Credicorp: Strong Buy Thanks To Peru's Improving Macroeconomic And Political Picture

Summary

- Peru's economy was hit by a variety of unfortunate developments over the past five years.

- These obstacles have all cleared up now, and Peru is set for a rapidly improving economic and political outlook.

- Despite this, Peruvian stocks have not made much progress in 2023.

- I believe Credicorp is particularly well-positioned to benefit. It sells at an historically cheap valuation while having a compelling digital strategy.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate. Learn More »

Christian Vinces/iStock via Getty Images

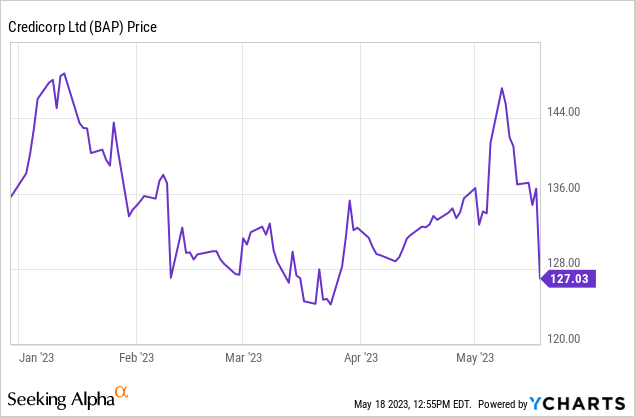

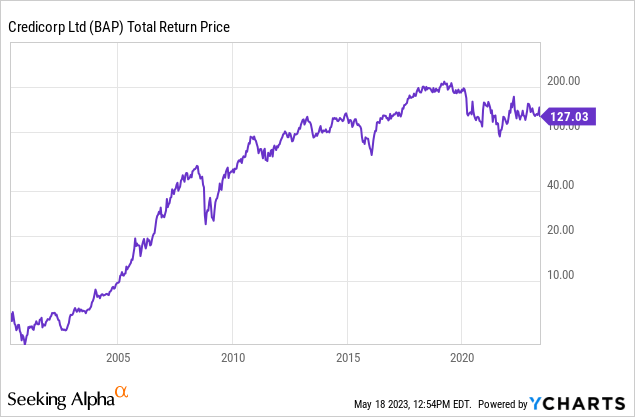

Credicorp (NYSE:BAP) is Peru's largest bank. Shares have had a volatile month of May, and with them trading at the low end of the year-to-date trading range, it's worth highlighting this financial company now:

Consider this article as partly a statement of the bullish case for Peru's economy in general, and partly a direct view on Credicorp in particular. Let's start with Peru more broadly.

Why I'm Upbeat On Peru

Peru has massive reserves of copper, lithium, gold, silver, and other key metals. This is useful at any time, but it's particularly so thanks to the focus on green energy.

Globally, we're far short of the required amount of mining capacity for copper, lithium and other key green metals. Peru is a much easier place to do business (warts and all) than many of the alternatives for these sorts of metals. Suppose you're picking between Russia, Congo, or Peru for a new mine project, that CAPEX goes to Peru the vast majority of the time.

Peru historically had above-average GDP growth over the past decade, despite the rough commodity price picture. It also is one of the better countries in terms of economic freedom, scoring highly in regulatory freedom and free markets, though having a lower score on rule of law.

Overall, Peru ranked 51st in the world in economic freedom this year, tying with France to give a sense of context. This puts it well ahead of both the world and LatAm averages. Peru also narrowly edged out Colombia and Mexico, thus making it the second-best large jurisdiction in LatAm for investment capital, after Chile. And that 51st ranking was even with former hard left president Castillo in power.

Peru's ranking should rise in 2024 now that the conservatives have retaken leadership of the government.

Despite the recent hard-left government and then the vast amount of protests, road blockages and so on in Peru late in 2022, it ultimately didn't have too lingering an impact on the economy. GDP only shrank 0.4% in the first quarter -- despite all the issues including significant cancellations in the tourism sector -- and Peruvian GDP is expected to accelerate in the back half of the year leading to 1.8% growth overall.

Despite Peru moving from a self-avowed communist as president in 2022 to a right-wing government today, however, Peruvian equities have been essentially flat in the interim. I believe that's an error and an opportunity for investors today.

Now, let's turn to the bank itself.

