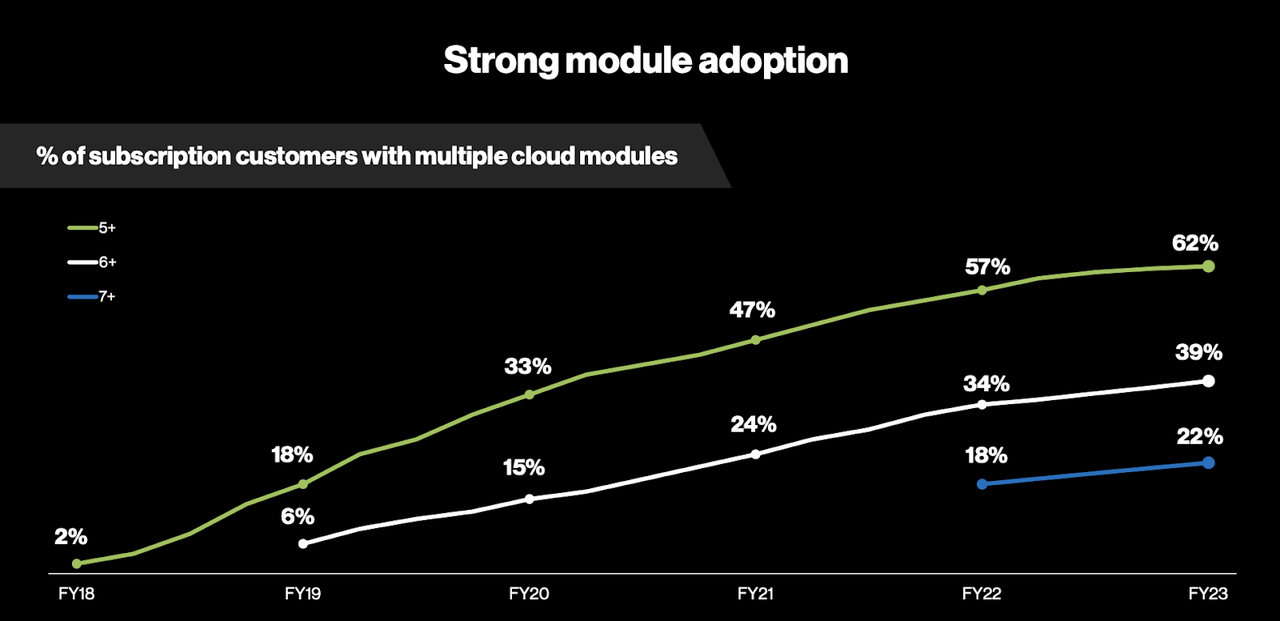

CRWD is poised to benefit from its deep product portfolio, as I expect that to be an easier path to growth than adding new customers in this difficult environment. CRWD has seen great success in cross-selling new products to existing customers and may continue to show such growth in the future.