Credicorp: Exceptional Returns On Equity

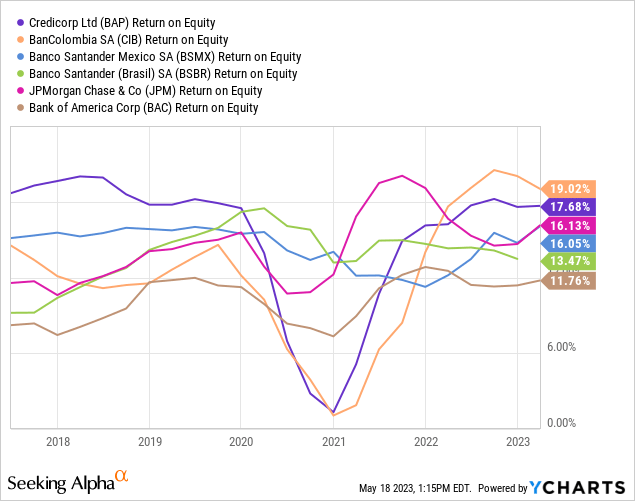

Credicorp has traditionally had best-in-class returns for banking returns in the Americas. Here is Credicorp's return on equity (dark purple line) compared to a variety of well-known LatAm and American banks in recent years:

As you can see, Credicorp traditionally had the highest ROE of all these banks prior to the pandemic, and often by a sizable margin. ROEs dropped across the board during the pandemic, but Credicorp has already surged back to an 18% ROE now. It trails only Bancolombia (CIB) in ROE today, and with Colombia facing intense political issues at this time, BAP stock is arguably the safer of the two at this point.

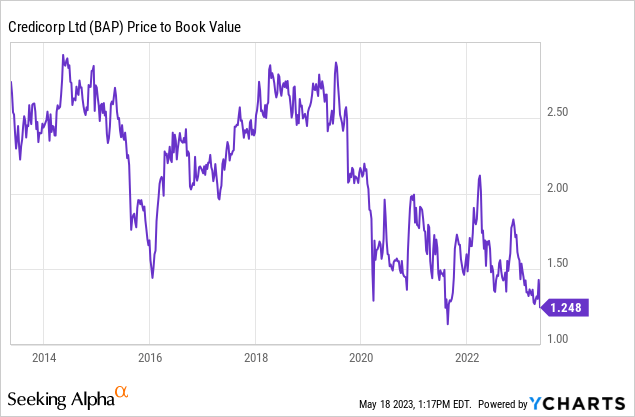

My rule of thumb is that banks are a good buy at 1/10th price/book of their return on equity. That is to say an ROE of 10% justifies a 1.0x P/B, a 12% ROE backs up a 1.2x P/B and so on.

Credicorp has traditionally traded at a premium to that, given its jaw-droppingly good returns. BAP stock has often traded at 2.5x book or above, showing the tremendous valuation investors have been willing to pay for the company's superior results.

Since 2019, however, Credicorp's price/book ratio has come down considerably, and has now hit a mere 1.25x:

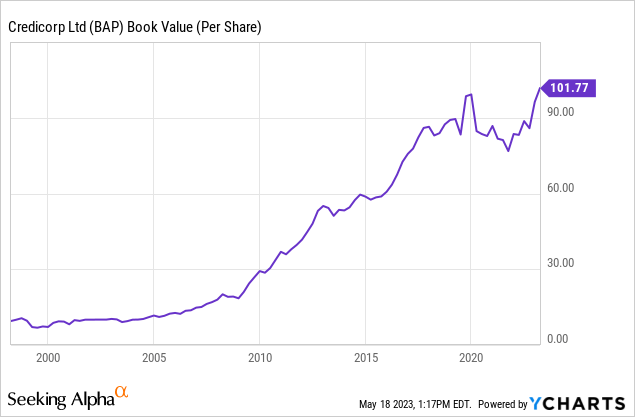

This isn't a flat denominator, either. The company's book value has increased a whopping ten-fold since the turn of the century:

As for why book value has stagnated over the past few years, keep in mind the above calculation is in dollars per share, rather than Peruvian Sol, and Peru's currency had devalued thanks to weak commodity prices, the strong dollar, and 2022 political mess. With the Sol now stabilizing, however, book value has broken out to new highs.

Looking forward, we should expect the Sol to further appreciate as the political drama fades from memory and investors focus on Peru's ample reserves of copper and other strategic metals. Throw in the bank's usual 8-10% annualized increase in value in base currency with a substantial increase from FX, and book value should be in the $125-150/share range over the next few years. Slap a 2x book value on it, in line with its 20% ROE and we're looking at a $250-300 share price.

This is discounting any upside from the FinTech business or other new ventures. Or from any multiple expansion if investors get excited about South America again, as they did in the late 2000s. Just on a base case, we should be looking at $250-300 over the next couple of years versus the current $130 or so share price.

There is a dividend on top of the capital gains as well. Credicorp has a highly variable dividend policy which is based on the company's profitability and local financial market conditions. That said, through a cycle, the bank should average at least $5/share in annual dividends going forward, which amounts to an approximately 4% dividend yield off the current entry point.

Strong Operational Results

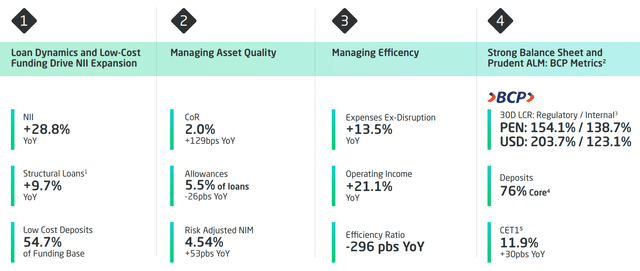

Credicorp has continued to report excellent quarterly earnings, despite the terrible political situation Peru witnessed over the past year. Here are the relevant metrics from Q1:

Credicorp Q1 Results (Corporate Presentation)

The company grew its loan book 10%, while net interest income rose more than 28%. The company enjoyed far faster income growth than loan growth due to the bank's best-in-Peru deposit base. Credicorp's large low-cost deposit base allows it to enjoy the upside from rising interest rates in Peru without having to pay out that much more to its depositors.

These results are all the more impressive given that much of Peru's corporate sector had been hunkered down waiting for the prior presidential administration to leave power. Lots of projects in fields as varied as real estate, retail, and infrastructure had been paused while ex-president Castillo was in charge.

Despite that, Credicorp was able to maintain double-digit year-over-year loan growth in recent quarters. That's thanks to strong consumer demand, as consumers were less affected by unfavorable political headwinds.

In any case, with the new right-of-center government now in place, Credicorp should have a lot more opportunities to lend to the corporate sector as well.

That's not all. I'd also note that Credicorp is one of the larger investment banks and wealth managers in Peru. Despite that, these fields have made up a tiny portion of earnings in recent quarters. The capital markets in Peru have been moribund in recent years, greatly limiting the ability for an investment bank to make money in that market. This should change with a more business-friendly government taking power, along with renewed interest in Peruvian oil, mining, tourism, and agricultural opportunities. This should lead to more underwriting and deal advising fees for Credicorp.

Yape: A Strong Hidden Digital Asset

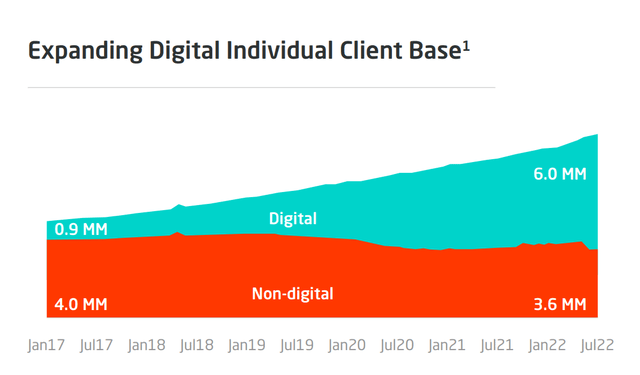

From a recent corporate presentation, we find this graph which sums up a chunk of the bullish case for BAP stock:

Credicorp client base (Corporate Presentation)

The company defines a digital client as people that engage in more than half their interactions through the website or app, or which bought a financial product through Credicorp's digital channels over the past 12 months.

Lots of banks have a digital strategy though. What makes Credicorp unique is that it built Peru's largest digital wallet internally as part of the bank's operations. And, in my view, that is not being reflected in BAP stock's valuation today whatsoever.

---

In 2020 and 2021, people paid mind-boggling prices for FinTech companies around the world. That includes in Latin America, where a variety of firms (often Brazilian) traded at stratospheric multiples.

The funny thing is that some of the most intriguing financial technology is actually occurring within traditional banks. The large banks aren't stupid; they know younger consumers want an easier-to-use product and are proactively preparing for that future.

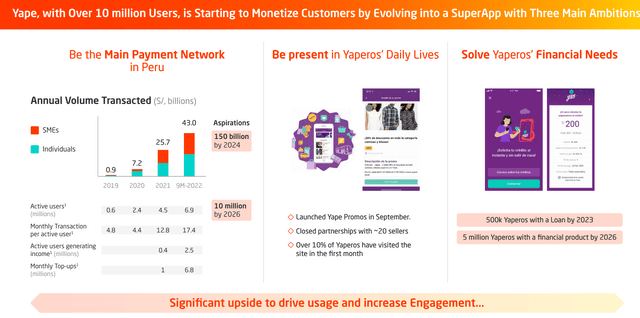

Credicorp, for example, has built Yape, which it aims to build into a Peruvian SuperApp:

Credicorp's Yape Superapp (Corporate Presentation)

Already, it has more than 6.9 million monthly active users, or more than 20% of Peru's entire adult population. Active users are making more than 17 transactions a month. A fair number of these are engaging in revenue-generating activities such as taking out loans or topping up their balances.