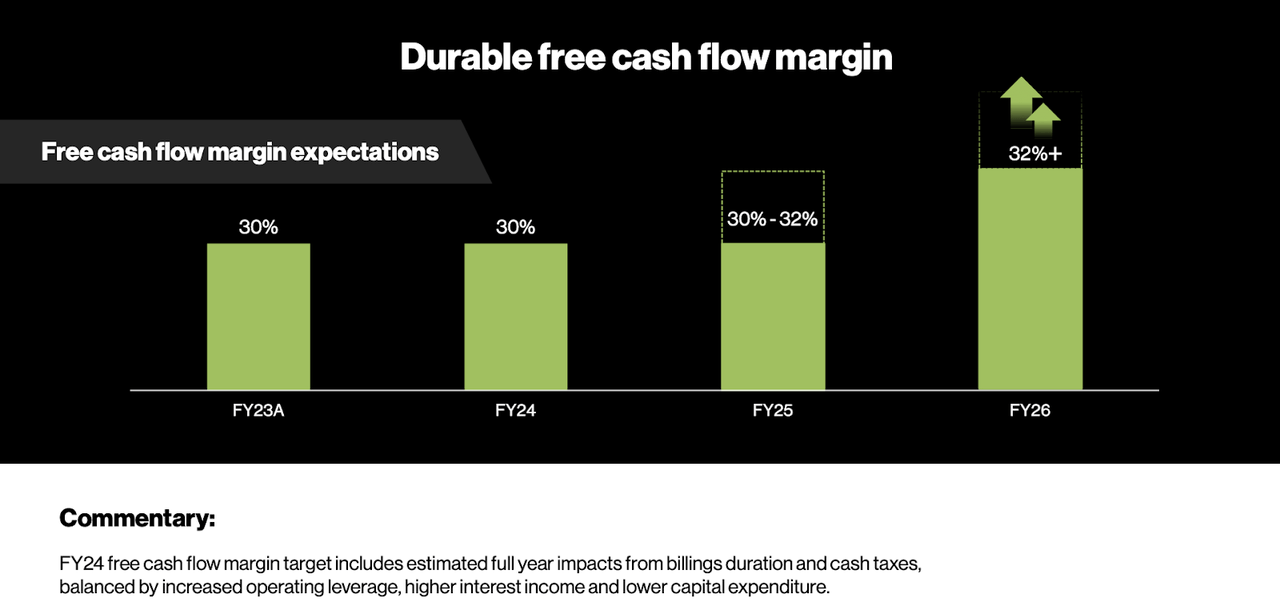

Management also guided for free cash flow margins to expand to 32% and beyond over the coming years.

Management has also guided for non-GAAP operating margins to reach their 20% to 22% long term target by FY25 - CRWD represents one of the few companies showing both rapid growth and strong cash flow margins. Investors may be wary of stock-based compensation, but management has guided for diluted shares outstanding to increase by less than 2% this upcoming year. On the conference call, an analyst asked management if they have plans to authorize a share repurchase program. Management's response indicated that while they were open to such an action, they are still taking it "on a quarter-by-quarter basis." While CRWD's stock continues to trade at a relative premium to peers, the valuation is reasonable and I can see the argument for share repurchases as they can help further the case for multiple expansion.

Is CRWD Stock A Buy, Sell, or Hold?

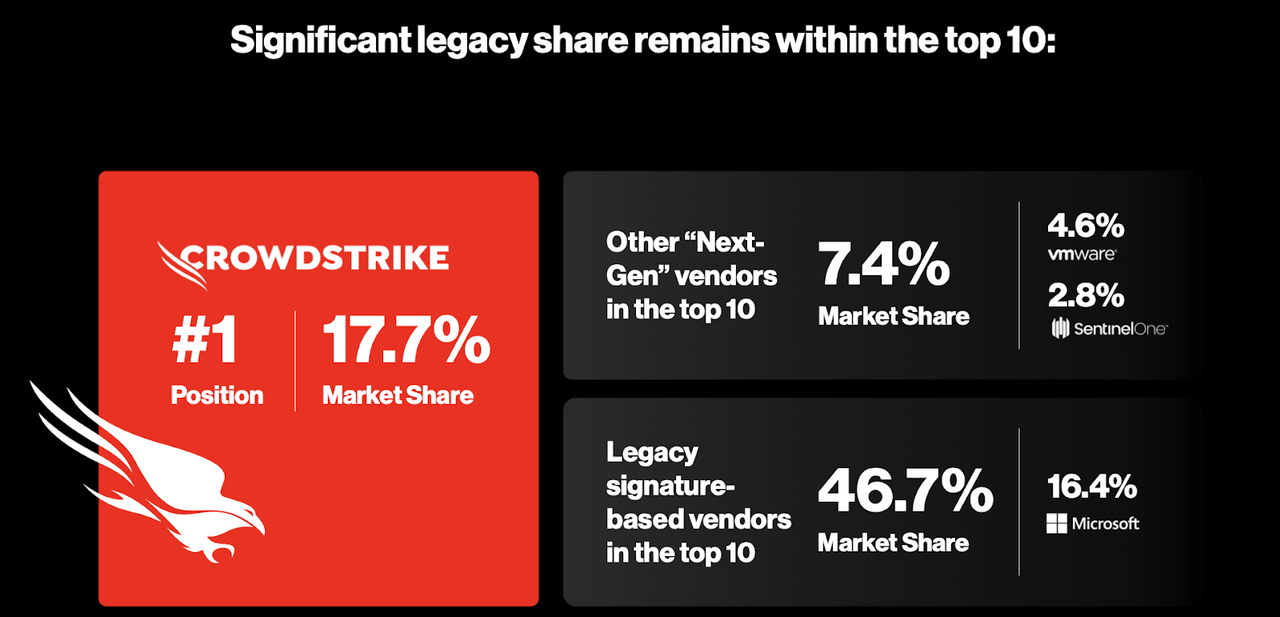

As stated earlier, CRWD is a top disruptor in the endpoint cybersecurity market. Endpoints merely refer to things like laptops and mobile phones. Those familiar with the industry are well aware that CRWD is the clear market leader and continues to take market share away from legacy vendors.