Yape was originally designed for use just by Credicorp (BCP bank) customers. However, a couple of years ago, it was converted into a platform that anyone could use, regardless of their bank affiliation. And, regulatory changes are set to make digital wallets more interoperable as well. Meaning, Yape will be able to function more and more independently of Credicorp in the future, perhaps setting the stage for an IPO, spin-off, or other way to monetize the asset.

Is Yape going to be the next great Latin American FinTech product? It's too early to say. What I can tell you is getting a 7 million person user base and one where transactions are growing more than 50%/year is a pretty interesting starting point. Meanwhile, you're paying virtually nothing for the digital business -- the whole bank, after all, is selling for less than 8 times forward earnings and at a considerable discount to its usual price/book ratio.

Long-time readers might get the sense I'm against FinTech companies. That would be incorrect. What I am against is paying massive multiples for companies that lose money and have unproven business models.

But, it's clear that financial technology will evolve over time and investors need to be positioned for that. I like owning digital technology plays -- such as Yape here -- when I can get them as cheap upside options on an already highly-profitable and successful business, particularly when it pays me a sizable dividend for holding shares as well.

---

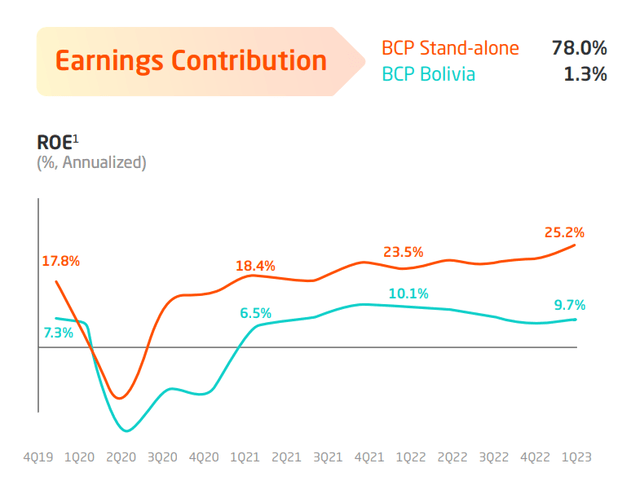

As an addendum to the above section, I'd note Credicorp is even more profitable and has better ROE and other such metrics than it looks. Here is ROE of Credicorp's core banking operations:

BCP Core ROE (Corporate Presentation)

You are reading that chart right, the firm's primary BCP bank is earning a ridiculous, unheard of, incredible 25.2% ROE in its home Peruvian market. This is right near the top of the league table for worldwide banks in terms of level of profitability.

The company has been investing heavily in Yape and other technology solutions that start off as less profitable than the core business.

The bank's investments are large enough to put a meaningful drag on current results. Even so, it's still delivering returns on equity far above anything the vast majority of American banks could generate despite funding its internal technology ventures. And, in return for those investments, Credicorp is creating fantastic new assets like Yape. This is about as good of a growth story as you'll find within an otherwise conservative highly profitable bank.

The Bottom Line

This is quite possibly the best-run and most efficient banking franchise in Latin America. I've long wanted to recommend it, with the problem being that there was always something wrong that made it a no-go.

In the late 2010s, commodity and metal prices were through the floorboards, making it hard to get excited about Peru, given its heavy reliance on those industries. In 2020, Peru had one of the worst immediate pandemic responses in the region, and was slow to reopen its economy compared to other emerging market countries. That was a blow to a country known for its world heritage tourism sites. In 2021, Peru elected a literal self-professed Marxist.

All the while, despite this litany of unfortunate developments, Credicorp has continued to deliver absolutely stellar earnings and growth. Imagine what the bank will do now that it finally will have a functional government, strong commodity prices, and the COVID-related tourism issues have passed.

Credicorp has been an absolutely phenomenal operation, both in its core banking business and in growing its digital and FinTech operations. It has been operating under dreadful conditions since the mid-2010s, and yet it has still earned strong profits and defended shareholder value.

Now, with the skies clearing up, Credicorp should see a rapid rerating. Shares should hit new all-time highs within the next couple of years as this rapid compounding machine starts rolling again:

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

This article was written by

Ian worked for Kerrisdale, a New York activist hedge fund, for three years, before moving to Latin America to pursue entrepreneurial opportunities there. His Ian's Insider Corner service provides live chat, model portfolios, full access and updates to his "IMF" portfolio, along with a weekly newsletter which expands on these topics.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAP,CIB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.