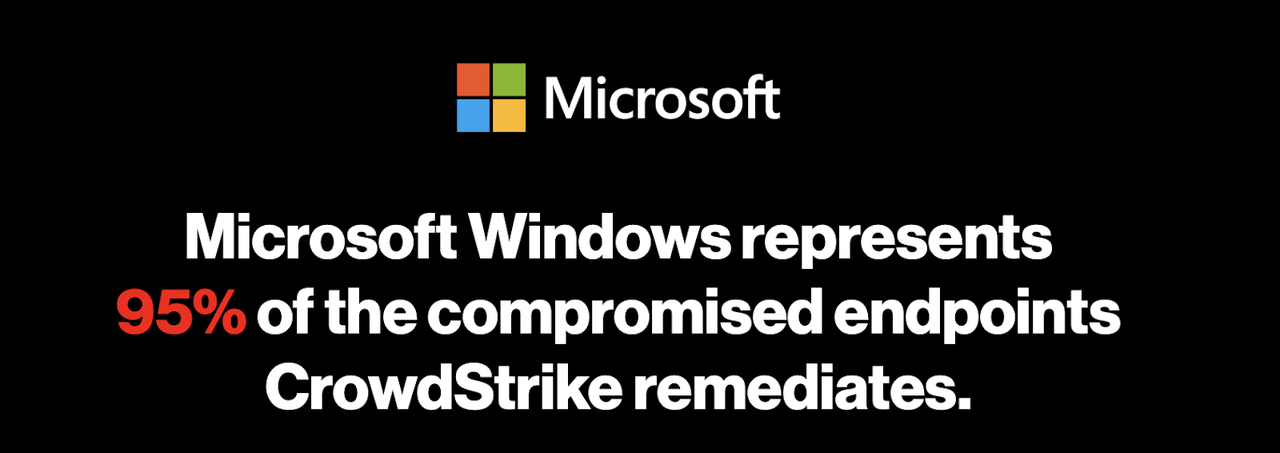

But management spent considerable time discussing its competitive advantages versus Microsoft at its investor day, as many investors seem to be of the misguided view that MSFT is the dominant leader. CRWD highlighted that MSFT represented the vast majority of compromised endpoints that its products fix and secure.

Management stressed that they have very high win-rates when competing head-on against MSFT and has often won existing customers who have complained about the difficulty in integrating MSFT cybersecurity products as well as their performance. MSFT, despite its reputation among tech investors, does not have the stature that Amazon (AMZN) has in e-commerce.

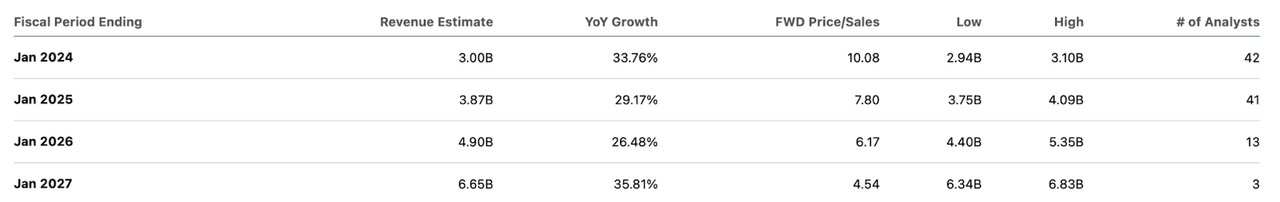

As of recent prices, CRWD was trading at around 10x sales - consensus estimates call for the company to more or less achieve FY26 guidance of $5 billion in revenue.

Based on my projection for 30% long term net margins, 25% growth, and a 1.5x price to earnings growth ratio ('PEG ratio'), I could see CRWD trading at 11.3x sales, representing around 30% compounded annual return upside over the next 3 years. I note that those assumptions may conservative as CRWD arguably deserves a PEG ratio in excess of 1.5x due to the secular growth tailwinds and strong financial position.

What are the key risks? Just as CRWD is disrupting legacy cybersecurity vendors, there is always the possibility that it itself gets disrupted at some point in the future. It is not clear if CRWD has a superior product offering than smaller operator SentinelOne (S), and it is possible that the company will have to always invest heavily in R&D in order to maintain the competitiveness of its product portfolio. Another risk is that of valuation. Like some peers, CRWD trades at a premium valuation likely due to both the attractive secular growth story as well as the strong cash flow margins. If sentiment were to worsen, then I can see CRWD trading down as much as 30% to trade in-line with peers. Finally, while management has attempted to make the claim that near term and medium term guidance is conservative, it is possible that management is overly optimistic and has failed to account for potential decelerating growth rates due to the law of large numbers. I continue to view a basket of undervalued growth stocks as being a top strategy to position ahead of a recovery in the tech sector. CRWD fits in such a basket due to its combination of secular growth and cash flow generation - I reiterate my buy rating.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRWD, AMZN, S either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best Of Breed Growth Stocks Portfolio

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.